SP Eventually Downgrades U.S Debt Ratings to Negative

Interest-Rates / US Debt Apr 18, 2011 - 09:35 AM GMTBy: Jesse

This is the same SP whose ratings were for sale to the banks throughout the build up to the financial crisis, and which has largely escaped investigation and indictment. So, even though their opinion here may be valid, how are we to know that it has not been bought again, with regard to timing and impact?

This is the same SP whose ratings were for sale to the banks throughout the build up to the financial crisis, and which has largely escaped investigation and indictment. So, even though their opinion here may be valid, how are we to know that it has not been bought again, with regard to timing and impact?

And of course the word of the downgrade was held completely confidential, even from insiders, right?

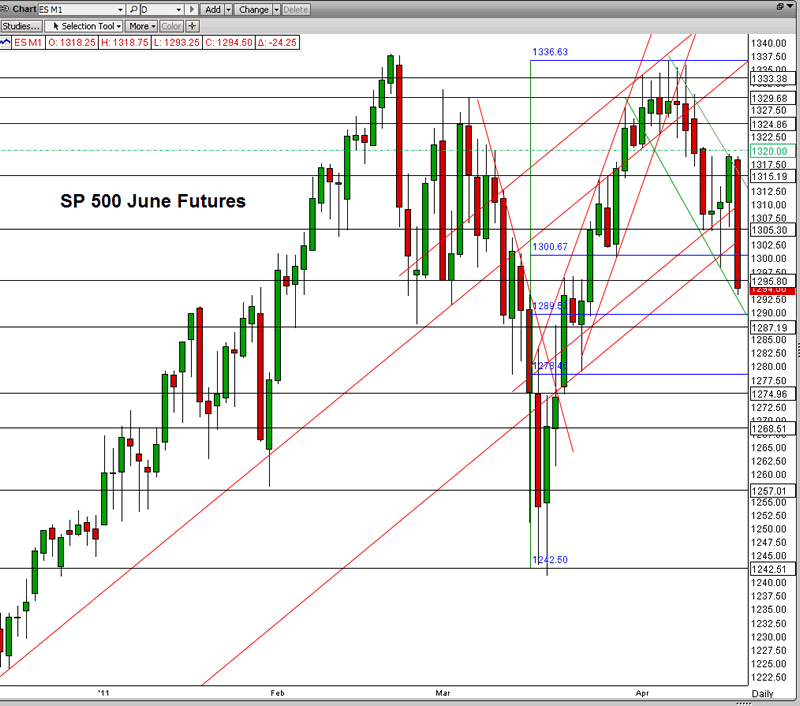

As I had cautioned last week, something wicked this way comes. Its tracks were on the tape, most likely in word leaking out to insiders who succeed as they usually do, not in any personal merit, but by breaking the rules for their benefit.

That is the problem in dealing with an unreformed, unindicted, and corrupt financial sector. Who do you trust? And this has a decided drag on economic recovery.

The failure to reform when he held the mandate was Obama's greatest mistake. But others made the same mistake, from the Congress to the Fed. Their motivation for this policy error will be the subject of much future speculation.

This negative outlook is not a surprise. It is consistent with a growing crisis in the US.

Of course in the secondary action the wiseguys took the opportunity to stage a calculated bear raid on the metals. Kind of like machine gunning the refugees and burning the life boats. Their criminality knows no bounds, has little self restraint, and is lawless, respecting nothing but power.

"Give me control over a Nation's Currency and I care not who makes its Laws."

I am not certain of the attribution of this quote, but as my old school economics professor demonstrated to us again and again, it is certainly the case as we analyzed the development of the European Union and World Trade Organizations in a transnational fiat currency regime.

There is opportunity in these short term swings but only for those will a cool head tempered by experience. In the short term fraudulent pricing and manipulation is widespread, with deceit as their currency. For most it is better to hold to your long term trend investments and not be overextended.

I shifted the weighting in my trading portfolio out of the overweight to the short side taking profits, to overweight bullion on the dip, still hedged.

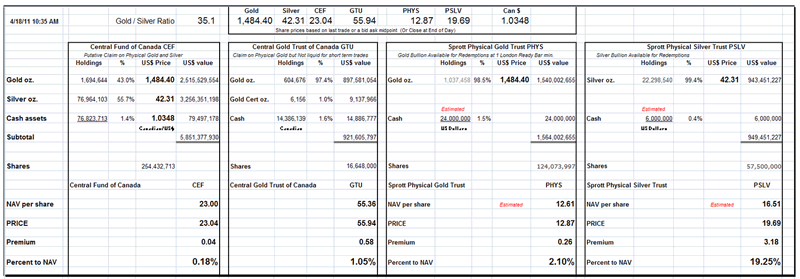

If you wonder why these bear raids happen, and why the paper bullion bankers defend certain price levels so viciously, often stepping in to hold gains to one or two percent in a day, this may help.

"Open interest in gold futures and options traded on the Comex typically exceeds supplies held in its warehouses. If the holders of just 5 percent of those contracts opted to take delivery of the metal, there wouldn’t be enough to cover the demand, Bass said."The US markets cannot withstand a determined run on the assets which the banks, and funds, and probably even the Fed have already sold. The financial sector is a deepening cesspool of cover up and deception resembling a confidence scheme, an accident waiting to happen. If it did not involve so many of the well placed and powerful it would have already fallen of its own weight and arrogance.

University of Texas Takes Delivery of Bullion

What more can I do, what else is there to say? What wonders will persuade a people determined to be as gods? What, indeed, is truth, in times of general deception, when even the caretakers cannot be trusted to hold their sacred oaths and duties? And yet this is nothing, compared to what is to come. Walk carefully in the light of God's love, holding to His tender mercies, unless you be misled, gaining some objects and advantages, but losing yourself.

"Let him who walks in the dark, who has no light, trust in the name of the Lord, and rely on his God." Is. 50:10

AFP

S&P adopts 'negative' outlook for US debt

WASHINGTON — Ratings agency Standard & Poor's on Monday revised its outlook on US sovereign debt to "negative" from "stable", citing Washington's looming debt and fiscal deficits.

"Because the US has, relative to its 'AAA' peers, what we consider to be very large budget deficits and rising government indebtedness and the path to addressing these is not clear to us, we have revised our outlook on the long-term rating to negative from stable," S&P said in a statement.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.