Gold New $1,500/oz Record Nominal High, Targets Inflation Adjusted High of $2,400/oz

Commodities / Gold and Silver 2011 Apr 20, 2011 - 01:34 PM GMTBy: GoldCore

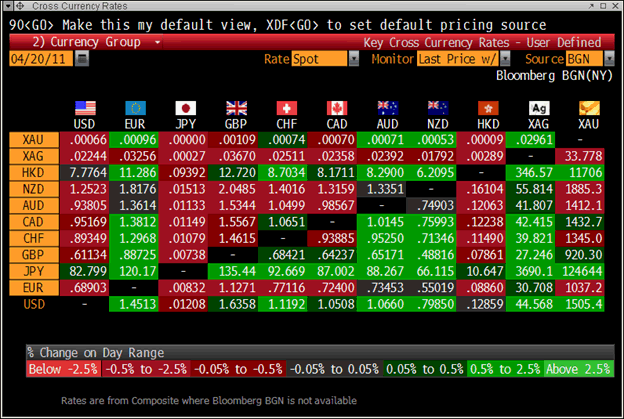

Gold has breached the $1500/oz level and reached new record nominal highs at $1,505.65/oz. Since yesterday it has gradually risen in all currencies and is approaching record nominal highs in all major currencies. Gold has risen to EUR1,037/oz, GBP920/oz, AUD1,412/oz, CHF1,344/oz and JPY124,640/oz, and is now not far from recent record nominal highs of EUR1,054/oz, GBP922/oz, AUD1,440/oz, CHF1,349/oz and JPY126,000.

Gold has breached the $1500/oz level and reached new record nominal highs at $1,505.65/oz. Since yesterday it has gradually risen in all currencies and is approaching record nominal highs in all major currencies. Gold has risen to EUR1,037/oz, GBP920/oz, AUD1,412/oz, CHF1,344/oz and JPY124,640/oz, and is now not far from recent record nominal highs of EUR1,054/oz, GBP922/oz, AUD1,440/oz, CHF1,349/oz and JPY126,000.

Cross Currency Table

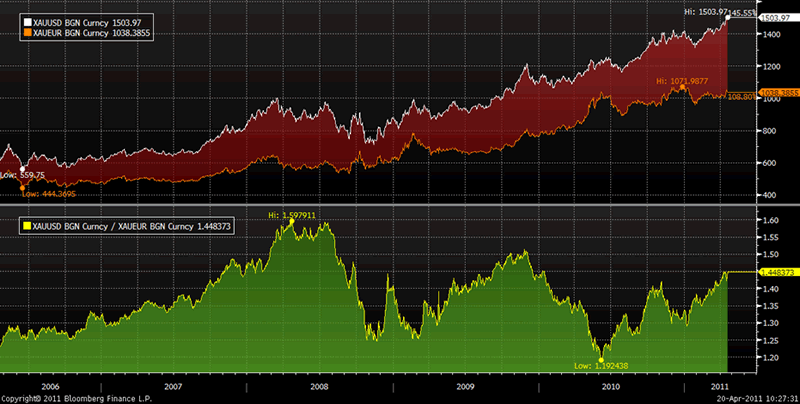

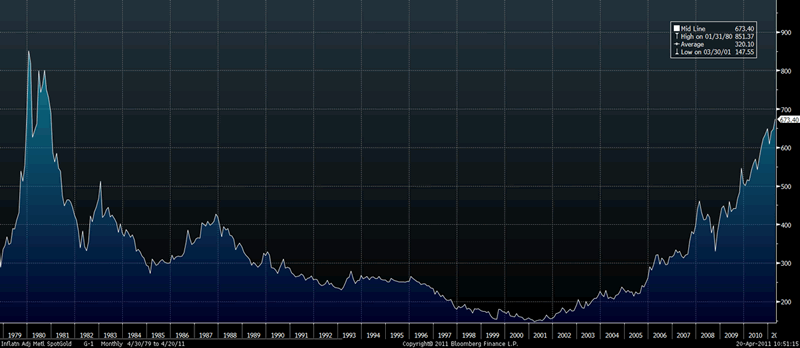

Given that all major currencies are becoming more debt laden by the day, gold’s finite currency credentials are again being appreciated. As ever it is very important to realise that gold is only at record highs in nominal terms and not in real terms.

Gold in USD and Gold in EUR – 5 Year (Daily)

$2,400/oz is the inflation adjusted (CPI) high of 1980 and given the very uncertain macroeconomic climate of today and concerns about the dollar and all major currencies, arguably even more uncertain than the 1970s, the real high remains a very viable target.

It is important to remember that while gold has risen some 6 times in 11 years ($250/oz to $1500/oz) it rose by 24 times in 9 years in the 1970s – from 1971 to January 1980 ($35/oz to $850/oz). This puts the recent reasonably gradual increase in gold prices in perspective and should give gold bears and top callers pause for thought.

Gold in Real Terms – Bloomberg Inflation Adjusted (CPURNSA)- 32 Year (Monthly)

Sharp falls of the dollar on foreign exchange markets could see a parabolic gold move and gold reach its real record high in the coming weeks and months. Should declining confidence in the dollar not result in sharp declines in the dollar than gold’s rise may continue to be gradual and steady.

Gold

Gold is trading at $1,503.60/oz, €1,035.18/oz and £918.51/oz.

Silver

Silver is trading at $44.70/oz, €30.77/oz and £27.30/oz.

Platinum Group Metals

Platinum is trading at $1,790.00/oz, palladium at $754/oz and rhodium at $2,250/oz.

News

(BBC) -- Gold price hits record at $1,500 an ounce

The gold price has risen above $1,500 an ounce for the first time after concerns about global economic recovery lifted the metal's appeal as a haven.

In trading in Hong Kong, gold hit a record $1,500.70 an ounce, which traders said was mainly a response to Standard & Poor's downgrade of US debt.

Silver also touched a 31-year high of $44.34 an ounce.

"In a word, sensational. Everything's feeding into this, sovereign debt, weak dollar, inflation," said one analyst.

But analysts were divided about whether the price could go higher and are waiting to see if trading in Europe and the US continues the momentum seen in Asia.

Jonathan Barratt, at Commodity Broking Services, said: "We often see a $20 rally after breaking a big number, then a pullback.

"We will see what Europe and United States do with this. $1,510 or $1,520 look possible, but prices are starting to look a little stretched up here."

Darren Heathcote, at Investec, said: "The market is so fickle at the moment and it wouldn't surprise me if we saw a sell-off."

Some market watchers see gold consolidating at its current level as it waits for the next reason to push higher.

Natalie Robertson, commodities strategist at ANZ, said: "I don't see prices convincingly past that level in the next few days unless we see something very negative, probably related to the eurozone sovereign debt.

"But we do see gold very well supported at the $1,490 level," she said .

Silver continued to soar, rising to a 31-year high for the fifth consecutive session.

Not only is silver increasingly seen as a haven, but there is also rising demand for industrial consumption.

"Silver is still in a clear bull trend that targets $50 next," said Taso Anastasiou, a UBS technical strategist.

(Press Association) -- Gold Price at All-time High

Gold has broken the 1,500 dollars-an-ounce barrier for the first time as fears over the global economy send investors flocking to safer investments.

The precious metal has hit a fresh all-time high in the wake of Monday's shock debt downgrade warning for America, which also resulted in silver prices reaching a 31-year record.

Standard & Poor's (S&P) sparked hefty share falls earlier this week when it slashed its outlook on US government debt to negative from stable.

The move added to continuing concerns over Europe's sovereign debt crisis and rising global inflation, which has seen a flight to safety among investors.

The US dollar has also been under pressure since the S&P blow, further fuelling the rise in gold prices.

The record gold price helped mining stocks leap ahead on the London market, with shares in firms such as Rio Tinto and Anglo American as much as 3% higher.

The traditional safe haven has soared in value in recent years as investors have been spooked by economic uncertainty.

Gold eased back at the start of the year after a run of positive economic data, but has since bounced back due to gloomy global developments.

The US debt outlook downgrade compounded concerns following political tensions in the Middle East and North Africa, Japan's crisis and more eurozone woes.

Ireland's rating was slashed to just above junk status last week by Moody's, while Portugal is edging closer to a bailout.

S&P said on making its debt warning that there was a "material risk that US policymakers might not reach an agreement on how to address medium and long-term budgetary challenges by 2013".

US Treasury Secretary Tim Geithner was quick to play down the caution, saying the US would keep its triple A rating.

However, some experts believe that with the world's biggest economy under pressure to cut its debt, the gold rally could see prices hit 2,000 dollars an ounce.

(Financial Times) -- Hedge funds surge to peak of $2,002bn

Assets under management in the global hedge fund industry have soared to an all-time peak, surpassing the pre-crisis high thanks to the strongest investor inflows in years.

The world’s hedge funds at present manage $2,002bn of client funds, according to Hedge Fund Research, the industry’s leading data provider.

(AFP) --Obama blames speculators for high gasoline prices

US President Barack Obama blamed oil "speculators" on Tuesday for soaring gasoline prices that risk weighing down the US recovery and could dampen his 2012 election hopes.

"It is true that a lot of what's driving oil prices up right now is not the lack of supply. There's enough supply. There's enough oil out there for world demand," Obama said at a campaign-style event not far from Washington.

"The problem is, is that oil is sold on these world markets, and speculators and people make various bets, and they say, 'you know what, we think that maybe there's a 20 percent chance that something might happen in the Middle East that might disrupt oil supply,'" he said.

"'So we're going to bet that oil is going to go up real high.' And that spikes up prices significantly," said the president, who recently launched his reelection campaign.

His comments came as oil prices rallied in New York, rebounding from the previous day's heavy losses as a weaker dollar boosted demand for dollar-priced commodities.

New York's main contract, light sweet crude for delivery in May, surged $1.03 to finish at $108.15 a barrel, even as US gasoline prices hovered just below the $4-per-gallon mark after rising steadily since late 2008.

"We're now in a position where we can investigate if there's unfair speculation. We're going to be monitoring gas stations to make sure there isn't any price gouging that's taking advantage of consumers," promised Obama.

"But the truth is that it is a world commodity, and when prices spike up like this there aren't a lot of short-term solutions. What we have are medium- and long-term solutions," he said.

Obama's Republicans foes have pounded him over the rise in fuel prices, accusing him of putting on hold new oil drilling that could eventually lead to lower prices.

(Reuters) -- Twelve banks worldwide sued for manipulating Libor

A European asset manager has sued one dozen U.S., European and Japanese banks, accusing them of conspiring to manipulate Libor, a benchmark used to set interest rates on hundreds of trillions of dollars of securities.

Vienna-based FTC Capital GmbH and two funds it operates in Luxembourg and Gibraltar accused the banks of conspiring to artificially depress Libor, and limit trade in Libor-based derivatives from 2006 to 2009.

The defendant banks include Bank of America Corp, Barclays Plc, Citigroup Inc, Credit Suisse Group AG, Deutsche Bank AG, HSBC Holdings Plc, JPMorgan Chase & Co, Lloyds Banking Group Plc, Norinchukin Bank, Royal Bank of Scotland Group Plc, UBS AG and WestLB AG.

Libor, whose full name is the London Interbank Offered Rate, is a measure for rates that banks charge each other, and is used worldwide as a short-term rate benchmark.

About $350 trillion of derivatives and other financial products are based on Libor. Small changes in the rate can have large impacts on the amounts of interest that can be charged.

FTC said the 12 banks colluded to suppress Libor to make them appear healthier than they were, and take advantage of trading opportunities not available to outside investors.

"During the most significant financial crisis since the Great Depression, U.S. dollar Libor rates submitted by contributor banks did not vary markedly, nor did they increase or decrease sharply," FTC said in its complaint filed Monday in the federal court in Manhattan.

"In a market not artificially suppressed, Libor rates should have increased significantly during this period," FTC added. "In addition, because different banks were experiencing different levels of severe stress, the banks should have been receiving markedly different borrowing rates."

Citigroup spokeswoman Danielle Romero-Apsilos said: "The lawsuit is without merit." Bank of America spokesman Lawrence Grayson, Credit Suisse spokesman Steven Vames, JPMorgan spokeswoman Jennifer Zuccarelli and Lloyds spokeswoman Sarah Swailes declined to comment.

Representatives of the remaining banks declined to make an immediate comment or could not immediately be reached for a comment.

U.S., British and Japanese regulators are examining whether major banks understated Libor to reduce their borrowing costs and the potential for investor panic, a person familiar with the matter said last month.

(Bloomberg) -- Oil, Gold Seen Rallying as Global Economy Overcomes ‘Headwinds’

Oil, platinum and gold may rally as the global economy withstands the “headwinds” of higher interest rates, Europe’s sovereign-debt turmoil and Japan’s nuclear crisis, according to Threadneedle Asset Management Ltd.

Threadneedle is bullish on oil and platinum as demand climbs, while gold may advance to a record $1,800 an ounce, manager David Donora said in an e-mail interview. The London- based hedge fund targets its $149 million main commodity fund to beat the Dow Jones-UBS Commodity Index by 6 percent in 2011.

Citigroup Inc. said this week industrial metals have “limited upside” while silver may fall as central banks curb inflation. Goldman Sachs Group Inc. has ended a call to buy raw materials including oil in the near term, while forecasting gains over the next 12 months.

“We see short-term headwinds as the market digests higher prices, tightening in emerging-market countries takes effect, and the market adjusts to the tragedy in Japan,” Donora said.

“We believe the recovery will continue and that demand for commodities will accelerate into the end of the year.”

Group-of-20 finance chiefs said last week the world economy is strengthening, citing “increasingly robust” demand growth even as Japan rebuilds from last month’s record quake and nuclear disaster and Europe battles a debt crisis. China, the world’s largest metals user, grew at a faster-than-estimated 9.7 percent in the first quarter, according to government figures.

Investors have more than doubled their bets on higher prices for commodities traded in the U.S., according to government figures. The Dow Jones-UBS Commodity Index has gained 5.2 percent this year and touched the highest level since 2008 on April 8, led by gains in silver and cotton.

‘Consistently Bullish’

Threadneedle Asset Management, founded in 1994, oversees total assets of $97 billion. The main commodity fund, which is managed by Donora and invests in energy, metals and agricultural futures as well as equities of producers, posted a year-to-date return of 9.2 percent, data compiled by Bloomberg showed.

Donora added gold to his list of this year’s best bets as investors seek to preserve their wealth against rising inflation and weaker currencies. The dollar lost 5.3 percent against a basket of currencies this year.

“One would expect gold to be the safe-haven currency of choice,” Donora said on April 18. Immediate-delivery gold, which has gained every year since 2001 and touched a record $1,499.32 an ounce yesterday, traded at $1,495.35 at 9:36 a.m. in Singapore.

Threadneedle is also “consistently bullish” on oil and platinum as they face supply constraints and increased demand, Donora said, without giving forecasts. Crude in New York has soared 30 percent in the past year to $108.39 a barrel as unrest in the Middle East hurt supply, while platinum rose 3.7 percent to $1,779 an ounce.

Global Campaign

The global campaign to fight inflation won’t curb demand for commodities, Donora said. Central banks across the globe, including the European Central Bank, have raised interest rates to counter rising prices and China has taken other steps, such as selling oilseeds at a discount to market prices.

“Any efforts to subsidize commodity prices to soften inflation are likely to offset the rationing effect of higher prices,” he said. “This leads to higher prices ultimately.”

Corn more than doubled in the past year, wheat surged 66 percent and soybeans rose 37 percent. World Bank President Robert Zoellick said on April 16 that the global economy is “one shock away” from a crisis in food supplies.

Still, Donora did not expect a return of the food crisis that was seen in 2008 as he has “a lot of confidence in the North American farmer.” The U.S. is the world’s largest exporter of wheat, corn and soybeans.

(Bloomberg) -- Immediate-Delivery Gold Surges to More Than $1,500 Per Ounce

Gold for immediate delivery climbed to more than $1,500 an ounce for the first time, rising as much as 0.3 percent to a record $1,500.43.

(Bloomberg) -- Gold Futures in Shanghai Surge to a Record

Gold futures on the Shanghai Futures Exchange jumped to an all-time high of 314.19 yuan a gram, surpassing the previous peak of 314 yuan reached in November.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.