Gold and Silver Correction Possible but Store of Value Demand Remains

Commodities / Gold and Silver 2011 Apr 26, 2011 - 10:18 AM GMTBy: GoldCore

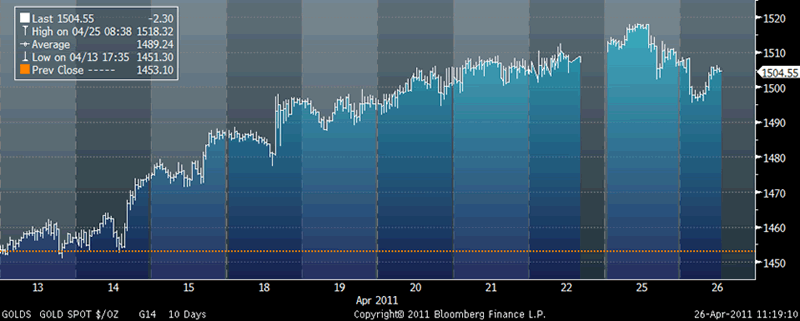

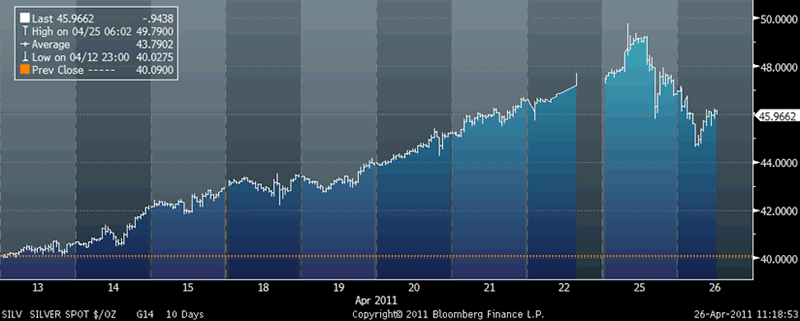

Silver and gold are lower today after the record nominal highs seen yesterday (gold marginally and silver significantly). Gold reached $1,518.30 per troy ounce, a nominal record, while silver climbed to $49.79 per ounce, its highest nominal level since the short term parabolic spike in 1980.

Silver and gold are lower today after the record nominal highs seen yesterday (gold marginally and silver significantly). Gold reached $1,518.30 per troy ounce, a nominal record, while silver climbed to $49.79 per ounce, its highest nominal level since the short term parabolic spike in 1980.

Gold in USD - 10 Day (Tick)

A period of correction and consolidation has been expected for some time and it may ensue as gold and particularly silver are overbought in the short term. However, absolutely nothing has changed with regard the primary fundamentals driving the gold and silver markets.

Ultra loose monetary policies are set to continue with Ben Bernanke, Federal Reserve chairman, to announce the conclusions of the Fed's monthly meeting to set monetary policy. Interest rates are set to remain near zero percent which will lead to many investors continuing to favour non-yielding gold due to the lack of opportunity cost.

Silver in USD - 10 Day (Tick)

Near zero percent interest rates and negative real interest rates as inflationary pressures grow are of course bullish for gold and silver and investors would be prudent to buy any dip.

Contrary to non-evidence based assertions that the recent price gains were purely due to “speculation”, recent rises are largely due to supply and demand fundamentals. The rises are primarily due to increased and robust physical demand for the precious metals due to inflation concerns, concerns about the debasement of the dollar, the euro and paper currencies, sovereign debt and geopolitical concerns.

These concerns are not going to disappear overnight and indeed are likely to intensify in the coming months with consequent financial and monetary ramifications. Inflation hedging and store of value buying of precious metals, especially from China, India and Asia, in set to continue for the foreseeable future (see news below).

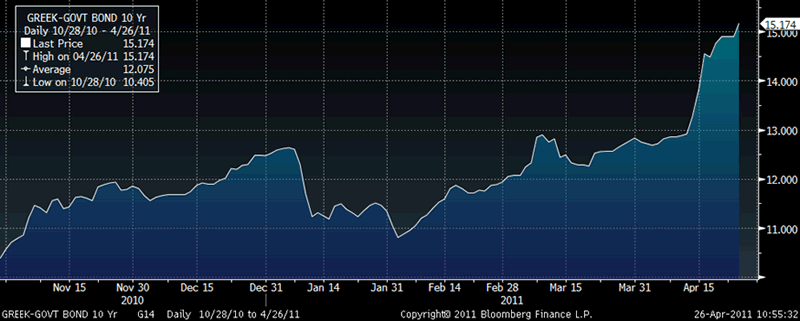

Greek 10 Year Bond - 180 Day (Daily)

Greek bonds have fallen again on news that the Greek budget deficit was wider than expected and on deepening concerns of an inevitable default.

Euro-area debt reached a record in 2010, Eurostat said today, making it harder for Germany, France and the Eurozone’s better-off countries to bear the costs of the fiscal crisis triggered by Greece, Portugal, Spain and Ireland. Debt rose in all 16 euro-region countries, lifting the bloc’s average to 85.1 percent of GDP from 79.3 percent in 2009.

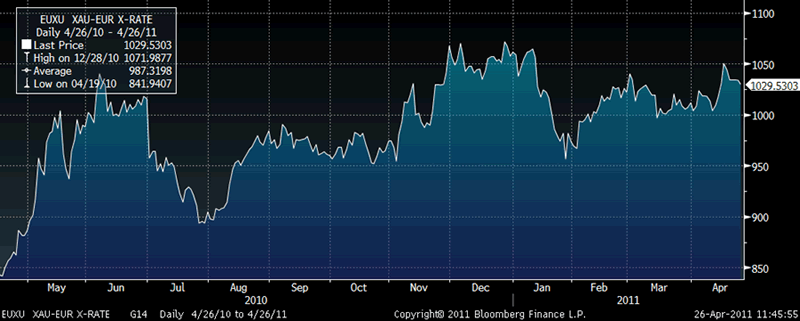

Gold in EUR - 1 Year (Daily)

The euro zone debt crisis is far from over and the risk of contagion remains very real. The euro, like other fiat currencies, is vulnerable to falling sharply against the finite currency of gold in the coming months.

Gold

Gold is trading at $1,502.65/oz, €1,028.79/oz and £911.80/oz.

Silver

Silver is trading at $45.52/oz, €31.17/oz and £27.62/oz.

Platinum Group Metals

Platinum is trading at $1,809.50/oz, palladium at $748/oz and rhodium at $2,250/oz.

News

(Financial Times) -- Precious metals cool after reaching highs

Precious metals weakened after touching highs as investors sought substitutes for paper currencies.

Gold reached $1,518.10 per troy ounce, a nominal record, while silver climbed to $49.31 per ounce, its highest level since a supply squeeze in 1980.

Trading was light in the spot market because of a bank holiday in London, the bullion centre. Spot gold pared gains to $1,509.51 per ounce, while silver was up 1.7 per cent at $47.48 per ounce.

Silver futures traded furiously on New York’s Comex exchange, however. Volume in the iShares Silver Trust, a $17bn US exchange-traded fund, surpassed share volume in the much larger SPDR S&P 500 stock fund.

Precious metals prices have surged as investors search for havens from a variety of risks, from inflation and weaker currencies to political turmoil.

“There’s been a resumption of sovereign risk worries in Europe, safe haven buying related to Japan and more recently, discussions over US debt,” said James Steel, precious metals analyst at HSBC in New York.

Silver, at a fraction of the gold price, has prompted individual investors to buy coins and exchange-traded funds. The grey metal has gained more than 160 per cent in the past year.

Suki Cooper, precious metals analyst at Barclays Capital, said: “Should that retail interest in silver slow down just a little bit, we would expect prices to correct quite sharply.”

The market considers $50 an ounce as the record nominal high for silver, although veteran traders say that in the chaotic trading of January 18, 1980, some small amounts changed hands in the physical market at higher prices.

(Bloomberg) -- Gold, Silver Decline From All-Time Highs as Investors Seek Cash

Gold and silver retreated from records as some investors sold the metals to lock in gains and raise cash to cover losses in other markets.

The MSCI Asia Pacific Index of equities declined for a second day today, after the Standard & Poor’s 500 Index yesterday dropped for the first day in four. Commodities snapped a four-day winning streak, led by crude oil and copper.

“Initial dollar-related profit-taking saw the precious complex down,” James Moore, an analyst at TheBullionDesk.com in London, said in a report to clients today. “Given the pace and scale of gains in gold and silver in recent weeks there is the threat of a deeper correction in the coming sessions, particularly if the FOMC minutes tomorrow indicate the Fed is close to starting monetary tightening.”

Bullion for immediate delivery dropped as much as 0.8 percent to $1,495.75 an ounce and traded at $1,504.43 by 9:58 a.m. in London. It climbed to an all-time high of $1,518.32 an ounce yesterday. Gold for June delivery fell 0.3 percent to

$1,505 an ounce on the Comex in New York. Silver tumbled as much as 4.8 percent to $44.6625 an ounce before trading at $45.9125. Spot silver rose to a record $49.79 an ounce yesterday.

Federal Reserve Chairman Ben S. Bernanke will hold a media conference after the Federal Open Market Committee statement tomorrow following a two-day meeting in Washington, where policy makers are expected to keep borrowing costs near zero.

The dollar advanced by as much as 0.6 percent against the euro earlier today, before trading 0.3 percent lower. Bullion typically moves inversely to the greenback. The U.S. currency gained as much as 0.5 percent before declining 0.2 percent against a basket of six currencies.

‘Possible Event Risk’

“The Federal Reserve meeting is a possible event risk but we expect that Ben Bernanke in its first public speech post-meeting will confirm that U.S. short-term rates are most likely to stay low,” Bayram Dincer, an analyst at LGT Capital Management in Pfaeffikon, Switzerland, said in an e-mail. “This confirmation of low nominal rates combined with higher inflation will be positive for gold.”

A correction in gold and silver price is unlikely to last more than three days, Dennis Gartman, an economist and the editor of the Suffolk, Virginia-based Gartman Letter, said in a daily report.

“It’s more the action in silver that’s making me a little queasy,” Charles De Vaulx, a manager at International Value Advisers LLC, said in an interview yesterday with Margaret Brennan on Bloomberg Television’s “InBusiness.” “It’s a much smaller market than gold, there’s anecdotal evidence that some silver-based, closed-end funds are even trading at a premium, so it seems to have become a lot too speculative.”

Silver holdings in the iShares Silver Trust, the biggest exchange-traded fund backed by silver, climbed 239.76 metric tons to a record 11,390.06 tons as of April 25 from 11,150.30 tons on April 21, according to figures on the company’s website.

Platinum lost 0.8 percent to $1,809.75 an ounce in London, while palladium declined 0.9 percent to $754.25 an ounce.

(Bloomberg) -- Investor ‘Euphoria’ to Spur India Silver Demand, Bourse Says

Silver demand in India will climb this year as investors boost purchases on expectation that prices will extend a record rally, according to the National Spot Exchange Ltd.

Demand will gain “at least 10 percent to 15 percent” from the current level of about 3,000 metric tons a year, said Anjani Sinha, chief executive officer of the Mumbai-based bourse. The exchange is the biggest in India for trading physical gold and offers spot contracts for silver, zinc and copper.

Silver surged to an all-time high of $49.79 an ounce yesterday as investors sought to protect their wealth against accelerating inflation and a weaker dollar. The metal, which has more than doubled in the past year, is the best performer on the Standard & Poor’s GSCI Index of 24 commodities.

“A new euphoria is there among the investors to buy silver,” Sinha said in a phone interview yesterday. “People in India have started believing it will go up further, so demand has picked up very well.”

Silver futures in India, which reached a record 73,600 rupees ($1,655) a kilogram yesterday, plunged as much as 5.3 percent on the Multi Commodity Exchange of India Ltd. today. Silver joined a slump in global commodities from oil to gold and grain, as the dollar rebounded and some investors sold the metal to lock in gains.

Global silver demand climbed 15 percent to 1.06 billion ounces last year, the highest level in at least 20 years, as investment jumped to a record and industrial usage rebounded from a five-year low, researcher GFMS Ltd. said in a report published by the Washington-based Silver Institute on April 7.

‘Rushing for More’

“Physical silver is on fire, so people are rushing for more,” said Ketan Shroff, managing director of Pushpak Bullions Pvt. in Mumbai. “People are very bullish on silver.”

Silver trading on the National Spot Exchange has increased at least 20 percent in the past month, Sinha said. Prices may reach 100,000 rupees per kilogram in the next three to six months, he said.

Silver’s relative cheapness to gold is spurring some investors to favor the metal over bullion. The ratio of gold to silver dropped to the lowest level since September 1980 yesterday. An ounce of gold bought 32.9 ounces of silver today, according to data compiled by Bloomberg.

“People are feeling more comfortable to buy silver and sell gold,” said Pushpak’s Shroff. “There’s a little bit of selling in gold and physical-silver buying.”

Futures Tumble

Silver for immediate delivery tumbled as much as 4.8 percent to $44.6625 an ounce and traded at $45.2887 at 10:10 a.m. in Mumbai. Gold for immediate delivery dropped as much as 0.8 percent to $1,495.75 an ounce today. The metal climbed to an all-time high of $1,518.32 yesterday.

“The recent rise in the silver price has been too sharp in too small a timeframe and we could see some correction in prices,” Pritam Kumar Patnaik, vice president sales, Kotak Commodity Services Ltd., said by e-mail. “The current upward momentum will push silver to new all time high above $50 an ounce but we could see some correction in the near term.”

(Bloomberg) -- Silver, Gold Rise to Records on Bets China’s Demand Will Climb

Silver and gold surged to records in London on speculation that China will buy precious metals to diversify its foreign-exchange reserves.

China, with more than $3 trillion in reserves, plans set up new funds to invest in energy and precious metals, Century Weekly magazine reported, citing unidentified people. Silver for immediate delivery surged to a record $49.79 an ounce, and gold reached $1,518.32 an ounce.

“People are expecting China to be a major buyer of precious metals,” said Adam Klopfenstein, a senior strategist at Lind-Waldock in Chicago. “Gold is piggybacking on silver.

You’re seeing a blowoff rally in silver, but we don’t know when the bubble gets popped.”

On the Comex in New York, silver futures for July delivery rose $1.096, or 2.4 percent, to settle at $47.173 at 1:59 p.m. Earlier, the price climbed as much as 8.2 percent to $49.845.

The metal reached a record $50.35 in January 1980 as the Hunt Brothers tried to corner the market.

Spot silver jumped as much as 5.4 percent and fell as much as 3 percent.

Gold futures for June delivery rose $5.30, or 0.4 percent, to $1,509.10, after climbing to a record $1,519.20. The spot price advanced as much as 0.8 percent.

Commodities have reached the highest since 2008, partly on demand for a hedge against inflation. Gold and silver have rallied amid sovereign-debt concerns in the U.S. and Europe. Silver has posted the biggest gain in 2011 among 19 raw materials in the Thomson Reuters/Jefferies CRB Index.

Rate Outlook

The dollar has dropped for four straight weeks against a basket of major currencies. The Federal Reserve may keep borrowing costs at zero percent to 0.25 percent, while European Central Bank officials signal further rate increases. Fed Chairman Ben S. Bernanke will hold a media conference after the Federal Open Market Committee statement on April 27 following a two-day meeting in Washington.

“The disdain for currencies generally and the need to embrace precious metals is still very strong,” said Dennis Gartman, an economist and the editor of the Suffolk, Virginia- based Gartman Letter.

Before today, spot silver more than doubled in the past year, while gold increased 32 percent.

“Silver in the long run really will end up in a bloodbath, but in the short term, the market loves it,” Dominic Schnider, a Singapore based director of wealth-management research for UBS AG, said today in a Bloomberg Television interview. The commodity’s 14-day relative-strength index, which may signal a decline above 70, was over 89.

Investment Demand

Investment demand for silver climbed 40 percent to a record in 2010, and fabrication use jumped to a 10-year high, GFMS Ltd. said in an April report published by the Washington-based Silver Institute. Assets held in exchanged-traded products rose to a record 15,509.54 metric tons on April 12, data compiled by Bloomberg from four providers shows. “Silver is definitely benefiting from spillover demand from gold as a haven investment,” said Li Ning, an analyst at China International Futures (Shanghai) Co. Silver also is found in products from solar panels to plasma screens and chemical catalysts.

(Bloomberg) -- Dim Dollar Outlook to Spur Gold Rally, WJB Capital’s Roque Says

The outlook for the dollar remains bearish, which means gold prices will keep rising from today’s record, according to John Roque, a managing director at WJB Capital Group Inc.

“People want to know the target for gold, and our response is: How low can the dollar go?” Roque said today in a television interview with Tom Keene on “Bloomberg Surveillance.” “We just think that the trend is up, and we’re just going to stick with it.”

Spot gold touched an all-time high today of $1,518.32 an ounce in London. On the Comex in New York, gold futures touched a record $1,519.20 an ounce.

(Bloomberg) -- Swiss Platinum Imports Were 3,350 Kilps in March, Customs Says

Switzerland’s platinum imports were 3,350 kilograms in March compared with 3,619 kilograms in February, according to the Swiss Federal Customs Administration.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.