QE2 and the Fate of the U.S. Economy

Economics / Quantitative Easing Apr 26, 2011 - 07:17 PM GMTBy: David_Galland

By David Galland, Casey Research : In the last few weeks, I’ve become particularly “attentive” to the intentions of Fed policy makers following the scheduled June end date for QE2.

By David Galland, Casey Research : In the last few weeks, I’ve become particularly “attentive” to the intentions of Fed policy makers following the scheduled June end date for QE2.

This is no small matter; an actual shift in Fed policy – as opposed to the smoke and mirrors sort – could temporarily play havoc on equities and commodities markets alike. How could it be otherwise, when under QE2 the Fed has been writing checks to the Treasury in amounts of upwards of $100 billion a month since last November?

As a point of reference, at the end of April 2007, the monetary base of the U.S. was $822 billion. At the end of April 2011, it will be $2.5 trillion, a three-fold increase. Call it what you want, “quantitative easing,” “stimulus,” “political payola,” “madness,” but monetary inflation is the correct term. And monetary inflation on this scale invariably leads to price inflation on a similar scale.

It is this “money,” steadily ginned out of thin air, that provides the fuel to keep the spendthrifts in Washington spending and props up the wounded economy.

It is also this “money” that sends equities and commodities soaring as investors look for higher returns and things more tangible to hold ahead of the rising inflation.

Removing the stimulus, therefore, will almost certainly have consequences.

Yet, because the politicos and their pets at the Fed have taken things so far beyond the pale at this point, so would a decision to keep the monetary pedal to the metal past June. As you can see in the chart below, technically speaking, the dollar is breaking down.

This steep downward slope of the dollar’s trend line over the last year begs for the Fed to attempt something to slow the dollar’s descent. Were they to signal a continuation of the same level of monetization now underway, past June, can anyone doubt that the dollar’s steep fall would only worsen, risking even collapse?

To my way of thinking, therefore, the logical starting point is for them to let QE2 expire in June, as planned, in order to show the world some monetary spine.

That is not to say that the Fed will leave its seat empty at Treasury auctions post-June – various members of the inscrutable institution have already made clear the intent to continue reinvesting the proceeds of maturing securities in the Fed’s portfolio back into Treasuries. Yet, even with that ongoing action – resulting in Treasury purchases to the tune of $17 billion a month – the net result will still be a monthly gap on the order of $80 billion.

All Eyes on Interest Rates

The dialing back of the Fed’s monetary machinations increases the possibility that interest rates will need to rise in order to attract buyers in sufficient quantities to fill the gap. And if there’s one thing we know, it is that rising interest rates would be devastating to an empire of debt such as the United States circa here and now.

One typically doesn’t like to see the empire in which one lives crumble into lesser states, as that is usually accompanied by a flagging quality of life and social unrest. Though there is bupkis that I, or any of us, can actually do at this point to rearrange things on the larger stage – it does behoove us to look after ourselves. Which, in the current case, requires a quick detour on the nature of interest rates.

We humans don’t really like change. And so we tend to embrace scenarios involving only gradual change – the soft sort that are easily coped with, with small and measured adjustments to the riggings.

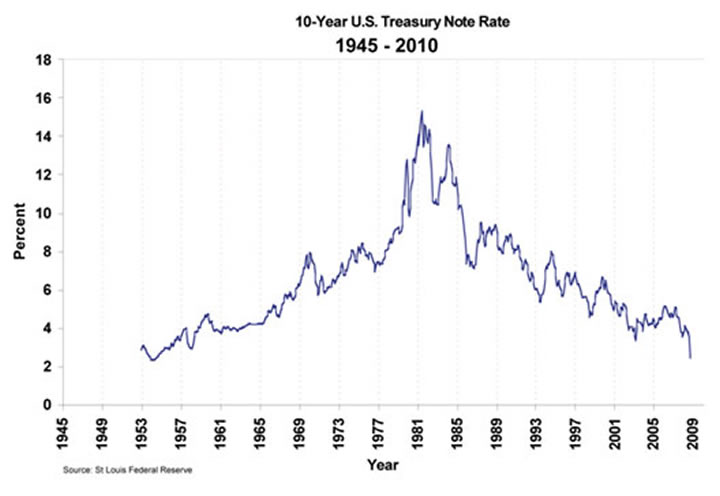

The risk in such a passive perspective can be seen in the chart here showing the benchmark 10-Year U.S. Treasury rates from 1945 to 2010. While it is worth noting that over that entire 65-year period rates have never been lower than they are just now, a clear sign that today’s low, low rates are anomalous – and doubly so given the amount of outstanding debt – my primary purpose for presenting this chart is to narrow your focus to the period between 1975 and 1977.

As you can see, in 1975 – a period associated with a temporary calm before heading into a final inflationary blow-off – interest rates were actually on the decline and had fallen below the levels of 1970. Then, in the blink of the proverbial eye, 10-year rates started accelerating upwards, moving from just over 6% to over 15%, driven by the raging inflation and, in time, a Fed policy shift designed to crush that inflation. While rates subsequently peaked and began to ease, in fits and starts, it took a full decade before they returned to the 1975 level.

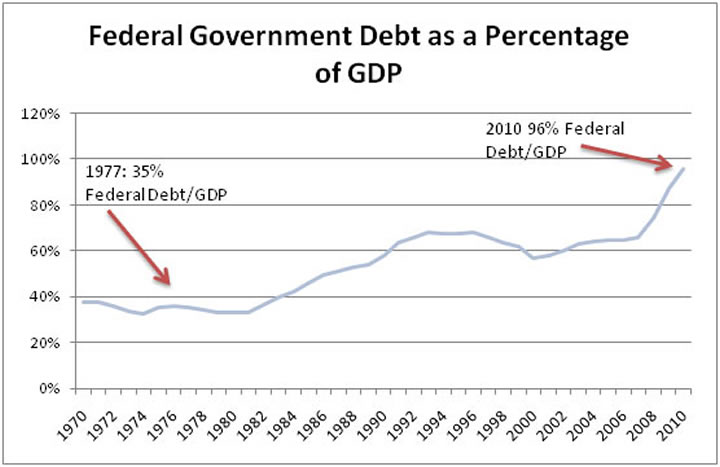

Unfortunately, the situation today is worse, which is saying something. As you can see from the next chart here, in 1977, U.S. federal debt was a third of where it is today as percentage of GDP, and this doesn’t reflect the coming ramp-up of trillions of dollars in additional debt that is now baked into the federal government’s spending plans.

Should we see a similar spike in interest rates to, say, 15%, it would create a black hole that wouldn’t just suck in all the government’s revenues, but pretty much the entire economy. This is a very real risk.

But back to the Fed and the crossroads it is soon arriving at. In the absence of any substantial reduction in government spending – a reduction on a scale that isn’t even being whispered about in the halls of power – the Fed is damned if it dials back its monetization (jacking up the potential for rising interest rates), or if it doesn’t (dooming the dollar and in time triggering higher interest rates as well).

The politicians and their friends down at the Fed can pretend, as they do, that the overhang on the economy of some $14 trillion in debt, and another $50 trillion or so in longer-term entitlements, is much ado about nothing. This view of theirs is confirmed by the current budget discussions that talk of slashing $4 trillion out of federal spending over the next 12 years – but ignore that this slashing still anticipates annual deficits on the order of $1 trillion. There are facts and fictions in this universe of ours, and it’s a fact that the notion of spending our way to better days is a fiction.

And so, in my mind, there is no question that the Fed will ultimately be forced to unleash QE3, and that will be followed by QE4, QE5 and so on through QE15 – or whatever number is in force at the time of the dollar’s collapse.

In the meantime, though, given the current ill health of the dollar, I remain convinced that the Fed will pause in its blunt-force monetization, come June. And that is likely to provide a shot in the arm for the dollar – versus the equivalent of a shot in the head to the dollar, should they reverse themselves and attempt to continue monetizing at the same elevated levels, past June. Among other consequences, a rising dollar could spell trouble for overheated commodities, at least over the short term.

The big unknown, of course, is what will happen to U.S. Treasury rates. And for reasons discussed a moment ago, this is a really important unknown. We shouldn’t have to wait overly long for some answers. But while we wait, a few scenarios to ponder:

- Best Case: For a time, post-June the Fed becomes a relatively less important player at the Treasury auctions, buying about $17 billion in Treasuries, vs. the $100 billion or so they are buying now, and the market responds favorably to the policy shift. The gap left by the Fed is filled in by institutions, and by friendly governments, looking to roll back their diversification into the euro and the yen – given the poor outlook for both. For a while Treasury rates remain relatively stable. And that encourages the U.S. government to continue spending willy-nilly and keeps the party for equities continuing for awhile longer, albeit with the participants on edge and watching the exits for any movement. A rebound in the dollar, one result of an inflow of renewed foreign buying, would hit the commodities, causing them to underperform until it becomes obvious to all down the road that the Fed will have to once again begin monetizing.

- Medium Case: Post-June, participation at the Treasury auctions weakens, but not disastrously. Rates rise, but also not disastrously. The economy teeters on the edge, but doesn’t fall. Neither does the dollar rise overly much, and something akin to a twitchy status quo continues as people wait for the other shoe to drop, as it inevitably must given that the overarching problem of sovereign and household debt has not been resolved. Volatility in equities and commodities increases, but there is no sustained move one way or the other. Yet.

- Worst Case: Post-June, auction participation falls significantly, and interest rates begin to accelerate to the upside, sending equities markets into a tailspin, dragging commodities down with them. The Fed quickly reverses course and begins writing the big checks to the Treasury, stabilizing interest rates but sending shock waves through FX markets as the dollar hits the floor and discovers the floor is made of glass. The precious metals and other commodities soar. With nowhere else to run, investors begin bargain shopping for fallen equities – which are linked to tangible businesses, after all – and they bounce relatively quickly as well. Meanwhile, as the dollar collapses, the cost of everything begins to soar, crushing the unprepared and triggering real hardship. Unable to push interest rates higher to head off the price inflation, the Fed heads retreat to a hidden bunker and begin looking for friendly countries willing to give them sanctuary.

Of course, no one can see the future – but I think all three of those scenarios are likely to materialize in the relatively near future, one after the other from Best to Worst.

If I am right, then the way to play it is to expect a near-term rally in the dollar. While the U.S. dollar is toilet paper, it is of a better quality than the euro or the yen. Which is not to say that it doesn’t deserve its ultimate fate – the fate of all fiat currencies – but rather that, as long as the Fed shows some restraint here, it may be able to stave off that fate a bit longer.

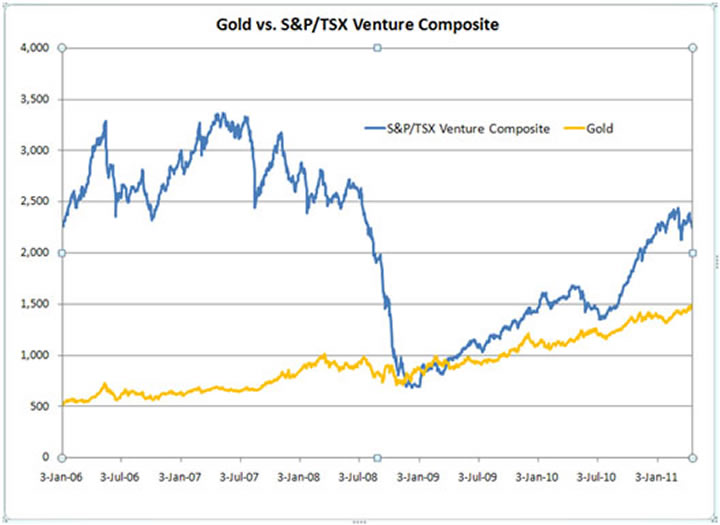

And that could put some serious pressure on commodity-related investments, especially the more thinly traded junior exploration stocks. The chart here shows the relative performance of the Toronto Stock Exchange Venture Index – the index offering the best proxy for micro-cap resource stocks – against the price of gold.

As you can see, there can be quite a divergence in the performance of these small stocks over the price of bullion. While gold’s rise has been remarkably orderly, the rise in the stocks has occurred in fits and starts, with some breathtaking setbacks along the way. Of late, the stocks have had a substantial run-up, which again gives me pause. I think it is a fairly safe bet, therefore, that if gold were to correct 15% or so, the juniors would again go on sale.

In time, however, because interest rates are so low and the sovereign debt problems so acute, the worst-case scenario – of rates spiking – followed by the Fed quickly reversing course, is a certainty.

Which is to say that, in the now foreseeable future, all things tangible will do the equivalent of a moon shot.

Again, you have to make your own decision as to which scenario we are most likely to see. In my view, from a risk/reward perspective, as long as you have a core portfolio in precious metals and other tangibles (including energy), then selling some of your more speculative positions (you know the ones) to raise cash can make a lot of sense. That way you’d have the ready funds available to snap up the bargains that will be created during the Fed’s brief attempt at slowing the dollar’s current fall.

The way I figure it, at this point you can find all manner of analysis that will tell you it’s all blue sky from here for the commodities. Thus, a cautionary note seems justified.

Be careful, at least for the next couple of months. If I’m right, then there is a helluva buying opportunity right around the corner.

[If David's right about what's coming next, then cashed-up investors will be positioned to capture some truly exceptional profit opportunities, maybe as soon as within the next month. Which makes this the perfect time to take advantage of the 3-month, 100% money-back-guaranteed, no-risk trial to the Casey International Speculator – dedicated to well-managed junior gold and silver companies with triple-digit upside potential. More here.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.