Gold and Silver Bubble? Some ETF Retail Investors Are Taking Profits

Commodities / Gold and Silver 2011 Apr 27, 2011 - 08:35 AM GMTBy: GoldCore

Gold and silver are tentatively lower this morning despite the dollar and especially the yen being under pressure. The possibility of Japan being downgraded has seen the yen join the dollar under pressure and gold has risen to over 124,000 Japanese yen per ounce, some 2% below the record nominal high just over 126,000/oz.

Gold and silver are tentatively lower this morning despite the dollar and especially the yen being under pressure. The possibility of Japan being downgraded has seen the yen join the dollar under pressure and gold has risen to over 124,000 Japanese yen per ounce, some 2% below the record nominal high just over 126,000/oz.

Gold in Yen - 1 Day (Tick)

Japan’s public finances were already very poor prior to the earthquake and nuclear catastrophe and are set to worsen considerably, which should see the yen fall sharply versus gold.

Sovereign debt risk remains elevated in the eurozone and the cost of servicing peripheral nations’ debt continues to rise. The cost of insuring debt sold by Greece, Portugal and Ireland rose to records this morning as have bond yields in Greece which have leapt to new records – over 16% on the 10-year and 25% on the 2-year. Irish and Portuguese 10-year yields have risen to 10.63% and 9.65% respectively.

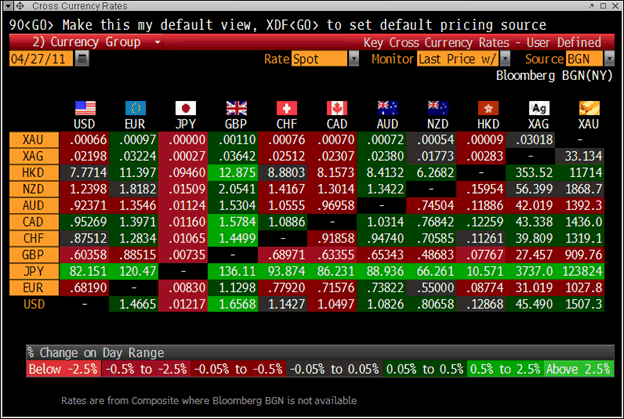

Cross Currency Table

Sovereign debt risk can now be seen in the eurozone but also in Japan and the US, and as long as sovereign debt risk remains elevated, precious metals will continue to be bought as hedges and for safe haven purposes. This should lead to the continuation of gold and silver’s secular bull markets. Although, participants should as ever realise that there will be corrections – some of which can be sudden and sharp.

Evidence shows that speculation in gold and silver remains muted as seen in the Commitment of Traders reports and the total gold and silver ETF holdings – neither of which have shown huge increases or signs of “irrational exuberance” or investors “piling in”.

Commitment of Traders (COT) data is hardly indicative of an overly bullish sentiment extreme that would normally precede a sharp sell off.

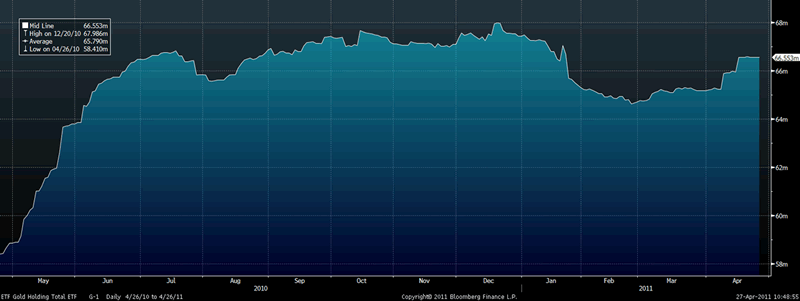

Total Gold ETF Holdings - 1 Year (Daily)

Total ETF gold holdings (see above) are near the levels seen last June and below the levels seen in September, October, November and December.

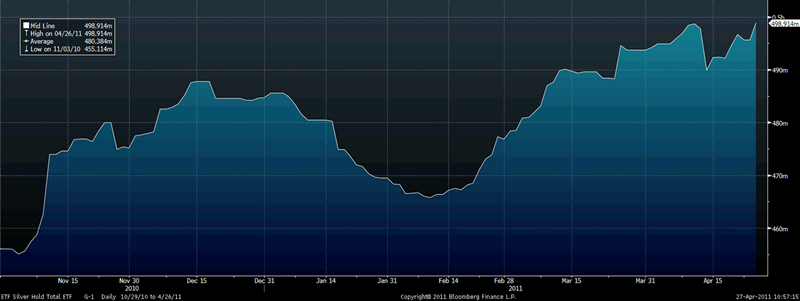

Total ETF silver holdings (see below) have risen in recent days but are not far above the levels seen in December 2010 – some 5 months ago.

Total Silver ETF Holdings - 1 Year (Daily)

Indeed, the ETF holdings appear to show that ETF precious metal holders are “stickier hands” than had been expected as gold holdings look to have consolidated above the 64 million ounce mark.

Total ETF gold holdings at 66.55 million ounces are worth nearly $100 billion at $1500/oz ($99,825,000,000). Total silver holdings of 498.914 million ounces price at $45.50/oz are worth only some $22.7 billion, suggesting that silver remains under-owned when compared to gold and could see a sharp increase in holdings in the coming months and years.

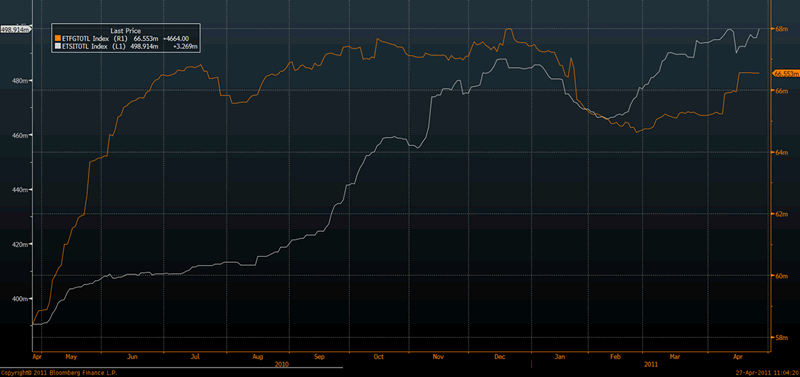

Total Gold and Silver ETF Holdings - 1 Year (Daily)

The $22.7 billion (total silver ETF holdings) is a small number when compared to the huge sums of money at the disposal of high net worths, hedge funds and sovereign wealth funds. The last quarter saw Apple’s iPhone revenue alone top $12 billion. This puts the silver holdings figure in perspective.

One hedge fund alone, the Man Group, has assets of over $69 billion.

Some Clients Taking Profits and More Opting for Coins and Bars

Many of our clients have taken profits on certificates in recent days. Most continue to be prudent and continue to maintain a core holding (for portfolio diversification and financial insurance purposes) but there are definitely concerns amongst some of a bubble.

Others have taken profits on certificates and bought gold and silver coins and bars (in secure storage or delivered). Recently orders for coins and bars have outweighed those for certificates and there is definitely an increased preference for physical coins and bars and for taking delivery.

Our ratio of sell orders to buy orders is the highest it has ever been. Industry associates confirm that they have been seeing an increase in selling on behalf of the public and that speculative buying continues but is minimal.

The majority of the western public remain unaware of gold and silver as investments and as stores of value. Most do not even know how much an ounce of gold costs in local currency terms as precious metals continue to be ignored by most of the non financial press or media.

This is in stark contrast to the Middle East and Asia where demand remains robust and may even be increasing due to inflation concerns.

Ignorance regarding gold and silver in much of the western world is hardly indicative of a mania or speculative bubble.

Gold

Gold is trading at $1,508.25/oz, €1,028.10/oz and £911.05/oz.

Silver

Silver is trading at $45.44/oz, €30.97/oz and £27.44/oz.

Platinum Group Metals

Platinum is trading at $1,807.00/oz, palladium at $749/oz and rhodium at $2,250/oz.

News

(Reuters) -- Silver steadies, gold perky ahead of Fed decision

* Gold, silver may be rangebound ahead of Fed meeting

* India shows strong appetite for physical silver

* Coming up: U.S. Fed chief Bernanke briefing; 1815 GMT

Silver steadied on Wednesday, after its largest one-day slide in over a month the previous day, while gold profited from a weaker dollar which came under pressure ahead of a U.S. Federal Reserve interest rate decision.

The Fed is not expected to signal any rush to scale back its multi-billion dollar support mechanisms for the economy, so investors are waiting to hear more on the outlook for monetary policy from chairman Ben Bernanke when he gives the central bank's first post-decision news conference later in the day.

With the dollar under pressure and its inverse link to gold strengthening for the first time in a week, the bullion price was set for a second day of gains, although a string of public holidays in the United Kingdom restricted volumes.

Spot gold XAU= was last up 0.4 percent at $1,506.90 an ounce by 0940 GMT, about 0.8 percent below Monday's record high at $1,518.10. U.S. futures for June delivery GCv1 were last up 0.3 percent at $1,507.30.

"It's consolidation. Gold has done a bit better than silver over the last couple of days, but we're still in a holiday period here in London so trading volumes are not as high as normal and I don't think there will be a huge move (ahead of the Fed," said Mitsubishi analyst Matthew Turner.

"I don't think there's much outlook until after the press conference," he said.

Gold could continue to draw strength from any weakness in the dollar, particularly if the Fed maintains its accommodative policy stance, in contrast with the European Central Bank, which has raised rates as it attempts to curb inflation.

"The market is a bit mixed ahead of the Fed meeting, which will influence the move of the dollar and precious metals," said Peter Fung, head of dealing at Wing Fung Precious Metals based in Hong Kong.

Silver steadied somewhat, following its largest one-day fall in a month the previous day. The price is on track for a 21 percent gain this month and a 47-percent rise this year, making it the top performing precious metal.

Dealers in Asia said strong physical demand was offering some support to silver, although holdings of silver in the world's largest exchange-traded funds staged their largest one-day outflow in nearly two weeks by April 26. [GOL/ETF]

Spot silver XAG= was last flat at $45.48 an ounce, having recovered from a 3-percent drop on Tuesday, its largest one-day slide in six weeks.

U.S. silver SIcv1 was last up 1 percent at $45.52. Implied volatility in silver options has been at its highest this week since November last year as the spot price has swung from lows around $43 to highs above $49 in the space of a week.

"The recent sharp increase in volatility is an indication of the increasing nervousness of market players and could be a sign that the rally in the silver price is approaching an end," said Commerzbank in a note.

In fundamental news for silver, MMTC, India's largest bullion importer, plans to double its silver purchases this fiscal year to 1,500 tonnes, to catch up with exploding investment interest.

Platinum XPT= was last up 0.4 percent at $1,804.49 an ounce, while palladium XPD= was flat at $750.00.

(Yonhap) -- S. Korean depositors look to foreign currency, gold

An increasing number of South Korean bank depositors are putting their money into foreign-currency denominated deposits or gold-buying deposits this month, data showed Monday, pointing to a growing appetite for safe assets.

Four local banks including top lender Kookmin Bank drew US$12.6 billion in foreign-currency deposits as of Thursday, up $149 million from the end of March, according to industry data. The deposits rebounded in February after falling for the fourth consecutive month in January.

The rise came as customers try to put their money into such deposits at a time when the value of the dollar remains weak.

The South Korean currency, which hit a 32-month high to the dollar last week, has risen about 5 percent per the greenback since the start of this year. The won is widely expected to be under upward pressure against the dollar, aided by robust exports and sustained inflows of foreign capital.

As the dollar has slid against major currencies amid the U.S. Federal Reserve's soft monetary policy, gold has extended its rallies, sending the price of the precious metal above $1,500 per ounce.

The risks of global inflation are raising expectations that the price of gold might rise as a tool of hedging inflation risks, market experts say.

Demand for gold-buying deposits in South Korea has risen, reflecting the popularity of gold as a form of investment, industry watchers said.

Such deposits came to 269.1 billion won (US$248.9 million) as of Thursday, up 13.6 billion won from the end of the previous month, according to Shinhan Bank. The deposits rose by 68.7 billion won from the end of last year.

If people put their money into such gold-buying deposits, they can invest in the equivalent amount of gold in accordance with changes in gold prices.

(Reuters Life) -- South Korean infants hit by gold price surge

Surging gold prices have forced South Koreans to cut down on traditional rings given to mark the first birthday of the children of friends and relatives, making jewellers to come up with a lighter and cheaper alternative to boost sales.

A gold ring is a traditional present to wish a baby good luck and fortune, but a rise in gold prices to a record $1,508 an ounce on Thursday has priced even the most devoted out. The rings are sized to the baby's finger and its name may be engraved inside.

"On average, monthly sales of dol (first birthday) rings is only one-tenth compared to last year," said Yoo Dong-soo, chairman of the Korea Precious Metals Association.

A new one-gram ring, much lighter than the customary baby gift weighing an eighth of an ounce or 3.75 grams, would help lift sales and preserve the long-standing tradition, he added.

The first birthday is a huge ceremonial occasion in Korean tradition that includes a birthday party. During the party, a baby, sometimes wearing gold rings, selects an item from among things such as thread, a pencil or money to predict their future, while families and guests watch.

"The one-gram ring sounds just doable for both party hosts and guests, we don't have to feel it's a burden," said Park Su-yeon, a 34-year-old mother who's planning her baby's first birthday party in May.

But sentiment only goes so far. Some parents have actually sold the rings engraved with their infant's name to take advantage of rising gold prices.

(Bloomberg) -- Silver May ‘Pull Back’ in Short Term, Standard Chartered Says

Silver may drop in the short term after the metal’s ratio to gold was “overextended” and prices touched a record in London, Standard Chartered Plc said.

“We look for a pullback in prices in the short term amid continued volatility,” analysts led by London-based Dan Smith said in a report today.

(Financial Times) -- Does every pause have a silver lining?

Count references to the Hunt brothers in leading newspapers and the results for 2011 look not unlike the stratospheric rise of silver – the market they infamously tried to control in 1980.

But since Monday’s $49.70 an ounce peak – close to the record just above $50 reached during the Hunt brothers’ episode – the metal is off more than 8 per cent.

Is this market “sticker shock” – the jittery trading that surrounds big round numbers – that can be overcome? Or is this the end of a frothy, speculative rally?

There has certainly been speculation in the form of market-savvy momentum-chasing hedge funds and the sort of retail investor interest often seen during bubbles.

But there is also genuine end-user interest: Indian consumers, priced out by the rally in gold, are increasingly turning to silver.

US consumers too have been doing their bit. Sales of silver coins have rocketed since the financial crisis. Some of this is linked to fear of the damage to the dollar from the Federal Reserve’s ultra-loose monetary policy.

Silver’s rally needs to be put into perspective. At almost 150 per cent over seven months, it is stunning, but far short of the spectacular 400 per cent in five months managed during the Hunt brothers episode.

Put against gold, silver does look distinctly racy. The ratio of gold to silver prices is at its lowest since 1980, and has plunged from 46 in January this year to 33.

There are reasons enough to think silver’s rally could fade. Fed “fears” should ease if, as expected, it confirms today that it will end its quantitative easing in June, even if no rate rises are yet in sight.

There is, however, no logical reason for $50 an ounce to be anything more than a psychological issue for investors.

But it would do no harm for investors to at least pause to take stock before even considering another push higher.

(Bloomberg) -- Hong Kong Mercantile Bourse to Start Trade With Gold May 18

The Hong Kong Mercantile Exchange, backed by the world’s largest lender, will start trading dollar- denominated gold futures on May 18, tapping demand for the metal which has rallied for 10 consecutive years.

The exchange received permission from the city’s Securities and Futures Commission, it said today in an e-mailed statement. The futures will be the bourse’s first product, and there are plans for industrial and other precious metals, energy, agriculture and commodity indices, it said. Gold futures are currently traded on the Comex division of the New York Mercantile Exchange.

Immediate-delivery gold soared almost 30 percent last year and this week reached a record $1,518.32 an ounce, as investors sought to protect their wealth from further currency debasement and accelerating inflation. Chinese demand may advance 15 percent this year as investors seek a hedge against inflationary pressure, according to the China Gold Association.

“Our new platform will offer Asia a bigger say in setting global commodity prices,” Barry Cheung, chairman of the exchange, said in the statement. “Market participants in the region have had to rely on Western exchanges for price discovery,” he said.

The new Hong Kong gold futures will be 1 kilogram per contract, with physical delivery in Hong Kong. Trading hours will be between 8 a.m. and 11 p.m. local time.

Trade on the Hong Kong bourse will start with at least 16 members including Morgan Stanley and MF Global U.K. Ltd., the exchange said. Transactions will be cleared through London-based LCH.Clearnet Ltd., the company said.

LCH.Clearnet is Europe’s largest clearing house, and has members including the London Metal Exchange, the world’s largest marketplace for copper and aluminum.

The Industrial & Commercial Bank of China, the world’s largest lender by market value, bought a 10 percent stake in the Hong Kong Mercantile Exchange in December to become a founding shareholder.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.