U.S. Debt Saturation and Money Illusion

Interest-Rates / US Debt Apr 27, 2011 - 02:40 PM GMTBy: Gordon_T_Long

Most of the clearly evident financial problems that surround us today stem from one cause - Debt Saturation.

Most of the clearly evident financial problems that surround us today stem from one cause - Debt Saturation.

Most, intuitively, sense this to be a correct assessment but few can either prove it or articulate it to the less sophisticated. Let me arm you to be the "Nostradamus" amongst your friends and colleagues in explaining the problem and what the future therefore foretells.

However, let me make it very clear, this will not make you popular. Smart maybe, but highly likely to make you unwanted at the social gatherings of the genteel.

However, let me make it very clear, this will not make you popular. Smart maybe, but highly likely to make you unwanted at the social gatherings of the genteel.

The first thing you will need in your role of 'all seeing' is the back of an envelope, or a somewhat clean napkin at your next luncheon. You will need only a few simple facts to go along with your prop.

THE FACTS MAME, JUST THE FACTS!

First, if you could total the world's balance sheets you would find that it would approximate $200 Trillion. In putting together this total you would discover that 75% of all financial assets are debt assets worth $150 Trillion. To most of us, debt is the epitome of a liability. To banks, however, it is not. It is considered an asset and recorded as such a banks ledger. Your liability is their asset.

The historical debt payment over a long period of time is 6% per annum. The Federal Reserve's dividend payment to its holders of capital was originally established in 1913 at precisely this 6% and is still accrued accordingly. Remember also, in a fractional reserve, fiat based banking system money can only be loaned into existence.

Today we have approximately $9 Trillion (6% of $150T) in annual debt payments that must be absorbed annually by increased productivity of the working classes.

Consider that the US Economy at approximately $15 Trillion is 25% of the global economy. Therefore the global economy approximates $60 Trillion ($62T officially, but we will use round numbers so we don't lose anyone in the arithmetic).

The working class therefore has to increase productivity by $9T divided by $60T or 15% annually to absorb the current global usury charges.

In the last few years of explosive debt growth we have passed the point of the global economy being able to grow and improve productivity at a fast enough rate, not to be literally consumed by this existing debt burden.

Unfortunately, it gets worse.

One of the problems in using GDP as a measure of growth is that it includes government spending. In the case of the US, it is approaching 25% of the output of the country. Within that, approximately $3.7 Trillion is $490B in interest payments or 13% of US expenditures. This actually

means that there is an additional 3% that must be added to the 15% or nearly 18%.

This is called Debt Saturation.

DIMINSHING MARGINAL PRODUCTIVITY.

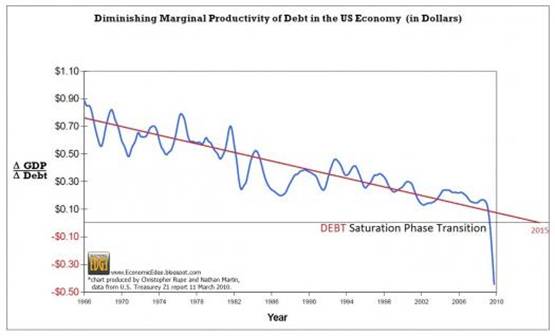

A very unpopular chart to deficit spending hawks is the chart showing the change in GDP as a ratio to the change in debt. The easiest way to understand this chart is to consider how much the economy will grow for every dollar of increased debt. As you can see, the effect of increased debt has been steadily losing its ability to increase economic growth and since the financial crisis has decidedly turned negative.

Increased debt is now counterproductive to the growth of the economy because the economy simply does not have sufficient productive investments to absorb it. We may have plenty of investments but they are mal-investments. They are investments that simply cannot pay the debt financing utilized.

The Korean Times recently illustrated that despite a booming Asian environment, technology firms are now struggling to cover interest payments. One in three firms on the Kosdaq failed to earn sufficient money to cover interest payments in 2010. The interest coverage ratio, otherwise dubbed times interest earned (TIE), refers to the measure of a firm’s ability to honor its debt payments. 280 out of 876 Kosdaq-listed outfits, or 32 percent, could not reach the benchmark reading of one in the interest coverage ratio.

TELLTALES OF DEBT SATURATION:

1- Non Performing Loans

The mal-investment is just too large to contain and is showing up in ever-increasing levels of non-performing loans. This is despite rolling over loans at false asset values.

Non-performing bank assets are increasing globally! The above chart from Reggie Middleton's BoomBustBlog graphically depicts this indisputable trend. What is this signaling three years after the financial crisis?

The rise in the above US non-performing assets is alarming. It reflects a 9.5% change since 2005. Everything is not at all well in the US banking sector.

Equally concerning is what is happening in Central and Eastern Europe where the change is 7%. I personally consider Central and Eastern Europe to be the unaddressed 'sub-prime' problem of Europe. I suspect it will eventually replace the PIIGS in financial media news coverage.

2- Chronic Unemployment

The money lenders look at unemployment in a different fashion than the average person and would have us easily confused by its adjustments, birth-death models and other deceiving statistics. To them it is not about how many of our fellow citizens are unemployed, but rather simply how many net new jobs are being created to pay for the annual usury assessment fee of the $9 Trillion we previously discussed. Herein lies their problem.

The internet has had a profound impact on the increase in productivity. Schumpeter's creative destruction is an engine running at full throttle. Vast swaths of jobs are being made obsolete through the adoption of new technology. The 'clerical' industry has almost disappeared in the span of 15 years through operational innovations such as supply chains. This has been tremendous for corporate profits allowing them to maintain highly leveraged balance sheets. The problem is that it has been solely at the expense of real job growth. No matter what a corporation does to make money, it eventually comes down to a consumer having the money to pay for the goods or services it produces.

We have reached the saturation point where we have insufficient real income growth to maintain the leveraged balance sheets of corporations. Government social nets are becoming burdened with making up the difference in either transfer payments (i.e.45 Million on food stamps in the US) or subsidies ( North Africa paying 28% of country budgets toward food subsidies for the unemployed population to survive). There are examples everywhere if you care to look. I have written extensively on this in my series on Innovation and in articles such as "Fearing the Gearing".

3- Money Velocity Doesn't Increase with Money Printing

Debt Saturation occurs when aggregate income no longer supports debt burdens. When governments print money, eventually Money Velocity increases as people incorporate inflation expectations into their buying behavior. When we examine the Federal Reserve's Money Velocity statistics we see that something is very different this time.

Despite increases in MZM, M1 and M2 money velocity maintains its downward slope with little suggestion of wanting to reverse trend.

We presently have inflation in what people NEED along with shrinking real disposable incomes. Since people must pay for their NEEDS with short term money (cash, check or credit card), there is little ability for them to adjust to inflation when they are living from paycheck to paycheck. If their disposable incomes were higher they would stockpile and turn their money over faster. Additionally, money as a multiplier would flow through our society. Instead, today the money does not move through multiple hands but is returned almost immediately to the banks as debt payment, since most intermediaries are also burdened with debt.

WHAT YOU MUST BE AWARE OF

First, You must understand the impact of mal-investments and the brake that debt is now applying to the Global Economy.

First, You must understand the impact of mal-investments and the brake that debt is now applying to the Global Economy.

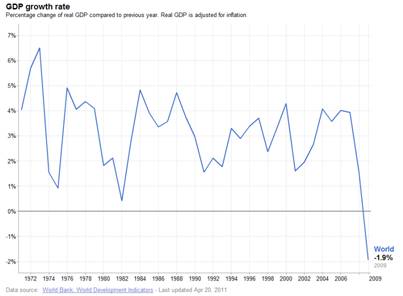

World Real GDP, adjusted for inflation on a year-over-year basis has plummeted. According to the World Bank this growth indicator has gone negative with the world's real GDP actually shrinking Y-o-Y.

The global growth engine has not only stalled but has clearly hit an unexpected brick wall.

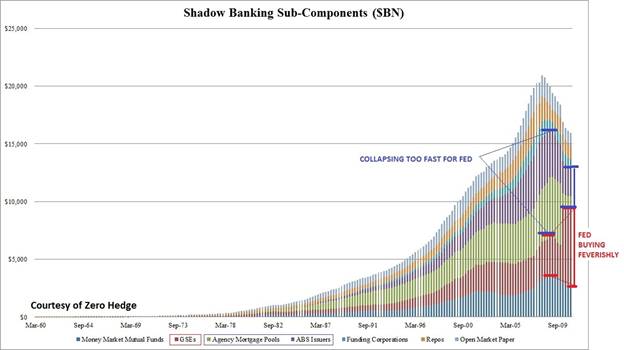

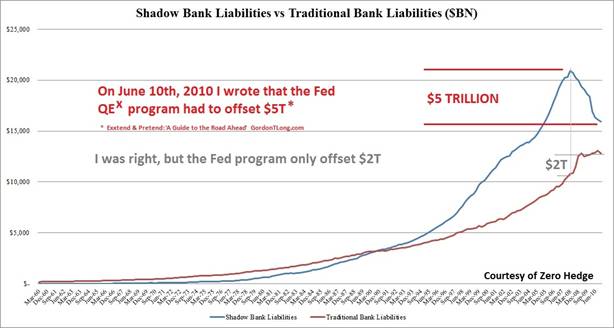

Secondly, You must understand the significance of the stalled and possibly fatally ill "Shadow Banking" Credit Engine.

Similar to moving about on an airplane or train it is hard to determine the speed you are traveling, because you have a limited

frame of reference. In a casual conversation with your fellow travelers it is easily forgotten or unnoticed that you are moving at a rapid speed. This is the situation we find ourselves in as the Shadow Banking System fails to rebound and the debt it once created is not being replaced. The liabilities of the Shadow Banking System are shrinking. These leveraged liabilities are now shrinking the global money supply despite every effort of central banks to combat it. The Central Banks are losing the battle. Like glacial tectonic shifts they are undermining the abilities of financial institutions to continue to carry and roll-over non performing debt.

Finally, You Must be Aware of: "Money Illusion"

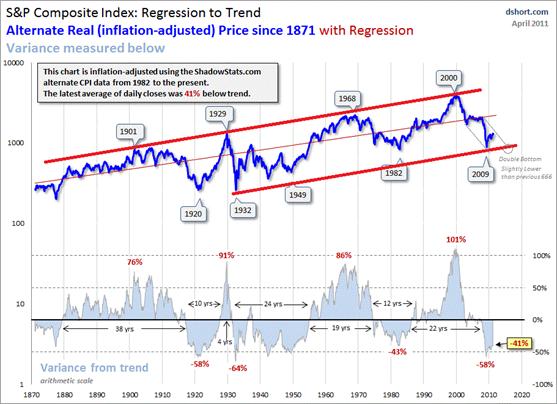

The overlay below of the Nominal and Real (ShadowStats inflation-adjusted) Dow illustrates the concept of Money Illusion, the tendency of people to think of currency in nominal, rather than real, terms. Below the Dow series is the Consumer Price Index (CPI) from 1913 and with estimates for the earlier years.

The above chart reflects what is actually going on in the financial markets. The secular bear market that began in 2000 is still underway. Since the 2009 lows we are experiencing a Cyclical Bull Market counter rally that is to be fully expected as part of a Secular Bear Market.

The above chart reflects what is actually going on in the financial markets. The secular bear market that began in 2000 is still underway. Since the 2009 lows we are experiencing a Cyclical Bull Market counter rally that is to be fully expected as part of a Secular Bear Market.

The chart to the right is adjusted for inflation based on published CPI numbers. If ShadowStats inflation numbers are used, as is the case in the above chart, then the chart to the right would more clearly resemble longer term secular bear markets already experienced.

CONCLUSION

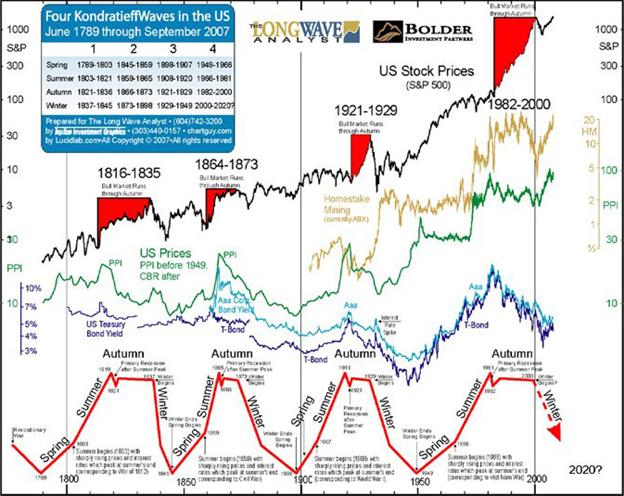

There is nothing magic in any of this and it has all been well documented, unfortunately by the Russians when they studied the capitalist system to identify its fundamental weaknesses. The Kondratieff long wave shows that the capitalist system suffers the build up and purging of debt on a generational basis on the frequency approaching 55 year cycles. We have extended this natural cycle by means of un-natural acts which I have written about in my extensive "Extend & Pretend" series of articles. Even in the days of old the king resorted to "jubilee" to cleanse the system. Of course we are much too sophisticated for such a simple solution today.

We have papered over the realities of "Too Big to Fail" by not allowing the proven tenets of capitalism to work. We have Anti-trust laws under the Sherman act to address 'too big', Control Fraud Laws to address questionable ethical behavior for the sake of profit (like mortgage fraud, liars loans etc) and Bankruptcy laws to liquidate failed enterprises to force debt holders to take haircuts and swap debt for equity. Instead we allow the prevalent game of Regulatory Arbitrage to run without restriction or detection. Existing laws are not being exercised in an attempt to protect what amounts to the emergence of a crony capitalist system. Benito Mussolini had a somewhat different world for the merging of corporate and government interests that I will leave for readers to recollect who have a historical penchant. It is not a word easily digested in the polite 'cocktail chatter' of today's genteel upper middle class.

Welcome to Kondratieff's Long Wave Cycle

FORETELLING THE FUTURE

In your new role as 'Nostradamus' to your friends you can safely predict a decade ahead to be a secular bear market in financial assets, in real terms. Nominal values may not show this clearly but it will be very evident in the reduced standard of living most Americans will experience.

You are going to have to work harder and harder, for less and less to survive at a lower and lower standard of living.

This will all be required to support the annual $9T debt bondage we have assumed as our politicos add additional 'stimulus' to a suffocating and debt saturated global economy.

Listen to FREE Global Insights audio, 3 times a week at www.GordonTLong.com Global Macro Issues for non-mainstream listeners looking for the truth.

Gordon T Long gtlong@comcast.net Web: Tipping Points Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2011 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.