Plummeting US Dollar: The Age of America is Over

Currencies /

US Dollar

Apr 30, 2011 - 06:53 AM GMT

By: Paul_Craig_Roberts

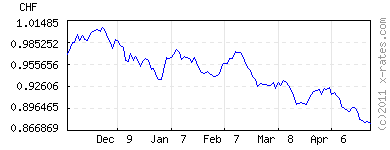

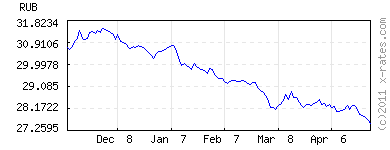

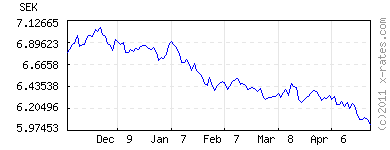

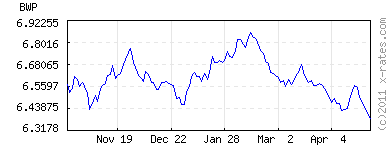

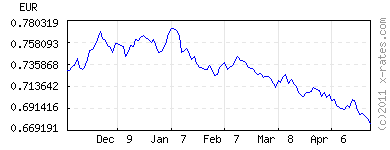

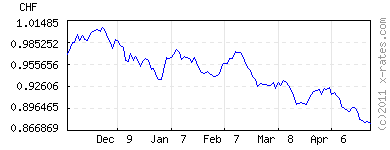

Today the Swiss franc made yet another new high against the super dollar, as it has been doing for 120 days. What you are reading in the graphs is less and less of the foreign currency that one dollar can buy. Of course, gold and silver also consistently hit new highs.

Today the Swiss franc made yet another new high against the super dollar, as it has been doing for 120 days. What you are reading in the graphs is less and less of the foreign currency that one dollar can buy. Of course, gold and silver also consistently hit new highs.

Swiss franc:

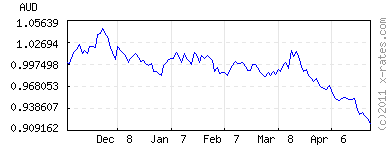

As did the Australian dollar:

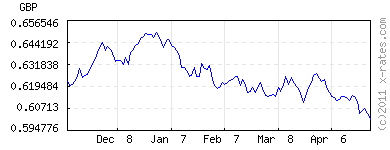

British pound:

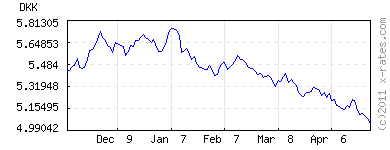

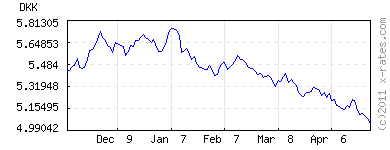

Danish krone:

Russian ruble

Swedish krona

Botswana pula:

European euro (despite the "sovereign debt crisis," a product of naive European trust in Americans and the criminality of Goldman Sachs and all of Wall St.):

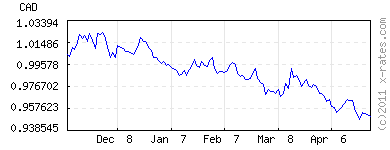

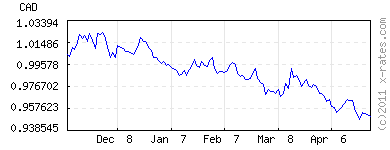

Other currencies, such as the Brazilian real and Canadian dollar have been consistently making new highs against the US dollar but failed by a few hundreds of a percent to do so today.

Canadian dollar:

Ben Bernacke says QE will end in June, but he is either delusional or lying. If the Fed stops monetizing Treasury debt, how will the $1.5-trillion-dollar annual operating deficit of the US government be financed? Are Americans, who are broke, suffering 22% unemployment, foreclosures on their homes and running out of money before the end of the month, as Wal-Mart's CEO recently stated, going to finance a 1.5-trillion annual government deficit? If you think so, I have a bridge to sell in Brooklyn.

The combined trade surpluses of China, OPEC, Japan and Russia are insufficient to finance more than one-third of the US budget deficit, assuming these countries are willing, in the face of the evidence, to continue to acquire US debt.

That means, even under the most optimistic scenario, that the Federal Reserve will have to purchase annually $1-trillion in Treasury debt.

In other words, the US, the great Super Power over-filled with hubris, has outdone the fiscal irresponsibility of third-world banana republics. Superpower America is financing itself by printing money.

Washington, by conducting open-ended wars of aggression against non-puppet states, by giving its approval to the off-shoring of US jobs and thereby US GDP, and by saddling bankrupt taxpayers with $1-trillion in non-recourse loans to mega-rich people in order that the richest and most favored could borrow from the Fed at nearly zero rates of interest hundreds of millions of dollars to buy under-valued student loans, credit card debt, mortgages, whatever, and have any profits from the purchase of under-valued assets put in their bank account and any losses put on the Federal Reserve's books. Obviously, the US economy is a scheme run by the rich for the rich.

In this scheme to impoverish Americans for the benefit of the mega-rich, the Federal reserve actually gave hundreds of millions of dollars to the wives of New York investment bank CEOs in non-resource loans. The already rich wives bought up under-valued debt and made a killing. The wives had no risk whatsoever, because if their investments failed, it went onto the Federal Reserve's books, not on the wives' entity. See Matt Taibbi's

The Real Housewives of Wall Street in Rolling Stone magazine.

As the International Monetary Fund said, recently, "the Age of America is Over."

Thank God.

Paul Craig Roberts [ email him ] was Assistant Secretary of the Treasury during President Reagan's first term. He was Associate Editor of the Wall Street Journal . He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University. He was awarded the Legion of Honor by French President Francois Mitterrand. He is the author of Supply-Side Revolution : An Insider's Account of Policymaking in Washington ; Alienation and the Soviet Economy and Meltdown: Inside the Soviet Economy , and is the co-author with Lawrence M. Stratton of The Tyranny of Good Intentions : How Prosecutors and Bureaucrats Are Trampling the Constitution in the Name of Justice . Click here for Peter Brimelow's Forbes Magazine interview with Roberts about the recent epidemic of prosecutorial misconduct.

© 2011 Copyright Paul Craig Roberts - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Today the Swiss franc made yet another new high against the super dollar, as it has been doing for 120 days. What you are reading in the graphs is less and less of the foreign currency that one dollar can buy. Of course, gold and silver also consistently hit new highs.

Today the Swiss franc made yet another new high against the super dollar, as it has been doing for 120 days. What you are reading in the graphs is less and less of the foreign currency that one dollar can buy. Of course, gold and silver also consistently hit new highs.