Federal Debt Burdens, How to Restore Fiscal Sanity in the United States

Politics / US Debt May 03, 2011 - 09:45 AM GMTBy: John_Mauldin

One of the great privileges of traveling and speaking as I do is getting to meet a wide variety of very interesting people. Of late, I have become friends with David Walker, former Comptroller General of the US, who is now crisscrossing the country warning of the deficit crisis. It is a message that my book Endgame resonates with. If we do not bring the deficit down below the growth rate of nominal GDP, we become Greece. We hit an economic wall and everything collapses. It will be a real and true Depression 2.0. Fixing this is the single most important topic and task of our generation. If we do not, worrying about P/E ratios, moving averages, long-term investments - anything else, in fact - is secondary. Solve this and we can go back to the usual issues.

One of the great privileges of traveling and speaking as I do is getting to meet a wide variety of very interesting people. Of late, I have become friends with David Walker, former Comptroller General of the US, who is now crisscrossing the country warning of the deficit crisis. It is a message that my book Endgame resonates with. If we do not bring the deficit down below the growth rate of nominal GDP, we become Greece. We hit an economic wall and everything collapses. It will be a real and true Depression 2.0. Fixing this is the single most important topic and task of our generation. If we do not, worrying about P/E ratios, moving averages, long-term investments - anything else, in fact - is secondary. Solve this and we can go back to the usual issues.

This week's Outside the Box is a presentation that David made recently. Powerful stuff. I urge you to forward this on. The message must be heard so that we can as a nation get this right. The world does not need a crippled USA.

David released a short statement about the Navy Seals getting Osama (finally!). It echoes my own thoughts.

"All Americans should come together in appreciation for the work of America's intelligence agencies and special forces who planned and executed yesterday's Osama Bin Laden operation. While his death is a key milestone in the fight against terrorism, the battle is far from over. More importantly, as I said in a CBS 60 Minutes segment in 2007, 'The greatest threat to America is not a person hiding in a cave in Afghanistan or Pakistan, it is our own fiscal irresponsibility.' That statement was true then and it is even more true now. It's now time for the President and the Congress to work together and address the fiscal debt bomb that represents a much greater threat to our country's and families futures."

My flight was cancelled, so I am in Toronto for one more night. The folks at Horizon Funds have graciously offered to take me to an early dinner and a private wine cellar, as I have a 4:30 AM (ugh) wake-up call and will turn in early. I hate 4:30 AM. That is not a civilized time of day. If I wanted to live like Dennis Gartman I could learn to deal with it, but I guess occasionally one does what one must.

One final thought. While getting OBL is a wonderful thing, it does little to change the reality of the Middle East, and may even finally create a true martyr (albeit one who was living well, and not in a cave). The world remains unsettled. Every speaker at my recent conference was asked what keeps them up at night. Every speaker mentioned the Middle East, some rather pointedly. It is a true wild card. But let us enjoy for the moment some token of pleasure for the just end of the planner of the 9/11 tragedy.

I will report more about the conference in future letters.

Your having a lot to think about analyst,

John Mauldin, Editor

Outside the Box

Restoring Fiscal Sanity in the United States: A Way Forward

Hon. David M. Walker, Founder and CEO of the Comeback America Initiative and Former Comptroller General of the United States (1998-2008)

Two hundred and twenty two years ago, the American Republic was founded. The United States had defeated the world's most powerful military force to win independence, and over a several year period, went about creating a federal government based on certain key principles, including limited government, individual liberty, and fiscal responsibility. That government was established by what is arguably the world's greatest political document - the United States Constitution.

Our nation's founders understood the difference between opportunity and entitlement. They believed in certain key values including the prudence of thrift, savings and limited debt. They took seriously their stewardship obligation to the country and future generations of Americans.

The truth is, we have strayed from these key, time-tested principles and values in recent decades. We must return to them if we want to keep America great and help to ensure that our future is better than our past.

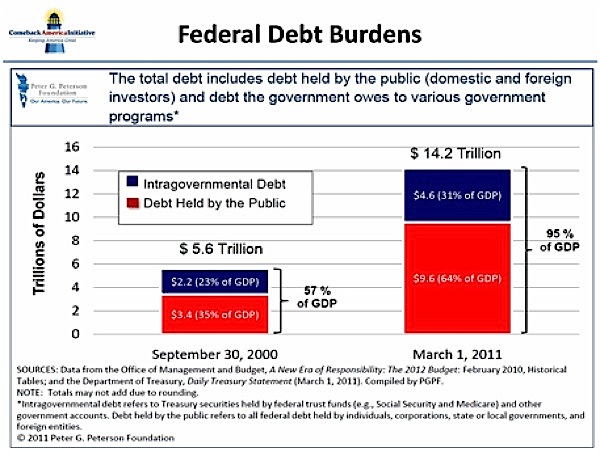

Believe it or not, to win our independence and achieve ratification of the U.S. Constitution, the U.S. only had to go into total federal and state debt equal to 40 percent of the size of its then fledgling economy. Fast forward to today, when the U.S. is the largest economy on earth and a global superpower - but total federal debt alone is almost 100 percent of the economy and growing rapidly. Add in state and local debt, and the total number is about three times as much as the total debt we held at the beginning of our Republic - and it is headed up rapidly. As the below graphic shows, our total federal debt has more than doubled in just the past ten and a half years.

America has gone from the world's leading creditor nation to the world's largest debtor nation. We have also become unduly dependent on foreign nations to finance our excess consumption. Many of these foreign investors have shunned our long-term debt due to concerns over future interest rates and the longer-term value of the dollar. And PIMCO, the largest Treasury bond manager in the U.S., also recently sold their Treasury security holdings due to a lack of adequate return for the related interest rate risk.

And who is now the largest holder of Treasury securities? It's the Federal Reserve. I call that self-dealing. The Fed may be able to hold down interest rates for a period of time; however, they cannot hold them down forever. The Fed's debt purchase actions are just another example of how Washington policymakers take steps to provide short-term gain while failing to take steps to avoid the longer-term pain that will surely come if we fail to put our nation's fiscal and monetary policies in order.

The Fiscal Fitness Index

In March 2011 the Comeback America Initiative (CAI) and Stanford University released a new Sovereign Fiscal Responsibility Index (SFRI) - or as my wife Mary refers to it, a Fiscal Fitness Index. We calculated each country's SFRI based on three factors - fiscal space, fiscal path, and fiscal governance.

Fiscal space represents the amount of additional debt a country could theoretically issue before a fiscal crisis is imminent. Fiscal path is an estimate of the number of years before a country will hit its theoretical maximum debt capacity. (The U.S. will hit its maximum within16 years, but will enter a "fiscal danger zone" within 2-3 years). Fiscal governance is a value based on the strength of a government's institutions, as well as its transparency and accountability to its citizens. Unfortunately, the U.S. ranks far below the average in all three of these categories - in particular, the fiscal governance category.

The overall SFRI index showed that the U.S. ranked 28 out of 34 nations in the area of fiscal responsibility and sustainability. And when you see which countries rank around us, it's clear that we're in a bad neighborhood. We're only a few notches above countries like Greece, Ireland, and Portugal, all of which have recently suffered severe debt crises. That report also showed that the U.S. could face a debt crisis as soon as two to three years from now, given our present path and interest rate risk. Below is the full list of rankings.

On the positive side, the CAI and Stanford report showed that if Congress and the President were able to work together to pass fiscal reforms that were the "bottom line" fiscal equivalent of those recommended by the National Fiscal Responsibility and Reform Commission last year, our nation's ranking would improve dramatically, to number 8 out of 34 nations. In addition, we would achieve fiscal sustainability for over 40 years!

So what are our elected officials waiting for? Do they want a debt crisis to force them to make very sudden and possibly draconian changes? If not, they need to wake up and work together to make tough choices. That's what New Zealand did in the early 1990s, when that country faced a currency crisis. Due to tough choices then and persistence over time, New Zealand now ranks number 2 in the SFRI - second only to Australia, which the Kiwis are not happy about! If New Zealand can do it, America can too!

The Recent Budget Policy Proposals

In order for us to begin to restore fiscal sanity to this country, President Obama has to discharge his leadership responsibilities as CEO of the United States Government. He got into the game with his fiscal speech on April 13, in which he largely embraced the work of his National Fiscal Responsibility and Reform Commission, although with a longer timeframe for implementation and less specifics on entitlement reforms. The President also endorsed the debt/GDP trigger and automatic enforcement concept that CAI had been advocating. Under this concept, Congress could agree on a set of statutory budget controls that would come into effect in fiscal 2013. Such controls should include specific annual debt/GDP targets with automatic spending cuts and temporary revenue increases in the event the annual target is not met. In my view, a ratio of three parts spending cuts, excluding interest savings, to one part revenue would make sense.

House Budget Committee Chairman Paul Ryan recently demonstrated the political courage to lead in connection with our nation's huge deficit and debt challenges. His budget proposal recognizes that restoring fiscal sustainability will require tough transformational changes in many areas, including spending programs and tax policies. Chairman Ryan's proposal includes several major reform proposals, especially in the area of health care. For example, he proposes to convert Medicare to a premium support model that will provide more individual choice, limit the government's long-term financial commitment and focus government support more on those who truly need it. He also proposed to employ a block grant approach to Medicaid in order to provide more flexibility to the states and limit the governments' financial exposure. These concepts have varying degrees of merit; however, how they are designed and implemented involve key questions of social equity that need to be carefully explored. And contrary to Chairman Ryan's proposal, additional defense and other security cuts that do not compromise national security and comprehensive tax reform that raises more revenue as compared to historical levels of GDP also need to be on the table in order to help ensure bipartisan support for any comprehensive fiscal reform proposal.

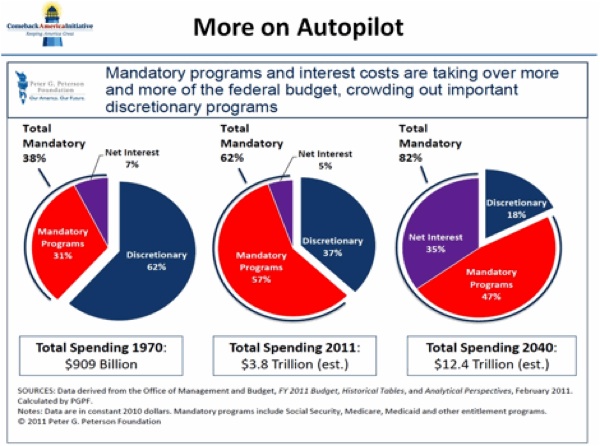

The President and Congressional leaders should be commended for reaching an agreement that averted a partial shutdown of the federal government and resolved funding levels for fiscal 2011. While it took way too much time and effort, this compromise involved real concessions from both sides and represents a small yet positive step towards restoring fiscal responsibility. But this action is far from the most important fiscal challenge facing both the Congress and the President. After all, Washington policymakers took about 88 percent of federal spending, along with much-needed federal tax reforms, "off the table" during the recent debate over the 2011 budget. In essence, they have been arguing over the bar tab on the Titanic when we can see the huge iceberg that lies ahead. The ice that is below the surface is comprised of tens of trillions of dollars in unfunded Medicare, Social Security and other off-balance sheet obligations along with other commitments and contingencies that could sink our "Ship of State". It is, therefore, critically important that we change course before we experience a collision that could have catastrophic consequences. As you can see in the series of pie charts below, mandatory programs like Social Security and Medicare already take up the largest share of the federal budget and, absent a change in course, will continue to do so in increasing amounts in the next several decades.

The Federal Debt Ceiling Limit

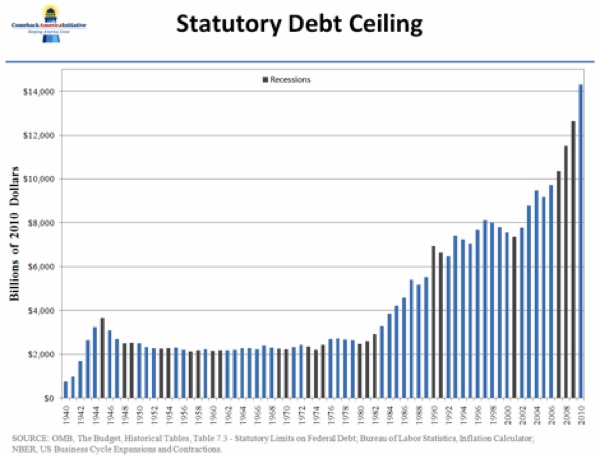

Now that the level of federal funding for the 2011 fiscal year has been resolved, there has been an increasing amount of attention on Congress' upcoming vote to increase the federal debt ceiling limit. As is evident by the chart below detailing the debt ceiling limit per capita adjusted for inflation since 1940, the U.S. started losing its way in the early 1980s. Fiscal responsibility was temporarily restored during the 1990s, when statutory budget controls were in place, but things went out of control again in 2003, the year after those budget controls expired.

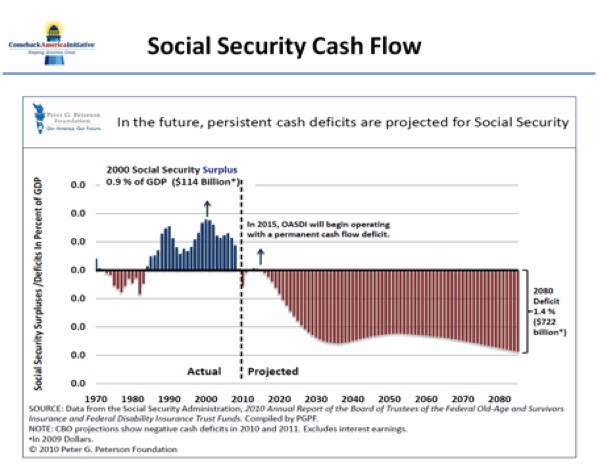

In essence, raising the debt ceiling is simply recognizing the federal government's past fiscally irresponsible practices. But while federal law provides for the continuation of essential government operations even if the government has not decided on a budget or funding levels for a fiscal year, such a provision does not exist in connection with the debt ceiling. Therefore, if the federal government hits the debt ceiling during a time of large deficits, which is the case today, dramatic and draconian actions will have to be taken to ensure that additional debt is not incurred. This would likely include a suspension of payments to government contractors, delays in tax refunds, and massive furloughs of government employees. In addition, since Social Security is now paying out more in benefits than it receives in taxes, the monthly payments may not go out on time if we hit the debt ceiling limit. That would clearly get the attention of tens of millions of Americans, including elected officials.

However, although failure to raise the debt ceiling is not a viable option given our current fiscal state, we must take concrete steps to address the government's lack of fiscal responsibility. We must also do so in a manner that avoids triggering a massive disruption and a possible loss of confidence by investors in the ability of the federal government to manage its own finances. Such a loss of confidence could spur a dramatic rise in interest rates that would further increase our nation's fiscal, economic, unemployment and other challenges.

In order to begin to restore fiscal sanity, Congress could increase the debt ceiling limit in exchange for one or more specific steps designed to send a signal to the markets, and the American people, that a new day in federal finance is dawning. To be credible, any such action must go beyond short-term spending cuts for the 2012 fiscal year. The debt/GDP trigger and automatic enforcement concepts I advocate above are one specific step Congress could take.

The S&P's revised outlook on the long-term rating for U.S. sovereign debt should be yet another wake-up call for elected officials and other policymakers in Washington. S&P's action serves as a market-based signal that independent ratings agencies believe the U.S. is on an imprudent and unsustainable fiscal path and that action is needed in order to maintain investor confidence. In my view, this action should have been taken place some time ago; however, it is now likely that other rating agencies will reconsider their ratings positions on U.S. Sovereign debt.

Moving Past Partisan Politics

The American people need to understand that doing nothing to address our deteriorating financial condition and huge structural deficits is simply not an option. Failure to act will serve to threaten America's future position in the world and our standard of living at home. Therefore, both major political parties must come to the table and put aside their sacred cows and unrealistic expectations. As John F. Kennedy said, "The great enemy of the truth is very often not the lie -- deliberate, contrived and dishonest -- but the myth -- persistent, persuasive, and unrealistic."

Given President Kennedy's admonition, liberals need to acknowledge that we need to renegotiate the current social insurance contract. For example, contrary to assertions by some, Social Security is now adding to the federal deficit and is underfunded by about $8 trillion. As you can see below, it will face escalating annual deficits beginning in 2015.

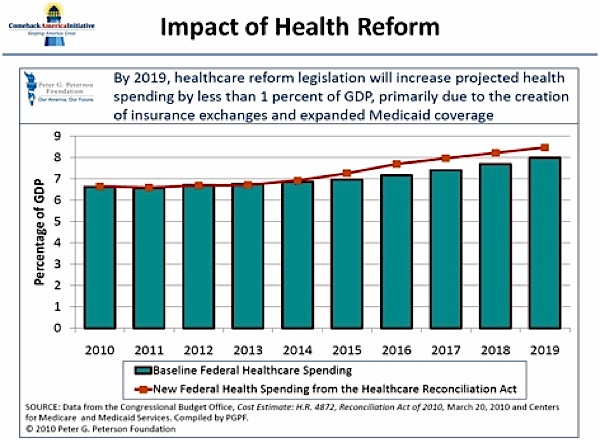

There is no debate that last year's health care reform legislation will result in higher federal health care costs as a percentage of the economy. (See the chart below). In addition, according to Medicare's independent Chief Actuary, based on reasonable and sustainable assumptions, last year's health care reform legislation will end up exacerbating our deficit and debt challenges rather than helping to lessen them. He estimated that the cost of the health care law to the Medicare program could be over $12 trillion in current dollars more than advertised.

Conservatives need to acknowledge that we can't just grow our way out of our fiscal hole. They need to admit that all tax cuts are not equal and there is plenty of room to cut defense and other security spending without compromising our national security. And while conservatives are correct to say that our nation's fiscal challenge is primarily a spending problem, they must recognize that some additional revenues will be needed to restore fiscal sanity. The math just doesn't work otherwise.

All parties must acknowledge that we can't inflate our way out of our problem and that we must take steps to improve our nation's competitive posture. This means that some properly targeted and effectively implemented critical infrastructure and other investments may be both needed and appropriate even if they exacerbate our short-term fiscal challenge.

Washington policymakers need to understand that the same four factors that caused the recent financial crisis exist for the federal government's own finances. And what are those factors?

First, a disconnect between those who benefit from prevailing policies and practices and those who will pay the price and bear the burden if and when the bubble bursts. Second, a lack of adequate transparency and accountability in connection with the true financial risks that we face. Third, too much debt, not enough focus on cash flow, and an over-reliance on narrow and myopic credit ratings. Finally, a failure of responsible parties to act until a crisis was at the doorstep.

There is growing agreement that the greatest threat to our nation's future is our own fiscal irresponsibility. In fact, as I noted in 2007 and Joint Chiefs Chairman Admiral Mullin stated last year, our fiscal irresponsibility and resulting debt is a national security issue. After all, if you don't keep your economy strong for both today and tomorrow, America's standing in the world and standard of living at home will both suffer over time - and waiting for a crisis before we act could also undermine our domestic tranquility.

So where should Washington go from here?

First, Congress and the President should reach a compromise agreement on an appropriate level of spending cuts in 2012 while also providing for some additional properly designed and effectively implemented critical infrastructure investments. Second, they should agree to re-impose tough statutory budget controls that will force much tougher choices on both the spending and tax side of the ledger beginning no later than 2013. Third, they should authorize and fund a national citizen education and engagement effort to help prepare the American people for the needed actions and to facilitate elected officials taking them without losing their jobs. Fourth, they should create a credible and independent process that will provide for a baseline review of major federal organizational structures, operational practices, policies and programs in order to make a range a transformational recommendations that will make the federal government more future focused, results oriented, successful and sustainable.

Spending levels certainly need to be cut. After all, the base levels of federal discretionary spending increased by over 30 percent between 2007 and 2010 during a time of low inflation. At the same time, all parties must be realistic regarding how much should be cut and how quickly it can be achieved. In my view, we should be targeting greater cuts than have been recently considered, but over a longer period of time: for example, real spending cuts of $125-$150 billion over several years. If we did so, the related savings would be significant and would compound over time.

As the National Fiscal Responsibility and Reform Commission, CAI, The No Labels political movement (of which I am a co-founder), and others have noted, everything must be on the table - and all political leaders need to be at the table - in order to put our nation on a more prudent and sustainable fiscal path. This includes a range of social insurance program reforms, defense and other spending cuts, and comprehensive tax reform that generates additional revenues, including both individual and corporate tax reform. We must keep in mind that the private sector is the engine of innovation, growth, and jobs. In addition, many businesses are taxed at the individual, rather than the corporate, level.

Realistically, it will take us a number of years to get back into fiscal shape. And while it would be great if we could do a "grand bargain" and enact a broad range of transformational reforms in one step, that just isn't realistic in today's world. Therefore, what is a reasonable order of battle to win the war for our fiscal future?

First and foremost we need to enact budget process reforms, re-impose the type of budget controls and engage in the fact-based citizen education and engagement effort referred to previously. The next order of battle items should be corporate tax reform and Social Security reform. Why corporate tax reform? Because it can help to improve our competitiveness, enhance economic growth and generate jobs.

And why Social Security reform? Because we have a chance to make this important social insurance program solvent, sustainable and secure for both current and future generations. We can also exceed the expectations of all generations and demonstrate to both the markets and the American people that Washington can act before a crisis forces it too.

The above efforts should be followed by broader tax reform and Medicare/Medicaid reforms. We will then need to rationalize our health care promises and focus more on reducing health care costs in another round of health care legislation. We must also begin a multi-year effort to re-baseline the federal government's organizations, operations, programs and policies to make them more future focused, results oriented, affordable and sustainable.

In summary, the truth is that the government has grown too big, promised too much and waited too long to restructure. Our fiscal clock is ticking and time is not working in our favor. The Moment of Truth is rapidly approaching. As it does, let us hope that our elected officials must keep the words of Theodore Roosevelt in mind: "In any moment of decision the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing." And "We the People" must do our part by insisting on action and by making the price of doing nothing greater than the price of doing something We must insist that our legislators offer specific solutions to defuse our ticking debt bomb in a manner that is economically sensible, socially equitable, culturally acceptable, and politically feasible We need to recognize that improving our fiscal health, just like our physical health, will require some short-term pain for greater long-term gain. The same is true for state and local governments.

We'll soon know whether Washington policymakers are up to the challenge and whether they will start focusing more of doing their job than keeping their job. They need to focus first on their country rather than their party. And yes, the President and Congressional leaders from both political parties need to be at the table and everything must be on the table in order to achieve sustainable success. Let's hope they make the right choice this time!

All of us who are involved with the Comeback America Initiative (CAI) will do our part. All that we ask is that you do yours. The future of our country, communities and families depends on it.

For more information about the Comeback America Initiative and No Labels, check out www.tcaii.org and www.nolabels.org.

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.