Gold Prices Remain a Dollar Play Despite Recent Events

Commodities / Gold and Silver 2011 May 04, 2011 - 02:29 AM GMTBy: Bob_Kirtley

The dash from $1425/oz to $1563/oz came to a halt today on news that is perceived to be good for the USD. The technical indicators are firmly in the overbought zone so a breather was on the cards. Note that the RSI had peaked well above the '70′ level and has now come back slightly, to sit at 73.50, still oversold, so this correction may continue for a few more days.

The dash from $1425/oz to $1563/oz came to a halt today on news that is perceived to be good for the USD. The technical indicators are firmly in the overbought zone so a breather was on the cards. Note that the RSI had peaked well above the '70′ level and has now come back slightly, to sit at 73.50, still oversold, so this correction may continue for a few more days.

Apart from the chart status of gold prices there have also been not one, but two events that have played their part in capping golds progress. The first is the announcement by President Obama, that Osama Bin Laden has been killed. This initially gave the US Dollar a much needed boost with the oscillations continuing as we write. The bounce by the dollar had a negative effect in gold and so gold prices have corrected by around $20/oz, which is nothing to write home about. This news item is a one off event and will soon pass with the spotlight being re-focused on the plight of the dollar.

The second event was market intervention by the powers that came in the form of a rule change regarding the purchase of silver as follows:

Investors in the standard '5,000 Ounce Silver Futures Contract', had the initial deposit required to purchase a contract increase to $12,825 from $11,745.

This rule change is in effect a margin call for for those investors who own silver futures contracts, so they had to either put up more cash or reduce their exposure by selling some of their contracts. This is not a one time event as the rules can be changed at a moments notice as we have experienced in the past. However, the effect on silver prices, a $4.00/oz correction, also casts a shadow on gold prices as any market intervention creates an air of uncertainty for all concerned.

For now we will allow the dust to settle and look to see if there is a bargain of a buying opportunity out there somewhere.

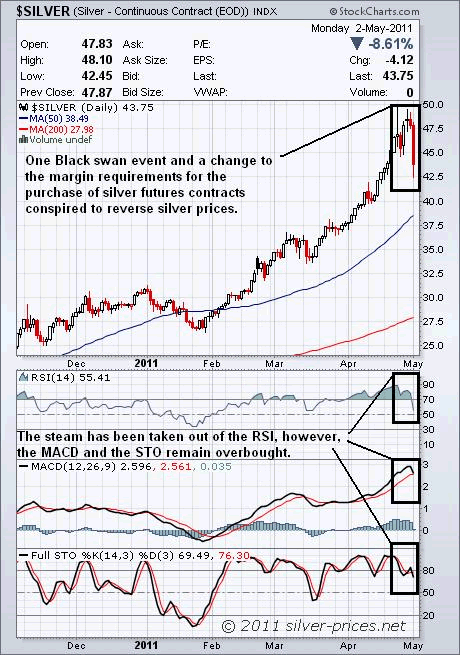

One Black swan event and a change to the margin requirements for the purchase of silver futures contracts conspired to reverse silver prices.

Silver on the Comex division of the New York Mercantile Exchange dropped considerably on Monday as investors were forced to stump up more cash or sell some of their holdings following the CME Group raising its margin requirements. Rule changes are a form of market intervention and should be part of an investors criteria during the decision making process alongside political risk etc.

However, if you have physical silver in your very own hands then you will not be subjected to such pressures. Sure the price of your silver drops in value when such actions are inflicted upon us, however, the silver tide is rising and the effect of this particular action will be short lived. On this occasion margin requirements were raised 13% by the CME Group, who are the owners of the Comex. The volatility indicator is moving towards 'severe' so we must now expect silver prices to move in order of four to five dollars, in either direction on any given day. The silver space is not a playground for those of a nervous disposition. So once having acquired your core holdings be prepared to sit through whatever this rocky road throws up and remember that nothing goes up in a straight line and the bears will have the odd moment in the sun.

Our strategy remains the same , physical metal in your hands is number one, followed by a selection of quality producers and finally, a few well thought out options trades. Ignore the bubble calls, that's nonsense and stick with the script.

Taking a quick look at the chart we can see that this pull back has taken the steam of the RSI, however, the MACD and the STO remain in the overbought zone. Should silver prices fall further treat it as the buying opportunity that you have been waiting for.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.