Germany Urges Portugal to Sell its Gold as Mexican Central Bank Buys 100 Tonnes

Commodities / Gold and Silver 2011 May 05, 2011 - 01:13 AM GMTBy: GoldCore

Gold is mixed while silver is down some 1.5% again today. Weakness is being attributed to profit taking, momentum-driven traders and rumours regarding selling of gold and silver by George Soros’s fund.

Gold is mixed while silver is down some 1.5% again today. Weakness is being attributed to profit taking, momentum-driven traders and rumours regarding selling of gold and silver by George Soros’s fund.

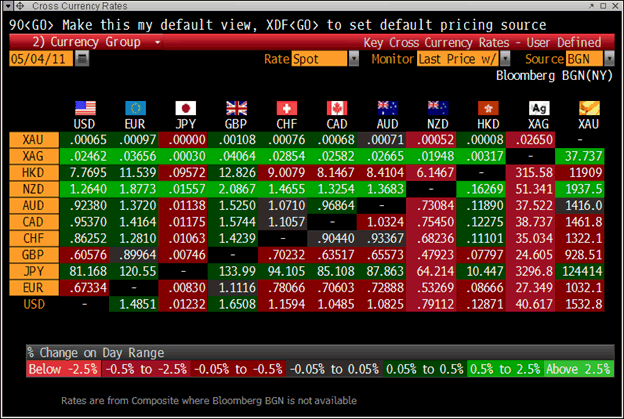

Cross Currency Table

The Soros rumours came from unidentified sources (“people close to the matter” - see news), are unsubstantiated at this stage and should be viewed cautiously until there is official confirmation and or we see the SEC filings showing Soros Fund Management has been selling their gold and silver ETF holdings .

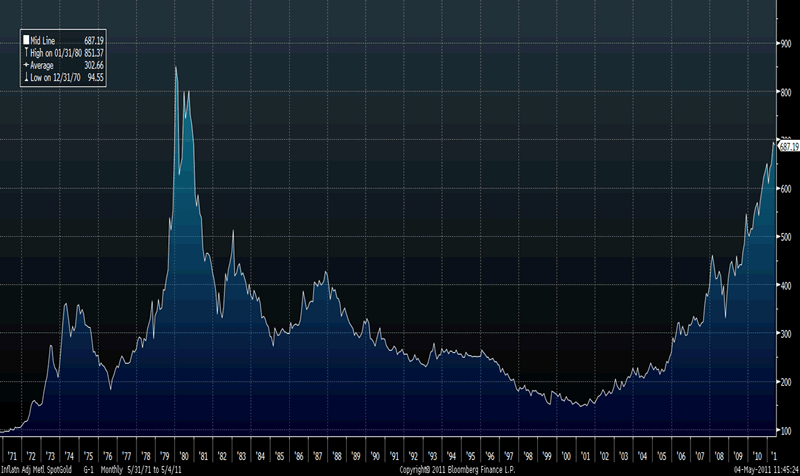

Gold in Real Terms – Bloomberg Inflation Adjusted (CPURNSA) - 40 Year (Monthly)

It should be remembered that this may be a case of simply taking profits and reducing allocations. There may also be the possibility that Soros Fund Management is selling some of their gold and silver ETF holdings in order to buy bullion in allocated accounts as Eric Sprott, David Einhorn and some other hedge fund managers and pension funds have been doing.

Those calling gold a bubble know little or nothing about economic and monetary history and monetary economics today. Gold is increasingly being seen as a monetary asset and as an important reserve currency by central banks internationally.

The drumbeat of a return to some form of gold standard is increasing and President of the World Bank Robert Zoellick’s comments to the Financial Times regarding returning to some form of gold standard suggest that monetary authorities internationally may be planning a return to a quasi-gold standard in order to restore stability to currency markets and recreate trust in fiat currencies.

Senior German Lawmakers Urge Portuguese Gold Sale

Another sign of the increased appreciation of gold as an important asset came from Germany today where Angela Merkel’s budget speaker and his opposition counterpart have urged Portugal to consider selling their gold.

Norbert Barthle, Germany’s governing coalition budget speaker and his counterpart Carsten Schneider from the Social Democrats, the biggest opposition party, urged Portugal to consider selling some of its gold reserves to ease its debt problems. They called for a review of Portugal’s request for financial aid to include gold and other potential asset sales.

The German lawmakers did not specify who should buy the gold from the Portuguese central bank but given the challenges facing Germany and the Eurozone, it is likely that the Bundesbank and the ECB would be willing buyers – if the gold is not already encumbered due to Portugal’s membership of the Eurozone.

Interestingly, there was an article in the Times of London on Monday suggesting that the Portuguese gold reserves (worth some $20.7 billion at today’s prices) be used to fund their bailout (see news).

Meanwhile creditor nations’ central banks continue to accumulate gold reserves as seen with the breaking news from the Financial Times that the central bank of Mexico has been diversifying their currency reserves (largely in dollars) into gold with the purchase of 100 tonnes of gold bullion in February and March.

Debtor nations with large gold reserves may be forced to sell gold reserves to creditor nations in the coming years as has been the pattern throughout history.

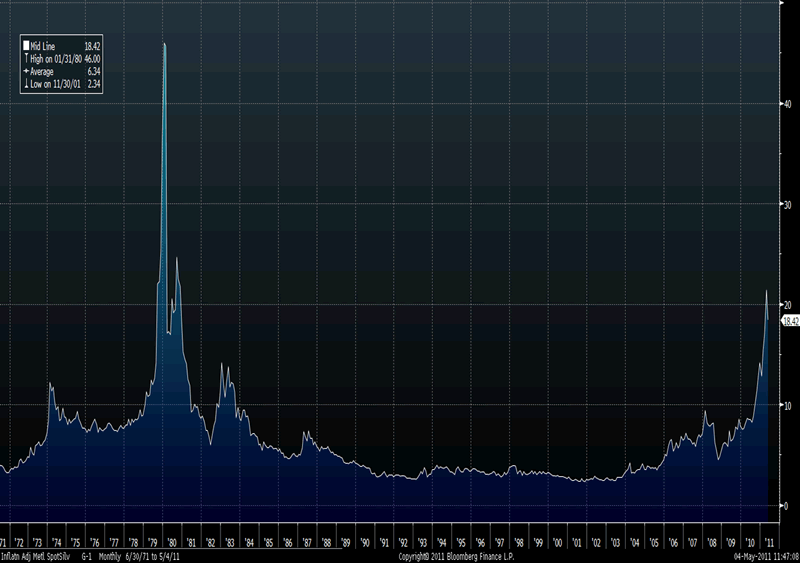

Silver in Real Terms – Bloomberg Inflation Adjusted (CPURNSA) - 40Year (Monthly)

Gold

Gold is trading at $1,535.75/oz, €1,031.45/oz and £928.33/oz.

Silver

Silver is trading at $40.92/oz, €27.48/oz and £24.73/oz.

COMEX silver futures have lost a significant 15 percent over the past four sessions, wiping out the recent gains which took the price to a 31-year nominal high at just below $50 at $49.79/oz on April 25.

Further weakness may be seen due to the leveraged nature of futures markets and the COMEX and the ability of large concentrated positions to manipulate the futures and spot price in the short term.

However, the fundamentals driving the market should see any correction be of short duration and bullion buyers should continue to gradually accumulate and buy on the dips. In time this correction will be seen as all previous corrections are seen today – as a correction in a “wall of worry” secular bull market.

Platinum Group Metals

Platinum is trading at $1,857.00/oz, palladium at $755/oz and rhodium at $2,250/oz.

News

(Bloomberg) -- German Lawmakers Urge Portugal to Mull Gold Sale, Passauer Says

A budget expert from Germany’s governing coalition and his counterpart from the biggest opposition party urged Portugal to consider selling some of its gold reserves to ease its debt problems, the Passauer Neue Presse reported.

Norbert Barthle, the Christian Democrats’ budget spokesman and Carsten Schneider from the opposition Social Democrats want a review of Portugal’s request for aid to include gold and other potential asset sales, the newspaper said, citing interviews.

(The Times) -- A golden opportunity for Portugal

Debt-laden Portugal has gold reserves worth $US20.7 billion ($18.9bn), enough to cut its bailout from the European Union by one fifth.

Portugal, Spain and Greece all have large central bank gold reserves that have not so far been tapped, despite their precarious financial situation.

Some economists and gold traders believe that they should sell part of their reserves to reduce the bailout burden on taxpayers in other parts of Europe.

Portugal has one of the biggest gold stashes in Europe, with 382.5 tonnes worth $US20.7bn. Its gold reserves equal 9 per cent of GDP, the highest of any European country.

This month Portugal agreed a bailout from the European Union worth up to 80 billion euros ($108.4bn) as it struggles with debt equivalent to 92.9 per cent of GDP. It became the third country after Greece and Ireland to seek a bailout.

Portugal wins $107b EU, IMF bailout deal The Australian, 13 hours ago

Rob Carnell, the chief international economist at ING Bank, said: "If you start including assets like these that are not normally factored into measures of debt, mobilising the resources could improve the position of these countries to a significant degree."

Most measures of a country's debt ignore the value of gold holdings, but the scale of reserves held by Portugal, Spain and Greece has called into question whether they should be utilised to ease their debt crisis.

Ross Norman, chief executive of the gold broker Sharps Pixley, said: "You would think that selling some gold would be the sensible thing to do, but perhaps it would send the wrong signal."

It is thought that these countries have not sold gold because it forms part of the European Central Bank's assumptions for the euro-zone's reserves. In addition, economists believe that a sudden gold sale by debt-crisis countries could trigger panic among investors.

"If there were suddenly a rush by everyone to sell the family silver, it could put downward pressure on the value of precious metals," Mr Carnell said.

Portugal's unusually large gold reserves were built up by the former dictator Antonio de Oliveira Salazar during his 36 years in power.

He diverted earnings from exports into gold particularly during World War II, when Portugal is believed to have received large amounts of gold from the Nazis.

Many of Europe's central banks have been sellers of their gold reserves in the past 20 years as the metal lost its attraction as a reserve asset.

(Financial Times) -- Mexican central bank buys 100 tonnes of gold

The central bank of Mexico bought nearly 100 tonnes of gold in February and March, the latest emerging market country to turn to bullion as a means of diversifying away from the faltering dollar.

The purchase is one of the largest by a central bank in recent history. The gold, worth $4.6bn at current prices, is equivalent to about 3.5 per cent of annual mined output.

The central bank has not been publicly announced the move, but has reported it both on its own balance sheet, posted online, and to the International Monetary Fund’s statistics on international reserves.

Central banks became net buyers of gold last year after two decades of heavy selling, a dramatic reversal that has helped propel the price of bullion to a series of record highs.

On Wednesday morning, gold was trading at $1,535 a troy ounce, down from the nominal record of $1,575.79 touched on Monday.

Mexico follows other booming emerging market economies, including China, India and Russia, which have all made large additions to their gold reserves in recent years.

Matthew Turner, precious metals strategist at Mitsubishi, the Japanese trading house, said the purchase “seems to confirm there’s an appetite now among emerging economies with large forex reserves to add to their gold reserves. Gold is seen as one way in which to diversify away from the dollar- or euro-denominated assets.”

The dollar has plunged 10 per cent since January against the world’s major currencies and is trading near an all-time low. Robert Zoellick, president of the World Bank, has suggested that gold should form part of a new international monetary system.

China announced in 2009 that it had bought 454 tonnes of gold over the previous six years; India bought 200 tonnes of gold directly from the International Monetary Fund in October 2009; and Russia has bought just less than 400 tonnes on the open market over the past five years.

However Mexico’s buying in February and March, which amounted to 93.3 tonnes of gold, is one of the most rapid programmes of accumulation on record. Apart from India’s off-market purchase in 2009, the 78.5 tonnes bought in March is the largest monthly purchase by a central bank in at least a decade, according to data from the World Gold Council.

The Bank of Mexico could not be reached for comment on Wednesday morning.

(Wall Street Journal) -- Steep Drop Tarnishes Big Bets On Silver – (Soros Fund, Others Said to Be Selling Gold, Silver)

Silver prices plunged, suffering their worst one-day drop in dollar terms in three decades, as investors fretted that rising trading costs could cripple a market exhibiting signs of froth.

Silver's fall of $3.50, or 7.6%, and a 1% drop in gold prices Tuesday came as some major investors have been selling. George Soros's big hedge fund, a firm operated by high-profile investor John Burbank and some other leading firms have been selling gold and silver, according to people close to the matter, after furiously accumulating precious metals for much of the past two years.

Their selling suggested the sharp, nine-month run-up for precious metals could be entering more dangerous territory.

Many investors have turned to gold, silver and platinum as the U.S. dollar has weakened. Precious metals often serve as an alternative to paper currencies. The dollar is down 8% so far this year against a basket of other currencies.

Rather than gold, many smaller investors favor silver, partly because of its much lower price per ounce.

Silver futures settled in New York Tuesday at $42.58 an ounce, after having flirted with $50 a few days ago.

The metal now is down 12.4% over two days. Tuesday's fall was the worst one-day percentage drop since December 2008.

Yet silver, which has had a huge run, remains up nearly 38% in 2011. It rose 84% last year.

And some prominent investment pros continue to favor precious metals, among them hedge-fund manager John Paulson.

Last week an exchange-traded fund, or ETF, that owns silver bullion—the iShares Silver Trust—was the most active ETF on the U.S. market on some days, a sign of the rabid recent interest in silver.

"We haven't seen this much volatility in decades," said Robin Rodriguez, a metals trader in Charlottesville, Va. "We have such large profits built in," so some investors are taking their winnings, said Mr. Rodriguez, who remains bullish on the metal.

Interest in holding the silver ETF grew so intense it became hard to borrow shares to sell, as bearish traders need to do if they want to sell the metal short and bet on a decline.

All this helped set up the tumble, which started late Sunday, catching many by surprise. As sell orders flooded the market in Asia, brokers sought more collateral from investors who had bought on margin, even as they fielded calls from anxious investors who wanted to sell.

"Everybody wanted to get out," said Richard Digenan, an executive at R.J. O'Brien, a brokerage firm in Chicago.

For those who invest in silver via the futures market rather than an ETF, exchanges and brokers have been raising margin requirements, the amount of collateral investors must leave with their broker to back a position.

CME Group, a commodity-exchange operator, has raised margin requirements three times in a week. It announced the latest increase Tuesday.

Many investors in silver futures make heavy use of borrowed money and were faced with either sending more collateral to their brokers or selling some contracts.

Exchanges tinker with margin requirements when market volatility is high. They worry about being exposed to losses themselves if a market moves too sharply and collateral proves insufficient.

Sudden caution by previous precious-metals bulls magnified investors' concerns.

For nearly two years, Mr. Soros's hedge-fund firm bought gold and silver, becoming the seventh-largest holder of the biggest gold ETF, the SPDR Gold Shares. Some others with stellar records—including Mr. Burbank, of Passport Capital, and Alan Fournier, of Pennant Capital—also have been passionate about precious metals, giving encouragement to individual investors to follow.

Now they are selling, in each case for distinct reasons.

While many who buy gold do so to protect against future inflation, Soros Fund Management bought gold to protect against the possibility of the opposite—debilitating deflation, or a sustained drop in consumer prices.

But now the $28 billion Soros firm, which is run by Keith Anderson, believes chances of deflation are reduced, eliminating the need to hold as much gold, according to people close to the matter.

People familiar with Mr. Anderson's thinking said he believes the Federal Reserve's continuing to pump money into the system has reduced the likelihood of deflation.

The Soros team, meanwhile, isn't especially worried about a surge in inflation. Mr. Anderson has argued that by the end of this year the Fed will signal that interest-rate increases are in the offing, possibly early in 2012, according to someone close to the firm. Higher interest rates would tend to suppress inflation.

The Soros fund has sold much of its gold and silver investments over the past month or so, according to this person.

Mr. Fournier of Pennant also has sold gold because deflation appears less likely, say people close to the matter. In his view, the markets will force the Fed to end its easy monetary policy and start raising interest rates.

Mr. Burbank, a longtime gold supporter who predicts growing worries about the creditworthiness of the U.S. and some other nations, has trimmed some of his investments to lock in profits, according to someone close to the firm. This person added that Mr. Burbank remains a long-term gold bull and expects to buy more gold-mining shares after a decline.

A number of high-profile investors remain huge holders of gold and silver, amid continuing concern about inflation and the dollar. Mr. Paulson, known for his lucrative bet against mortgages a few years ago, told investors he still has most of his personal money in gold-denominated funds operated by Paulson & Co.

Mr. Paulson told investors Tuesday morning that gold prices could go as high as $4,000 an ounce over the next three to five years, as the U.S. and U.K. flood the money supply. Gold settled in New York at $1,540.10 a troy ounce Tuesday.

Wexford Capital, a $6.5 billion fund that has been a large buyer of silver over the past year, retains much of its metal positions, according to someone close to the matter.

Andrew Hall, a former star trader at Citigroup who runs hedge fund Astenbeck Capital Management LLC and trades for Phibro, a unit of Occidental Petroleum Corp., told his clients last month that gold and silver will continue to "march higher" unless evidence emerges of "an imminent rise" in interest rates. Higher interest rates could help the dollar and make other investments more competitive vis-a-vis precious metals, which pay no interest.

The CME's increases in margin requirements mean futures investors now need to post $16,200 in collateral to trade one contract of silver, which is worth $212,880 at Tuesday's close.

(Bloomberg) -- Soros Fund Management Said to Sell Gold, Silver Assets, WSJ Says

Soros Fund Management LLC, the $28 billion hedge fund run by Keith Anderson, has sold much of its gold and silver holdings, with many of the sales occurring in the past month, the Wall Street Journal reported, citing unidentified people familiar with the situation.

Soros Fund Management sold the assets because of a reduced risk of deflation, according to the report. Michael Vachon, a spokesman, declined to comment when contacted by e-mail today by Bloomberg News.

Silver futures dropped for a third day, set for the worst run since January, as an increase in margin requirements on the Comex drove investors away. Gold also declined.

July-delivery silver slumped as much as 5 percent to $40.465 per ounce in New York, after losing 7.6 percent yesterday and 5.2 percent on May 2. The metal was at $41.305 at 12:41 p.m. in Singapore, taking losses over the three days to 15 percent. The most active futures climbed 28 percent in April, the biggest monthly gain since January 1983, and advanced to $49.845 an ounce on April 25, the highest level since 1980.

CME Group Ltd., Comex’s owner, said this week that the minimum amount of cash that must be deposited when borrowing from brokers to trade silver futures will rise to $16,200 per contract at the close of business yesterday from $14,513. A year ago, the margin was $4,250.

‘Lead Indicator’

“Silver is often the lead indicator for changes in trends, or at least for corrections,” David Wilson, an analyst at Societe Generale SA, wrote in a note. After futures rallied to a record $50.35 an ounce in January 1980, prices dropped 78 percent in four months.

From the start of this year to the end of April, silver futures rallied 57 percent and were the best performer among the 24 raw materials tracked by the Standard & Poor’s GSCI Index.

Demand for silver and gold has been supported by growing prospects for currency debasement and accelerating inflation. The dollar fell 7.5 percent against a basket of six major currencies this year, sliding to its lowest level since 2008.

Silver assets held in exchange traded products fell 1.1 percent to 15,169.80 metric tons yesterday, while gold holdings stood little changed at 2,069.78 tons, according to data compiled by Bloomberg.

Gold for June delivery in New York declined as much as 0.6 percent to $1,531.20 an ounce, after losing 1.1 percent yesterday. Futures reached a record $1,577.40 on May 2.

(Bloomberg) -- Shanghai Exchange Raises Silver Trade Deferred Compensation Fee

Shanghai Gold Exchange raised deferred compensation fee for its silver trading in order to control risk, the exchange said today in a statement.

The price difference between the Chinese silver prices over the global market prices has widened recently amid great volatility, raising risks in the trading of the precious metal, the exchange said. The exchange decided to raise the fee to 0.03 percent from the current 0.025 percent, effective May 9.

(Bloomberg) -- Investors Should Buy Gold on Any Price Weakness, SocGen Says

Gold prices may have a “correction”in the short term and investors should buy the metal on any weakness, Societe Generale SA said today in an e-mailed report to clients.

Prices may decline in the short term because the dollar may have weakened too fast and as the end of quantitative easing in the U.S. tightens liquidity, the bank said. Still, the risk of further dollar depreciation, negative real interest rates and debt issues means there is a positive long-term outlook for gold, the bank said.

(The Telegraph) -- Warren Buffett shuns gold as an investment

"Gold really doesn't have utility," the 80-year old told shareholders at Berkshire Hathaway's annual general meeting. "I'd bet on a good producing business to outperform something that doesn't do anything."

Gold prices reached new highs 15 times in April as a weaker dollar and fears of inflation encouraged some investors to seek the metal as a store of value.

The financial crisis has helped propel gold higher as initial worries of deflation gave way to current concerns that very low interest rates in much of the developed world is helping to stoke inflation. Gold is already up 10pc this year after climbing for each of the last ten.

It isn't a rally that Mr Buffett, whose investment skill has turned him into the world's third-richest man, will be joining in. Asked about gold at the annual meeting in Omaha, Nebraska, Mr Buffett said "if you take all of the gold in the world and put it into a cube, it would be about 67 feet on a side and you could get a ladder and get up on top of it. You can fondle it, you can polish it, you can stare at it. But it isn't going to do anything."

Gold's current rally has also found new momentum as the world's central bankers become net buyers for the first time in two decades last year. According to the World Gold Council, central banks bought 87 metric tonnes of gold last year as many developing countries sought some diversification away from the dollar.

Charlie Munger, Mr Buffett's long-term business partner at Berkshire, said that "there's something peculiar about an asset that will really only go up if the world is going to hell.”

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.