Gold and the U.S. Dollar

Commodities / Gold and Silver 2011 May 06, 2011 - 05:17 AM GMTBy: John_Hampson

On April 25th I stated that I would not be taking partial profits on silver as I anticipated gold had not yet peaked and would reach a daily RSI reading of over 80 before doing so, in line with historical peaks. Well, the latter proved correct as gold moved higher to print a daily RSI of 82 on April 28th, but by that time the relationship between the two precious metals had broken down and silver was already in retreat. So, opportunity missed on silver to part-sell higher and part-buy-back-in lower, but I am now turning my attention to the opportunity of adding more at lower prices in the precious metals complex as we press on towards the secular peak around 2013.

On April 25th I stated that I would not be taking partial profits on silver as I anticipated gold had not yet peaked and would reach a daily RSI reading of over 80 before doing so, in line with historical peaks. Well, the latter proved correct as gold moved higher to print a daily RSI of 82 on April 28th, but by that time the relationship between the two precious metals had broken down and silver was already in retreat. So, opportunity missed on silver to part-sell higher and part-buy-back-in lower, but I am now turning my attention to the opportunity of adding more at lower prices in the precious metals complex as we press on towards the secular peak around 2013.

In assessing the ultimate support levels for precious metals I look to gold rather than silver, due to the latter's volatile characteristic as a leveraged gold play, and gold has been supported throughout the secular bull to date by its 200 MA or 200 EMA. This is now approaching $1400, and I believe is the lowest likely level that gold would fall to:

But are we likely to see a period of pullback and consolidation for precious metals that may take us down to such a level? Well, silver looks ripe for a period of consolidation following its parabolic spike, and the US dollar looks ripe for a sustained bounce, as it has done for some time:

Source: Sentimentrader / Cobra's Market View

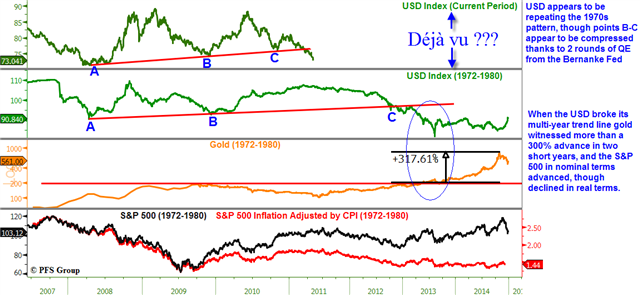

If the US Dollar were to make a sustained bounce here, then the historical rhyme from the last secular commodities bull market suggests gold would indeed retreat some and consolidate, as shown in the highlighted area of the chart below. Note the similarities in the dollar's performance over the last several years with the 1970s, but perhaps accelerated by QE, and also note how the USD moved overall sideways in the final stages of gold's last secular peak, reminding us that we don't need a declining dollar for gold to advance, as long as real interest rates are negative.

Underlying Source: PFS Group

There is also a seasonally weak spot for precious metals from early May into the end of June, so I believe the balance of probability is that we have begun a period of trend reversal in precious metals and dollar, where gold and silver take a break from the limelight. I will therefore be looking for opporunities to add to precious metal long positions between now and the end of June, ideally in the $1400-1450 price zone for gold.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.