Rush For Treasury Bonds Safety As Risks Rise At Cash Money Market Funds

Interest-Rates / US Bonds Nov 17, 2007 - 01:41 AM GMT

Certain “yield enhanced short term bond funds” which have been offered as higher yield substitutes for money market funds have been feeling the pinch from the credit markets. The latest victim is a company that you'd not normally think of as a finance company, General Electric Company. “The diversified manufacturing company's money management arm, GEAM, which oversees the $5 billion GEAM Trust Enhanced Cash Fund, is still invested in the fund, but GE warned last week that it would sell holdings amid tough market conditions.

Certain “yield enhanced short term bond funds” which have been offered as higher yield substitutes for money market funds have been feeling the pinch from the credit markets. The latest victim is a company that you'd not normally think of as a finance company, General Electric Company. “The diversified manufacturing company's money management arm, GEAM, which oversees the $5 billion GEAM Trust Enhanced Cash Fund, is still invested in the fund, but GE warned last week that it would sell holdings amid tough market conditions.

It allowed the handful of institutional investors who put money alongside GE's assets to get out first, letting them redeem at 96 cents on the dollar.”

Wachovia, Legg Mason and Bank of America are putting up hundreds of thousands of dollars to shore up their money market funds. There has not been a single money market fund that “broke the buck'” since 1994. Apparently, these institutions don't want to be the first. This is putting even more stress on the financial system.

Is your money market fund safe?

As banks, mutual fund companies and other financial institutions work to shore up their money market funds, investors are asking themselves, “ Are they safe? ” The answer isn't so clear when it comes to money market funds. They are not covered by the Federal Deposit Insurance Corporation, sometimes even if offered by a bank. Instead, there is an implicit understanding that the net asset value will always be $1.00 per share.

What can you do about your own money market funds? The first thing is to ask the company if there is any exposure to subprime mortgages. Second, check the yield. If your fund is paying more than the average money market fund, it may be using “yield enhancements” that come from mortgage derivatives. Third, does the company that sponsors your money market fund have substantial assets? If so, they will be more motivated to preserve the asset value of their money market funds. Finally, why not invest in a money market fund that is based on U.S. Treasury securities? If your company doesn't offer one, find one that does.

Producers and Consumers…

…don't usually have a lot in common, but this week there is a common theme running in both the Producer Price Index and the Consumer Price Index. The theme is, the headline that makes the front page of your newspaper isn't telling you what you really need to know. For example, the headline for the Producer Price Index told us that the cost of finished goods rose .1% in the month of October. But the year-over-year cost of finished goods (Table A) increased from 4.4% in September to 6.1% in October. How they got the math for the headline to work is beyond me. Table B is even worse, since the cost of crude goods jumped from 11.4% in September to 25.7% in October. Our business owners must be magicians, to get a 25.7% increase in raw goods to come out the other side at only 6.1% increase in finished goods.

Japan market is getting nastier…

…with nearly a 15% decline in the past month. Last night's market didn't offer a reprieve, as the Nikkei sold off due to worries about Japanese banks exposure to the subprime markets. You have to understand that it all started here. In order to keep the Japanese economy afloat, it's Central Bank offered loans to all comers at virtually 0%. This gave the U.S. mortgage market a boost through teaser rates, interest only and variable rate mortgages to anyone that could fog a mirror. Now the chickens are coming home to roost.

…with nearly a 15% decline in the past month. Last night's market didn't offer a reprieve, as the Nikkei sold off due to worries about Japanese banks exposure to the subprime markets. You have to understand that it all started here. In order to keep the Japanese economy afloat, it's Central Bank offered loans to all comers at virtually 0%. This gave the U.S. mortgage market a boost through teaser rates, interest only and variable rate mortgages to anyone that could fog a mirror. Now the chickens are coming home to roost.

China fears impact of U.S. slowdown.

China's commerce ministry warned on Thursday that a slowing US economy would trigger a drop in Chinese exports that would mark a “turning point” for China's rapid economic growth.

China's commerce ministry warned on Thursday that a slowing US economy would trigger a drop in Chinese exports that would mark a “turning point” for China's rapid economic growth.

Exports contribute more than a third of China 's economic growth and 10% of its gross domestic product. China is not prepared for an economic hard landing when our economy slows down. We may see evidence of this as early as the Christmas shopping season, which is fast coming upon us.

Consumers and markets on the precipice .

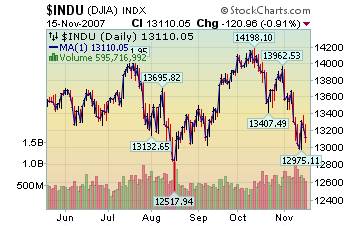

The US consumer is on the precipice of experiencing the first recessionary phase since 1991 – the last time we had the combination of punishingly high energy prices, weakening employment, real estate deflation and tightening credit conditions. And the consumer has accounted for as much as 70% of the total growth in the U.S. economy. Meanwhile, the Dow Jones Industrials are just above their August lows.

The US consumer is on the precipice of experiencing the first recessionary phase since 1991 – the last time we had the combination of punishingly high energy prices, weakening employment, real estate deflation and tightening credit conditions. And the consumer has accounted for as much as 70% of the total growth in the U.S. economy. Meanwhile, the Dow Jones Industrials are just above their August lows.

Bonds buoyed by bad news.

We are seeing a lot of rotation by investors out of stocks and into bonds. But they aren't the only investors concerned enough to buy our treasury bonds. Foreign central banks have bought $634 million of our U.S. treasuries in the past week. Is it because our treasuries are one of the few sources of stability in view of subprime problems and declining markets? Let's hope so!

We are seeing a lot of rotation by investors out of stocks and into bonds. But they aren't the only investors concerned enough to buy our treasury bonds. Foreign central banks have bought $634 million of our U.S. treasuries in the past week. Is it because our treasuries are one of the few sources of stability in view of subprime problems and declining markets? Let's hope so!

Foreclosures hit a snag.

The pooling of home loans into securities has been practiced for decades and helped propel real estate prices in recent years as investors sought the higher yields that such mortgage trusts could provide. Some $6.5 trillion of securitized mortgage debt was outstanding at the end of 2006. But as foreclosures have surged, the complex structure and disparate ownership of mortgage securities have made it harder for borrowers to work out troubled loans, in part because they cannot identify who holds the mortgage notes, consumer advocates say.

The pooling of home loans into securities has been practiced for decades and helped propel real estate prices in recent years as investors sought the higher yields that such mortgage trusts could provide. Some $6.5 trillion of securitized mortgage debt was outstanding at the end of 2006. But as foreclosures have surged, the complex structure and disparate ownership of mortgage securities have made it harder for borrowers to work out troubled loans, in part because they cannot identify who holds the mortgage notes, consumer advocates say.

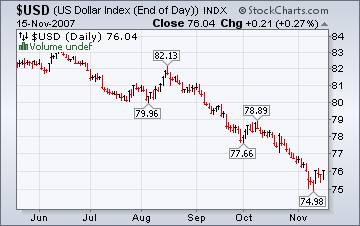

A comeback for the dollar.

A small reversal in the Dollar is in the making. This is the first time the dollar has had a chance to come up for air since early October. Is this the real thing? The answer may be found by observing the price of gold, which is known to trade inversely against the dollar. One contrarian sign that a trend change may be in the offing is the press , which has finally jumped onto the “bash the dollar” wagon with both feet. Supermodels are also known not to have the best timing.

A small reversal in the Dollar is in the making. This is the first time the dollar has had a chance to come up for air since early October. Is this the real thing? The answer may be found by observing the price of gold, which is known to trade inversely against the dollar. One contrarian sign that a trend change may be in the offing is the press , which has finally jumped onto the “bash the dollar” wagon with both feet. Supermodels are also known not to have the best timing.

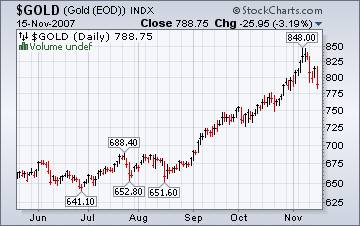

A sudden shift for Gold investors.

The selling in the gold market began without any noteworthy gains in the dollar or a major sell-off in oil. It was about the weight and fatigue in the market. In other words, the cycle of higher prices was over. Not surprisingly, the other commodities listed below also had the same reaction. The higher prices in gold have recently been a catalyst for mining companies to take more risks. This may also be a sign that the rally is near completion.

The selling in the gold market began without any noteworthy gains in the dollar or a major sell-off in oil. It was about the weight and fatigue in the market. In other words, the cycle of higher prices was over. Not surprisingly, the other commodities listed below also had the same reaction. The higher prices in gold have recently been a catalyst for mining companies to take more risks. This may also be a sign that the rally is near completion.

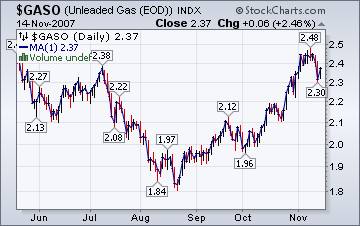

Prices at the pump drop.

Oil inventories had been dropping since early October, putting pressure on finished petroleum products, such as gasoline and heating oil. This week saw an unexpected rise in oil inventories while OPEC cut its forecast for global oil demand. Imports of crude oil are also up 831,000 barrels from the previous week, alleviating the supply strain.

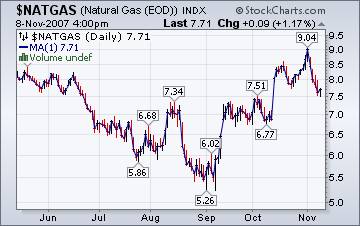

Natural gas prices may lead the way down for other sources of energy.

The colder weather this week was not unexpected by natural gas producers and shippers. The high inventory levels was enough cushion to allow lower prices, says the EIA Natural Gas Weekly Update . Meanwhile, China raised the price of ex-factory natural gas by 50% in order to curb consumption and bring the cost of domestically produced natural gas more in line with the cost of imported natural gas.

The colder weather this week was not unexpected by natural gas producers and shippers. The high inventory levels was enough cushion to allow lower prices, says the EIA Natural Gas Weekly Update . Meanwhile, China raised the price of ex-factory natural gas by 50% in order to curb consumption and bring the cost of domestically produced natural gas more in line with the cost of imported natural gas.

The War on Error.

J.R. Nyquist makes a great observation on the men that lead our country, especially regarding the war in Iraq . Everyone has heard the phrase, “Good Enough for Government Work.” It implies that government work is second rate. In defense of the government workers, there is incompetence, but the vast majority of people working for our governments at all levels are hardworking employees doing very difficult jobs. Unfortunately, the jobs being undertaken and the bureaucracies needed to do them are so massive that the individual is lost in the shuffle. And it is too easy to take potshots at “incompetence” when individual initiative is frowned upon.

Bob Woodward quotes former Defense Secretary Donald Rumsfeld as saying, “The charge of incompetence against the U.S. government should be easy to rebut if the American people understand the extent to which the current system of government makes competence next to impossible.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.