Gold and Silver Bullish Arugments

Commodities / Gold and Silver 2011 May 07, 2011 - 07:14 AM GMTBy: Ashraf_Laidi

This headline-charged first week of May has been dominated by the announced death of Osama Bin Laden, a historic 5-cent retreat in the euro and the greatest weekly decline in silver. But the week could have witnessed a positive transition (another one) in favour of precious metals. Here is why;

This headline-charged first week of May has been dominated by the announced death of Osama Bin Laden, a historic 5-cent retreat in the euro and the greatest weekly decline in silver. But the week could have witnessed a positive transition (another one) in favour of precious metals. Here is why;

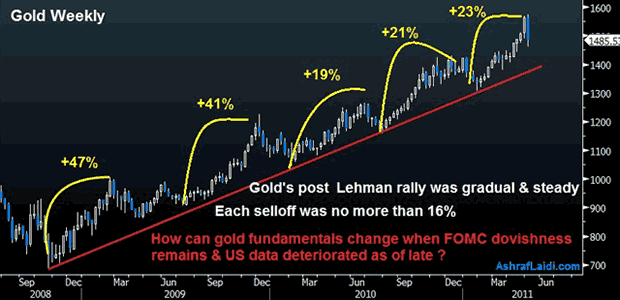

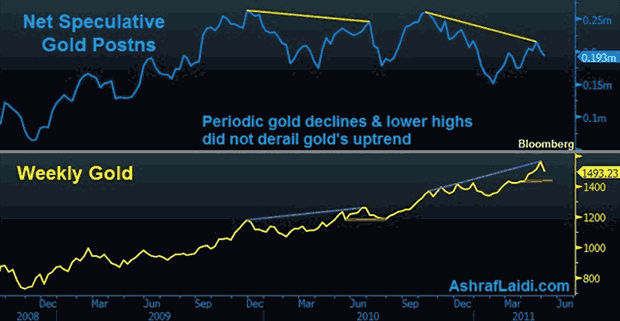

The selloff in metals was initiated by a knee-jerk reaction to Osama Bin Laden's death on the argument that the safe haven trade in favour of precious metals may no longer valid. The gold and silver sell-off were limited to 5%, before a modest rebound ensued in Monday Europe. But the main culprit to the metals selloff was the subsequent increases in silver margin requirements at the Comex, which accumulated an 84% increase in 2 weeks. Liquidation became the name of the game regardless of whether Boston Fed's Rosengren said USD weakness was not responsible for inflation or that further easing measures were not off the table.

Taking a step back, the monetary policy arguments for gold and against the USD remain the following:

i) FOMCs consistently dovish remarks regarding muted inflation; ii) Fed's downgrading of growth and; iii) Fed's planning to reinvest mortgage securities payments, which is a form of passive easing as the balance sheet is prevented from shrinking. Externally, the USD remains challenged by the contrasting monetary policy picture involving a tighter ECB/BoE/RBA relative to the Feds continued quantitative easing. This remains the yield differential driver to USD weakness. Any periodic reverberations regarding peripheral Eurozone debt concerns, equity market pullbacks disappointing earnings have proven -- and will likely to continue proving an opportunity for buying the dips in EURUSD, AUDUSD, gold and silver.

It will take the removal of the aforementioned fundamental dynamics in order for the USD to mount any credible rebound of more than 5% ie above 75 for at least 3-4 weeks. Such a strict requirement is necessary in order to avoid the several short-lived rebounds in the US currency, such as those seen in June 2009, August 2010 and February 2011.

Euro Arguments for Metals?

Sentiment remains the biggest tipping point in FX markets. Everything else is mere details. Todays rumours that Greece is considering exiting from the Eurozone amplified damage on an already falling single euro. The rumour, circulated by Germanys Spiegel added that Eurozone finance ministers held and European Commission were holding secret crisis meeting in Luxembourg on Fri. If these rumours bear weight and EU officials start discussing Greece publicly into the rest of the month, FX traders could begin to change their thinking away from the EUR. This could be especially magnified if sentiment begins emphasizing the end of QE2 story, which we do not consider to be swift. (The Fed will continue to reinvest maturing mortgage bond payments, thereby the purchases will not be terminated drastically).

In the event that "Greece" and "Euro Exit" become part of the conversation, gold and silver could find their safehaven allureonly this time it would be on the back of Eurozone debt concerns as opposed to QE3-bound Fed policy. It was exactly one year ago (the day of the Flash Crash) that Angela Merkel rocked the euro and risk markets by announcing Germanys crackdown on naked shorting of CDS. Very few media outlets have discussed this part of the Flash Crash. But such was a key development was responsible in another 10% slide in EURUSD into early June. A year later, Greece could be back on the table to the favour of rising USD, gold and at the expense of euro. The argument seems all too possible, but many dynamics continue to stand in the way of USD. This only enhances the outlook for gold and silver.

So far, EU officials swiftly denied such meeting but the euro continued to fall. Two weeks ago, the euro was unruffled by all sorts of negative news such as Portugals bailout, no confidence votes and revelations of deeper than expected haircuts on private bonds. But Thursday's ECB press conference seemed to have made all the difference when JC Trichet happened to omit the vigilance phrase in describing the banks focus on inflation. The resulting selloff was interpreted by the usually over-positioned FX market as a change in direction in the ECBs monetary policy. That is far from the truth. Trichet did NOT abandon the phrase of closely watching inflation. Instead, he resorted to the occasional omission of vigilance, which tends to be brought back when it is time for hawkish rhetoric and actual tightening. As you read this piece, you realize the rhetorical and policy tools available to the ECB for hawkish and dovishness without uttering the word euro.

We warned in our Premium Piece in today's Intermarket Insights this week's euro close below the $1.45 may have potentially negative implications due to the break below the January trendine support. Tune in for the interplay between the dovish Fed & the increasingly restless Eurozone See chart

Click here to try our Premium service of daily trades & intermarket insights.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2011 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.