Euro Gold Targets Record EUR 1,072/oz on Risk of Forced Greek Default and Euro Zone Debt Contagion

Commodities / Gold and Silver 2011 May 10, 2011 - 08:56 AM GMTBy: GoldCore

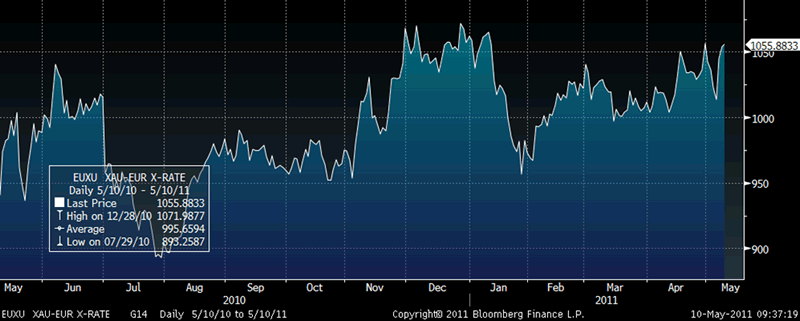

Gold and silver continue to rebound from their sell offs as euro zone periphery worries intensify with real risks of defaults and possible contagion. Gold has risen from €1,010/oz to over €1,057/oz since Friday. The long period of correction and consolidation may soon see a break out above resistance at record nominal highs of €1,072/oz - less than 1.5% below the current price.

Gold and silver continue to rebound from their sell offs as euro zone periphery worries intensify with real risks of defaults and possible contagion. Gold has risen from €1,010/oz to over €1,057/oz since Friday. The long period of correction and consolidation may soon see a break out above resistance at record nominal highs of €1,072/oz - less than 1.5% below the current price.

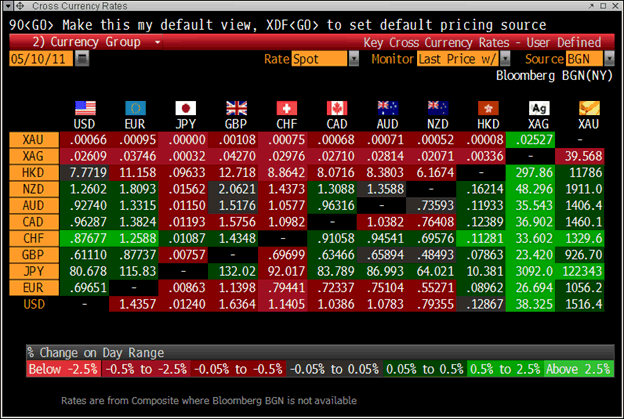

Cross Currency Rates

The recent strength of the euro looks set to end as sovereign debt risks come to the fore again. This will likely see the euro fall versus most currencies and especially against gold.

There has been the usual misinformed and non evidence based assertions that the gold and silver markets were ‘bubbles’ and that they have burst. The same simplistic assertions were made after the sharp price corrections seen in 2008 and were proven badly wrong.

Gold in Euros – 4 Day (Tick)

There may have been a degree of speculative froth in the very short term, particularly in the silver market, however as we have continually shown in recent months both the CFTC’s Commitment of Traders reports and the total ETF gold and silver holdings did not show evidence of retail investors “piling into” these markets.

A tiny minority of retail investors demanding physical bullion may be beginning to effect prices marginally but they continue to be but small players in the bullion markets – especially when compared to the power and financial clout of Wall Street banks, hedge funds, pension funds and central banks.

Gold in Euros – 1 Year (Daily)

Those diversifying into gold and silver bullion would be advised to continue to ignore those who simplistically call gold and silver bubbles. Many have been calling gold and silver bubbles since early 2008 when gold rose above $850/oz and silver rose above $20/oz.

Most failed to warn about the bubbles in equity and property markets and therefore do not have a good track record in this regard.

Their analysis continues to be selective and simplistic and can occasionally be biased. The fundamentals of supply and demand and the small and finite physical bullion markets being confronted with robust increased demand internationally and particularly in China, India and wider Asia are ignored. Also ignored are ultra loose monetary policies and currency debasement on a scale not seen before in modern history.

Rather than continually attempting to call the top of the gold and silver markets and thereby discouraging people from owning the financial insurance that is gold and silver, it would be wiser to admit that they cannot predict the future and that people should be diversified in order to protect against the extraordinary degree of macroeconomic, monetary and geopolitical risk in the world today.

Gold

Gold is trading at $1,515.94/oz, €1,054.79/oz and £926.73/oz.

Silver

Silver is trading at $38.40/oz, €26.72/oz and £23.47/oz.

Platinum Group Metals

Platinum is trading at $1,796.75/oz, palladium at 730/oz and rhodium at $2,075/oz.

News

(Bloomberg) -- HSBC Raises Gold, Silver, Platinum, Palladium Forecasts for 2011

Gold will average $1,525 an ounce this year, up from a previous forecast of $1,450, HSBC Holdings Plc said today in an e-mailed report.

The bank raised its silver estimate for this year to $34 an ounce, from $26, and increased its 2011 platinum forecast to $1,850 an ounce, from $1,750. It raised its 2011 palladium outlook to $825 an ounce, from $750.

(Bloomberg) -- Marc Faber Favours Gold Over Commodities and Equities on China Concerns

-- The growth of China’s M2 money supply, which has exceeded the U.S. total, signals further declines in commodities and stocks as it boosts prospects for more interest- rate increases in the world’s second-largest economy, according to investor Marc Faber.

The CHART OF THE DAY shows that money supply in China, including money in circulation and deposits, is increasing even after the central bank raised borrowing costs four times and increased banks’ reserve requirements seven times since mid- October. The lower panel shows the Thomson Reuters-Jefferies CRB Index of 19 raw materials slumped 9 percent last week while the MSCI World Index of stocks lost 2.1 percent.

“The next time-bomb could be detonated by some adverse economic developments in China,” said Faber in the May edition of his Gloom, Boom & Doom report. “Following a rebound we may go down more,” he said yesterday, referring to commodities and stocks in an e-mailed reply to questions from Bloomberg News.

China, the largest consumer of industrial metals and energy, is seeking to cool inflation which accelerated to a 32-month high in March. Demand fueled by its growing economy, which last year surpassed Japan’s in gross domestic product, contributed to record highs in copper and cotton this year.

Most investors have been bullish on commodities and stocks, expecting them to benefit from the so-called “inflation trade,” Faber said. Managed-money net-long positions in futures and options in U.S. commodities dropped 2.4 percent in the week ended May 3, according to Commodity Futures Trading Commission data tracked by Bloomberg. That’s 7 percent below the October level, the highest since records began in 2006.

“When everybody thinks alike, I become very defensive,” said Faber. “I’m deferring any new purchases of the beneficiaries of the inflation trade, except for gold,” he said.

(Bloomberg) -- Gold May Rise to $2,000 as Alternative to Currency, Sprott Says

Gold may climb to $2,000 an ounce this year as investors buy the metal instead of holding currencies, said Eric Sprott, chairman of money manager Sprott Inc.

Gold will rise by at least 17 percent this year, Sprott said today in an interview during the New York Hard Assets Investment Conference. The metal averaged $1,228.45 an ounce last year on the Comex in New York and ended 2010 at $1421.40.

“It’s gone up 17 percent a year for the past 11 years; I’m sure it will do that as a minimum,” Sprott said. “It could easily hit $2,000 this year. That wouldn’t be out of the question.”

Gold has risen for 10 straight years and reached a record May 2 in New York as demand increased from investors seeking an alternative to the U.S. dollar. Silver has climbed for nine of the past 10 years and reached a 30-year high of $49.845 on April 25.

Sprott has lauded gold and gold stocks for at least a decade, and his company offers products for investors seeking to own precious metals.

Silver prices will rebound and jump above $50 on surging investment demand for the precious metal, which also has industrial and photographic uses.

“I see huge amounts of money moving in the physical silver market, almost as much as gold, so I think the price is going to go up faster than the price of gold,” Sprott said. “I suspect we’ll be back through $50 not too far from here.”

Silver Rises

Silver futures for July delivery advanced $1.829, or 5.2 percent, to settle at $37.116 an ounce at 2:09 p.m. on the Comex. Silver fell 27 percent last week.

Sprott, the keynote speaker today at the natural-resources investment conference, said that gold was the investment of the last decade and silver is the investment of this decade as confidence in governments’ finances diminishes.

“The demand will be driven by the debasement of currency,” Sprott said. “I can’t tell you how much demand there will be until I know how much they’re going to debase the currency.”

Sprott rose 26 cents, or 2.9 percent, to C$9.25 today in Toronto Stock Exchange trading. The shares have increased 15 percent this year.

(Bloomberg) -- Gold, Platinum Are ‘Attractive’ After Drops, Credit Suisse Says

Gold and platinum are “attractive” after last week’s drop, Credit Suisse AG said in a report.

Silver is the “only market that we still think is overvalued,” analyst Stefan Graber said in the report.

Soybeans are favored in agriculture and copper and aluminum in industrial metals sectors.

(Bloomberg) -- Silver Extends Rebound as S&P’s Downgrade of Greece Fans Demand

Silver futures climbed, extending their rebound from the worst weekly drop since at least 1975, after Standard & Poor’s cut Greece’s credit ratings by two levels to B, reigniting haven demand. Spot gold declined.

Silver futures jumped as much as 2.1 percent to $37.90 an ounce before trading at $37.515 at 1:39 p.m. in Singapore. The metal slumped 27 percent last week as investors sold commodities from oil to copper. Immediate-delivery gold fell 0.4 percent to $1,507.98 an ounce, while futures rose 0.3 percent to $1,507.50.

“The bounce in silver is not too surprising” as there’s “a strong market appetite to buy anything on the dip,” Mark Pervan, commodity analyst at ANZ Banking Group Ltd., wrote in a note. The Greek downgrade “reaffirms the reason why investors require the safe-haven support of the precious-metals market.”

Further reductions for Greece after yesterday’s move are possible as the risk of default rises, S&P said in a statement. Another cut would make Greece the lowest-rated country in Europe as yesterday’s reduction, the fourth by S&P since April 2010, left it even with Belarus.

Before last week, demand for precious metals had strengthened this year as investors sought protection against financial turmoil in Europe, geopolitical tensions in the Middle East and the weakening dollar.

Net investment demand for silver will exceed 100 million ounces for a third year in 2011 as political and economic turmoil spurs demand, according to CPM Group, which has published reports on precious metals since 1971.

Focus on Greece

“The focus could remain on Greece,” said Ong Yi Ling, a Singapore-based analyst at Phillip Futures Pte Ltd. “Safe-haven inflows into gold and silver may increase if the euro-zone debt crisis accelerates.”

Greece’s money managers warned of further damage to the economy should European leaders restructure the country’s debt. “It would be devastating for the Greek economy, and detrimental for the rest of the European Union and the euro,” Aris Xenofos, president of the Hellenic Fund & Asset Management Association, said before the cut. The group represents 36 companies.

Silver assets held in exchange traded products, or ETPs, fell for a sixth day yesterday to 14,191.21 metric tons, taking their decline over the period to 1,173 tons, according to data compiled by Bloomberg. Gold ETP holdings fell 3.1 tons, or 0.2 percent, to 2,054.64 tons yesterday, data showed.

Gold may climb to $2,000 an ounce this year as investors buy the metal instead of holding currencies, Eric Sprott, chairman of money manager Sprott Inc., said in an interview yesterday. Silver may climb to more than $50 an ounce, he said.

Immediate-delivery palladium and platinum were little changed at $729.50 an ounce and $1,794.50 per ounce, respectively.

(Bloomberg) -- Silver Investor Demand Climbs on Haven Appeal, CPM Says (1)

Net investment demand for silver will exceed 100 million ounces for the third straight year in 2011, as political and economic turmoil spurs demand for a store of value, said CPM Group, which has published reports on precious metals since 1971.

Investors will be net buyers of 142.2 million ounces of silver, after purchasing 142 million last year and 141.9 million in 2009, Jeffrey Christian, CPM’s managing director, said today in a presentation in New York. In 2008, the total was 58.4 million. Prices will be higher by the end of the year, Christian said.

Purchases climbed for “a safe haven, a portfolio diversifier, and because of positive supply-and-demand fundamentals,” CPM said in a statement, after releasing its 223-page silver yearbook.

Last week, silver futures plunged 27 percent, the most since at least 1975, after the Comex exchange in New York boosted margins by 84 percent in two weeks. Before the plunge, the price doubled in the past year.

Today, silver futures for July delivery added $1.829, or 5.2 percent, to close at $37.116 an ounce. On April 25, the price reached $49.845, a 31-year high. The exchange is owned by Chicago-based CME Group Inc.

Demand for silver coins increased more than 11 percent to 74.5 million ounces in 2010 from a year earlier, the highest since 1968, CPM said in the statement.

Supplies of refined silver may rise 4.7 percent to 1.03 billion ounces this year, the largest gain since 2005, CPM said. Fabrication demand is likely increase 5.5 percent to 890.9 million ounces, the researcher said.

In 2010, silver futures rose 84 percent. Gold climbed 30 percent, the 10th straight gain, while palladium almost doubled and platinum advanced 21 percent.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.