Silver Forecast to Surge to $450 and Gold to $12,000

Commodities / Gold and Silver 2011 May 13, 2011 - 08:36 AM GMTBy: GoldCore

Gold and silver are higher this morning with the dollar, the British pound and commodity currencies falling in value. It is too early to tell whether the recent margin-driven, paper sell off on the COMEX is over but physical supply remains limited while demand remains robust, particularly in China, India and wider Asia.

Gold and silver are higher this morning with the dollar, the British pound and commodity currencies falling in value. It is too early to tell whether the recent margin-driven, paper sell off on the COMEX is over but physical supply remains limited while demand remains robust, particularly in China, India and wider Asia.

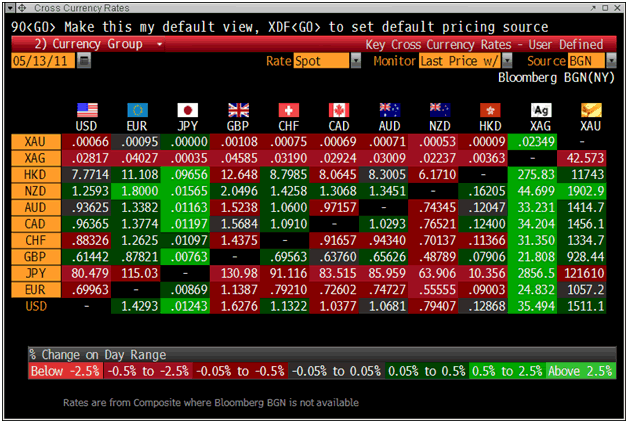

Cross Currency Rates

Knowledgeable experts continue to urge investors to own gold and silver due to the likelihood of much higher prices, currency and inflation risk.

One of the most respected global technical and macro strategists in the world, Robin Griffiths has said that silver and gold could rise to $450 and $12,000 per ounce respectively due to the debasement of paper currencies.

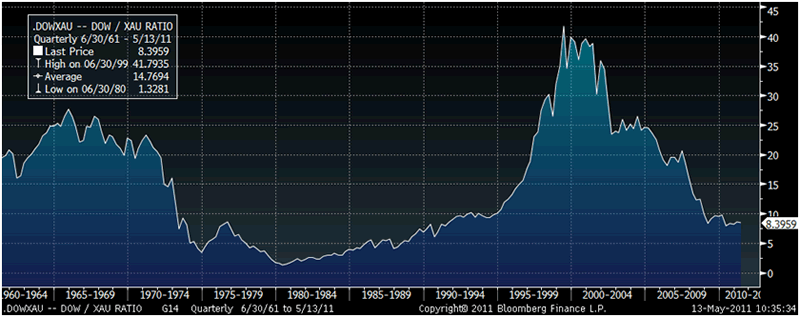

Dow Jones to Gold Ratio – 50 Years (Quarterly)

Griffiths was chief technical strategist with HSBC for over 20 years, has 44 years investment experience and now works for Cazenove Capital, one of the oldest investment houses in the world tracing its origins back to the 17th century. It manages money on behalf of blue-blooded clients and is widely believed to manage some of the British Royal family’s wealth.

When asked by King World News if his $350/oz target was a realistic price level for silver Griffiths stated, “That is absolutely not unrealistic. If you adjust the old all-time high for inflation...that gives you $450 for silver. Then you add in the fact that they are printing money, you can take it higher than that without any difficulty at all.”

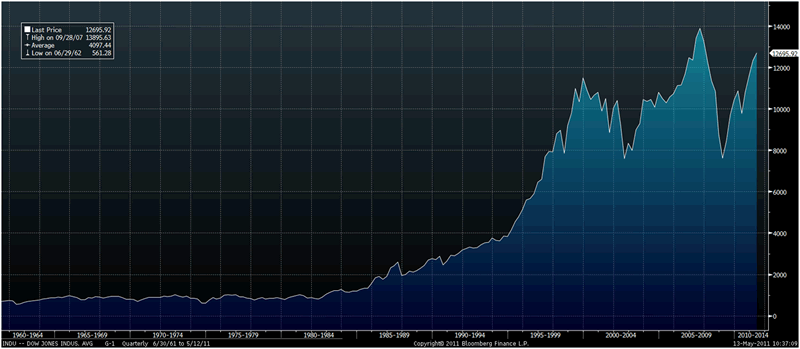

Dow Jones Industrial Average – 50 Years (Quarterly)

Griffiths told King World News that “Bulls (bull markets) are very successful at wobbling people out at the wrong time. “

Griffiths has previously said that not owning gold today is a form of insanity and “may even show unhealthy masochistic tendencies, which might need medical attention." (see here)

He has also critiqued the western media’s superficial coverage of gold and their resort to Warren Buffett’s ignorant comments on gold despite money printing and international currency debasement on a scale never before seen in history .

Meanwhile, perhaps the leading commodity expert of our time, Jim Rogers, has said that silver was not and is not a bubble.

Regarding the recent price correction he said, “I don't know what caused it maybe it was short covering, maybe it was rumors. I have no idea.” He continued "silver went down a great deal but if you raise margin requirements 150%-200% you would expect something to collapse," he added.

"I hardly see how silver could be a bubble when, even at its top, it's still below its all-time high. That's not much of a bubble."

If it goes to $150 this year, all other things being equal, then I'd say you better sell your silver. If it goes to $150 in 10 years then I would say that's a normal progression up and that's the way things work. But if the US dollar suddenly turns into confetti then you better hold your silver at $200. So it depends on the circumstances and the timing more than anything else.

Since 2003, GoldCore has said that gold and silver will reach their inflation-adjusted highs of $2,400/oz and $130/oz. Our estimates appear increasingly conservative, especially given the fact that the official inflation statistics have been debased over the years and are not an accurate reflection of real inflation.

Predicting the future price of any asset class is impossible. Predicting that gold and silver will continue to protect against financial and economic shocks and crashes and global currency debasement is possible.

The current correction should be used as another buying opportunity in order to protect against the continuing extraordinary degree of macroeconomic, monetary and geopolitical risk in the world.

Gold

Gold is trading at $1,512.49/oz, €1,058.20/oz and £930.31oz.

Silver

Silver is trading at $35.92/oz, €25.13/oz and £22.09/oz.

Platinum Group Metals

Platinum is trading at $1,753.50oz, palladium at $718/oz and rhodium at $2,025/oz.

News

(King World News) -- Robin Griffiths - Silver Could Eclipse $450, Gold $12,000

With gold over $1,500 and silver around the $35 level, today King World News interviewed one of the top strategists in the world, Robin Griffiths of Cazenove. Cazenove is one of the oldest financial firms on the planet and is widely believed to be the appointed stockbroker to Her Majesty The Queen. When asked if this time around silver will eclipse the 38 fold up-move which took place in the 70’s Griffiths replied, “Yes, I think getting to $50 was a slam dunk certainty, you test the old all-time high. We now have a consolidation for let’s call it two months and I think then we are going to go on up because the paper monies are still being printed.”

Griffiths continues:

“I’ve got it (silver) as a ten bagger from current levels. You don’t want to be wobbled out here because of a few champagne bubbles. You want to be able to stay with and add to your long-term holdings. Bulls (bull markets) are very successful at wobbling people out at the wrong time.”

When asked if his $350 target was a realistic price level for silver Griffiths stated, “That is absolutely not unrealistic. If you adjust the old all-time high for inflation...that gives you $450 for silver. Then you add in the fact that they are printing money, you can take it higher than that without any difficulty at all.”

When asked about gold specifically Griffiths remarked, “The run-up to the peak in markets like gold is between now and 2015. I think it will all be over by 2015, a lot of it depends on how aggressively paper monies get printed from here on in. I think $3,000 is an absolute minimum target. I can believe in targets certainly above $5,000 and it’s theoretically possible to go to $12,000, that’s dollars an ounce for gold.

If Mr. Bernanke stays on his current agenda I think those higher numbers will be what you will see. We’re looking at the trashing of the dollar. As Marx pointed out, it’s the most assured way of destroying your economy.

There’s a book called ‘The Road to Serfdom’ by Hayek, pointing out that when a country is in debt, getting deeper into debt as Lord Keynes said, ‘Doesn’t work.’ All it does it make the problem worse and it takes longer to solve.

We’re moving away from the dollar being the main reserve currency on the planet...We’re going to move into an era where world trade is done in mixes of renmenbi, rupees and baskets, and the baskets of currencies will need to be weighted by something can’t be printed like gold.”

(Bloomberg) -- Gold Demand in India Increases Amid Record Prices, Kotak Says

Gold demand in India, the world’s biggest consumer of bullion, strengthened this year as record prices failed to deter buyers, according to Kotak Commodity Services Ltd.

“Demand is usually price sensitive, however, the continuing rise in price has made buyers comfortable to buy at higher levels,” Pritam Patnaik, vice president for sales at Kotak, a commodity broker, said in e-mailed response to questions from Bloomberg News.

UBS AG said this week its gold sales to India are more than 10 percent higher this year as demand grows outside the traditional wedding and festival periods. Gold, rallying for an 11th year, reached a record this month as investors sought a protection of wealth from a slumping dollar and inflation.

“Overall demand is good, it is almost like last year, or a little better,” Rajesh Mehta, chairman of Rajesh Exports Ltd., India’s largest jewelry maker and exporter, said in a phone interview from Bangalore. “It’s primarily jewelry demand more than the investment” demand, he said.

Gold demand in India may increase to more than 1,200 metric tons by 2020 as economic growth boosts incomes and household savings, the World Gold Council said on March 31.

Demand surged 66 percent to 963.1 tons in 2010, according to the London-based council.

Gold for immediate delivery was little changed at $1,503.75 ounce at 10:25 a.m. in Mumbai. Prices have advanced 5.9 percent this year and reached an all-time high of $1,577.57 an ounce on May 2. Gold for June-delivery fell 0.2 percent to 22,017 rupees ($490) per 10 grams on the Multi Commodity Exchange of India Ltd. today, down from a record 22,856 rupees on April 30.

“Gold has been on an upward momentum for the past one decade and outlook still remains upbeat,” said Kotak’s Patnaik. “Sluggish recovery in the global economy, rising inflation concerns and dollar devaluation will keep gold prices higher this year.”

(Bloomberg) -- Quake to Cost Japan 30-50 Trillion Yen, Hayman’s Bass Tells CNBC

The Japanese quake two months ago will cost the country 30 trillion ($371 billion) to 50 trillion yen in the next two years, J. Kyle Bass, managing partner at Hayman Capital Management LP told CNBC’s David Faber.

(Bloomberg) -- Gold Sales Under Central Bank Gold Accord 53.2 Tons, WGC Reports

Central banks and the International Monetary Fund sold 53.2 metric tons of gold so far in the second year of the third Central Bank Gold Agreement, the World Gold Council said.

The IMF sold 52.2 tons of the total, the WGC said. The second year of the accord ends Sept. 26. Sales in the first year of the accord reached 136.1 tons.

(Bloomberg) -- Silver Trading in Shanghai to Extend Surge on Inflation Demand

Silver trading in Shanghai, which jumped 65 percent in terms of volume last month, will continue to increase on demand for a safe-haven investment, even as the government moves to curb volatility and speculation.

“Chinese investors have piled into silver as one of the investment choices to hedge against rising inflation,” Shi Heqing, silver analyst at Beijing Antaike Information Development Co., said today. The government’s move to increase margins in an effort to curb volatility won’t affect buying interest in physical material, Shi said.

Volume on the Shanghai Gold Exchange rose to 33,293 metric tons in April from 20,206 tons the month before, according to data from the exchange, the main bourse for silver trade. The central bank raised reserve requirements a day after reports showed inflation and lending exceeded economists’ estimates in April, with consumer prices rising more than 5 percent.

“China’s physical demand for silver may remain high as industrial use from the electronics and solar energy sectors and demand for silver coins and bars will rise,” Shi said. China turned to a net importer of silver in 2010, a situation that has not changed this year, according to Antaike.

Prices in Shanghai have tumbled about 30 percent this month after the exchange adjusted daily trading limits and margins four times in the past week to control speculation. Last week, silver futures in New York plunged the most since at least 1983 after the Comex exchange boosted margin costs by 84 percent. On April 25, the metal reached $49.845, the highest since the Hunt Brothers tried to corner the market in 1980.

Individual Investors

Most of the silver trading in Shanghai is conducted by individual investors, while institutions remained the most active investors in gold and platinum trading, according to the exchange’s data.

Silver for immediate delivery plunged as much as 8.1 percent yesterday to $32.3125 an ounce, the lowest level since Feb. 25. It dropped 1.2 percent to $34.3225 at 1 p.m. Singapore time. The Shanghai contract declined 0.2 percent to 7,646 yuan a kilogram.

The Shanghai exchange widened the trading band for silver contracts to 13 percent from 10 percent today and also raised the margin requirement to 19 percent from 18 percent.

(Financial Times) -- Silver price swings led by Shanghai trades

Chinese speculators have emerged as a big driver of silver’s spectacular rally and subsequent crash with trading in the metal in Shanghai soaring nearly 30-fold since the start of the year.

The commodity, nicknamed “the devil’s metal” for its wild price swings, surged 175 per cent from August to a peak of almost $50 a troy ounce two weeks ago. Since then, it has plummeted 35 per cent, hitting a low of $32.33 on Thursday.

At the same time, silver turnover on the Shanghai Gold Exchange, China’s main precious metals trading hub spiked, rising 2,837 per cent from the start of this year to a peak of 70m ounces on April 26, according to exchange data.

The number of contracts outstanding, an indicator of investor exposure, doubled over the same period.

Edel Tully, precious metals strategist at UBS, said Chinese investors were “one big factor behind silver’s rally, particularly in April”.

The surge in silver prices has attracted investors the world over, from China and India to the US, where the metal has become the investment of choice for Americans distrustful of the actions of the government and central bank. Silver’s stunning rise has inspired a rash of conspiracy theories as investors and analysts struggle to explain the speed and scale of the rally.

Silver trading in Shanghai remains below the levels in London and New York, the two main global hubs, but its rapid growth means its has become increasingly significant in driving prices, bankers said. Turnover in New York silver futures, the most liquid futures contract in the metal, averaged about 700m ounces a day in April.

“I’m pretty certain it’s the Chinese retail [investment] that is driving this move,” one senior precious metals banker said. “There’s an enormous amount of speculation going on out there, they’ve got the bit between their teeth.”

Ms Tully said Chinese investors cut their positions in silver sharply last week as prices tumbled, before returning to the market early this week and driving a short-lived rebound in prices. “No less than during silver’s swift ascent, [Chinese] agency was very evident in its tumbling descent.”

Whether Chinese buying continues “will be a major determinant of whether silver can finally take out $50”, she added.

Silver’s collapse last week began a rout that sent global commodities’ prices 10 per cent lower, raising concerns that a two-year boom may be over.

Ivan Glasenberg, chief executive of Glencore, the commodity trader that plans to float this month, dismissed the drop as “froth” being flushed out of the market, saying that supply and demand fundamentals remained strong.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.