Q2 Economic Contraction Highly Probable

Economics / Double Dip Recession May 15, 2011 - 12:50 PM GMTBy: Tony_Pallotta

Recently I have been discussing the possibility that the US economy is in fact in a period of contraction. I want to revisit that call as I don't loosely throw out such a statement without backing it up with real data. Q1 2011 GDP was 1.77%, a 43% reduction in Q4 2010 GDP of 3.11%. Although Q1 GDP could be revised higher over the next two revisions it did highlight three sources of contraction.

Recently I have been discussing the possibility that the US economy is in fact in a period of contraction. I want to revisit that call as I don't loosely throw out such a statement without backing it up with real data. Q1 2011 GDP was 1.77%, a 43% reduction in Q4 2010 GDP of 3.11%. Although Q1 GDP could be revised higher over the next two revisions it did highlight three sources of contraction.

Initial data for April has further supported potential economic contraction with four regional Fed manufacturing surveys showing a sharp reduction in growth, near outright contraction in ISM Services, a very sharp increase in weekly unemployment claims and a deteriorating trade deficit.

You don't need to be an economist to understand GDP in its most simplest terms.

GDP=Consumer+Government+Investment+Trade

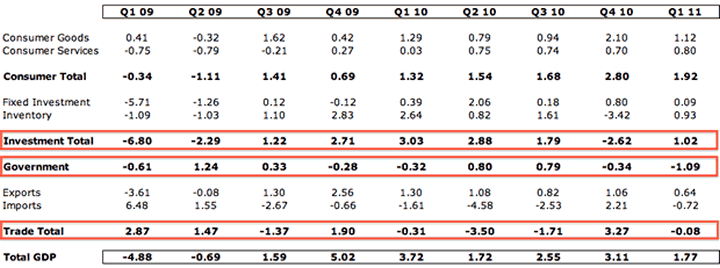

The following table shows how each component has contributed to economic growth over the last two years. The red highlights are those the economy is most vulnerable to.

Consumer: The consumer continues to hold up relatively well and has averaged 71% of total GDP since January 2009. Needless to say the consumer needs to be able to hold on here. There is no reason to count them out in Q2 or in the foreseeable future.

The one caution though is disposable personal income (income after taxes) on an inflation adjusted basis over the past six months has contracted when adjusting for the temporary reduction in FICA taxes. The combination of government aid and delinquent homeowners (average time without paying a mortgage is now 400 days) are keeping the consumer afloat.

Bottom line the consumer should continue to support the economy in the short term regardless of their lack of real organic income growth.

Government: The government was a net drag on economic growth the past two quarters. State governments are forced to balance their budgets and as tax revenues fall (falling property tax a big source) it is probable they will continue to contract. This leaves a big question mark with the Federal government and the reality they cannot expand further stimulus such as the FICA tax reduction.

Bottom line government is likely to contract further with a low probability of it contributing to growth in Q2.

Investment: There are two components to investment (1) inventory and (2) fixed investment. After five quarters of growth and rebuilding bare shelves inventory contracted -3.42% in Q4 but saw growth of 0.9% in Q1. Current inventory to sales levels suggest inventory could see further growth but why the sudden deterioration in economic data in April, primarily jobless claims? Did manufacturers and retailers get spooked in which case they are less likely to expand inventory levels? That is quite possible.

The contribution from Fixed Investment dropped from 0.8% in Q4 to 0.09% in Q1 driven from a 75% reduction in growth in non residential, primarily structures.

Bottom line investment could easily contract versus contribute to growth in Q2. Are manufacturers willing to expand current inventory levels? Who will finance new construction spending and is there demand for such investments?

Trade: This appears to be the most vulnerable source of contraction in Q2. In Q4 the trade deficit improved and in fact was a positive contribution to growth of 3.27% (when total growth was 3.11%) but then reversed to -0.08% in Q1. Most recent trade data shows the trend deteriorating further.

Bottom line trade will be the most likely source of contraction in US GDP as exports fail to maintain the pace of rising imports.

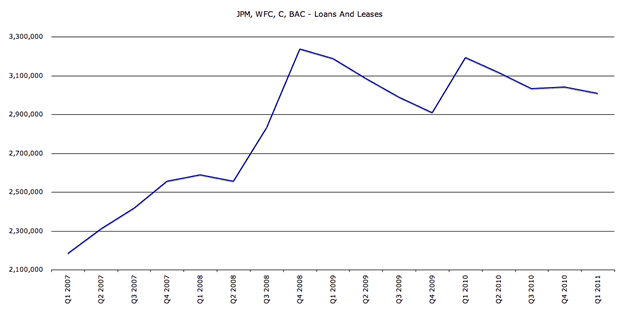

In closing I want to visit one final reason why economic contraction may very well come sooner than most expect. There is no growth in credit formation. Since Q4 2008 total loans and leases (credit outstanding on bank balance sheets) for JPM, C, WFC and BAC contracted 7.1%. In other words the largest sources of private credit are not lending but rather pulling in credit.

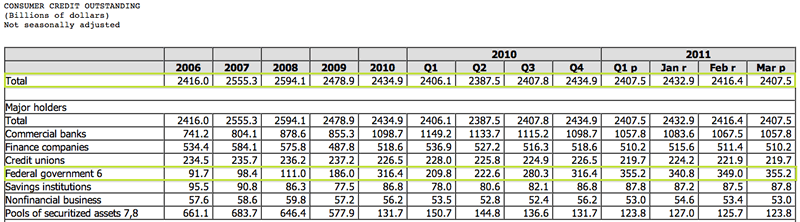

Without private lending this leaves the real "Bank Of America," the US government.The most recent consumer credit data shows the role the government is playing in expanding credit. Since 2009 government funded credit has risen 91%. Since 2006 it has risen 285%.

Lastly, the above scenario is based on one highly probable reality. The US government fails to address the growing national debt and is able to kick the can beyond the 2012 presidential election. As the data shows without the real "Bank Of America" or the Fed the level of contraction will be unprecedented.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.