Key Markets And Indicators Divergence: Stocks, Copper, Treasuries, Bonds, Investor Sentiment and Commodities

Stock-Markets / Financial Markets 2011 May 22, 2011 - 03:17 PM GMTBy: Tony_Pallotta

I posted a few charts this week showing some extreme levels and or divergences and wanted to combine them into one follow up post. The equity markets are at a very important juncture right now and confusion is rampant in every trader's mind.

I posted a few charts this week showing some extreme levels and or divergences and wanted to combine them into one follow up post. The equity markets are at a very important juncture right now and confusion is rampant in every trader's mind.

The markets have fooled almost everyone over the past two years and with QE2 ending in six weeks the headlights draw near as the deer stand in the middle of the road unsure which way to run.

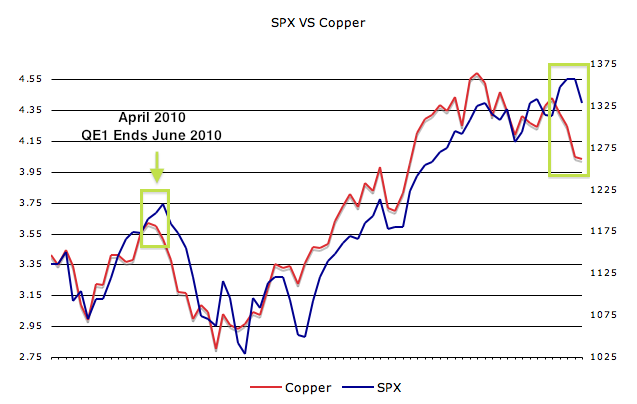

Copper: Copper has been a very good indicator of equity direction even during Fed QE when other correlations have broken down. We currently have a very large divergence with the SPX and the question becomes did copper put in a bottom based on last week's price action or was that a similar bounce as previously witnessed since the February 2011 high of 4.6495.

I believe the answer to the above question regarding the future of copper was answered on Friday with the COT report (found here). Commercial accounts have positioned themselves for a major correction in copper. In fact the last time they were positioned as such was April 2010 when QE1 was ending and copper was trading at $3. These are not traders but rather producers and users of copper. They know what's going on in the market as they are the market.

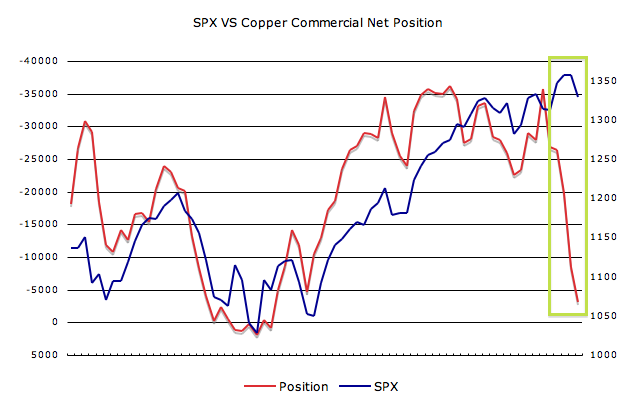

The chart below shows the correlation between the SPX and Copper Commercial Net Positions.

Corporate Bond Spreads: Amazing how the spread between high yield and investment grade corporate debt bottomed in 2011 at 80 basis points (bp) while in 2007 it bottomed at 79 bp. They could trade lower as high yield catches even more of a bid but they are at multi year lows after an impressive move since 2009.

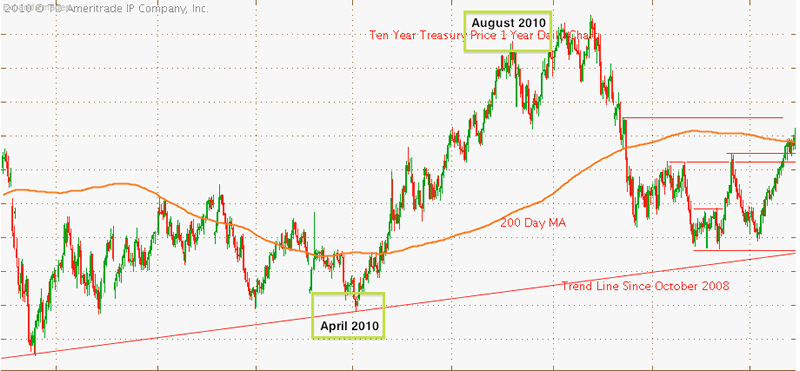

Treasury's: Using history as a guide bonds caught a bid in April of 2010 a full two months before QE1 ended and have begun to show a similar pattern in 2011.

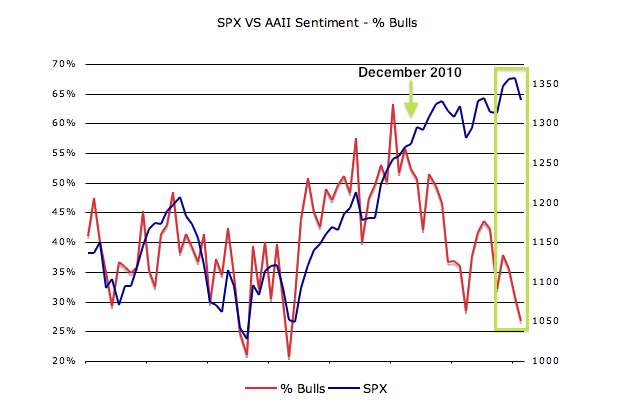

AAII Investor Sentiment: The divergence is at an extreme and someone is clearly wrong. History would say it is sentiment as the lower the number of bulls the higher the market will move. The divergence is absolutely massive though and remains the one big thorn in the side of the bears.

Commodities (data as of May 18, 2011): Commodities have peaked. Why would they peak now other than to fade QE2 or as economic data weakens? Commodities peaked in the summer of 2008 on average two to three months before the markets began their correction. The other question is why did Glencore, the largest commodity trader go public now and why has the IPO price already be taken out to the downside as investors bring down their valuations?

Copper – Peaked on February 15 – down 11.8%

WTI Crude – Peaked on May 5 – down 12.9%

Corn – Peaked on April 11 – down 4.3%

Wheat – peaked on February 9 – down 8.2%

Soybeans – peaked on February 9 – down 37.2%

Cotton – peaked on March 7 – down 28.2%

Sugar – peaked on February 2 – down 36.2%

Cocoa – peaked on March 4 – down 20.6%

QE History: With the second round of QE coming to an end we now have three of four events to use as a historical guide. Two times are the beginning of QE and one is the end of QE. All three times markets faded the news. History would then say the end of QE2 will also be faded. It is quite possible 1,370 on the SPX was in fact the beginning of that fade.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.