How To Handle A Stock Market Down Day

Stock-Markets / Stock Markets 2011 May 25, 2011 - 02:39 AM GMTBy: David_Grandey

On Monday, the markets gapped down and stayed down most of the day.

On Monday, the markets gapped down and stayed down most of the day.

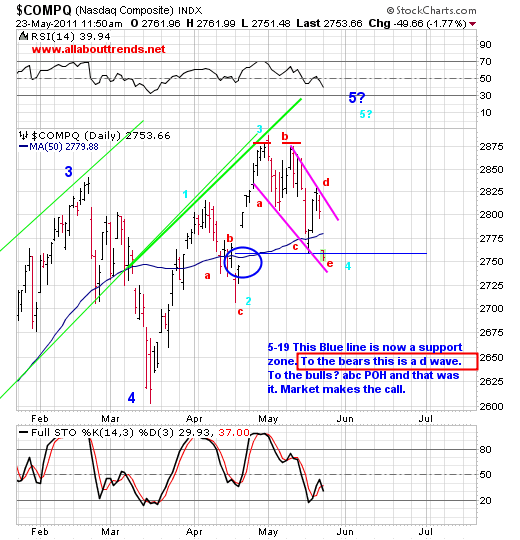

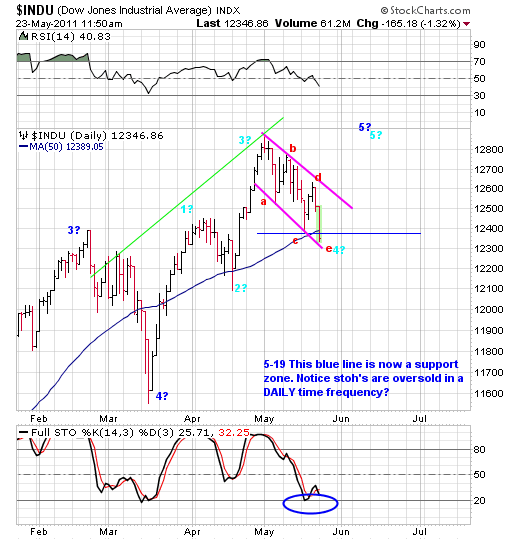

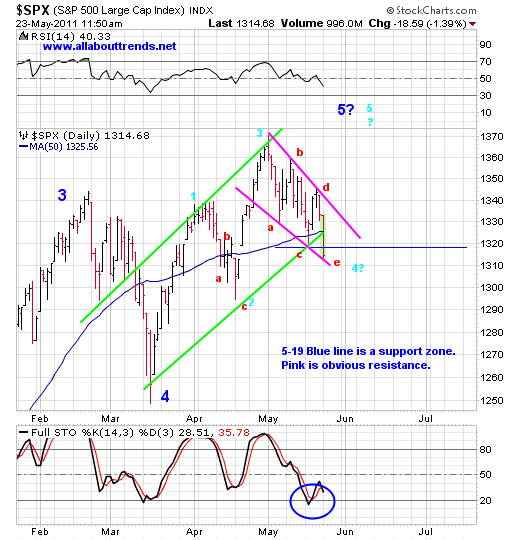

At first glance seeing as how we broke the blue support zone should we freak out and sell sell sell? Should we jump to a conclusion immediately?

Well before we answer that question let’s back up a moment and shift to what we do when we see markets getting hammered in pre-market (remember gaps are events over which you have no control over anyway as you never know when they are coming).

When we see markets are going to open down the first thing we do is WE DON’T REACT! The second thing we do is we let the opening nervousness settle down and THEN we look at our current holdings to see exactly what they are doing/showing technically speaking. This is what we mean when we say “Let Your Stocks Tell You What To Do By The Action They Are Exhibiting”

We look at technical supports, we look at how much we are down on the position on its own, but never really need to freak out because of trade size risk management. So you see, as always trade size risk management saves you ALL the time and allows you to never have to concern yourself with “am I getting hammered?” More often than not a bad day for you is that of a little spilled coffee on yourself.

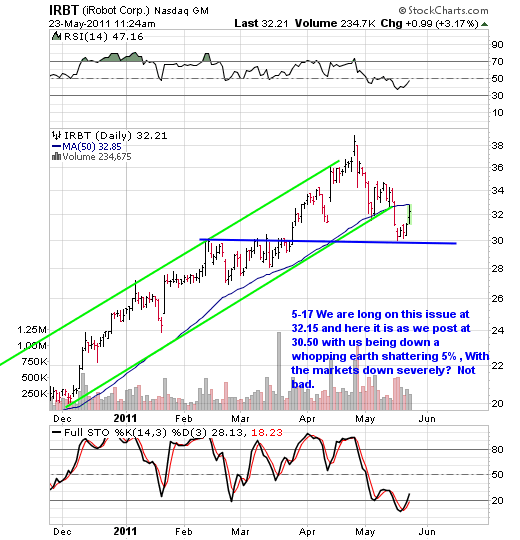

Case in point a good example of why we don’t want to jump to conclusions immediately is that of IRBT. Last week this issue broke its uptrend and at one point we were underwater to the tune of about 8% on the position on its own.

Monday this issue rallied right back up to the 50-day and here we are at break even again. This is exactly why we don’t jump to conclusions. Had we jumped to a conclusion on the break down? We’d have taken a loss, now? Breakeven to slightly ahead. It doesn’t happen all the time but more often than not for us it has. The phrase that comes to mind is “it’s more of an art than it is a science”.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.