Bullied Stock Markets Make Case for Mid-Cap Growth Stocks

Stock-Markets / Stock Markets 2011 May 31, 2011 - 06:11 AM GMTBy: Money_Morning

Jon D. Markman writes:

The markets may have been bullied a bit recently, but the way things are shaping up makes a solid case for mid-cap growth stocks.

Jon D. Markman writes:

The markets may have been bullied a bit recently, but the way things are shaping up makes a solid case for mid-cap growth stocks.

Markets rolled modestly higher on Friday ahead of the Memorial Day weekend as bulls once again shrugged off some bad data points on the economy and focused on some good news. But for the week and month, stocks were down across by the board by as much as 2.5%.

The really bad data Friday came from a plunge in pending home sales, while the news was only mildly weak in personal income and spending. I guess people just aren't carrying that optimism over to the home-buying sector.

The Dow Jones Industrial Average finished the week with a 0.6% loss, while the Standard & Poor's 500 Index sank 0.2%, the Nasdaq Composite fell 0.2% and the Russell 2000 rose 1%.

Developed markets outside the United States are up 3.7% for the year, while emerging markets are exactly flat.

For the year, the Dow is up 7.5%, the S&P 500 is up 5.8%, the Nasdaq is up 5.4% and the Russell 2000 is up 6.7%.

It's a little strange to see the stodgy, big old stocks of the Dow leading the major indexes, and it is primarily as a result of the success of large-cap healthcare stocks - Health Care SPDR (NYSE: XLV), up 14% this year - and staples, as in Consumer Staples Select Sect. SPDR (NYSE: XLP), up 10%, and energy, Energy Select Sector SPDR (NYSE: XLE), up 12%. Examples of each of these are Pfizer Inc. (NYSE: PFE), up 22%; Kraft Foods Inc. (NYSE: KFT), up 11%; and Exxon Mobil Corp. (NYSE: XOM) up 14%.

As for the commodities basket, best this month were orange juice futures, +12%; lumber, +6.6%; and wheat, +5.5%. Laggards were silver, -17%; coffee, -10.7%; and crude oil, -10.6%.

Bonds were higher this week because they loved the bad news about lingering unemployment and a poor read on pending home sales. It's not that they like to see people suffer; it's that inflation is their arch enemy, and when people are out of work they can't ask for higher wages.

Meanwhile, we also got a second read Thursday on U.S. real gross domestic product (GDP) in the first quarter. It showed that headline growth rose at 1.8% annualized in the January-March time span, which was disappointing since it was the same amount originally estimated and not a few ticks higher.

Many economists were expecting more like 2.2%. Compare that to other countries' first quarters: According to BMO analysts, the data show +6.1% in Germany, +5.6% in South Korea, +2.1% in Mexico, +1.9% in the U.K., or the 3.7% dive in Japan.

Market Gets Bullied

Pushing around the market in the past week and month is the dollar. It's down 5.2% this year, which again helps companies that sell a lot overseas by making U.S. goods cheaper. The dollar was up as much as 4% through mid-May, making this month troublesome, but as it has fallen 1% in the past week equities' values have improved.

The latest read on unemployment claims also kept a lid on enthusiasm this week.

They unexpectedly rose in the week of May 21, by 10,000 to a two-week high of 424,000. Economists expected a decline to 400,000. And just to make matters worse, the prior week was revised up to 414,000 from the prior announced level of 409,000.

It's a little hard to believe we are this far along in a recovery and jobs are still scarce. It's true that unemployment claims are a very volatile data series, yet still something is happening. What?

Well, the plain fact is that businesses are hiring but they are not going crazy. They are being cautious until they are more confident that demand for goods and services will meet or exceed expectations. Remember thatCisco Systems Inc. (Nasdaq: CSCO) last week told executives to hold back on new hiring. And I hear from my sources at Microsoft Corp. (Nasdaq: MSFT) that layoffs are planned there as well.

This is one of those things that are bad for people, but good for stocks. Companies are simply figuring out how to do more work with fewer people. The whole nature of work is changing in a lot of places as companies adjust to their customers' needs and their changing revenue stream.

If you subscribe to The New York Times online, read an article published this week titled, "At Well Paying Law Firms, a Low Paid Corner.". It describes how top-tier law firms have created a new career track for attorneys who are willing to give up the potential of making partner for the chance to set their own hours, travel less and live in parts of the country with lower costs of living.

The article provides a fascinating glimpse into the ways that companies adapt to change, and learn to bring in higher rates of earnings despite bringing lower rates of revenue. They hire less, but they might get more out of the people that they do hire, and actually pay them less.

And finally, one more bit of news that depressed the Dow stocks a bit was word that, in aggregate, corporate profits, on an after-tax basis, dropped 0.9% in the quarter -- the first decline in over two years. Ouch.

Bottom line:The news was bad in the second half of the week, but trading was good. That's the right combination. When stocks rally, even a little, in the face of bad news it usually means that the sourness is already discounted in prices, and the next move can be higher to discount a recovery.

The Case for Mid-Cap Growth Stocks

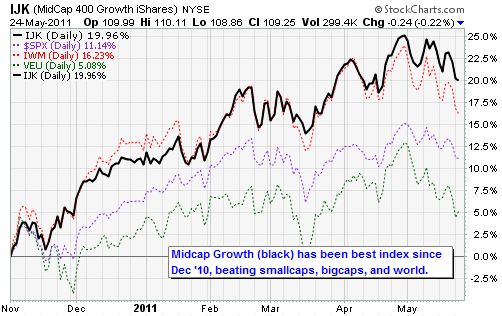

For investors trying to keep it simple, my recommendation all year has been to focus on the growth half of the S&P Midcap 400 -- available for purchase through the iShares S&P Midcap 400 Growth (NYSE: IJK) -- because this is the part of the cycle that favors them. They are small enough to grow briskly despite weakness in the broad economy, but large enough to take advantage of international opportunities.

The main thing I look for in a big holding is that it sink less into the broad market lows than its peers and that it climb out of those lows faster.

Above you can see a quick reality check. Your biggest portfolio holding does not have to be higher for every market jiggle and jaggle, because that will lead you into some very unproductive performance chasing. But it does have to be true for periods longer than three months. As you can see in the chart just since November 2010, the IJK sank into December much less than the S&P 500 (purple line) or non-US developed markets (green line). Then it jumped out of the Thanksgiving low a lot more sharply.

Then in March it also sank a lot less into the lows inspired by the Japanese earthquake, and again rose out of those lows more sharply. And now it has fallen less sharply since the April highs.

The big idea with putting 55% of the money into a single fund is that if the goal is to perform better than the market on a risk-adjusted basis, you need to own something different than the market. That's unassailable. Yet the number of major bets you can make is not large.

You could make a big sector bet, but those are tricky because sector strength waxes and wanes. You could make a big bet on commodities, but again you would really need to stay on top of those in a very active way -- and you would not meet the goal of low volatility. So in my view it comes down to a bet on size (large, medium or small) and style (growth or value).

I did not want to recommend a big bet on small-caps because they tend to be more focused on domestic sales, and the U.S. economy is not the torch of the world right now. And if you bet on large-caps, you are really back to simply betting on the market. And as for value, well, it tends to work best coming out of deep lows, and then the baton is passed to growth.

You may disagree with all of these assumptions, but after a lot of math and testing behind these assertions I come away with a decision to focus on mid-cap growth stocks. Everything else -- sector bets on healthcare, staples and the rest -- is color around the edges of the big picture.

The Week Ahead

May 30: Memorial day. U.S. markets closed.

May 31: Chicago PMI; Conference Board Consumer Confidence Index.

June 1: Motor vehicle domestic sales; ISM Manufacturing Index; Construction spending.

June 2: Initial jobless claims, Nonfarm business productivity; Unit labor costs.

June 3: Nonfarm payrolls; Unemployment rate; Average workweek; ISM services index.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source :http://moneymorning.com/2011/05/31/bullied-markets-make-case-for-mid-cap-growth-stocks/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.