Canadian Dollar is No Haven from a US Dollar Collapse

Currencies / Canadian $ Jun 01, 2011 - 06:46 AM GMTBy: Jeff_Berwick

We spend a lot of time here at The Dollar Vigilante chastising Ben Bernanke and the Federal Reserve and preparing our subscribers for a collapse of the US dollar - something which has been paying off very handsomely, with gold and silver at record highs this year - but don't take that to mean that we prefer any other fiat currency. No fiat currency in the western world is any better than the US Dollar. In fact, in every case, they are worse.

We spend a lot of time here at The Dollar Vigilante chastising Ben Bernanke and the Federal Reserve and preparing our subscribers for a collapse of the US dollar - something which has been paying off very handsomely, with gold and silver at record highs this year - but don't take that to mean that we prefer any other fiat currency. No fiat currency in the western world is any better than the US Dollar. In fact, in every case, they are worse.

The Federal Reserve is still, despite its secrecy, one of the most transparent central banks in the world. It also has, over the last century, despite inflating the dollar downward by 97%, been one of the least inflationary banks.

We often hear of people denounce the US dollar and correctly divine that it is headed to worthlessness, but, in the same breath, they say they own other fiat currencies like the Canadian dollar.

This is a case of ignorance of the workings of banks like the Bank of Canada - or virtually any other major central bank in the world, for that matter.

There are numerous reasons why the Canadian dollar will not survive a US dollar collapse:

- The Canadian economy is very tied to the US economy

- The Canadian Government is intent on devaluing the Canadian dollar alongside the US

- The Bank of Canada has virtually no gold backing the Canadian dollar

- All that does back the Canadian dollar is the US dollar and other fiat currencies

- The Canadian dollar is not used globally

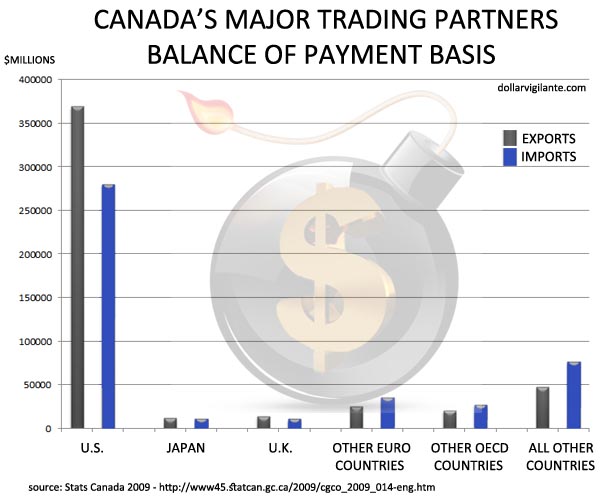

The Canadian Economy is Very Tied to the US Economy

We need only show one graphic to make this point:

It is obvious that if the US goes through a monetary collapse or even just a major depression, the Canadian economy will be hobbled significantly.

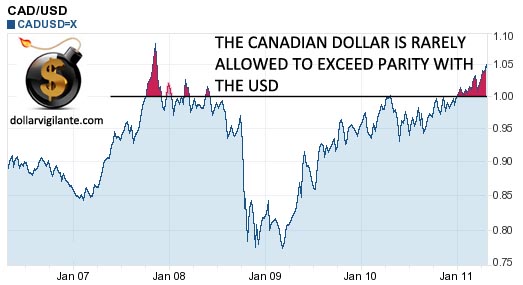

The Canadian Government is intent on devaluing the Canadian dollar alongside the US

The Canadian Government has made it painfully clear that they have no intention of allowing the Canadian dollar to rise much more than par with the US dollar. The reason: lobby groups and voting blocks from export based industries will depose of any government which allows this to happen.

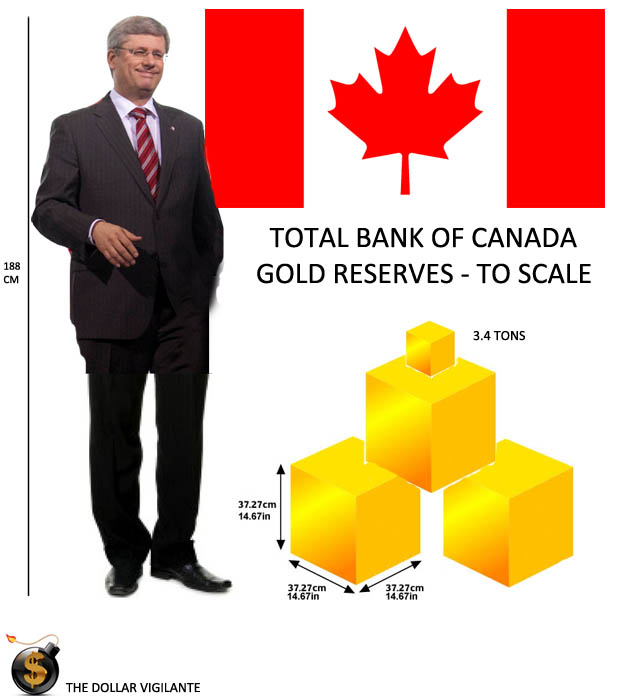

The Bank of Canada has virtually no gold backing the Canadian dollar

Since 1980, Canada has sold 99.5% of it gold. Canada now has the 78th largest holding of gold of all countries. Countries such as Bolivia, Bangladesh, Cambodia and Macedonia have more gold than does the Bank of Canada.

The Bank of Canada used to have 653 tonnes but today it only holds 3.4 tonnes. To give a rough idea of what all of Canada's gold holdings look like, we created this rough estimate of what it would look like if Canadian Prime Minister, Stephen Harper, was standing beside it:

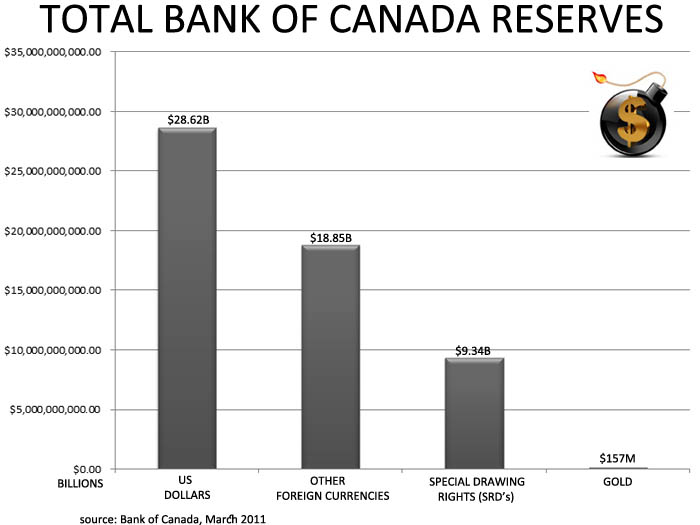

All that does back the Canadian dollar is the US dollar and other fiat currencies

If you believe that the US dollar is headed to zero then it makes no sense to own the Canadian dollar. Practically all that backs the Canadian dollar is US dollars.

The Canadian dollar is not used globally

The Canadian dollar is not a true global currency. There is only one, current, true global currency: the US dollar. It is accepted on the streets of New Delhi, Phnom Penh, Buenos Aires, Moscow and practically everywhere. Try bringing some Canadian monopoly money to Shanghai and try buying some street noodles. You'll see how valid of a global currency the Canadian dollar is. No soup for you!

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.