Agri-Food Commodity Cycle Stocks Investing

Commodities / Agricultural Commodities Jun 04, 2011 - 11:24 AM GMTBy: Ned_W_Schmidt

What is the most dangerous word in the investment world? Using this word is almost assuredly first step toward owning an investment with issues that ultimately lead to unhappiness. That word? Quite simply is, "But..." That word can actually take two forms, explicit and implicit.

What is the most dangerous word in the investment world? Using this word is almost assuredly first step toward owning an investment with issues that ultimately lead to unhappiness. That word? Quite simply is, "But..." That word can actually take two forms, explicit and implicit.

Consider first The Great Silver Crash of 2011 now unfolding. Quite clearly the Silver bubble has burst, and the basic path of Silver is down. However, many times we heard this past month, "but my chart says..." or "but the longer term moving average..." or "but hyperinflation is..." or "but the dollar is going to vaporize". Some similar "buts" are being heard in Agri-Food. But, "buts" do not change a market's direction.

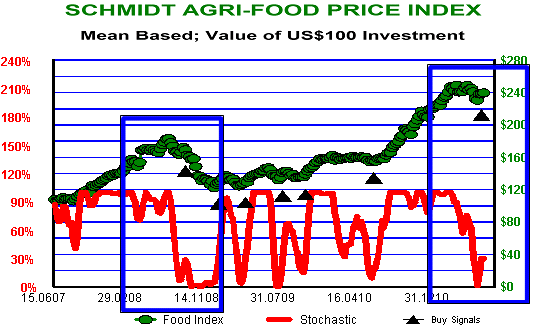

Plotted in the above chart is our Agri-Food Price Index, green line. That red line is the stochastic associated with that index. Two blue rectangles highlight the breakdown of the previous commodity cycle and the current environment. In both cases, the stochastic signaled a breakdown out of the existing pattern. As the great philosopher once said, "Looks a lot like deja vu all over again."

Now, what is a stochastic? That measure attempts to guess where in the existing channel price is trading. The name, stochastic, is derived from "a guess." In the above chart we use the stochastic to identify buy signals. In doing so, we always note that the first stochastic buy signal out of an up move should be ignored as it is really a signal that the pattern is breaking down.

What ignited the Agri-Food commodity price run of the past year was Russia and Ukraine halting export of wheat in the Summer of 2010. Much of the Middle East and parts of Europe rely on wheat from those countries due to generally low cost and short transport. That embargo on exports caught many countries unprepared, as generally that wheat was always available. Just in time inventory management works wonderful, till it does not work at all. Only real wheat shortage was localized, and predominantly in those nations, like Egypt, that rely on Russian wheat.

Now the news is changing. Russia is on the way to resuming wheat imports on the first of July. That happens at the same time the world has a generally adequate stock of wheat. China's southern harvest started this past week, and looks to be in good shape. Western U.S. wheat is not as good as last year, but the combines will soon be bringing it out of the fields. Spring wheat in North America has some difficulties as wet conditions are preventing planting in some areas.

Response to the announcement of Russian wheat exports resuming has been a long list of "buts..." All those responses are an attempt to deny that the second derivative of the world wheat supply is turning positive in the short-term. Resumption of wheat exports from Russia and the Northern Hemisphere harvest now under way may turn wheat into the damp squib of 2011. With that, the current consolidation in Agri-Food commodity prices should continue to unfold. Given that background, what paths are open to investors?

Agri-Equities are comprised of two major sectors, large multinational companies and smaller, largely Asian, companies. In the past year as the latest Agri-Food commodity cycle was unfolding, large multinational companies, what we refer to as Tier One, performed exceptionally well. Our sample of Tier One Agri-Equities has returned about 50% in the past year versus about 28% for S&P 500.

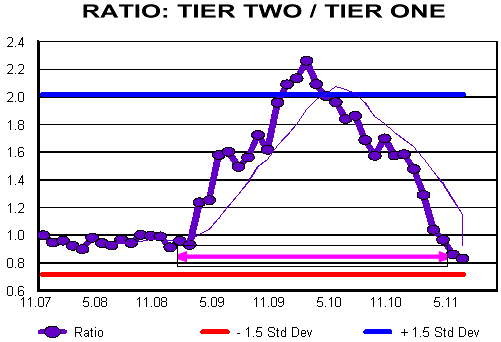

In the above graph the ratio of a price index for Tier Two Agri-Equities to Tier One Agri-Equities is displayed. The fall of that ratio over the past year is due to the superior performance of Tier One Agri-Equities. When falling, Tier One, large multinational Agri-Equities, is doing better. When rising, Tier Two, Asian Agri-Equities, is doing better.

Arrow in that chart indicates the similar position of the ratio back in time. At about the time the previous Agri-Food commodity price cycle turned down, the Tier One Agri-Equities began to turn in poor performance and Tier Two Agri-Equities came alive. Much of the buying of large multinational Agri-Equities in the earlier cycle had been as proxies for actual Agri-Food commodities. That same response has existed in recent times. Many funds that could not buy corn bought tractor stocks.

When the previous Agri-Food commodity cycle turned down, investors looked to those Agri-Equities possessing both secular and organic growth, rather than those simply benefitting from a robust commodity price cycle. That type of growth was found in the Asian Agri-Equities. The ratio in the above chart suggests that the market may again be approaching a point where Asian Agri-Equities could again become a dominant Agri-Investment theme. Investors might be advised to ignore the extreme pessimism, most of it unjustified, on Asian Agri-Equities. They are in fact the ones closest to the structural case for Agri-Food, China and the rest of Asia.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.