Gold Stocks are Underowned and Oversold but Need Catalyst

Commodities / Gold & Silver Stocks Jun 10, 2011 - 05:08 AM GMTBy: Jordan_Roy_Byrne

While Gold is only 2% from all time highs, the gold stocks have struggled and underperformed badly. This is reminiscent of 2008, although we don’t think a similar result is coming. The fact is as QE 2 ends and the failed recovery peaks, money is moving out of risk assets and into Bonds. Gold is holding up very well but the gold stocks are struggling and in need of a catalyst.

While Gold is only 2% from all time highs, the gold stocks have struggled and underperformed badly. This is reminiscent of 2008, although we don’t think a similar result is coming. The fact is as QE 2 ends and the failed recovery peaks, money is moving out of risk assets and into Bonds. Gold is holding up very well but the gold stocks are struggling and in need of a catalyst.

Let’s take a look at GDX (large caps) and GDXJ (juniors). In the following chart we show both along with the bullish percent index for the sector, which is at 40% but often bottoms at 25%-30%. For GDX we note strong support at $48 and $50 with support at $51. Meanwhile, GDXJ remains above key support at $34. Should that falter we are looking at $31.50-$32.00 as the next support.

Whatever bullish sentiment there was at the end of 2010, has completely eroded. Assets in Rydex’ Precious Metals Fund (courtesy of sentimentrader.com) are near an 18-month low and very close to a two-year low.

We should also note that sentiment is not so bullish on Gold itself. Mark Hulbert’s HGNSI indicator,, which was 70% at the recent top, fell to 7% at the recent bottom and is now only 20%. Yes, with Gold only 3% away from a new all time high, the average market timer recommends mostly cash instead of a long Gold position. Furthermore, open interest in Gold futures is 22% off its high and the speculative long position is 21% off its high.

Technically the gold stocks are in a good low-risk position. However, there needs to be a fundamental catalyst for the sector to bottom, build a base and embark on a new sustained advance. Strengthening of the real price of Gold always helps, though its effect is not immediate and usually lags by a few months.

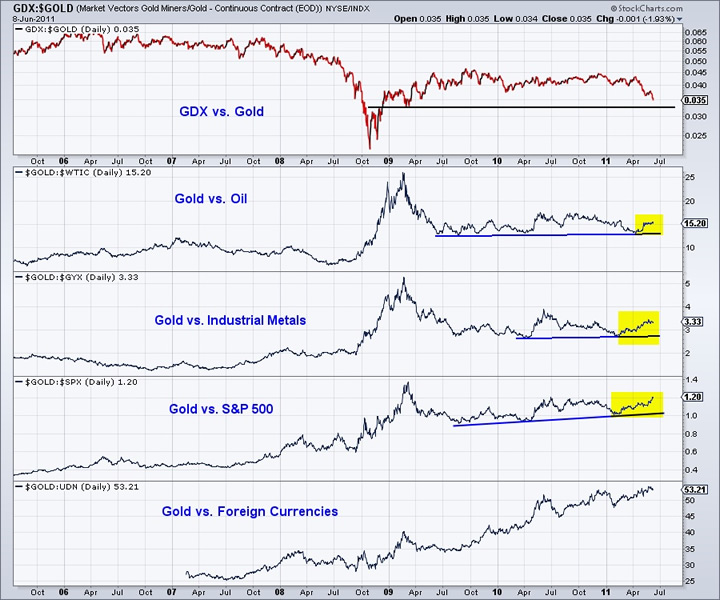

In the following chart we graph Gold against other markets. Similar to 2008, we see that the gold stocks are falling against gold yet Gold is quietly strengthening against Oil, Industrial Metals and the S&P 500. The real price of Gold began to strengthen across the board in September 2008 and it was only a month later that the sector bottomed.

As growth and deflation reemerge as the primary concerns, we will see Gold continue to strengthen against all markets and assets (sans Treasury Bonds). That is a positive though not immediate catalyst for the gold stocks. The worse the economic numbers and the worse conventional assets perform the more likely the Fed is to continue to provide increased artificial support. Moreover, the strong Treasury market provides the Fed political cover and the ability to monetize bad debts. They want to do this when Bonds are strong not weak.

To conclude, there is no immediate catalyst for the gold stocks but things are starting to move in the right direction. As the economy stalls and the equity market peaks more money will move out of risk assets and eventually into Gold and then the gold shares. We are already seeing the start as Gold is firming in relative terms. Look for a bit more weakness in the gold stocks but ultimately this summer should host a major low and the gold stocks will be in a fantastic position heading into 2012.

In a bull market you always want to buy the dips. In this sector, the dips can be exaggerated. Now is the time to pay attention. In our premium service we are uncovering many great prospects in the established and speculative categories.To find out more about how we manage risk and volatility and what stocks we are following, then consider a free 14-day trial to our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.