Flash Crash Takes a Bite of Natural Gas

Commodities / Natural Gas Jun 13, 2011 - 02:50 PM GMTBy: EconMatters

After infecting the stock market last May and hit the precious metals market, silver in particular, primarily due to raised margin requirement, flash crash has now taken a bite of the natural gas market as well.

After infecting the stock market last May and hit the precious metals market, silver in particular, primarily due to raised margin requirement, flash crash has now taken a bite of the natural gas market as well.

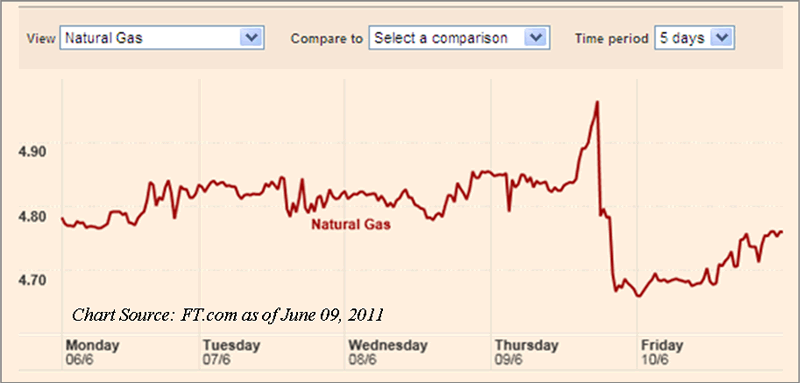

FT.com reported that the Nymex (New York Mercantile Exchange) floor had been closed for more than five hours on the evening of Wednesday, June 9 when July natural gas dropped 8.1%, to $4.510 per mmbtu (See Chart). The fall also triggered a 20-second trading pause for the August Henry Hub futures contract.

More curiously, coincidence or not, this flash crash took place in the confluence of the following market events this week, which most likely should encourage the long natural gas trade:

- The International Energy Agency (IEA) said on Monday June 6 that it expects global gas demand to overtake coal before 2030, and come close to oil around 2035, and that global gas demand to grow by an average of 2% a year, which will end the current gas glut by 2015, by when demand would begin to outstrip supply.

- On Thursday, June 9, Exxon Mobile announced that it bought two privately held natural gas company--Phillips Resources and related company TWP Inc.--for $1.69 billion last week, adding about 317,000 acres for exploration in the Marcellus shale basin.

At the same time, some market players blamed the overnight drop on computer algo trading, while other says it is a 'fat finger'..... again (probably the same one from last May?), and that there could be another round of inquiry or investigation by the Commodity Futures Trading Commission (CFTC) and the Exchange.

Henry Hub price has risen 15% in the past month, close to a one-year high of $5 per mBtu, on warmer than usual weather and prospects for future LNG exports. While fat finger or computerized trading may very well be the cause behind the sudden crash, it looks more like technical profit taking by some big player(s).

Natural gas prices in the U.S. have been stuck in a rut due to ample supplies from the shale gas boom, as a result, many players have increased their short positions on natural gas. According to CFTC, as of May 30, commercial participants, who accounted for 64.7% of open interest, held net short positions, while non-commercial participants, who accounted for 24.5% of open interest, also increased their increased their short positions by 7.1%.

That means, if the same player(s) change their positions, instead of a flash crash, we probably will see a natural gas prices spike by short squeeze. This is just one characteristic of a modern day commodity paper palace where a majority of the trades does not take physical delivery.

For now, natural gas for July delivery has recovered and settled up 1.8%, at $4.757 a million British thermal units by Friday, June 10. Futues rose 1.1% for the week.

Disclosure - No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.