Gold and Silver Stocks Bottom Imminent

Commodities / Gold and Silver 2011 Jun 17, 2011 - 07:24 AM GMTBy: Jordan_Roy_Byrne

Gold and Silver equities have led the markets lower and have underperformed the metals significantly this year. For the past month or so Gold has firmed and Bonds have moved higher as most asset classes have declined. Unfortunately mining equities have been among the worst performers. However, our work leads us to believe that an important bottom should be in place very soon.

Gold and Silver equities have led the markets lower and have underperformed the metals significantly this year. For the past month or so Gold has firmed and Bonds have moved higher as most asset classes have declined. Unfortunately mining equities have been among the worst performers. However, our work leads us to believe that an important bottom should be in place very soon.

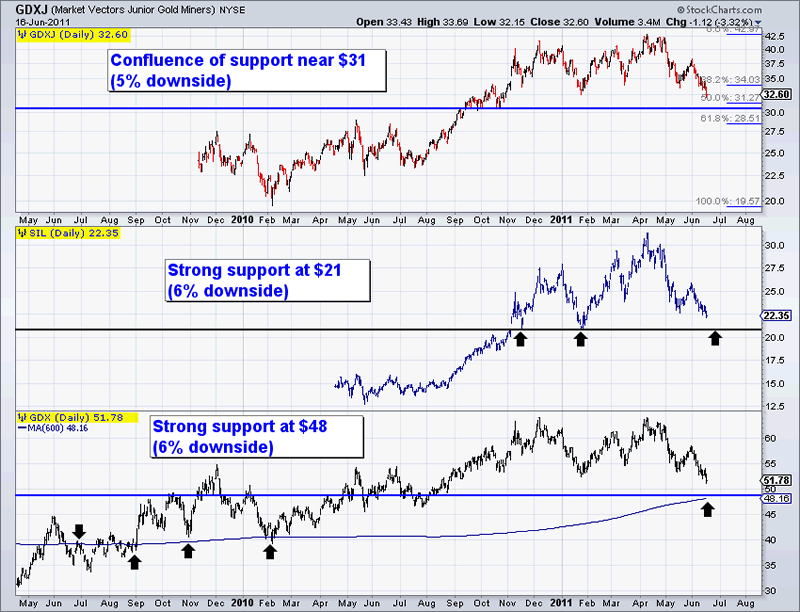

From top to bottom we plot GDXJ (junior golds), SIL (silver stocks), and GDX (large cap golds). While each has broken down in recent days, each is only 5-6% away from a confluence of very strong support. These ETFs gained significantly in 2010 and what we are seeing is a correction and deep retracement of substantial gains. Buying on weakness in a bull market is always a good plan but with the exceptionally volatile mining stocks we want to see deep oversold conditions and the presence of strong support.

In addition to an oversold condition and technical support, we want to see evidence that the sector is unpopular and underowned in a short-term sense. We don't want to get bullish when the crowd is chasing a particular market. Below is a chart from sentimentrader.com which shows data from the Rydex Precious Metals Fund. In only the past five and a half months, assets in the fund have declined from $345 Million to $135 Million.

The broad weakness in risk assets and the decline in precious metals shares has some worried and concerned. However, this is not another 2008. Then there was credit stress in the private sector and not on the sovereign side. Oil and inflation cut into margins of the miners and there was forced selling as hedge funds blew up. We don't see any of these problems today.

The sector will bottom in the coming days and look for it to coincide with a worsening of problems in Europe. Bond yields in Greece, Portugal, Ireland and Spain are dangerously breaking out to the upside while credit default swaps are starting to move. As the Euro weakens Gold may catch a nice bid in anticipation of more debt monetization.

To find out more about how we manage risk and volatility and what stocks we are following, then consider a free 14-day trial to our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.