Greeks Turn to Gold as Safe Haven Demand Surges

Commodities / Gold and Silver 2011 Jun 22, 2011 - 08:14 AM GMTBy: GoldCore

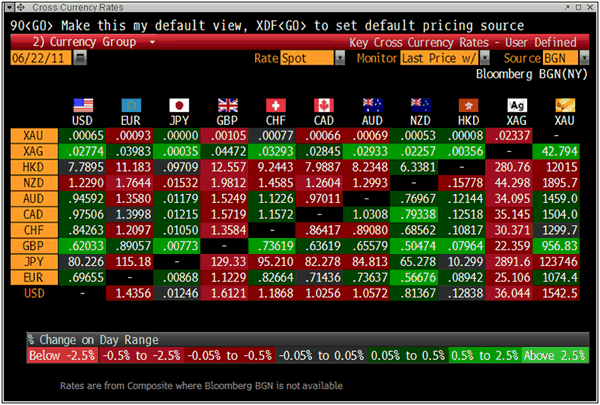

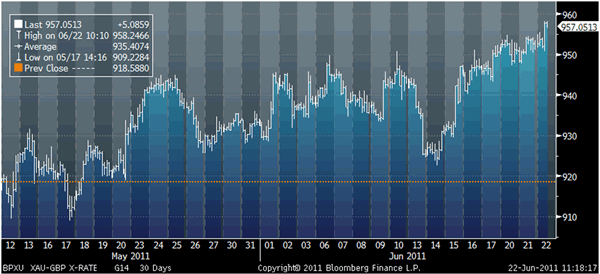

Gold is trading at $1,544.31/oz, €1,072.96/oz and £957.30/oz. Gold is lower in dollars but higher in euros and has reached new record highs in pounds sterling at £958.25/oz. Gold is being supported by strong and increasing demand internationally.

Gold is trading at $1,544.31/oz, €1,072.96/oz and £957.30/oz. Gold is lower in dollars but higher in euros and has reached new record highs in pounds sterling at £958.25/oz. Gold is being supported by strong and increasing demand internationally.

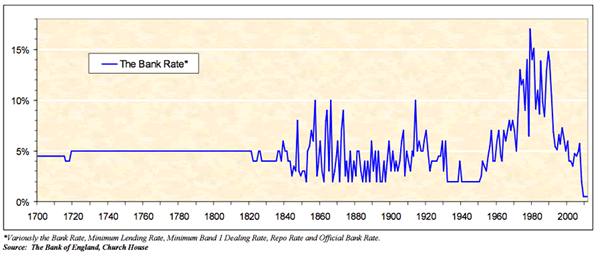

Sterling has fallen after the BoE minutes raised concerns of further quantitative easing and currency debasement. The Bank of England looks increasingly likely to maintain its ultra accommodative monetary policies. Interest rates may continue to remain at multi century lows and the BoE is again considering more printing of money to buy government debt.

UK Interest Rates – 1700 to Today

Despite Papandreou winning yesterday’s vote, the Greek parliament must now approve the austerity measures and this is leading to continuing nervousness in markets.

Cross Currency Rates

European equities have been sold this morning and Italian, Portuguese and particularly Irish debt are under pressure showing that the risk of contagion remains real. There remain many possible impediments to a solution to Greece's and the Eurozone’s sovereign and banking debt crisis. That is, if indeed, a solution is possible given the scale of the crisis and the fact that it is systemic.

Gold in British Pounds – 30 Days (Tick)

Gold and silver’s increasing safe haven status is seen in news from the Financial Times (front page) and from Bloomberg today (see news).

The Financial Times reports that “Greek citizens are emptying savings accounts and buying gold as they brace themselves for the possibility of a sovereign default and a run on the banks.”

Sales of gold coins have soared as savers seek a safer and fungible source of value, says the FT.

“When the global financial crisis started, our sales of coins to investors overtook bullion for the first time,” said Harry Krinakis, at Sepheriades, a Greek precious metals trader. “Now the sales ratio has reached five to one.”

Tomas, a computer technician, has exchanged his euro savings for gold coins: “I keep them at home just like my grandmother did in the second world war.”

Athens Stock Exchange General Index – 10 Years (Weekly)

Gold is again being seen in Greece as an essential store of wealth, hedge against inflation and safe haven asset.

This is not surprising given the scale of the crisis and the sharp falls seen in Greek property and equity markets (see chart above).

The fact that gold cannot default or go bankrupt unlike every single corporation, bank and government in the world is making it the safe haven of choice again.

There is also the important fact that it cannot be debased by bankers and central bankers unlike currencies and bonds.

Greece is the canary in the coalmine and the likelihood is that what is happening in Greece today, people using their cash deposits in banks to buy gold bullion, will be seen in many other countries in the coming months.

Indeed, news from the Perth Mint of record sales of silver coins is indicative that this trend has already begun.

Bloomberg reports that “Silver-coin sales from Australia’s Perth Mint, which was founded in 1899 and processes all of the country’s bullion, have surged to a record as buyers seek to protect their wealth with the metal known as poor man’s gold.

The mint sold 10.7 million 1-ounce silver coins since July 1 last year, according to Sales and Marketing Director Ron Currie. That’s 66 percent higher than the previous full fiscal year and about 10-fold more than five years earlier. Sales of 1- ounce gold coins will be close to a record, he said.

Confirming robust demand internationally, UBS said that its gold sales to India have increased significantly and that sales of gold coins and bars in Europe have also accelerated in recent days.

GoldCore has seen a marked increase in sales last week and this. Silver in particular had seen a sharp drop in sales since late April but buying renewed again last week. Renewed buying comes after a long period of hesitancy on behalf of many clients since the sell off at the end of April led to heightened concerns that the “bubble” had burst.

Yet another indication, if one were needed, that gold is anything but a bubble comes in the news that the People’s Bank of China is planning to double its issuance of gold bullion Chinese gold coins.

Both the FT and Bloomberg report that the People’s Bank of China plans to issue about 1 million ounces of its 2011 panda gold bullion coins compared with plans at the end of last year for 500,000 ounces of the coins.

Gold is far from being a bubble. Bubbles witness investors and speculators greedily piling in in expectation of making quick profits. It is quite the opposite today as risk and concern is leading to diversification into gold and buying of gold bullion as a long term store of wealth internationally.

Today, those buying gold and silver are increasingly protected due to the floor being put under precious metal prices due to Indian, Chinese and Asian public and central bank buying of gold.

SILVER

Silver is trading at $36.09oz,€25.07/oz and £22.37/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,740.00/oz, palladium at $763/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.