Silver, Comex and The War Over Money

Interest-Rates / Global Debt Crisis Jun 24, 2011 - 12:20 PM GMTBy: Andy_Sutton

Once again, S&P is at it, issuing its monthly threat to the USGovt to fall into compliance or risk its AAA credit rating. On the surface, these warnings have become rather laughable in that the ratings agency feels the need to say something while, in effect, saying nothing. As time has gone by, the idea that the markets would be jittered by an actual ratings cut has become equally absurd. To hear it reported, you’d think the market consisted of a bunch of first graders who need S&P, Moody’s or Fitch to tell them the sky is blue.

Once again, S&P is at it, issuing its monthly threat to the USGovt to fall into compliance or risk its AAA credit rating. On the surface, these warnings have become rather laughable in that the ratings agency feels the need to say something while, in effect, saying nothing. As time has gone by, the idea that the markets would be jittered by an actual ratings cut has become equally absurd. To hear it reported, you’d think the market consisted of a bunch of first graders who need S&P, Moody’s or Fitch to tell them the sky is blue.

To the average American, the threat comes not from what the ratings agencies might do, but what is being done (or not done) to cause the entire flap to begin with. The only real difference between the US and the PIIGS or anyone else is that we have a standing contract with the moneychangers to provide as much liquidity as is necessary to achieve whatever goals are desirable; not to America, but to the moneychangers themselves. It is a subtle distinction, but one that I notice way too many people who understand things are tripping over. We can’t talk about debt without talking about the Fed and we can’t have a reasonable discussion about the Fed without examining its motives. We have to mention that your local bank gets paid a 6% per annum dividend from the fed for its mandatory participation in the system, among many other things you won’t hear on television.

Obviously one of the ways dollar holders the world over have sought to fight back is through the ownership of precious metals. They are the anathema of fiat currencies. They cannot be forged, printed, or created as computer digits in their physical form. This is nothing new; there has been a secular bull market in metals for over a decade now while the dollar has faded from a desired asset into a ‘necessary evil’ as the world speeds headlong into the clutches of regional and perhaps even global currency regimes.

The moneychangers tolerated the bull market in precious metals for a time as even they recognize the value of real money. Central banks went from being net sellers of gold to net buyers several years ago and have been accumulating. The story of Asian demand, largely unspoken of in the USFinPress has been quietly driving the markets even higher. For US investors, precious metals became a bright spot considering the equity markets have lost around 20% when adjusted for the government’s overly modest inflation figures in the past 10 years. The inflation cat escaped the bag in 2006 and 2007. The Fed then cemented the truth that inflation is a monetary event by its quantitative easing actions. The subsequent rises in virtually every tangible asset since have created a clear causal relationship between monetary action and price formation that even the most stalwart of Keynesians will have an impossible task refuting. Finally, US investors had something that they could rely on to provide protection against inflation. They’d lost the ability to do so with traditional bank CDs, money market funds, and sweep programs. It is only fitting that the moneychangers now try to change the rules they themselves established. And it is even more fitting that they waited until so late in the game to do so. The attacks are subtle to the point that the average metals investor might not understand the implications, but there is a war going on over money itself.

The Attack on Precious Metals

The first of these two attacks has had a profound effect on metals investors, and at the same time created a massive opportunity through the resultant market dislocation. The attack plan all along by the banking cartel has been to discredit gold and silver as monetary instruments while at the same time accumulating large amounts of both. This rush to tangibles has left warehouses with increasingly smaller amounts of metal to work with, particularly silver (see graphic). Wonder of all wonders, people were stepping up to the plate, motivated by people like Jim Sinclair among others, and taking delivery of metals instead of playing in the paper metals markets. People have begun to understand how the ETFs and many other ‘paper gold’ instruments are merely tools of metals manipulators.

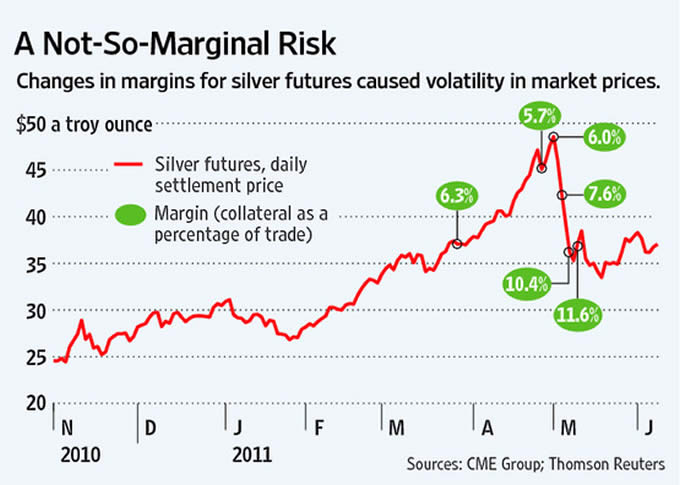

When silver closed within a whisker of $50 an ounce back in early May, CME took to action by hiking the margin maintenance requirements on silver contracts. Without going into the sordid details, in essence it made it more expensive to hold silver contracts in that the contract holder had to put up more capital. The stated reason behind this action was to limit ‘speculation’ in that particular market. The action followed the traditional mantra of the manipulators – anytime metals prices increase it is because of speculation and when they fall it is because of fundamentals. This is a losing battle that has cost the megabanks untold sums of fiat cash to fight, but the supply of currency is unlimited. CME has hiked margin requirements 6 times between late March and early May, beating silver down from the high $40s to the mid $30s. Gold has been affected as well, albeit to a much lesser extent on a percentage basis. The more recent of these hikes have been on gold contracts as well as silver.

The second attack has come out recently in emails to customers of some online futures brokers who are interpreting the new financial ‘reform’ bill to inhibit the OTC sale of gold and silver on a leveraged basis. Without delving into the legalese, it will become essentially impossible, starting July 15, to buy or sell spot gold or silver in almost all cases. Many have asked if this is going to affect coin and physical sales, and there has been no indication that this is the case at all; it pertains to leveraged or margined transactions only. So far.

Again, the stated purpose of these actions in the aggregate is to curb ‘speculators’. Obviously we could split hairs on the semantics of such a statement since pretty much anyone who makes any type of investment is a speculator in that they are making an allocation in the hope (not guarantee) that they will profit from it. Oddly enough, in all this talk of speculators nobody bothered to mention the major banks that are routinely short millions of ounces of silver in the paper markets. Apparently they are not speculators, nor are they engaged in rather poorly disguised attempts at market manipulation. Those types of activities would quickly be sniffed out and stomped by Congress and our ever-vigilant regulators. Wouldn’t they?

It is pretty clear what is going on here. The cartel is losing its metal (and its mettle) and is attempting to flush out those contract holders who are most likely to take delivery – the marginal investors who buy futures contracts then remove the metal from the exchanges. Also obvious is the hope is that the increased margin reqs will drive them out. It will not bother the JPMorgans or the HSBCs in the least. If nothing else, these actions reek of desperation and are indicative of the fact that the physical, buy-and-hold crowd is substantial, is here to stay, and is in fact winning the war. Keep it up folks, congratulations on a job well done.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.