Gold Mixed as Soros Warns "We are on the Verge of an Economic Collapse"

Commodities / Gold and Silver 2011 Jun 27, 2011 - 08:28 AM GMTBy: GoldCore

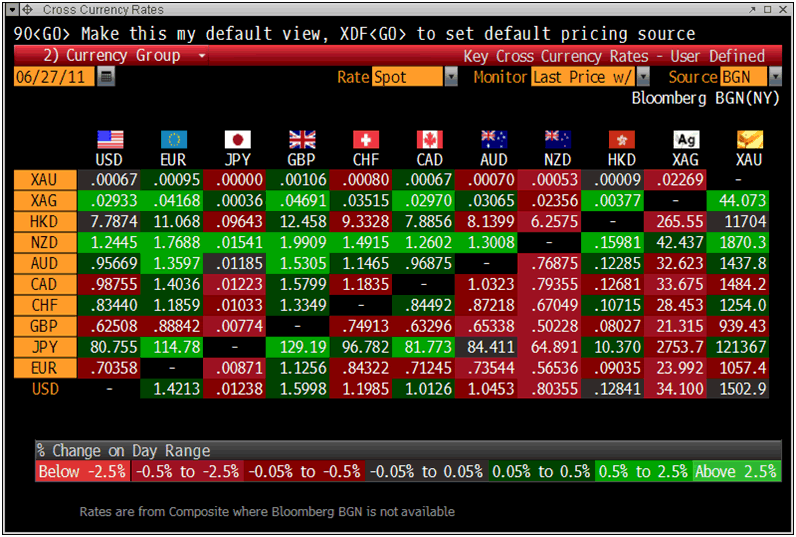

Gold is trading at $1,502.40/oz, €1,055.87/oz and £939.18/oz.

Gold is trading at $1,502.40/oz, €1,055.87/oz and £939.18/oz.

Gold is mixed today after last week’s 2.4% fall. The short term trend remains negative but medium and long fundamentals remain supportive as do the very challenging and risky macro, sovereign debt and currency environment. Physical buying remains strong at the $1500 level with premiums for gold bullion bars higher in Singapore and Hong Kong.

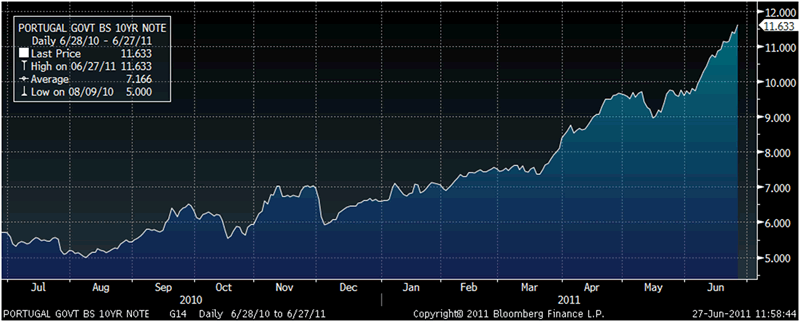

The risk of contagion in the Eurozone and indeed a global financial contagion remains real. Peripheral European bond markets are under pressure again today with 10 year bond yields in Ireland rising to over 12.1% and to over 11.65% in Portugal.

Cross Currency Rates

European leaders are preparing for a default by Greece. The German finance minister, Wolfgang Schaeuble, said yesterday that Europe is preparing "for the worst".

George Soros, Chairman of Soros Fund Management and famous for breaking the Bank of England in 1992, has warned that "we are on the verge of an economic collapse which starts, let's say, in Greece but it could easily spread."

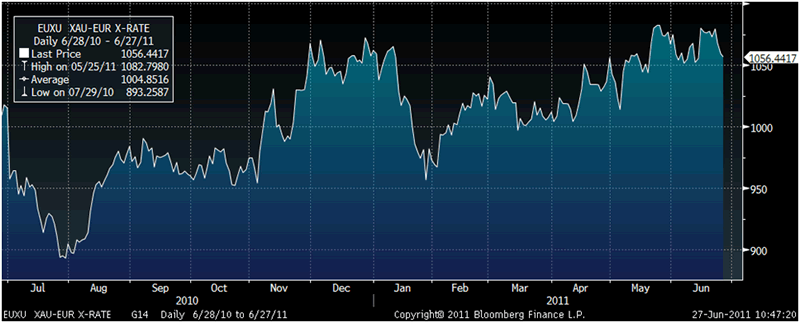

Gold in Euros – 1 Year (Daily)

The 80-year-old investor said that the “financial system remains extremely vulnerable."

Soros added that "there are fundamental flaws that need to be corrected." The core flaw, says Soros, is that the euro is not backed by a political union or joint treasury, so when something goes wrong with a participating country, there is "no provision for correction."

Soros said that it is "probably inevitable" that highly indebted countries will be given a way to quit the euro.

Gold has been the strongest currency in the world in recent years and all major fiat currencies, including the Swiss franc, have fallen against it. Should Greece revert to drachmas, Ireland to punts, Spain to pesetas, Italy to lira and Portugal to escudos, these countries would suffer massive inflation and the price of gold would surge in terms of these local currencies.

PORTUGUESE GOVERNMENT BONDS 10YR NOTE – 1 Year (Daily)

The assertion that gold is a bubble may soon be seen as silly as gold increasingly reasserts itself as a safe haven asset and currency.

Gold’s primary advantage is that it protects against currency devaluation – this will be realized again in the coming weeks and months.

The very strong demand for gold seen in Greece in recent days will likely soon be experienced in other peripheral Eurozone countries. It will likely be replicated internationally as concerns mount about currency debasement and currencies in general including the euro, the British pound and the U.S. dollar.

Soros Gold ETF Sale - Well Publicized but Poorly Analyzed

Soros’ recent sale of his gold ETF holdings made headline news internationally with much commentary claiming that Soros sale of his gold ETF holdings means that gold has “peaked” and the “bubble” may soon burst.

However, what was less reported was the fact that Soros maintained very significant positions in gold mining companies.

It is highly unlikely that Soros Fund Management would maintain significant allocation to gold mining companies if there was a belief that gold was a bubble that was soon to burst.

Indeed, if his hedge fund truly believed that gold was a bubble and significantly overvalued, it would seem sensible of them to have shorted the gold ETF and not have added to gold mining positions.

More plausible is that Soros, given his political activism, may have decided that he did not want continuing publicity regarding his large ETF gold holding. ETF gold holdings like all securities must be declared in SEC filings.

Given Soros view that “we are on the verge of an economic collapse” and his oft repeated deep concerns about the U.S. dollar, it is very possible that he is accumulating gold in allocated accounts away from the spotlight of the media and the public.

London Good Delivery gold bars (400 oz) can be bought in volume at much the same prices as the gold ETF. They can be stored at a cheaper cost but have the added advantage of not having to be declared.

Importantly, London Good Delivery gold bars are highly liquid and would be more liquid than ETFs in the event of a systemic crash and or currency crisis. This is one of the reasons that increasingly respected hedge fund manager, David Einhorn, has opted for gold bars in allocated accounts in specialist depositories.

Counter party risk is also one of the reasons that the University of Texas Investment Management Co., the second-largest U.S. academic endowment, said April 14 that it has taken delivery of about $1 billion worth of gold bullion bars.

SILVER

Silver is trading at $34.07oz,€23.94/oz and £21.30/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,686.00/oz, palladium at $729/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.