Gold Trading at $1500, BOE’s Posen Says Stagflation Unlikely in UK

Commodities / Gold and Silver 2011 Jun 28, 2011 - 06:29 AM GMTBy: GoldCore

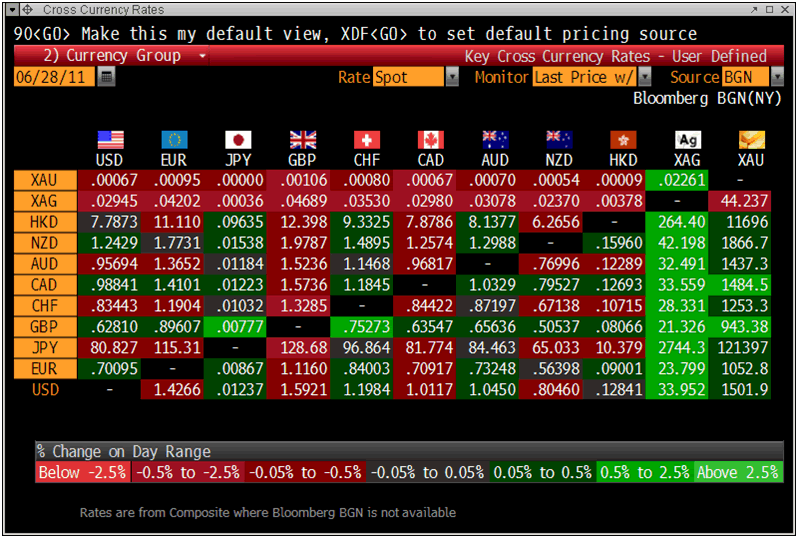

Gold is trading at $1,501.60/oz, €1,052.35/oz and £941.09/oz.

Gold is trading at $1,501.60/oz, €1,052.35/oz and £941.09/oz.

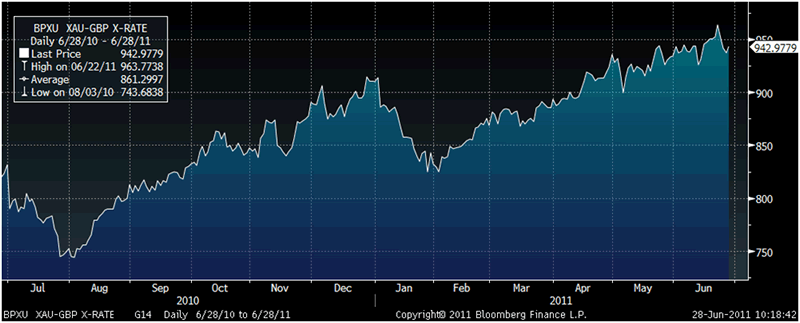

Gold is marginally higher in all currencies and 0.7% higher in sterling after a downward revision of UK GDP from 1.8% to 1.6% growth saw sterling decline. Stagflation appears to be taking hold in the UK with soaring food and energy costs eroding household incomes and economic growth continuing to decline.

Cross Currency Rates

Despite UK inflation being 4.5% in May, more than twice the Bank of England's target, the BOE’s Posen’s ultra dovish comments are leading to speculation that zero percent interest rates and ultra loose monetary policy will continue for the foreseeable future.

This poses risks to those on fixed incomes in the UK, savers, the poor and the elderly, and to countries that export to the UK such as Ireland.

Posen said that the Bank of International Settlements (BIS) call for central banks to raise interest rates was “nonsense”. Posen also said there is little risk of a repeat of 1970s-style stagflation.

Gold in GBP – 1 Year (Daily)

His comments are odd given the fact that the UK is already experiencing high inflation and declining economic growth and looks on the verge of a contraction in economic growth and another recession and possibly a depression.

Posen’s lack of appreciation of the real risk of inflation and stagflation both of which the UK is already experiencing leave him open to the accusation that he is talking “nonsense”.

The U.K. government’s fiscal deficit is likely to be a very high 9% of GDP this year and the U.K.’s banking system has a large amount of risk exposure (including sovereign debt exposure), which pose risks for the pound. The Chinese credit rating agency estimates that about 40% of the UK’s banking system’s GBP 2 trillion worth of assets is exposed to risk.

These real risks and the BOE’s ultra loose monetary policy will likely result in sterling continuing to weaken in the coming months.

The parlous state of the euro and the dollar mean that the pound may not fall sharply against these currencies. However, it is likely to fall against gold and new record nominal highs over £1,000/oz seem likely soon.

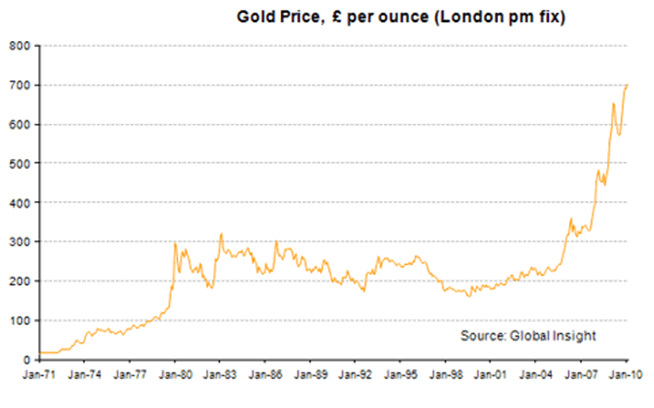

Gold in Nominal British Pounds – 1971 to 2010

It is important to remember that the recent record highs in sterling are nominal and when gold reaches £1,000/oz it will only have returned to the inflation adjusted price levels seen back in 1980.

In sterling terms gold rose from below £20/oz to over £300/oz in the 1970’s or 15 times.

Were gold to replicate the performance in sterling again today then gold would have to rise from the ‘Gordon Brown bottom’ (when Gordon Brown commenced selling 60% of the UK gold reserves - increasingly regarded as one of the Treasury's worst financial mistakes which has cost UK taxpayers almost £7 billion) in 1999 at £170/oz to over £2,550/oz in the coming years.

China’s “Silver City” Opens First Precious Metal Exchange – Goal of Trillion Yuan in Trade by 2015

China's first precious metal exchange opened in Yongxing County in central China's Hunan province yesterday.

"Our goal is to reach 1 trillion yuan ($154.6 billion USD) in annual trading volume by the end of 2015," Cao Minghui, the exchange's general manager said at the center's opening ceremony.

"We also hope that the exchange will give Yongxing County a voice in the global precious metal market," Cao said.

Yongxing County ( 中国中部投资博览会 ), is known as the "Silver City" of China for its abundant reserves of silver. Silver output in China’s “Silver city” reached 2,050 metric tons in 2010.

The Hunan South Rare and Precious Metal Exchange, built with a total investment of 260 million yuan (40.2 million U.S. dollars), opened in Yongxing County, whose silver output accounts for one-fourth of the country's total silver output, according to Cao.

The exchange, covering an area of 189 mu (12.6 hectares), includes an exchange hall, several vaults and a quality inspection center.

This is another indication of China’s appreciation of the precious metals and an indication that the surge in demand seen in recent months is likely sustainable.

UBS reports today that Chinese physical interest has been “tweaked by recent price action”.

The Shanghai Gold exchange has seen turnover increase by some 60% this week when compared daily averages so far in June.

“Combined turnover for the AU9999 and AU9995 contracts on the Shanghai Gold exchange has increased to about 8000 kg daily over this week, up from a daily average of around 5000 kg for the month as a whole” UBS said.

Investment demand for silver both as a store of value and as a hedge against inflation continues to surprise the bears. Many buyers in Asia have experienced stagflation and hyperinflation.

The demand is also very strong on the industrial side where the increasing range of industrial applications is leading to very significant demand that the silver market does not appear to be able to accommodate at these prices.

Chinese demand for silver increased a huge four fold to 3,500 tonnes in 2010 – up from 877 tonnes in 2009.

SILVER

Silver is trading at $33.96oz,€23.80/oz and £21.28/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,692.70/oz, palladium at $735/oz and rhodium at $1,925/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.