U.S. June Employment Report Preview

Economics / Employment Jul 05, 2011 - 02:37 PM GMTBy: Asha_Bangalore

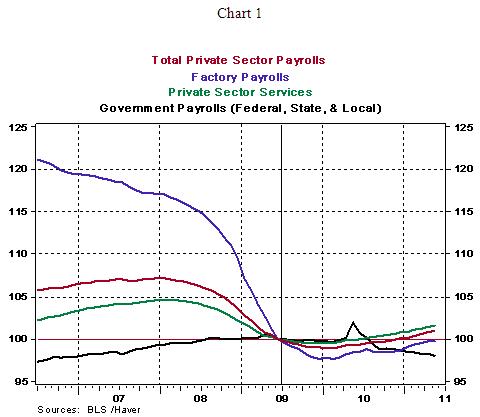

The civilian unemployment rate of 9.1% and tepid growth in payroll employment (see Chart 1) after two years of economic growth remain a key concern. Chart 1 is an indexed chart where the level of employment in June 2009 (the end of the recession) is set equal to 100. Private sector payroll employment has risen past the level seen when the recovery commenced (100.91 in May 2011). The key contributions are from private sector services and factory employment. Government employment (excluding the spike related to temporary hiring for Census 2010) stands close to levels seen in 2007.

Total payroll employment increased only 54,000 in May, while private sector hiring posted an increase of 83,000. The persistence of a high level of initial jobless claims (426,750, latest four-week moving average) supports expectations of another soft employment report for June. Readings of hourly earnings are projected to hold below 2.0% from a year ago, underscoring the absence of wage inflation. The jobless rate is expected to move down one notch to 9.0% in June, putting the second quarter average at 9.0% vs. 8.9% in the first quarter. In May, 45.1% of the unemployment indicated that they have been unemployed for over 27 weeks. This extended period of unemployment is another aspect that keeps the FOMC vigilant about the underlying fundamentals of the labor market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.