Silver Platter Investor Opportunity

Commodities / Gold and Silver 2011 Jul 07, 2011 - 04:03 PM GMTBy: Jim_Willie_CB

Every few years, a tremendous opportunity arises. The autumn months of 2007 and the autumn months of 2008 offered such an opportunity to buy silver. That $11 silver price is long gone. Many smart folks seized it. Whatever can be said on such silver platters applies almost equally to gold. The silver sprint gains are typically much larger than the gold steady gains. The coming autumn months will feature a gaggle of supposed financial analyst experts backpeddling in their hasty damage control. They have been broadcasting a wide assortment of low level propaganda posing as competent analysis, as they attempt to make the point that the anti-USDollar trade is done, the gold trade is over, the silver trade is spent. They are so wrong.

Every few years, a tremendous opportunity arises. The autumn months of 2007 and the autumn months of 2008 offered such an opportunity to buy silver. That $11 silver price is long gone. Many smart folks seized it. Whatever can be said on such silver platters applies almost equally to gold. The silver sprint gains are typically much larger than the gold steady gains. The coming autumn months will feature a gaggle of supposed financial analyst experts backpeddling in their hasty damage control. They have been broadcasting a wide assortment of low level propaganda posing as competent analysis, as they attempt to make the point that the anti-USDollar trade is done, the gold trade is over, the silver trade is spent. They are so wrong.

A comedy of clumsy oafs and dolts on the Wall Street payroll awaits the public in a grand chapter on stage. They will struggle to explain the move in silver over $50 on its way to $80 per ounce. They will struggle to explain the move in gold over $1600 and then $1700 per ounce. The mainstream news has been deeply involved in a delicate balancing act. They must report the news, but it is almost all very bullish for the precious metals. A new financial mini-disaster unfolds almost every week. Last two weeks were Greece. The next week might be Portugal. They must report the news, but it paints a picture of a broken monetary system with debased currencies. They must report the news, but it openly provides the gory blow by blow details of ruined sovereign debt. The United States debt situation is Greece times one hundred.

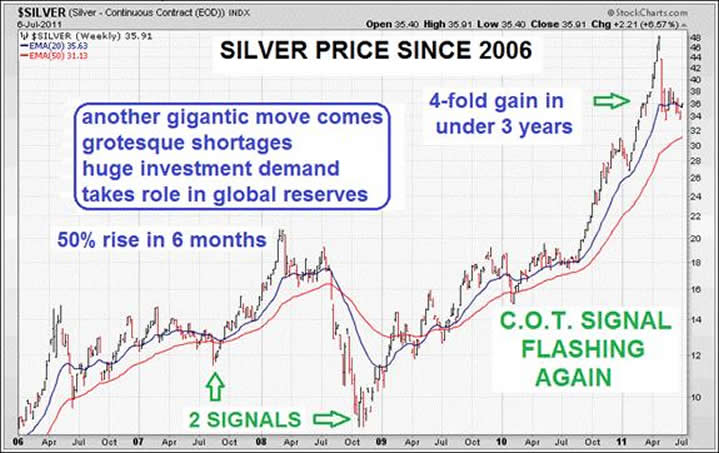

This week, the loquacious jackass will permit some lovely pictures to tell the story. Three graphs adequately tell of a grand opportunity to latch onto the powerful Gold Train with a super-charged Silver Scout. Who were the smart buyers back in September of 2007? The false phony deceptive mainstream message then was that the subprime mortgage problem was contained. That was the first major stumbling block by the hapless witless clueless USFed Chairman Bernanke. He has made not a single correct economic or financial system analytic call. Who were the smart buyers back in October of 2008? The false phony deceptive mainstream message then was that a TARP solution was being put in place to save the US banking system. The solution turned out to be basic largesse to the big US banks, enabling purchase of preferred shares, enabling outsized executive bonuses, and enabling secretive bailouts of banks across the globe. Without the Financial Accounting Standards Board allowance for insolvent banks to continue to dictate the value of their own balance sheets, otherwise known as systemic accounting fraud, the big US banks would have been liquidated. The entire Too Big To Fail principle is actually a battle cry to avoid solutions, to protect the banking elite that was mostly responsible for multiple $trillion bond fraud and mortgage fraud. Without any reservation, it can be said that TBTF means No Solution, no remedy, no recovery, and no attempt at anything remotely resembling a road to economic recovery. In my view, TBTF is the epitaph on the USEconomy and the nameplate on the USTreasury Bond default. So who were the dummies who ignored the opportunity to buy gold and especially silver in September 2007 and October 2008? The majority of them listened and trusted the mainstream news, the Wall Street misdirection, and all their fallacious messages.

THE COMMITMENT OF TRADERS SIGNAL

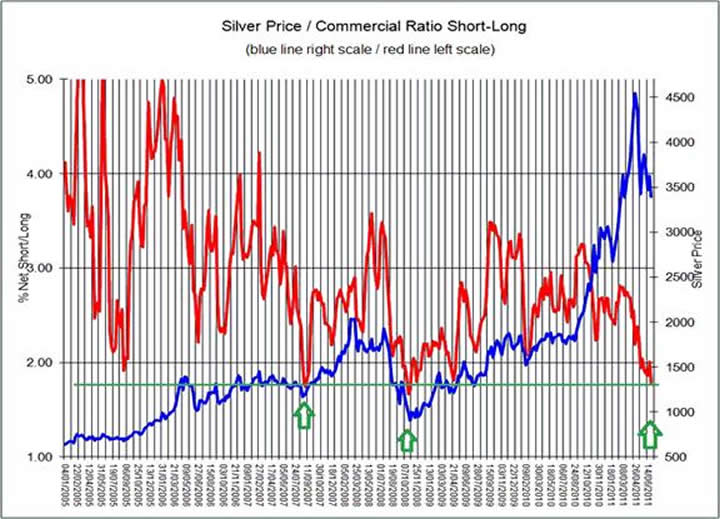

A big hat tip to internet contributor RG, whose message was relayed by the Midas Report. Consider verbatim his message, in which he gleefully proclaims to be calling all Rocketeers of the Happy Silver Ship. The goodfellow RG wrote, "The latest Commitment of Traders Report for silver is now screaming out at full volume BUY BUY BUY. In fact, the Commercial Short-Long Ratio that I have already bored you with at great length in recent correspondence is now down at a multi-year super extreme of 1.79. Below is an up-to-date chart of the COT picture. In summary there have only been four other weeks in this whole bull cycle where the ratio has dropped below 1.80, four weeks. The first two weeks of these was the 28th August 2007 and the following week of the 4th September 2007. The second tranche was the 21st October 2008 and the following week 28th October 2008.

If you study below both the chart of silver over that period and also the HUI gold mining index, you can see how these extreme lows below 1.80 in the ratio coincided on both occasions very markedly with a bottom in both the silver price and the mining index. On each occasion this proved to be a multi-year opportunity to take positions in both the metal and the precious metal mining stocks.

Each time the price of silver rose by some 60% to 90% within a six month period! And the HUI index rose some 90% to 160%. Folks, there is no such thing as a risk-free trade. There is no such thing as a free lunch. And there is no such thing as a one-way bet. However, there are certain times in an investment cycle when an outstanding opportunity presents itself and advantage should be taken. The evidence above shows very clearly the historic correlation between an extreme low below 1.80 on the Commercial Short-Long Ratio and a multi-month bottoming in the price of both silver and the precious metal mining stocks. I have been trading the precious metal sector since 2003 and I would consider this to be one of perhaps four of the most suitable buying opportunities within the last eight years!" The man RG makes a compelling argument, without providing the background factors that push the gold & silver prices upward. He simply points out the COT signal and the resulting performance after two significant lows were registered in precious metals prices. Very convincing inded. Thanks to RG also for the fine chart.

Note the green arrow in September 2007, a strong signal when silver was at a $12/oz price. Note the green arrow in October 2008, a strong signal when silver was just above the $9/oz price. The same type of signal is identified with yet another strong signal here & now in July 2011 with silver price at $35-36/oz. It is ready for the next big upleg. This time gold might lead, but as usual silver will follow and run fast and hard making yet more breathtaking gains. The great springtime consolidation is over. The power merchants have spent their ammunition with no lasting reversals, only pause with consolidation. They must manage unending financial crisis without motive toward remedy or solution. The climb has begun. Eager investors have waited and will wait no longer. The Chinese have already begun to re-enter the gold & silver markets armed and loaded with a $3 trillion war chest. Hong Kong exchanges await the precious metals trade. Lawsuits against the tainted SLV and GLD funds are in progress. A little more backfilling might be required. The fundamentals are incredibly powerful and bullish for both precious metals. The global monetary and sovereign debt situation is in ruins, crumbling more with each passing month. If corrupt henchmen are not in charge, then clowns and charlatans are at the USGovt, its finance ministries, the USFed itself, the many regulatory bodies, and so much more.

PAST SIGNAL PERFORMANCE

Consider the silver price move from the two points in the past. The move up by 50% in six months to March 2008 was interrupted by the Wall Street meltdown, followed by the insolvent collapse of the US banking system. Those who bought all the way down from $20 to the bargain price of $9.5 were amply rewarded. The key was to avoid leverage, paper contracts, and the mainstream nonsense spouted daily with errant focus and deceptive view. The sudden banking system insolvency in 2008 was followed by grand orchestrated attacks on the entire anti-USDollar trade. Hardly a hedge fund was not attacked by their own creditors and brokers on Wall Street, incredibly desperate to stay afloat. They found relief in white pixie dust. The US banks collapsed but did not suffer failure. Instead, with FASB aid, coupled with TARP confiscated funds, they continue to limp along as Grand Zombies. The silver price gain since October 2008 has been on the order of 4-fold, almost 300%. This is a stunning gain. The same will be said when silver surpasses the $100 price level. The ruin of major currencies in falsely posed money forms, the parade of USGovt debt, the hapless unfixable condition of the USEconomy, the submerged US households, and the US banks suffering from shadow home inventory coupled with investor lawsuit marred by defiant default in legal challenge, these over-arching factors assure much greater ruin of money. They assure a march to $100 silver. Many naysayers will be silent a year from now.

Ditto for the gold price moves, but the size of the gains are much less. The shape of the chart is very similar though. The springtime correction was not as great, but the gold gain was only half the silver gain. The crumbling global monetary system is the primary push factor for gold, not price inflation. The quality and substance of money is under scrutiny and question. In the next year or more, the price inflation factor will be put more in the forefront. Investors and households will be forced to seek out true inflation hedges, if not hedges against personal ruin.

FACTORS IN VIEW & ON HORIZON

The future holds many crucial factors to be extremely important. The Greek Govt debt bandaid will prove again to be pathetic and useless, buying a little time, while it aids the big European banks in toxic asset redemption. The bag holder is the Euro Central Bank, going down the tubes with its outsized Southern European sovereign debt and deep losses. The debt contagion will spread to Portugal next, then Spain and Italy. Those two large nations, spared the shame and focus up until now, will deliver two lethal deadly blows in the near future. When these two large columns fall on the European bank offices, the Germans will finally announce their exit plan. The Euro Central Bank just hiked interest rates by 25 basis points to 1.5% in defiance of the USFed. My Jackass forecast made in early 2009 was that the USFed would be dead last in hiking rates, and that call seems correct. The big US banks have troubles in court. They actually believe a mere $8.5 billion can permit them to walk away from well over $1 trillion in bond fraud. They want bond fraud and mortgage contract fraud forgiveness with limits on restitution and penalties. Their executives in New York City and London still enjoy $200 lunches. Not a single settlement deal will stick, not when investors and individuals are winning every single court challenge against the banks. The municipal bond and auction bond fraud deals will follow. The budget battle within the chambers of the USGovt has exposed the polarization, corruption, ineptitude, lack of leadership, and inability to avoid the catastrophe. It is simply too broken to fix. Taxes cannot be raised due to economic fragility.

Entitlements cannot be cut due to public outcry and dependence. War cannot end since too profitable to the syndicate. Deficits will pile up regardless of any accords. Whatever progress is made will serve as tiny down payment for a bigger problem just a few months ahead. The next news item to anticipate is flirtation with USTreasury auction failures, against a backdrop of absconded USGovt worker pension funds. It is no wonder Treasury Secy Geithner wants to leave town. The next QE initiative will come in response to an auction failure, as buyers have vanished and primary bond dealers are under extreme distress. The lousy auctions last week were the telling indicator, largely ignored by the blind in the madding crowds. The US states are falling like flies in the summer heat, trapped inside window frames. Their extraordinary measures to avoid default have become almost a tragic comedy. Talk has come of splitting California into two states, of silicon and latin stripes. Illinois and New Jersey are basket cases. Wisconsin is a war zone.

The USEconomy sputters down the hill over the cliff with lost brake systems and no functioning engine. The industrial base has been forfeited in its core. Legitimate income was replaced by debt which defaulted. Then lastly consider the assault on global crude oil supply, the silly futile release from strategic petroleum reserves, following the Gulf of Mexico shutdown. The elite want $150 crude oil. The oil release effect has been forgotten already in just two weeks. With all the positive factors toward gold & silver, by the middle of next year in 2012, one must wonder what motivated people not to invest in precious metals after seeing the strong COT signal once more. The smart ones among us have learned long ago to ignore the Wall Street sell side artisans, to ignore the USGovt wrecking ball managers, to ignore the equity stock analysts whose paper game has turned into a leveraged valuation bonfire. Money faces ruin, as Gold & Silver offer preservation and growth during the greatest transfer of wealth in over a century. Recall the barons who exploited the Great Depression, whose names are part of the elite landscape of banking and politics and philanthropy.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"When I initially read your writings, they provoked a wide range of emotions in me from fear and anger to outright laughter. Initially some of your predictions ranged from the ridiculous to impossible. Yet time and again, over the past five years, I have watched with incredulity as they came true. Your analysis contains cogent analysis that benefits from a solid network of private contacts coupled with your scouring of the internet for information."

(PaulM in Missouri)

"Your analysis is absolutely superior to anything available out there. Like no other publication, yours places a premium on telling the truth and provides a true macro perspective with forecasts that are uncannily accurate. I eagerly await each month's issues and spend hours reading and studying them. Many times I go back and re-read the most current issue just make sure I did not miss anything the first time!"

(DevM from Virginia)

"I think that your newsletter is brilliant. It will also be an excellent chronicle of these times for future researchers."

(PeterC in England)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.