Using Elliott Waves: As Simple As A-B-C

InvestorEducation / Elliott Wave Theory Jul 08, 2011 - 11:05 AM GMTBy: EWI

When Ralph Nelson Elliott discovered the Wave Principle nearly 70 years ago, he explained how social (or crowd) behavior trends and reverses in recognizable patterns. You can learn to identify these patterns as they unfold in the financial markets, and use them to help anticipate where prices will go next. Elliott Wave International has developed a free comprehensive online course -- The Elliott Wave Tutorial: 10 Lessons on the Wave Principle -- which describes these patterns and explains how they relate to one another.

When Ralph Nelson Elliott discovered the Wave Principle nearly 70 years ago, he explained how social (or crowd) behavior trends and reverses in recognizable patterns. You can learn to identify these patterns as they unfold in the financial markets, and use them to help anticipate where prices will go next. Elliott Wave International has developed a free comprehensive online course -- The Elliott Wave Tutorial: 10 Lessons on the Wave Principle -- which describes these patterns and explains how they relate to one another.

To use the Wave Principle as you analyze the markets, you need a basic understanding of the Elliott method -- the rules and guidelines, the literal shape of individual waves, even when the larger trend may turn.

To get you started, we've included an excerpt from the free Elliott Wave Tutorial, adapted from Elliott Wave Principle by Frost and Prechter, and a short video clip from the live presentation, Tips from a Pro.

__________________________

Here is your quick lesson excerpted from The Elliott Wave Tutorial:

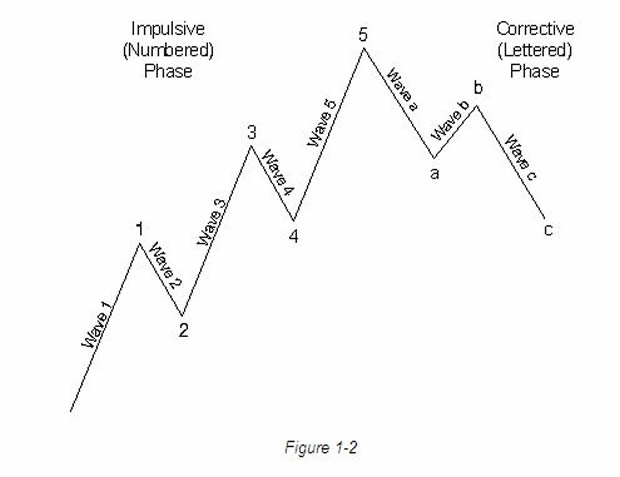

In his 1938 book, The Wave Principle, and again in a series of articles published in 1939 by Financial World magazine, R.N. Elliott pointed out that the stock market unfolds according to a basic rhythm or pattern of five waves up and three waves down to form a complete cycle of eight waves. The pattern of five waves up followed by three waves down is depicted in Figure 1-2.

One complete cycle consisting of eight waves, then, is made up of two distinct phases, the motive phase (also called a "five"), whose subwaves are denoted by numbers, and the corrective phase (also called a "three"), whose subwaves are denoted by letters. The sequence a, b, c corrects the sequence 1, 2, 3, 4, 5 in Figure 1-2.

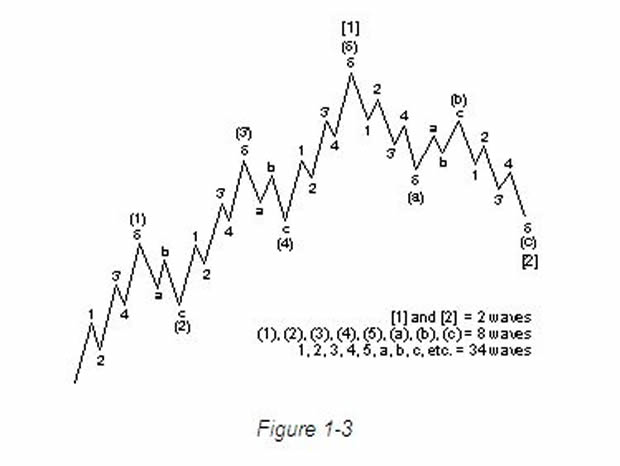

At the terminus of the eight-wave cycle shown in Figure 1-2 begins a second similar cycle of five upward waves followed by three downward waves. A third advance then develops, also consisting of five waves up. This third advance completes a five wave movement of one degree larger than the waves of which it is composed. The result is as shown in Figure 1-3 up to the peak labeled (5).

At the peak of wave (5) begins a down movement of correspondingly larger degree, composed once again of three waves. These three larger waves down "correct" the entire movement of five larger waves up. The result is another complete, yet larger, cycle, as shown in Figure 1-3. As Figure 1-3 illustrates, then, each same-direction component of a motive wave, and each full-cycle component (i.e., waves 1 + 2, or waves 3 + 4) of a cycle, is a smaller version of itself.

Every wave serves one of two functions: action or reaction. Specifically, a wave may either advance the cause of the wave of one larger degree or interrupt it. The function of a wave is determined by its relative direction. An actionary or trend wave is any wave that trends in the same direction as the wave of one larger degree of which it is a part. A reactionary or countertrend wave is any wave that trends in the direction opposite to that of the wave of one larger degree of which it is part. Actionary waves are labeled with odd numbers and letters. Reactionary waves are labeled with even numbers and letters.

Watch this video clip from Tips from a Pro for more on Elliott waves:

EWI's Chief Currency Strategist Jim Martens explains how learning to use Elliott waves can be as simple as counting to 5 and knowing your A-B-Cs.

This article was syndicated by Elliott Wave International and was originally published under the headline Using Elliott Waves: As Simple As A-B-C. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.