Leveraged ETF's and ETN's, The Biggest Scam on Wall Street?

InvestorEducation / Exchange Traded Funds Jul 12, 2011 - 12:38 PM GMTBy: Jared_Levy

It's the day the market fell apart. The day the usual became the impossible.

It's the day the market fell apart. The day the usual became the impossible.

Imagine you purchase an exchange-traded fund or note and the next day it just suddenly stops trading. Would you be scared? Angry? Frustrated?

What if you had a profit and couldn't collect one cent of it?

As frightening as that sounds, this exact scenario just occurred last Friday in a very heavily traded and popular exchange-traded note (ETN) called the iPath Long Enhanced S&P 500 VIX (VZZ:NYSE), which is a leveraged ETN based on the Volatility Index (VIX).

Shares of IPath Long Enhanced S&P 500 VIXare being removed from the market, not because of bankruptcy or delisting, but because of an obscure, widely unknown clause in the prospectus that forces the shares to be "redeemed" or cashed out when the index trades at a certain value.

In this case $10 was the redemption trigger price. So once iPath Long Enhanced S&P 500 VIX hit that level on Friday, all stockholders (actually note holders in this case) were forced to redeem their shares for $10. Even the ones who sold short at $9.68 were forced to take a loss.

Let me explain...

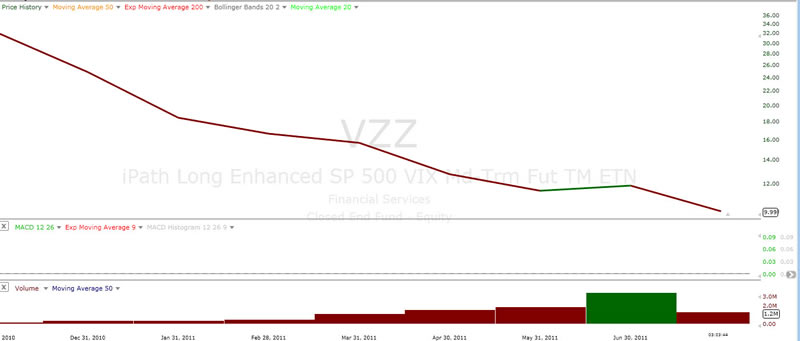

Monthly chart of iPath Long Enhanced S&P 500 VIX since inception

This index has done nothing but drop in value since first coming to market less than nine months ago (talk about a short trading life)... It's lost over 70%! But this ETN had more surprises in store. Many investors actually lost more than they had to on Friday, because they were selling the index all the way down to $9.68 last Friday. If they had known about the clause, they would have known they would be stopped out at $10.

The worst part is that there are other leveraged indexes like this that have similar clauses.

In fact, ALL of the levered ETNs issued by iPath (Barclays Bank) have these early redemption clauses. Here are the symbols you should be aware of: RTLA, RTSA, MFLA, MFSA, EMLB, EMSA, ROLA, ROSA, SFLA, SFSA and VZZ.

It's not just iPath, there are many more ETNs out there that contain this or similar clauses, so make sure you READ THE PROSPECTUS before you buy or sell any ETF or ETN.

(Don't forget to sign up for Smart Investing Daily and let me and fellow editor Sara Nunnally simplify the market for you with our easy-to-understand articles.)

Nuances and Small Print Can Hurt You

Leveraged ETFs and ETNs can cause much more trouble than forcing you to trade in your shares if the index hits a certain price. Let's look at another example.

Many leveraged ETFs managers use extremely complex financial instruments to generate their returns. But there is no such thing as a free lunch. Those complex instruments cost money; they charge annual management fees (1-2% on average), plus other expenses.

The real problem with many of these products is their "daily rebalancing."

Most leveraged ETFs get their leverage only for the day and then at the end of the day, that leverage resets, which can hurt you in the long term. This is the biggest profit siphon when investing in a leveraged ETF.

Let me show you what that means in a real life example.

The Direxion Daily Financial Bull 3X Shares (FAS:NYSE) is an ETF that is supposed to give you three times the returns of the Russell 1000 financial index. But does it really?

Let's go through a scenario if the Russell 1000 index moves up 5% today and drops 5% tomorrow and you are long the FAS.

If you bought FAS today at $30, it would gain about $4.50 (15%), which puts the end-of-day value at $34.50. At the end of today, the ETF would actually take those profits and invest them the next day, starting fresh. This is called rebalancing.

So tomorrow, you now have $34.50 invested at three times leverage, so if the Russell index then drops 5%, the FAS would drop 15% ($5.18) to $29.32, leaving you with a net loss of $0.68, even though the underlying index is actually flat in that two-day period. Oh, and don't forget to the management fees and commission.

Puzzled? You should be... Read the fine print!

This same sort of "odd behavior" can also be seen in dozens of ETFs including the new gold ETFs Direxion Daily Gold Miners Bull 2X Shares (NUGT:NYSE) and Direxion Daily Gold Miners Bear 2X Shares (DUST:NYSE), which are both being advertised like crazy.

So What About the iPath S&P 500 VIX Short-Term Futures ETN?

It may be comforting to know that the iPath S&P 500 VIX Short-Term Futures ETN (VXX:NYSE) does NOT have an early redemption clause and may not cease trading, like iPath Long Enhanced S&P 500 VIX. But that doesn't mean your money can't evaporate if you don't know what you are doing.

The VXX does have a clause that allows the manager (Barclays) to do a REVERSE 4-for-1 split if the index gets below $25. Now that the index is again trading for $20, that is a very real possibility.

Reverse stock splits are generally NOT a good thing. A 4-for-1 reverse split means you will have one-fourth of the shares you had before at four times the price. It's like taking three-fourths of your shares away and leaving you with less equity in a decaying asset... That's not where I want to be.

The iPath S&P 500 VIX Short-Term Futures ETN Is Usually Losing Value

The iPath S&P 500 VIX Short-Term Futures ETN is subject to a natural decay because it buys futures today that generally are higher than where the underlying asset (the Volatility Index) is currently trading. Think about it; the VIX is trading at $15.95 and the VXX is trading at $20. Would you pay $20 for something that's worth $15.95? If the VIX stays at $15.95, the fund is essentially losing $4.05.

This decay effect is happening continuously with minimal exceptions, especially when the VIX is flat or declining, which it's been doing since October 2008.

Trading ETFs and Volatility

Not all products are evil, although there are some that are robbing investors of their hard-earned dollars. But the truth is, when it comes to trading volatility, the only real, efficient way to do so is with options. I spent my entire career doing just that.

Options can be used to create low-risk, high-probability bets on volatility. I utilize some volatility in WaveStrength Options Weekly, you can learn more here.

DO NOT trade VIX options unless you are an extremely advanced trader. They are not your typical options and can be dangerous. I wrote about their dangers in this Smart Investing Daily article.

At our next summit in Las Vegas this year, the Money Crisis Survival Summit, I will be offering a breakout class for equity traders to make their way into the world of options. We've been telling you that this unstable investment environment means you have to be a nimble investor.

Options give you the chance to trade in adverse market conditions. It's all about survival, and we're going to give you the tools you need to protect yourself and prosper in the coming money crisis.

Learn more about the event by clicking here. But spaces are starting to run out, so be sure to reserve your spot at out Money Crisis Survival Summit now.

Editor's Note: The Money Crisis Survival Summit is selling out fast. I am not sure how much longer we will be able to keep registration only.

If you want to get an in-depth options trading how-to with Jared, reserve your spot today. If you change your mind between now and September, let us know and we'll scratch you off our list.

Learn more about the event and how to get your name on the list here.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/smart-investing-daily/smart-investing-060311.html

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2011, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.