Politicians Repeating Public Proclamations & Denouncements of Early-1930s

Politics / Economic Depression Jul 13, 2011 - 12:18 AM GMTBy: Aftab_Singh

In light of the monetary woes that have spread across the globe, I thought I’d demonstrate that the continuing montage of oratory acrobatics coming from our politicians are not a new thing. Here, I show a few examples of the demagogic proclamations that emerged during the early-1930s.

In light of the monetary woes that have spread across the globe, I thought I’d demonstrate that the continuing montage of oratory acrobatics coming from our politicians are not a new thing. Here, I show a few examples of the demagogic proclamations that emerged during the early-1930s.

First of all, I should say that the following statements are not taken arbitrarily from the internet. As you may know, there are all kinds of versions of ‘Executive Order 6102′ (banning private gold ownership) and so on. Although I admire the conspiratorial skepticism of my fellow online publishers, I fear that a great number of these sites accidentally publish things that are not true. Even if they are true, there seems to be .

So, just to get things clear; all of the quotes below are from the ‘Federal Reserve Bulletins’ available in pdf form for all to see courtesy of the St Louis Fed (and, in particular, courtesy of the Federal Reserve Archival System for Economic Research department). Incidentally, these bulletins are just fantastic — they allow one to gain a clear view of the historical path of social mood, the intellectual biases of the past and much more. Personally, I have spent long hours looking through some of these and I would recommend reading some of them if you ever come across an hour or two to spare.

The Setting:

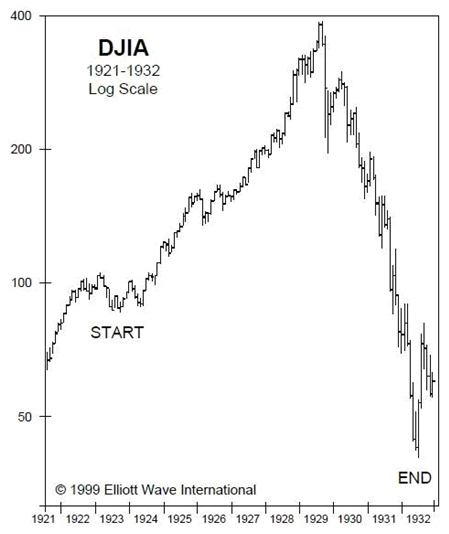

As can be seen on the chart below from Elliott Wave International, after a decade of resource misallocation via the the excessive accumulation of debt, the stock market underwent a truly colossal crash. As we all know, this tore through the wider economy with a vengeance.

[NOTE:

- I'm being intentionally brief because, especially over the past few years, people have written extensively about this period in history. If you want to understand more about the 1920s and 1930s, I highly recommend Murray Rothbard's fantastic book, America's Great Depression. It's available for free at the mises institute or at the greshams-law.com book store.

- The emphases on the quotes below are ours.]

March 1933: – Wooo! Bank Holidays!… Hmm, wait, actually…

On the morning of February 14 the Governor of Michigan declared a bank holiday to February 21, “for the preservation of the public peace, health, and safety, and for the equal safeguarding without preference of the rights of all depositors.” This holiday in Michigan was extended, in effect, on February 21, and on February 25 a bank holiday was declared in Maryland, followed within a few days by similar action in a large number of other States… On the morning of March 4, the Governor of the State of New York issued a statement proclaiming Saturday and Monday to be bank holidays. Similar action was taken in Illinois, Massachusetts, New Jersey, Pennsylvania, and elsewhere. On March 4, therefore, which was a Saturday, the banks in almost all the States were either closed or operating under restrictions.

March 1933: – I, Hereby do declare, with the yada yada yada power invested in taken by me, …

On the morning of March 6, 1933, the President of the United States issued the following proclamation:

BY THE PRESIDENT OF THE UNITED STATED OF AMERICA

“A PROCLAMATION

“Whereas there have been heavy and unwarranted withdrawals of gold and currency from our banking institutions for the purpose of hoarding; and

” Whereas continuous and increasingly extensive speculative activity abroad in foreign exchange has resulted in severe drains on the Nation’s stocks of gold; and

” Whereas these conditions have created a national emergency; and

” Whereas it is in the best interests of all bank depositors that a period of respite be provided with a view to preventing further hoarding of coin, bullion or currency or speculation in foreign exchange and permitting the application of appropriate measures to protect the interests of our people; and

” Whereas it is provided in section 5 (b) of the Act of October 6, 1917 (40 Stat. L. 411), as amended, ‘That the President may investigate, regulate, or prohibit, under such rules and regulations as he may prescribe, by means of licenses or otherwise, any transactions in foreign exchange and the export, hoarding, melting, or earmarkings of gold or silver coin or bullion or currency * * * ‘; and

” Whereas it is provided in Section 16 of the said Act ‘that whoever shall willfully violate any of the provisions of this Act or of any license, rule, or regulation issued thereunder, and whoever shall willfully violate, neglect,or refuse to comply with any order of the President issued in compliance with the provisions of this Act, shall, upon conviction, be fined not more than $10,000, or, if a natural person, imprisoned for not more than ten years, or both;

“Now, therefore, I, Franklin D. Roosevelt, President of the United States of America, in view of such national emergency and by virtue of the authority vested in me by said Act and in order to prevent the export, hoarding, or earmarking of gold or silver coin or bullion or currency, do hereby proclaim, order, direct and declare that from Monday, the sixth day of March, to Thursday, the ninth day of March, Nineteen Hundred and Thirty Three, both dates inclusive, there shall be maintained and observed by all banking institutions and all branches thereof located in the United States of America, including the territories and insular possessions, a bank holiday, and that during said period all banking transactions shall be suspended. During such holiday, excepting as hereinafter provided, no such banking institution or branch shall pay out, export, earmark, or permit the withdrawal or transfer in any manner or by any device whatsoever, of any gold or silver coin or bullion or currency or take any other action which might facilitate the hoarding thereof; nor shall any such banking institution or branch pay out deposits, make loans or discounts, deal in foreign exchange, transfer credits from the United States to any place abroad, or transact any other banking business whatsoever.

” During such holiday, the Secretary of the Treasury, with the approval of the President and under such regulations as he may prescribe, is authorized and empowered (a) to permit any or all of such banking institutions to perform any or all of the usual banking functions, (b) to direct, require or permit the issuance of clearing house certificates or other evidences of claims against assets of banking institutions, and (c) to authorize and direct the creation in such banking institutions of special trust accounts for the receipt of new deposits which shall be subject to withdrawal on demand without any restriction or limitation and shall be kept separately in cash or on deposit in Federal Reserve Banks or invested in obligations of the United States.

“As used in this order the term ‘banking institutions’ shall include all Federal Reserve banks, national banking associations, banks, trust companies, savings banks, building and loan associations, credit unions, or other corporations, partnerships, associations or persons, engaged in the business of receiving deposits, making loans, discounting business paper, or transacting any other form of banking business.

“In witness whereof, I have hereunto set my hand and caused the seal of the United States to be affixed.

“Done in the City of Washington this 6th day of March—1 a. m. in the year of our Lord One Thousand Nine Hundred and Thirty-three, and of the Independence of the United States the One Hundred and Fifty-seventh.

[SEAL] “FRANKLIN D. ROOSEVELT “By the President:

“CORDELL HULL

“Secretary of State”

March 1933: – ‘This legislation is necessary, and I do mean: NECESSARY!’

“Our first task is to reopen all sound banks. This is an essential preliminary to subsequent legislation directed against speculations with the funds of depositors and other violations of positions of trust.

“In order that the first objective—the opening of banks for the resumption of business—may be accomplished, I ask of the Congress the immediate enactment of legislation giving to the executive branch of the Government control over banks for the protection of depositors; authority forthwith to open such banks as have already been ascertained to be in sound condition and other such banks as rapidly as possible; and authority to reorganize and reopen such banks as may be found to require reorganization to put them on a sound basis.

“I ask amendments to the Federal Reserve Act to provide for such additional currency, adequately secured, as it may become necessary to issue to meet all demands for currency and at the same time to achieve this end without increasing the unsecured indebtedness of the Government of the United States.

“I cannot too strongly urge upon the Congress the clear necessity for immediate action. A continuation of the strangulation of banking facilities is unthinkable. The passage of the proposed legislation will end this condition, and I trust within a short space of time will result in a resumption of business activities.

“In addition, it is my belief that this legislation will not only lift immediately all unwarranted doubts and suspicions in regards to banks which are 100 per cent sound but will also mark the beginning of a new relationship between the banks and the people of this country.

“The members of the new Congress will realize, I am confident, the grave responsibility which lies upon me and upon them.

“In the short space of five days it is impossible for us to formulate completed measures to prevent the recurrence of the evils of the past. This does not and should not, however, justify any delay in accomplishing this first step.

“At an early moment I shall request of the Congress two other measures which I regard as of immediate urgency. With action taken thereon we can proceed to the consideration of a rounded program of national restoration.” …

April 1933: – Die Hoarders! Die!

“EXECUTIVE ORDER FORBIDDING THE HOARDING OF GOLD COIN, GOLD BULLION AND GOLD CERTIFICATES

“By virtue of the authority vested in me by section 5 (b) of the act of October 6, 1917, … , I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section do hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates within the continental United States by individuals, partnerships, associations and corporations and hereby prescribe the following regulations for carrying out the purposes of this order:

“SECTION 1. For the purposes of this regulation, the term ‘hoarding’ means the withdrawal and withholding of gold coin, gold bullion or gold certificates from the recognized and customary channels of trade. The term ‘person’ means any individual, partnership, association or corporation.

“SEC. 2. All persons are hereby required to deliver on or before May 1, 1933, to a Federal Reserve bank or a branch or agency thereof or to any member bank of the Federal Reserve System all gold coin, gold bullion and gold certificates now owned by them or coming into their ownership on or before April 28, 1933, except the following:

” (a) Such amount of gold as may be required for legitimate and customary use in industry, profession or art within a reasonable time, including gold prior to refining and stocks of gold in reasonable amounts for the usual trade requirements of owners mining and refining such gold.

” (b) Gold coin and gold certificates in an amount not exceeding in the aggregate $100 belonging to any one person; and gold coins having a recognized special value to collectors of rare and unusual coins.

” (c) Gold coin and bullion earmarked or held in trust for a recognized foreign government or foreign central bank or the Bank for International Settlements.

“(d) Gold coin and bullion licensed for other proper transactions (not involving hoarding) including gold coin and bullion imported for reexport or held pending action on applications for export licenses.

…

“SEC. 9. Whoever willfully violates any provisions or of any rule, regulation, or license issued thereunder may be fined not more than $10,000, or, if a natural person, may be imprisoned for not more than 10 years, or both; and any officer, director, or agent of any corporation who knowingly participates in any such violation may be punished by a like fine, imprisonment, or both.

The President’s order of today requiring the turning in of hoarded gold, and at the same time providing that gold shall be available for all proper purposes, is an expected step in the process of regularizing our monetary position and furnishing adequate banking and currency facilities for all customary needs…

April 1933: – Ownership is Evil… Only we – your governmental supermen – know what is proper, and what is not proper…

SEC. 1. Licenses for proper transactions and for purposes not covered in preceding articles.—Any person showing the need for gold coin or gold bullion for a proper transaction not involving hoarding or for gold coin or gold bullion for a purpose specified in the Executive order of April 5, 1933, and not covered by the foregoing articles of these regulations, may make application to the Secretary of the Treasury for a equivalent amount of any form of coin or currency license to purchase, or if such coin or bullion is already in his possession, to retain such coin or bullion, in amounts as may be reasonably necessary for such proper transaction or purpose. Applications shall be filed with any Federal Reserve bank. The application shall be filed in duplicate, executed under oath and verified before an officer duly authorized to administer oaths and shall contain (a) the name and address of the applicant, (b) the amount of gold coin or gold bullion desired to be purchased or retained, (c) the amount and description of the gold coin or bullion on hand, if any, at the date of the application, (d) the proper transaction or purpose to which the gold coin or gold bullion will be devoted and the facts making necessary its purchase or retention, (e) such other facts as will enable the Secretary of the Treasury to determine whether the transaction is proper, and (f) a statement that the applicant will use such gold coin or gold bullion as he may be permitted to purchase or retain only for the transaction or purpose set forth in the application. In the case of an applicant for a license who has delivered in obedience to the Executive order of April 5, 1933, gold coin, gold bullion, or gold certificates, the application, in addition to the above, shall state in detail (1) the amount of gold coin, gold bullion, or gold certificates delivered in obedience to the Executive order of April 5, 1933, (2) the date of such delivery, and (3) the bank at which delivered.

SEC. 2. Disposition of applications.—On the receipt of any such application, the Federal Reserve bank shall make such investigation of the case as it may deem advisable and shall transmit to the Secretary of the Treasury the original of such application, together with (a) any supplemental information it may deem appropriate and (b) a recommendation whether a license should be granted or denied. The Federal Reserve bank shall retain a copy of the application for its records.

SEC. 3. Granting or denial of the license.—Upon receipt of the original application and the recommendation of the Federal Reserve bank transmitting it, the Secretary of the Treasury will grant or deny the license. A license will be granted on application for the retention or acquisition of gold coin or bullion made by any person showing the need for such gold coin or bullion in accordance with the provisions of section 8 of the Executive order of April 5, 1933, in cases where such person has gold coin, gold bullion, or gold certificates in his possession, or in obedience to said Executive order, has delivered such coin, bullion, or certificates. A license so granted shall be for an amount of gold coin or bullion not exceeding the amount of such coin, bullion, or certificates held or delivered. When the issuance of a license is approved by the Secretary of the Treasury, the Federal Reserve bank through which application was made will issue a license to the applicant. If denied, the Federal Reserve bank will be so advised and shall immediately notify the applicant. The decision of the Secretary of the Treasury shall be final…

May to December 1933: – We’re saved! All praise the almighty contradiction!

Return of currency to the Federal Reserve banks continued during June, notwithstanding the fact that an increased volume of industrial and trade activity was reflected in larger demands for cash for payroll purposes and for retail trade. The movement indicates that the return of cash previously held in hoards has been in larger volume than the increase in currency requirements arising from the revival of business activity. Funds arising from the return of currency and from the purchase of $85,000,000 of United States Government securities by the Reserve banks were used by member banks in retiring $110,000,000 of discounts and $10,000,000 of maturing acceptances at the Reserve banks, and in increasing their reserve balances by $120,000,000.

Excess reserves of the member banks at the end of June were about $500,000,000, the increase of about $150,000,000 for the month reflecting in part the increase in reserve balances held and in part a reduction in required reserves resulting from a decline in net demand deposits. The decline in these deposits occurred after the middle of June following the prohibition laid down by the Banking Act of 1933, which became effective June 16, on the payment of interest by member banks on deposits payable on demand. Funds previously held by depositors in this form were shifted in part into time deposits, on which interest is paid, and in the case of deposits of country banks with their city correspondents were transferred in part into balances with Federal Reserve banks…

February 1934: – The Gold Reserve Act, Monetary Debasement Par Excellence…

THE WHITE HOUSE, WASHINGTON, February 10, 1934.

MY DEAR GOVERNOR: Several days ago I approved the Gold Reserve Act of 1934. The law itself in no way impairs the strength of the Federal Reserve banks. They have simply exchanged their gold for gold certificates issued by the Treasury and collateralled by one hundred percent of gold. These gold certificates so collateralled with gold supply all reserve requirements of the Reserve Act. This bill interferes in no way with the credit, currency, or supervisory responsibilities of the Reserve banks. Their powers will continue to be exercised in the interest of agriculture, commerce, and industry, just as they have been for the past twenty years.

It gives me pleasure at this time to express my appreciation of the splendid services that the Federal Reserve System has rendered in connection with our efforts to bring about recovery. It has been an institution of incalculable value throughout the twenty years of its existence; soon after its organization it was an important factor in enabling this country to aid in winning the war; and more recently it has given firm support to the Government’s efforts in fighting the depression. It has stood loyally by the interests of the people by supplying them with a sound currency, by placing at the disposal of member banks a large volume of reserves available to finance recovery, by exerting a powerful influence toward the rehabilitation of the commercial banking structure, and by cooperating in every way with the Government’s financial program.

Very sincerely yours, FRANKLIN D. ROOSEVELT.

Hon. EUGENE R. BLACK,

Governor Federal Reserve Board, Wash- ington, D.C.

MESSAGE TO CONGRESS

To the Congress:

In conformity with the progress we are making in restoring a fairer price level and with our purpose of arriving eventually at a less variable purchasing power for the dollar, I ask the Congress for certain additional legislation to improve our financial and monetary system. By making clear that we are establishing permanent metallic reserves in the possession and ownership of the Federal Government, we can organize a currency system which will be both sound and adequate.

The issuance and control of the medium of exchange which we call “money” is a high prerogative of government. It has been such for many centuries. Because they were scarce, because they could readily be subdivided and transported, gold and silver have been used either for money or as a basis for forms of money which in themselves had only nominal instrinsic value.

In pure theory, of course, a government could issue mere tokens to serve as money— tokens which would be accepted at their face value if it were certain that the amount of these tokens were permanently limited and confined to the total amount necessary for the daily cash needs of the community. Because this assurance could not always or sufficiently be given, governments have found that reserves or bases of gold and silver behind their paper or token currency added stability to their financial systems.

There is still much confusion of thought which prevents a world-wide agreement creating a uniform monetary policy. Many advocate gold as the sole basis of currency; others advocate silver; still others advocate both gold and silver whether as separate bases, or on a basis with a fixed ratio, or on a fused basis.

We hope that, despite present world confusion, events are leading to some future form of general agreement. The recent London agreement in regard to silver was a step, though only a step, in this direction.

At this time we can usefully take a further step, which we hope will contribute to an ultimate world-wide solution.

Certain lessons seem clear. For example, the free circulation of gold coins is unnecessary, leads to hoarding, and tends to a possible weakening of national financial structures in times of emergency. The practice of transferring gold from one individual to another or from the Government to an individual within a nation is not only unnecessary but is in every way undesirable. The transfer of gold in bulk is essential only for the payment of international trade balances.

Therefore it is a prudent step to vest in the government of a nation the title to and possession of all monetary gold within its boundaries and to keep that gold in the form of bullion rather than in coin.

Because the safe-keeping of this monetary basis rests with the Government, we have already called in the gold which was in the possession of private individuals or corporations. There remains, however, a very large weight in gold bullion and coins which is still in the possession or control of the Federal Keserve

Although under existing law there is authority by Executive act, to take title to the gold in the possession or control of the Reserve banks, this is a step of such importance that I prefer to ask the Congress by specific enactment to vest in the United States Government title to all supplies of American-owned monetary gold, with provision for the payment therefor in gold certificates. These gold certificates will be, as now, secured at all times dollar for dollar by gold in the Treasury—gold for each dollar of such weight and fineness as may be established from time to time.

Such legislation places the right, title, and ownership to our gold reserves in the Government itself; it makes clear the Government’s ownership of any added dollar value of the country’s stock of gold which would result from any decrease of the gold content of the dollar which may be made in the public interest. It would also, of course, with equal justice, cast upon the Government the loss of such dollar value if the public interest in the future should require an increase in the amount of gold designated as a dollar.

The title to all gold being in the Government, the total stock will serve as a permanent and fixed metallic reserve which will change in amount only so far as necessary for the settlement of international balances or as may be required by a future agreement among the nations of the world for a redistribution of the world stock of monetary gold.

With the establishment of this permanent policy, placing all monetary gold in the ownership of the Government as a bullion base for its currency, the time has come for a more certain determination of the gold value of the American dollar. Because of world uncertainties, I do not believe it desirable in the public interest that an exact value be now fixed. The President is authorized by present legislation to fix the lower limit of permissible revaluation at 50 percent. Careful study leads me to believe that any revaluation at more than 60 percent of the present statutory value would not be in the public interest. I, therefore, recommend to the Congress that it fix the upper limit of permissible revaluation at 60 percent.

That we may be further prepared to bring some greater degree of stability to foreign exchange rates in the interests of our people, there should be added to the present power of the Secretary of the Treasury to buy and sell gold at home and abroad, express power to deal in foreign exchange as such. As a part of this power, I suggest that, out of the profits of any devaluation, there should be set up a fund of $2,000,000,000 for such purchases and sales of gold, foreign exchange, and Government securities as the regulation of the currency, the maintenance of the credit of the Government, and the general welfare of the United States may require.

Certain amendments of existing legislation relating to the purchase and sale of gold and to other monetary matters would add to the convenience of handling current problems in this field. The Secretary of the Treasury is prepared to submit information concerning such changes to the appropriate committees of the Congress.

The foregoing recommendations relate chiefly to gold. The other principal precious metal— silver—has also been used from time immemorial as a metallic base for currencies as well as for actual currency itself. It is used as such by probably half the population of the world. It constitutes a very important part of our own monetary structure. It is such a crucial factor in much of the world’s international trade that it cannot be neglected.

On December 21, 1933, I issued a proclamation providing for the coinage of our newly mined silver and for increasing our reserves of silver bullion, thereby putting us among the first nations to carry out the silver agreement entered into by 66 governments at the London Conference. This agreement is distinctly a step in the right direction and we are proceeding to perform our part of it.

All of the 66 nations agreed to refrain from melting or debasing their silver coins, to replace paper currency of small denominations with silver coins, and to refrain from legislation that would depreciate the value of silver in the world markets. Those nations producing large quantities of silver agreed to take specified amounts from their domestic production and those holding and using large quantities agreed to restrict the amount they would sell during the 4 years covered by the agreement.

If all these undertakings are carried out by the governments concerned, there will be a marked increase in the use and value of silver.

Governments can well, as they have in the past, employ silver as a basis for currency, and I look for a greatly increased use. I am, however, withholding any recommendation to the Congress looking to further extension of the monetary use of silver because I believe that we should gain more knowledge of the results of the London agreement and of our other monetary measures.

Permit me once more to stress two principles. Our national currency must be maintained as a sound currency which, insofar as possible, will have a fairly constant standard of purchasing power and be adequate for the purposes of daily use and the establishment of credit.

I am confident that the Nation will well realize the definite purpose of the Government to maintain the credit of that Government and, at the same time, to provide a sound medium of exchange which will serve the needs of our people.

FRANKLIN D. ROOSEVELT. THE WHITE HOUSE,

January 15, 1934.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.