Moody's Puts U.S. AAA Credit Rating at Risk of Downgrade

Interest-Rates / US Debt Jul 14, 2011 - 05:20 AM GMTBy: Mike_Shedlock

At long last the bond vigilantes have a spotlight on US debt. Please consider Japan Stock Futures Fall as Yen Rises as Moody’s Reviews U.S Credit Rating

At long last the bond vigilantes have a spotlight on US debt. Please consider Japan Stock Futures Fall as Yen Rises as Moody’s Reviews U.S Credit Rating

Moody’s Investors Service put the U.S., rated Aaa since 1917, under review for a credit-rating downgrade for the first time since 1995 on concern the government’s $14.3 trillion debt limit will not be raised in time to prevent a missed payment of interest or principal on outstanding bonds and notes even though the risk remains low. The rating would likely be reduced to the Aa range and there is no assurance that Moody’s would return its top rating even if a default is quickly cured.

Federal Reserve Chairman Ben S. Bernanke told Congress the central bank is prepared to take additional action, including buying more government bonds, if the economy appears to be in danger of stalling. The Fed last month completed a program to buy $600 billion of Treasury bonds that aimed to stimulate the economy by reducing borrowing costs, boosting stock prices and spurring consumer spending.

Moody’s Places 7,000 Municipal Ratings on Downgrade ReviewBloomberg reports Moody’s Places 7,000 Municipal Ratings Tied to U.S. on Downgrade Review

Moody’s Investors Service placed 7,000 municipal ratings on review for possible downgrade after it warned the U.S. may lose its Aaa investment grade.

Gold Soars as Bernanke Pledges More Stimulus

At 12:30 I reported Bernanke Pledges More Monetary Stimulus, Dollar Tanks, Gold Soars to Record High

The ping-pong match between the ECB and Fed to see who can make the worst policy decisions the fastest, switched back in favor of the Fed today with Bernanke's pledge to pour on the monetary stimulus if needed.

Most think it's a given that the stock market will soar when Bernanke starts QE3. I don't. Just because it did last time does not mean it will every time.

One of these times Bernanke is going to react in a way that spooks the bond market in a major way, and the market will slap him silly just as happened to Jean-Claude Trichet and the ECB over Trichet's "no default" insistence.Bernanke Slapped Already?

The market was relatively giddy when I made those comments. I was on the road having lunch when I made those comments. I have internet access now at 8:46 PM, for the first time since.

This is the way things looked after the close.

S&P 500 Intraday Chart

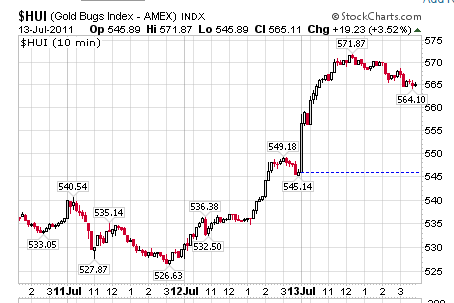

As I type, I note that the S&P futures are down 4 points to 1308. I also note that gold held nearly all of its gains today as did the $HUI, unhedged miner index.

$HUI Intraday Chart

I caution that it is too early to say what the market is reacting to, if indeed it is reacting to anything at all. However, this could be the start of the bond and equity markets either having had more than they can take from the monetarist policies of Bernanke and/or the fiscal policies of Congress.

I repeat my caution that one of these times, the market is going to spit directly in the face of Bernanke when he pulls one of his monetarist stunts. I do not know if this is the time, but the sooner it happens the better off the US and the rest of the world will be.

University of California Economist Brad DeLong (who is calling for more monetary easing), should put this in his pipe and smoke it. DeLong is blind, but I assume he can still breathe.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.