Gold Breaks Over $1600, Silver Over $40.30 on Risk of Systemic and Fiat Currency Crisis

Commodities / Gold and Silver 2011 Jul 18, 2011 - 10:41 AM GMTBy: GoldCore

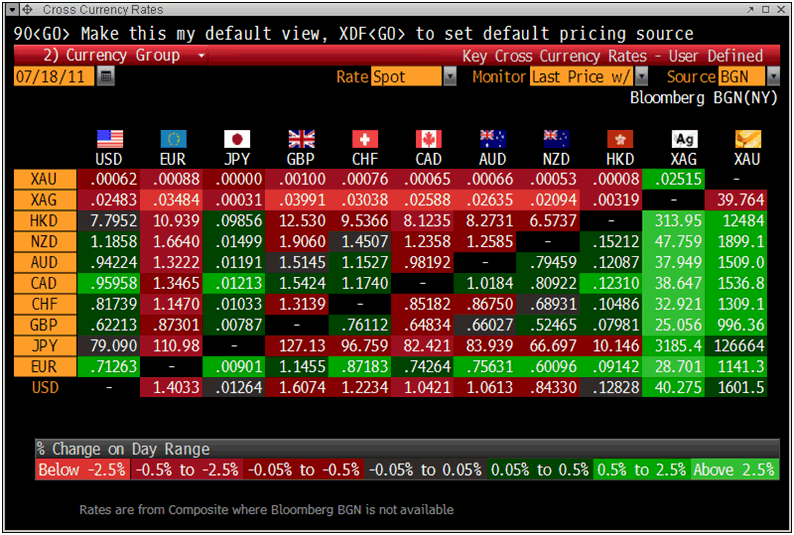

Gold is trading at $1,600.84/oz, €1,141.34/oz and £996.35/oz.

Gold is trading at $1,600.84/oz, €1,141.34/oz and £996.35/oz.

Gold rose to new record nominal highs in debt laden U.S. dollars, euros and pounds today due to the growing risk of a systemic financial collapse and fiat currency crisis.

Gold rose 0.5% in U.S. dollar terms to a new nominal record high at $1,602.05 per ounce. Euro falls saw the dollar rise 0.8% against the euro and gold rise 1.4% in euro terms to EUR 1,041 per ounce.

Gold rose 0.9% in British pound terms to £996 per ounce. Gold rose 0.8% to CHF 1,309 per ounce in the ‘safe haven’ fiat currency the Swiss franc (more below).

Cross Currency Rates

European equities are lower with the FTSE down 1.1%. Asian equities were mixed with the Nikkei eking out a 0.4% gain.

Oil prices are lower despite continuing considerable geopolitical risk in North Africa and the Middle East.

Spanish, Italian and Greek bonds are under pressure with the yield on the Greek 10 year rising over 18% and Italy’s 10 year back over the 6% mark.

The second stress test is increasingly being seen as an abject failure and another futile exercise to obfuscate and deny the massive exposure of European banks.

This exposure is not just to sovereign debt, but also to loans worth in the trillions - including residential mortgages, small-business loans, corporate debt and commercial real-estate loans to individuals and institutions.

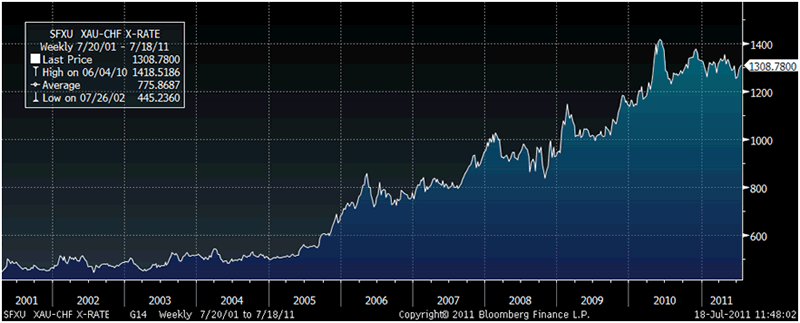

Gold in Swiss Francs – 2001 to July 2011 (in Nominal Terms, Non Inflation Adjusted Terms)

The much used contagion word is still not understood by most and we are beginning to see a classic contagion vicious circle as the bailout of western banks led to a deterioration of sovereign debt markets and now many of these same banks are massively exposed not just to sovereign debt but to individual, corporate and institutional debt.

A failure to raise the debt ceiling and a U.S. Treasury default would have severe consequences for the global financial system, given the central role played by U.S. Treasuries and U.S. government bonds.

Nearly every part of the global financial system from retail investors to companies and from governments to central banks hold Treasuries for reserves, for collateral and or for security.

Thus, a U.S. default would mean that the modern financial system itself could be at risk of collapsing.

The massive debt pyramid that gradually grew since 1971 (when Nixon closed the gold window and the U.S. dollar and all currencies became simply paper currencies dependent on the performance of governments and central bankers) and went parabolic due to the cheap money ultra loose monetary policies of recent years is at risk of collapsing which will result in a systemic crisis.

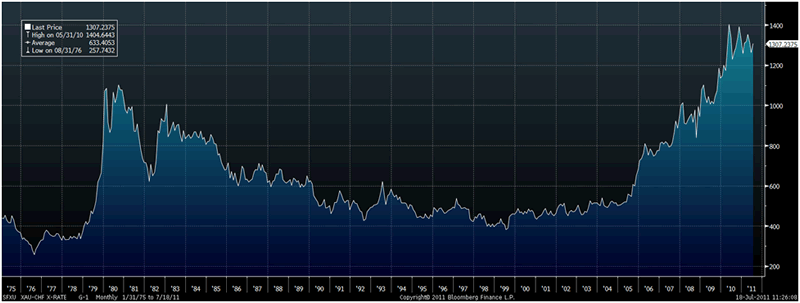

Gold in Swiss Francs – 1975 to July 2011 (in Nominal Terms, Non Inflation Adjusted Terms)

A systemic crisis would lead to even greater money printing in order to prevent a complete deflationary meltdown and this will lead to a currency crisis where cash and all it forms is shunned and investors opt for assets that cannot default such as gold and silver bullion.

Currencies like the Norwegian krone, Singapore dollar, Australian dollar and Swiss franc are likely to outperform the debt saturated U.S. dollar, British pound and euro.

However, they have already seen sharp price gains and a systemic crisis and contagion would affect all fiat currencies as no country or financial market would be immune to a major Eurozone country or countries sovereign default or a U.S. sovereign default.

The Swiss franc has already depreciated by nearly 50% against gold since the outset of this crisis (in 2006) with XAU / CHF having risen from 707 CHF per ounce to 1,306 CHF per ounce (see chart above).

Similarly, the Swiss franc was no safe haven in the stagflation of the 1970’s when the Swiss franc fell very sharply versus gold.

In 1971, gold was trading at CHF 140 per ounce but by 1980, it has risen to over CHF 1,100 per ounce or an increase of nearly 700% (686%) as inflation and stagflation took its toll on the open Swiss economy and global economy.

In recent months, the Swiss National Bank has been debasing the Swiss franc and attempting to devalue it versus other fiat currencies due to deflationary pressures.

Currency interventions have been costly for the Swiss central bank, which has tried to prevent too quick a rise in the franc versus the dollar, the euro and other major currencies.

Despite these market interventions, the franc has hit new highs against other major paper currencies. Philipp Hildebrand, head of the SNB, has warned of deflationary risks from a strong franc to justify the interventions, which are controversial in Switzerland.

Competitive currency devaluations and global currency debasement mean that all fiat currencies are at risk of devaluing and losing purchasing power.

No paper currency or cash instrument is a safe haven today and this will be graphically seen in the coming months.

Gold and silver continue to push towards their real record high (inflation adjusted) from 1980 of $2,400 and $140 U.S. dollars per ounce. Sharp gains for the precious metals in Norwegian krone, Singapore dollars, Australian dollars, Swiss francs and all fiat currencies are also likely.

SILVER

Silver is trading at $40.19/oz, €28.65/oz and £25.01/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,761.00/oz, palladium at $781/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.