Gold “Fever” in Asia and Central Bank Demand Could Cause an “Earthquake” in the Gold Market

Commodities / Gold and Silver 2011 Jul 21, 2011 - 09:30 AM GMTBy: GoldCore

Gold is trading at $1,599.41/oz, €1,127.77/oz and £989.06/oz.

Gold is trading at $1,599.41/oz, €1,127.77/oz and £989.06/oz.

Gold is mixed against various currencies today but is higher in euros after the euro has fallen on concerns that European leaders gathering for the summit in Brussels may not be able to resolve the Eurozone’s debt crisis and prevent contagion in the financial system.

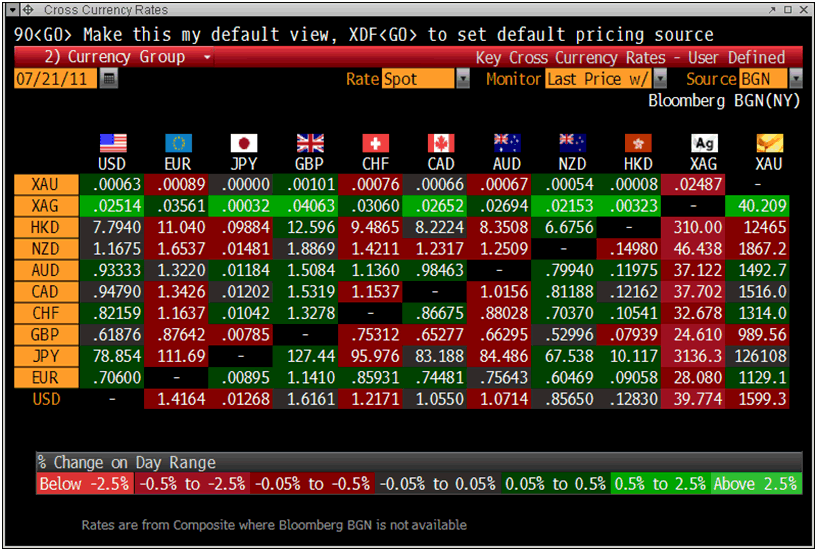

Cross Currency Rates

Gold is trading at USD 1,600.10, EUR 1,128.1, GBP 989.50 and CHF 1,315.10 per ounce.

Asian indices were mixed and European indices have snapped a two day advance, and commodities declined, on signs economic growth is slowing in Europe and China. The Stoxx Europe 600 Index slipped 0.4 percent as Ericsson AB lost the most in more than two years and earnings missed analysts’ estimates. The FTSE has fallen 0.35%. Futures on the Standard & Poor’s 500 Index slid 0.3 percent.

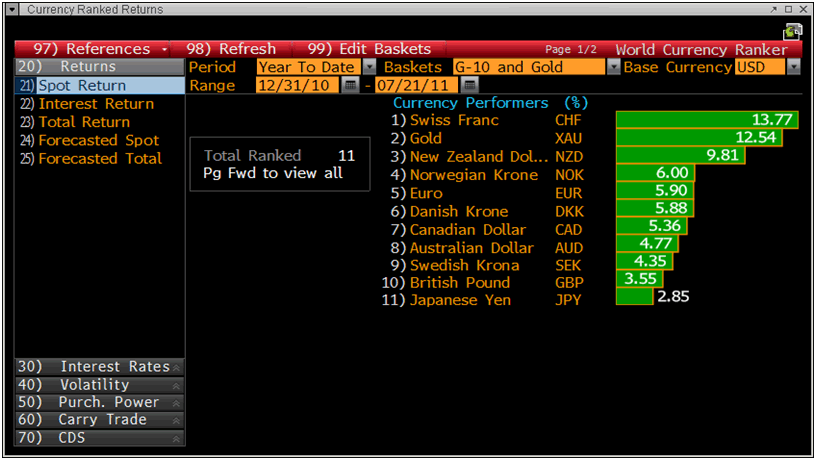

Gold and G10 Currencies Versus the US Dollar – 2011 YTD

An interesting analysis article on gold by Reuters confirms massive and growing demand for physical gold in Asia and the risk of dislocations and rapidly rising prices in the gold market due to central bank demand.

The giant middle class populations in Asia, especially China and India are buying physical gold bullion in volume due to concerns about global growth, in order to protect themselves from stubbornly high inflation and concerns about the declining value of their respective paper currencies.

Gold demand in China alone is expected to rise about 20% to near 700 tonnes this year from 570 tonnes in 2010.

Official figures show inflation at 6.4% but real inflation is likely higher and the authorities are struggling to tame annual inflation.

Gold and G10 Currencies Versus the US Dollar – 2011 YTD

The massive increase in demand from Asia is sustainable. Especially in China where gold ownership was banned from 1950 to 2003 and therefore per capital consumption of gold is increasing from a near zero base.

Besides this Asian demand, there is also the continuing and growing central bank demand. Central banks were net sellers for most of the last 30 years and became net buyers in 2010 due to monetary and systemic concerns.

The analysis piece reports something experts on the gold market have been saying for some time, which is that “central banks have to tread lightly, as sizable purchases could jolt the relatively small gold market.”

“Last year, global gold supply, including mine production and scrap, stood at 4,108.2 tonnes, which translates into about $210 billion at current price.”

Meanwhile, “the amount of U.S. debt held by the public stood at $9.75 trillion by July 19, doubling from five years earlier -- adding nearly $1 trillion a year, based on data from the U.S. Treasury Department.”

Dong Tao, chief regional economist at Credit Suisse said that "gold supply simply doesn't grow as fast as China's foreign reserves. Only the increase in U.S. debt can match that."

Central banks could raise gold holdings marginally, he said, but sizeable purchases could cause an “earthquake” in the market.

"We can buy whatever with our money without causing price distortion, but a $2-trillion, $3-trillion elephant will certainly cause distortion”, said Tao.

China has the world's biggest foreign reserves, which stood at $3.2 trillion at the end of June. Gold holdings of 1,054.1 tonnes make up just 1.6 percent of its reserves, though China ranks sixth among the world's top official holders of gold.

Some coverage of gold’s record nominal highs in recent days suggested that gold’s rise in value was due to investors “piling into” gold due to fears about the EU and U.S. debt crisis. The phrase “piling in” suggests that rising gold prices are due to speculative “hot money” and that therefore prices would fall as quick when the speculative money decides to sell.

However, Asian and central bank demand for physical gold bullion is not speculative rather it is smart money which is passively diversifying and buying and holding for the long term.

SILVER

Silver is trading at $39.84/oz, €28.09/oz and £24.64/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,774.75/oz, palladium at $794/oz and rhodium at $1,900/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.