European Leaders Kicking the Debt Crisis Can Down the Road

Economics / Global Debt Crisis Jul 23, 2011 - 03:44 PM GMTBy: John_Mauldin

This week we start with the latest version of the solution to the European Crisis, the details of which are now coming out. Then we look at the global economy, and some signs that seem to point to a softening. And then there's some data on US employment from a friend who has some thoughts about what we really need to do to get unemployment to come down. There is a lot to cover.

This week we start with the latest version of the solution to the European Crisis, the details of which are now coming out. Then we look at the global economy, and some signs that seem to point to a softening. And then there's some data on US employment from a friend who has some thoughts about what we really need to do to get unemployment to come down. There is a lot to cover.

But first, we have posted the latest of our Conversations with John Mauldin on the website. It is with Dylan Grice of Societe Generale in London, and he is just brilliant. Subscribers will love it. Basically, Conversations with John Mauldin is my subscription service where you can "listen in" on my conversations with my friends from around the world talking about the topics of the day. Subscribers give it rave reviews, and of course we do transcriptions. You can go to http://www.johnmauldin.com/conversations/ and type in CONV as the code to get a $50 discount off the $199 price. And, of course, you'll get the past conversations as well, with all sorts of well-known analysts. To learn more just click on the link. And now, let's turn to Europe.

Kicking the Can Yet Again

My friends at GaveKal point out that this is "... the sixth time in 18 months European leaders have announced a definitive solution to the Euro crisis. Should this version of the final bailout be taken any more seriously than the first and second solutions to the Greek crisis in May and September 2010 or the Irish bailout of December 2010 or the Portuguese rescue package of March 2011 or the breakthrough vote in the Greek parliament of last month? The supposedly good news for markets was that the -21% haircuts to be imposed on Greek creditors (as estimated by banker groups) were less than half those suggested a few days ago."

A 21% haircut is a bad joke. If you assume that Greece can afford to spend 10% of their revenues just to pay the interest, which is what they will need to be able to do to get out of their crisis, then the haircuts look more like 75-80%. Sean Egan, the most credible credit analyst in the country, estimated this week that the eventual haircuts on the Greek debt will be 90%.

You can read the release from the EU leaders in its entirety, if you like, at http://www.foxbusiness.com/markets/2011/07/21/read-eu-leaders-full-statement-on-greek-bailout/. I really have no idea what you should drink as you read it.

Here is what it really says: We are going to keep throwing good money after bad and work as hard as we can to transfer the debt that is on the banks to the ECB and European taxpayers as long as the voters will let us. This first tranche will be another €109 billion. That will last a few years, and Greece will only have to pay about 3.5% on that debt and the rollover debt, and people who expected to be repaid in that period will see payment extended to either 15 or 30 years.

You can call this what you like, and they call it "selective default," but it is a default. There will be government guarantees on the debt, so the ECB can take it from the banks.

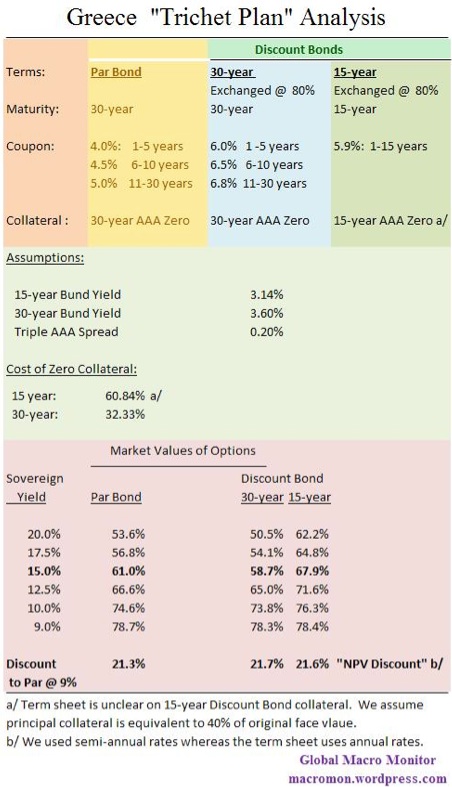

Let's see what the "voluntary" debt rollovers will look like and what the likely debt destruction will be. This is from Global Macro Monitor.

First, notice that the plan claims haircuts will only be 21%. But that assumes you can sell the new bonds at a 9% interest rate. If the interests rate demanded by the market are 15%, which is closer to reality, the haircuts are closer to 67%, after what appears to be an initial 20% cut. Will any institution not immediately try and get those bonds into the hands of the ECB? This is just ugly.

I have to quote what may be the most laughable part of the whole document:

"4. We call for a comprehensive strategy for growth and investment in Greece. We welcome the Commission's decision to create a Task Force which will work with the Greek authorities to target the structural funds on competitiveness and growth, job creation and training. We will mobilise EU funds and institutions such as the EIB towards this goal and relaunch the Greek economy. Member States and the Commission will immediately mobilize all resources necessary in order to provide exceptional technical assistance to help Greece implement its reforms. The Commission will report on progress in this respect in October."

Ok, the Greek economy is in a depression, so let's fire up a jobs program. Run by socialists and bureaucrats. The entire Eurozone is slipping into a slow-growth recession, and these guys are just focusing on Greece.

It's Not Just Greece

And that's the problem with this latest patchwork fix. It assumes that Greece is the problem and if we solve Greece everything else will get solved. The document analyzed above promises that bondholders of other nations will not suffer any haircuts. It does say that the Irish will get lower rates. But why won't the Irish ask for haircuts? And it is my contention that the Irish will eventually reject the ECB loans they took on for their banks. And that will be a 100% haircut for the ECB. Not to mention that the Irish can point out that they didn't do anything wrong or cheat to get into the Eurozone. They just built too many houses and ran up huge bank losses.

It's just simple math. The Irish can't afford to pay that debt. It should have never been taken on to begin with, and Irish voters threw the government that did it out of power. It cannot be lost on the leaders in Ireland that when the Greek prime minister called the EU's bluff, the EU blinked. Trichet agreed to take on Greek debt after saying "non" for months, but with guarantees, kind of, sort of. Merkel caved. Ireland has to be paying attention. (By the way, I am going to go to Ireland in late September on a fact-finding mission. More below.)

Is Portugal any better off this week than last? Italy? Spain? Italy and Spain have barely any nominal growth in GDP, and the nominal growth of both these countries is below their debt-service growth. That is basically Ponzi-level finance. They have to issue new debt just to finance the old debt. And that is why interest rates are rising in both countries. Spanish banks have huge holes in their balance sheets from real estate loans that simply have not been written down. If Spain were forced to underwrite their banks, they would quickly be insolvent. To be sure, Italy introduced a new budget that, if followed, will make real headway on their deficit; but it also means a slower-growth economy for the next year.

To get an idea of the relative size of the problem, Germany has a GDP of about €2.5 trillion. The Italians have issued DEBT of €1.9 trillion. Italy's debt-to-GDP ratio is approaching 120% (if it's not already there) and is the second highest in Europe, following Greece. There is not enough money in Europe to help Italy, should the markets start to really run up their interest rates, as they must roll over debt. And higher rates mean that the debt costs and interest payments will be even larger. Their latest budget deficit was 4.6% of GDP, which means they need to borrow rather large sums of money.

Italy does have a few things going for it. Much of its debt is of longer duration, so they have some room to maneuver for a few years if interest rates can remain kind, but they must find a way to increase growth or they too will become a Eurozone problem. The latest budget and austerity measures may give them a surplus, which they can use to pay down debt; and that would placate the markets.

And don't forget France. The French may talk a good game, but their budget is in a shambles and their entitlements are unsustainable. There is a French day of reckoning coming.

Who is Going to Buy that Debt?

I had a conversation with my good friend Lord Bridport, who runs a major bond trading house in Geneva, selling bonds to pension and insurance funds in Europe. The plan is for the Eurozone to issue eurobonds and sell them into the private market to back the various bailout schemes. I asked him whether he thought his clients would buy. He said very clearly he would recommend they do not buy until it is quite clear who and what will back them. Otherwise, buy German and other solvent-country bonds. This is going to be a tough sell in Europe, gentle reader, if Alex is saying "no"; and he is not alone.

You Have to Admire the Commitment

You simply have to admire the commitment of European leaders to ignore common sense, simple arithmetic, and their voters in pursuit of the goal of a United Europe at all costs. It is really quite astounding.

I would remind my American readers that if you go back and read the history of the 1780s and our original Constitutional Convention (1787), it was the same determination on the part of our founding fathers that gave us a constitution. The convention was originally just supposed to be for amending the Articles of Confederation. Alexander Hamilton and James Madison never had any such intentions and argued forcefully for a full-blown change, with George Washington presiding. They got their way. There was no great clamor among the people for a United States of America and the loss of sovereignty of the 13 original states, which happened over time, by the way. The founding fathers would be aghast at the lack of state sovereignty today.

Can Europe do something along these lines? Possibly. They will need to move toward more fiscal consolidation, acknowledge that the European Central Bank is going to have to take on at least €1 trillion in debt by printing money, and that governments will have to run balanced budgets, much like our states; but the transition will be costly. And it will take time. And the obstacles are many, and not just monetary.

We at least had just one language (more or less) and the shared experience of a successful revolution. Plus a growing economy and plenty of opportunity and relatively free land in the west for pioneers, as well as some real visionaries as leaders.

John F. Kennedy once held a dinner in the White House for a group of the brightest minds in the nation at that time. He made this statement: "This is perhaps the assembly of the most intelligence ever to gather at one time in the White House, with the exception of when Thomas Jefferson dined alone."

Who commanded the respect of the nation like Washington, or Adams or Hamilton or Madison? Would that we had such leaders today. We can't even agree on cutting the deficit when almost everyone says we need to. Well, except for Paul Krugman.

I hope Europe pulls it off. I really do. They have done the US a huge favor by adopting this latest plan, as it keeps their banking system from imploding; because their banks are essentially insolvent with all the sovereign debt on their books. Such a banking crisis, which would be worse than 2008, in my opinion, would no doubt plunge a world already slowing down back into recession and pull our own slow-growth economy down into recession with them.

How long can they kick the can down the road? My guess is that it will be longer than we suspect. Will European voters go along with the continual lurching from crisis to crisis and piling more and more debt onto taxpayers? Will Germany allow the ECB to destroy its balance sheet and the euro with it? Can they keep their Bundesbank mentality in check and put to rest the ghost of the Weimar Republic?

I continue to predict the euro is going to parity against the dollar if it survives with all the current members intact. Parity may be optimistic. Stay tuned. I will follow this closely, gentle reader, and keep you updated.

The Problem of US Employment

I wrote about a year ago about how difficult it was going to be to really bring unemployment down. Rather than go back and replay that piece, I am going to pass on a note that my friend Barry Habib sent me today, which is quite sobering, and then add my thoughts. Quoting:

"A healthy employment market is the key to a strong economy. The housing market, along with many other important sectors of our economy, is highly dependent on people feeling confident in their ability to find work. But with the rate of unemployment above 9% and the economy sputtering to recover, everyone is asking how and when will the employment situation improve? This economic lynchpin is a very hot topic, which is also a critical element of many political, economic proposals. But while promising or estimating a decline in the unemployment rate may sound good, when the actual numbers are looked at more closely, realistically, and held to the light of historical performance, the forecasted declines may be far more difficult to achieve.

"For almost 40 years, the average rate of unemployment was below 6%. But the latest recession has pushed the rate far above what had been considered "normal". So will we get back to the "normal" levels we have been accustomed to? I don't see that happening for at least a long while. Let's look at some data.

"There are about 311 Million people in the US. Our natural population growth rate, which compares births to deaths, is 0.6% per year. Our overall growth rate, which adds in migration, is 0.9% per year. There is currently a little less than half of the total population in the workforce, or about 153 Million people. So a 10% rate of unemployment would amount to about 15.3 million people wanting to find work. These factors create the need for job creations that will keep pace with the growing workforce so that the rate of unemployment can at least remain stable. How many jobs need to be created to absorb the growing workforce? About 115,000 per month. This calculation takes the current work force and overall growth rate into account. Therefore, the US must create 115,000 jobs each month just to keep pace!

"These numbers also tell us that if we want to reduce the rate of unemployment by 1%, there must be about 1.53 million jobs created. But remember that our population is also growing. That means young men and women are entering the workforce every day. And the positive migration causes more people seeking employment. During the last decade, there have been two stock market tumbles and a housing crash. This has adversely changed many previous plans to retire, and causing individuals to remain in the workforce longer than they may have originally planned. And if we want to see a reduction in the unemployment rate, we will need to see job creations over and above 115,000 per month. Therefore, targeting or projecting a 1% decline in the rate of unemployment requires 1.53 million jobs created plus 115,000 jobs per month for as long as it takes to achieve the target.

"In order to calculate this correctly, we need to factor in the time frame that this target is being projected over. For example, if the target is one year, then the 1.53 million jobs would be divided by 12 months, or about 125,000 per month. We then add this to the 115,000 needed to keep pace, which brings the total to a lofty 240,000 jobs per month for 12 months average. If the target is for a drop in unemployment by 2% in three years, the total jobs needed to be created are 3.06 Million, divided by 36 months - or about 85,000 jobs per month, plus the 115,000 needed to keep pace with population growth. This means we would have to add and average of 200,000 jobs per month for 3 years. And when we start to look at historical performance, we begin to see just how hard it is to accomplish this.

"For the record, I understand that demographics from 50 years ago are different, as well as different circumstances and moving targets. It's true we can't create an exact duplicate set of conditions. And I also understand that as the population grows, the 115,000 jobs needed each month will compound over time. That said, I am keeping it a bit simple so we can illustrate the concept.

"I went back 50-years on the BLS site and found some very interesting data. The best year for job gains was 1978, when the US added an average of 356,000 per month. Best decade was the 1990's, with 181,000 average monthly gains During the past 50-years the average gains per month were only 124,000. The worst decade was the 2000's, which actually saw monthly job losses that averaged 10,000 per month.

"We often hear projections on reaching a lower level of unemployment within a certain time frame. Let's look at a chart to see how many jobs it would take to reduce the current 9.2% rate to a lower level over some different periods of time.

"The colors on the chart help us see how likely this scenario may be. For example, the numbers in the red boxes indicate that this has never been done before during the time frame desired. Green boxes indicate that this is close to a historical average. Blue boxes are an optimistic, but achievable goal. Grey boxes have numbers that have been reached in the past, but very rarely. The yellow box indicates that this has happened only once before - and that is over 50 years of data...meaning a very slim 2% chance.

"We often hear of a return to a 6% unemployment rate. Well if the goal is to do this in 4 years, then the US would need to create just under 250,000 jobs per month on average during this period. There are 47 rolling 4 year periods during the past 50 years. For example 1961 - 1964 is one. Then 1962 - 1965 is the next, and so on. During this time, a level above 250,000 jobs per month average for a 4 year rolling period only happened three times. There were a few more times when the numbers were close, but the chance of this happening was less than 10%. If history is a guide, the promises and projections we have been hearing, will have a very low probability of becoming a reality.

"History tells us that bringing unemployment down to 8% over 4 years is just about 50/50. This is very worrisome. And back to our earlier example of bringing the rate down 2% in 3 years - The 200,000 monthly job gains needed during a 3 year period of time has about a one in three chance of happening, according to the historic data.

"Let's look at the total needed to get to 7% unemployment in 5 years, or about 171,000 jobs per month average. There are 46 rolling 5 year periods during the past 50 years. There were 17 times where the creations were above the number needed to reach the goal. That is just a little better than a one in three chance. Not very good odds, and worse - this is what many projections are based upon.

"Job creations need to be the central focus of our leaders. Small Businesses create so many of these jobs and should be given the tools to help them do this."

OK, John here. The times Barry talks about, of large job creation, were during periods of either high innovation or significant home and infrastructure building and increasing leverage. That is just not in the cards now. It requires an economy rocking and rolling north of 4% GDP growth. We are barely at 2%. In May, total state payrolls (the data came out today) were down 64,000; in June they were up 65,200, averaging out to +1,200 for the two months combined.

We keep hearing about what the government should do to create jobs. And the reality is that it can do precious little. Private businesses create jobs, and nearly all net new jobs for the last two decades have come from start-up businesses. What government can do is create an environment that encourages new businesses, get rid of red tape (especially in biotech, where the FDA is mired in the 1980s!), stop creating even more rules that make it costly for new businesses to hire, and so on. I could go on, but the fact is, we are in for a rather long period of higher-than-comfortable unemployment. And that means lower tax revenues and a more difficult economy.

Washington DC, Vancouver, NYC, Maine, and now Europe

I am making a last-minute trip to Washington, DC on Sunday, at the invitation of some Senators and Congressmen. Monday morning I will be meeting with Congressmen, then have lunch with some chiefs of staff of Senators (evidently, some of them actually read me - who knew?), and then have meetings with a growing group of Senators, some of whom seem to have read my book, Endgame.

I have not pushed my book for some months, but the response has been very good. Great reviews, along the lines of "the best explanation of the crisis we face." The book is not just about the US, but the entire developed world. I hope I can add something to the political conversation on Monday. I know there is a desire to cut the deficit all at once; but we have to realize, this must be a long process, unless we want to engender a true depression. It is going to be tough enough to cut a few hundred billion a year.

The Republicans have put up two plans. The House passed one. Obama is criticizing them for not compromising, but he has offered no concrete plan, just vague ideas about cuts of the "player-to-be-named-later" variety. You can't compromise when you don't have anything on the table to compromise with. The budget Obama submitted last February was rejected by the Senate 97-0. Not one Democrat voted for it. We must raise the debt ceiling, but we must also get serious deficit reduction into the process. I am not against tax reform (indeed, I am all for a lot of tax ideas), but we can't pass any tax increases without guaranteed cuts that are much larger than the increases. And we need to recognize that tax increases will not make it any easier for new businesses to start up.

I fly back late Monday night and get up early to fly to Vancouver for two nights, then back Thursday and write Friday. I leave the followingTuesday with son Trey for two nights in NYC and then on to Maine, about which more next week. And I'll have a report on my DC trip. I expect to learn more than I impart, but I will try to offer up a few ideas. Wish me luck!

In September, I will be going to London, Malta (for a day), back to London, and then spend four days in Ireland and a few days in Geneva before I head home. I am really looking to meet people in Ireland.

Have a great week; I know I will. Dinners on Tuesday and Wednesday with so many friends - Bill Bonner, Pat Cox, Keith Fitzgerald, Frank Holmes, David Tice, Mike West of Biotime, Rick Rule, et al. - what a wonderful time. And then Thursday with my Canadian partner, John Nicola, in a seminar, before heading back. Enjoy your week.

Your curious as to what Monday holds analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.