Mortgage Arrangement Fees Double

Housing-Market / UK Housing Dec 02, 2007 - 12:35 AM GMTBy: MoneyFacts

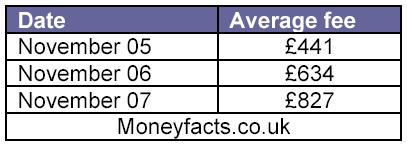

Latest Moneyfacts.co.uk research reveals the average mortgage arrangement fee has almost doubled during the last 2 years. Figures from November 2005 showed an average flat arrangement fee at £441. Today it stands at £827, with a massive 9% of prime deals now charging a percentage fee.

Latest Moneyfacts.co.uk research reveals the average mortgage arrangement fee has almost doubled during the last 2 years. Figures from November 2005 showed an average flat arrangement fee at £441. Today it stands at £827, with a massive 9% of prime deals now charging a percentage fee.

David Knight mortgage analyst from Moneyfacts.co.uk - the leading independent financial comparison site, comments:

“Thousands of borrowers coming off a two year fixed rate will be bracing themselves for higher interest charges, with the best deals over 1% higher than in 2005. But they will also need to prepare themselves to pay much higher fees, with the average fee rising 100%.

“The use of percentage fees has become more common with 9% of all prime mortgage deals charging a percentage fee ranging between 0.2% and 3.5%. The highest fee from Northern Rock at 3.5% would add a massive £4,550 to an average loan of £130K.

“The increase in fees may not automatically mean that the cost of the deals has increased. What it does mean is the maze which borrowers need to navigate to get the best deal has become more complicated.

“Unfortunately too many borrowers still focus their initial attention on getting the best rate, without taking full consideration of the true cost of the deal. Providers to some degree exploit this by offering a wide range of low rate, high fee deals.

“With around 24% of all mortgages not charging a fee, the market certainly offers choice, no matter what type of deal you are after.

“No fee, low fee, high fee and even percentage fees can offer a good deal for the right borrower. The trick is to successfully navigate the 6000 plus deals to find the best one for you. This maze of thousands of mortgages, with differing rate and fee combinations means it is more important than ever that prospective borrowers need to do their homework before committing to their new mortgage deal.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.