Gold $8,500 Now Possible, IMF Warns American on “Exorbitant Privilege”

Commodities / Gold and Silver 2011 Jul 29, 2011 - 07:42 AM GMTBy: GoldCore

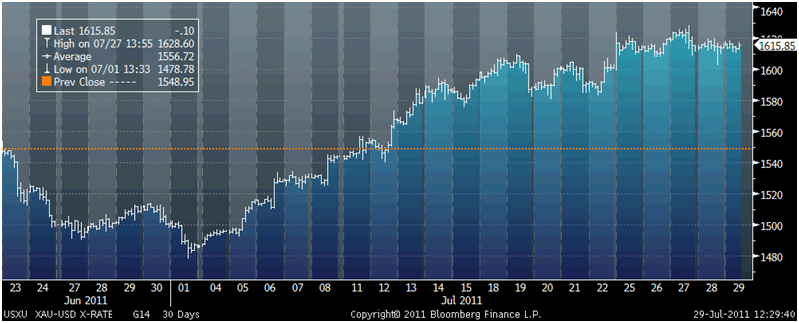

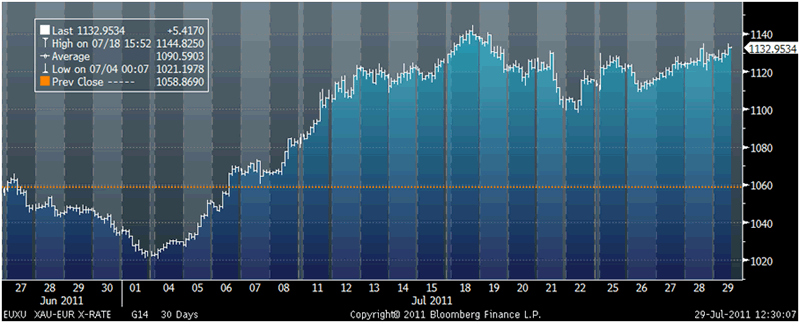

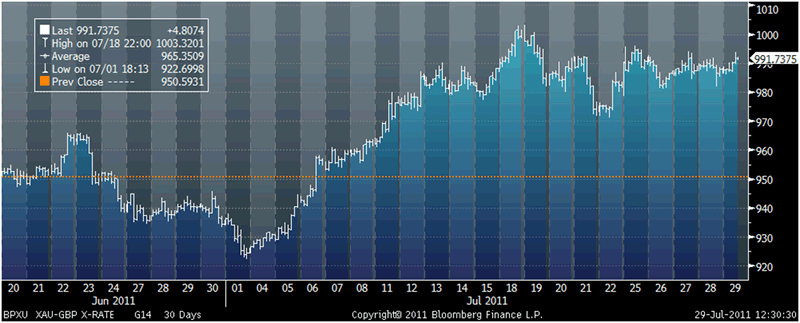

Gold is trading at USD 1,615.20, EUR 1,132.70, GBP 991.92 and CHF 1,293.10 per ounce. Gold’s London AM Fix was USD 1613.75, EUR 1129.76, GBP 991.67 (10:41 GMT). Gold is set to finish a turbulent July higher showing its safe haven attributes again. Gold is higher in all fiat currencies month to date and is 7.6% higher in U.S. dollars.

Gold is trading at USD 1,615.20, EUR 1,132.70, GBP 991.92 and CHF 1,293.10 per ounce. Gold’s London AM Fix was USD 1613.75, EUR 1129.76, GBP 991.67 (10:41 GMT). Gold is set to finish a turbulent July higher showing its safe haven attributes again. Gold is higher in all fiat currencies month to date and is 7.6% higher in U.S. dollars.

Gold is flat in dollars and slightly higher in euros and British pounds. The pound is weaker after poor UK consumer sentiment figures underlined the risk of another UK recession. Global equities have remained reasonably robust despite the continuing drama in Washington regarding the debt ceiling negotiations.

Cross Currency Rates

.png)

Asian equities were quite resilient and only had marginal losses overnight (Nikkei -0.69%, Hang Seng -0.53%, STI +0.1% Shanghai -0.3%, Sensex -0.19%, Kospi -1.05%).

Similarly European equity indices while lower are reasonably robust despite the continuing political failure in Washington overnight to reach a deal. The FTSE is 1.02% lower and the CAC and DAX 1% and 1.4% lower respectively.

The Italian 10 year has risen to 5.91% and Irish 10 year yields have risen to 10.83%.

While US debt markets remain calm with little move up in yields, it must be remembered that the Federal Reserve has been buying US treasuries (with digitally created money) to lower overall interest rates and thus stimulate lending and this may be artificially depressing US interest rates.

XAU-US Dollar Exchange Rate

A U.S. default remains highly unlikely – unless American politicians continue to play Russian roulette for the sake of power.

The more challenging and real risk is that posed by the coming downgrade or downgrades of US debt, the threat to the dollar as global reserve currency and continuing currency depreciation and debasement.

IMF Chief Warns America on “Exorbitant Privilege”

New IMF Chief Christine Lagarde has warned overnight that the global reserve currency status of the dollar is at risk due to the “worrisome” US debt debate.

XAU-EUR Exchange Rate

Failure by the United States to raise the debt ceiling would likely lead to a decline in the U.S. dollar and raise "doubts" among those using it as a reserve currency, Lagarde said.

"One of the consequences could be a decline of the dollar as a reserve currency and a dent in people's confidence in the dollar."

The U.S. currency has had an “exorbitant privilege because it was the reserve currency that most central banks had,” Lagarde said in an interview on PBS’s “Newshour” yesterday. “If there was a dent in this exorbitant privilege and the confidence that most people have towards the dollar, it would probably entail a decline of the dollar relative to other currencies.”

The use of the “exorbitant privilege” phrase by the former French finance minister is important and not an accident.

It echoes the former French President, Charles de Gaulle’s comment regarding the dollar being “America’s exorbitant privilege” at a landmark press conference in 1965 that led to the end of the London gold pool or government cartel which attempted to keep the gold price fixed at $35 per ounce.

The Bretton Woods Agreement had conferred upon the U.S. significant economic and monetary advantages (which it enjoys to this day) when it was agreed that the US dollar would be the world's reserve currency replacing the British pound, which performed this function for over 100 years due to the classical gold standard.

XAU-GBP Exchange Rate

This made the dollar “sovereign” among currencies and conferred significant privileges deniedother currencies.

French President Charles de Gaulle challenged America’s exorbitant privilege in 1965 and extolled the virtues of gold as money and as a reserve currency: "Any workable and acceptable international monetary system must not bear the stamp or control of any one country in particular. Truly, it is hard to imagine any standard other than gold. Yes, gold, whose nature does not alter, which may be poured equally well into ingots, bars, or coins, which has no nationality, and which has, eternally and universally, been regarded as the unaltered currency par excellence ..."

Lagarde’s comments echo those of President Sarkozy in 2007 when he told George Bush and the Congress that "the dollar cannot remain solely the problem of others.” . . . “If we're not careful monetary disarray could morph into economic war. We would all be its victims."

Lagarde’s comments suggest that the IMF is considering or has plans for an alternative reserve currency.

The comments echo those of other G10 leaders and especially the Russians and Chinese who have been increasingly vocal about the risks posed to the dollar. Indeed, Putin recently called the US a “hooligan” for flooding the world with printed dollars.

Leading international financiers such as George Soros and Warren Buffett have also warned about the risks posed to the dollar. Although Buffett has remained quiet about the risk more recently.

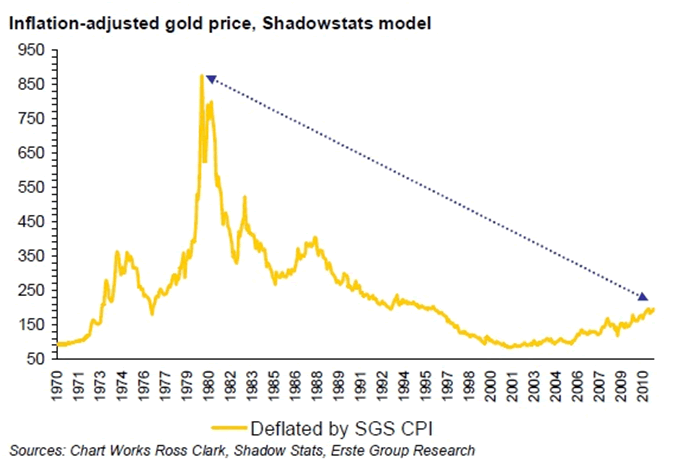

Cazenove’s Griffiths Says “Essential to Own Gold” - $8,500/oz Is Possible

Interviewed yesterday by King World News, Cazenove Capital's highly respected strategist, Robin Griffiths, remarked that you “have to own” gold. He said that the real inflation adjusted high from 1980 (using the more accurate RPI) was over $8,500 per ounce and gold could reach that level in the coming years.

He said that silver was volatile but would likely outperform gold.

Griffiths said in January that fiat currencies were being "printed into oblivion," and so not owning gold is "a form of insanity."

He continued saying that not owning gold “may even show unhealthy masochistic tendencies, which might need medical attention."

Robin Griffiths is highly respected. He was chief technical strategist with HSBC for over 20 years and has 44 years investment experience and is considered to be one of the top strategists in the world.

Cazenove Capital is one of the oldest investment houses in the world tracing its origins back to the 17th century and the company was founded in 1823. It manages money on behalf of blue blooded clients and is widely believed to manage some of the British Royal family’s wealth.

Other News

Citigroup have said that gold looks like it could go higher and does not look overvalued. Citigroup said that $5,000/oz was not likely to be reached unless there was a “meaningful deterioration in the macroeconomic environment.”

UBS said this morning that gold sales to India for May are up 161% year-on-year – another sign of robust demand from India.

For the latest news, commentary, charts, infographics and videos on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $39.59/oz, €27.77/oz and £24.32/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,776.35/oz, palladium at $821/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.