Are Junior Resource Stocks Really Undervalued?

Commodities / Gold & Silver Stocks Aug 03, 2011 - 01:09 AM GMTBy: Q1_Publishing

Are junior resource stocks undervalued?

Are junior resource stocks undervalued?

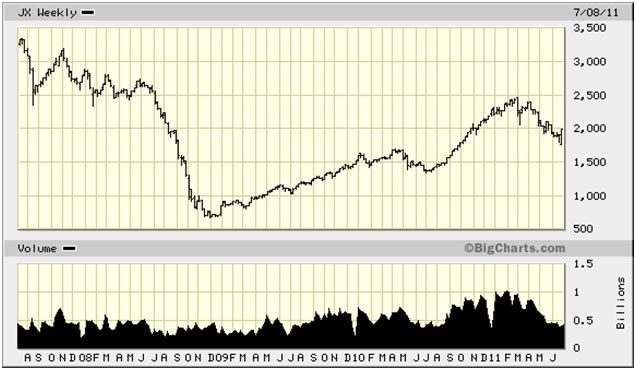

A quick look at the chart below of the TSX Venture Index would indicate they are:

As you can see, the TSX Venture Index is down more nearly 40% from its 2007 highs set when gold first passed $1000 an ounce.

More currently, the Index has been in steady decline since March. It has lost more than 20% of its value from peak to trough. In fact, it has been one of the worst performing markets in the world. Greece, Italy, Spain, and Egypt have all fared better.

On top of that, the current decline has coincided with a relatively strong market for commodities. Gold, silver, oil, and base metal prices have continued to rise or, at worst, stayed flat.

The lagging performance undoubtedly has a lot of junior resource stock investors interested. But wait, there’s something else at work here.

And at the Prosperity Dispatch, where we try and look a bit beyond the well-traveled surface, we’ve found an indicator that’s a much more accurate measure of value for the Venture market and which also paints a much different picture than the Index would show.

Numbers Don’t Lie

The TSX Venture decline has sent shares of many junior resource stocks diving. Many have been halved or worse in the since the spring.

But it’s not the share price that matters so much as the total value of the company or, in this case, the markets total value.

After all, if a company’s share price gets cut in half while it doubles its shares outstanding through warrant/option exercises and additional financings, there has been no change in the market value of the company.

The same is true for the overall TSX Venture market.

The chart below shows the total value of the TSX Venture has declined much less than the overall TSX Venture Index:

The chart shows the TSX Venture has given back a mere 16% of its total market value since March. The TSX Venture Index declined by nearly 25% over the same time period.

The divergence is critical. And understanding it will give you a good idea of what criteria will be essential to outperforming the TSX Venture Index going forward.

The High Cost of Shareholder Dilution

The divergence between share performance and total market value has proven the market’s ability to issue more shares can and will from time to time outweigh demand for shares, regardless of how strong demand may be growing.

The importance of this is more glaring when you back over the past few years.

For example, the current market value of the TSX Venture is just over $65 billion. Its peak in March 2011 was about $77 billion.

Granted, that’s not too terrible of a downswing. But when the newly issued shares from additional financings, options, and warrants are added in, the effect on an individual share’s value can be very high.

Consider this. The TSX Venture Index was at 3,200 in March 2007. At the time the total market value was about $64 billion.

Today, the Index is sitting around 2,000. That’s nearly 40% lower than it was in March 2007. But the total market value at $65 billion is current roughly equal what it was at the high in 2007.

Basically, the value of each share has been cut by 40% while the number of shares has increased by nearly 67%.

In short, anyone holding between 2007 to today has lost 40% of their value to dilution while commodity prices have mostly eclipsed their 2007 prices levels – many by a wide margin.

The Rising Tide Has Risen, What Now?

At this point, you can no longer bank on a rising tide to lift your boats.

Although a quick look at the TSX Venture Index chart may appear attractive, it hides the costly dilution that has happened over the past few years.

All is not lost though. This is still the TSX Venture and there are massive gains to be had. However, since we’re long past the “easy money” period, you have to take less risk and keep more cash on hand for when corrections do come.

And it’s now more important than ever to stick to junior resource stocks you love, with solid management, sizeable assets, and strong development plans, and shares that offer very high rewards for the risks involved.

Going forward, it’s not going to be like December 2008 when the total market value of the TSX Venture fell to $17 billion (about one fourth of its current value) when we proclaimed 2009 was going to be the year to take risks, but there will be risks worth taking. Just not as many.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2011 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.