U.S. Dollar Debt Crisis, Vested Interests Bad Mouth Gold

Stock-Markets / US Debt Aug 09, 2011 - 07:03 PM GMTBy: James_Quinn

"Believe me, the next step is a currency crisis because there will be a rejection of the dollar, the rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened." - Ron Paul

"Believe me, the next step is a currency crisis because there will be a rejection of the dollar, the rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened." - Ron Paul

As usual the MSM did its usual superficial dog and pony show for the American public on Saturday and Sunday. The overall tone on every show (not journalism) was to calm the audience. Every station had a "downgrade special" to explain why you shouldn't panic over the downgrade of the United States. As we can see, it didn't work. Worldwide markets went berserk. The reactions of the various players in this saga have been very enlightening to say the least.

As I watched, listened and read the views of hundreds of people over the last few days, I recalled a statement by David Walker in the documentary I.O.U.S.A. This documentary was made in late 2007 before the financial crisis hit. The documentary follows Walker, the former head of the GAO, and Bob Bixby, head of the Concord Coalition, on their Fiscal Wake Up tour.

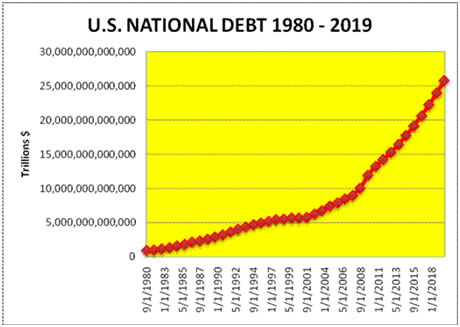

In the film, Walker tells the audience: “We suffer from a fiscal cancer. If we don’t treat it there will be catastrophic consequences.” He argued the greatest threat to America was not a terrorist squatting in a cave in Afghanistan, but the US debt mountain. He was nervous about the increasing dependence on countries such as China, which are the biggest holders of US Treasury bonds. Bixby explained: “If you knew a levee was unsound and people were moving into that area, would you do nothing? Of course not.” These men were sounding the alarm when our National Debt was $9 trillion. Evidently, no one in Washington DC went to see the movie. They've added $5.5 trillion of debt to our Mount Everest of obligations.

After listening to the shills, shysters, propagandists, and paid representatives of the vested interests over the last few days, Mr. Walker's response to someone pointing out Europe and other countries were in worse shape than the U.S. came to mind:

“What good does it do to be the best-looking horse in the glue factory?”

At the end of the documentary there was a prestigious panel of thought leaders discussing ideas to alter the country from its unsustainable fiscal path. I was shocked when Warren Buffett basically stated there was nothing to worry about:

“I’m going to be the token Pollyanna here. There is no question that our children will live better than we did. But it’s just like my investments. I try to buy shares in companies that are so wonderful, an idiot could run them, and sooner or later one will. Our country is a bit like that.”

Buffett has since turned into a Wall Street/Washington apologist, talking his book. He declared this weekend the US deserves a quadruple A rating. He has tried to protect his investments in GE, Goldman Sachs, Moodys and Wells Fargo by declaring their businesses as sound and their balance sheets clean. He is now just a standard issue sellout spewing whatever will protect his vast fortune. Truth is now optional in Buffett World.

The Oracle of Omaha has continuously bad mouthed gold and pumped up the economic prospects for the U.S. He trashed gold in his March 2011 report to shareholders:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

I guess the leadership of this country has created a bit of fear in the market, as gold has risen from $1,400 to $1,750 and Warren's beloved financial holdings have tanked, along with the stock price of Berkshire Hathaway (down 23% since March). There seems to be an inverse relationship between the barbarous relic and lying old men shilling for the vested interests.

Vested Interests

When you watch the corporate mainstream media, or read a corporate run newspaper, or go to a corporate owned internet site you are going to get a view that is skewed to the perspective of the corporate owners. What all Americans must understand is everyone they see on TV or read in the mainstream press are part of the status quo. These people have all gotten rich under the current social and economic structure. Buffett, Kudlow, Cramer, Bartiromo, Senators, investment managers, Bill Gross, Lloyd Blankfein, Jamie Dimon, Jeff Immelt, and every person paraded on TV have a vested interest in propping up the existing structure. They are talking their book and their own best interests. Even though history has proven time and again the existing social order gets swept away like debris in a tsunami wave, the vested interests try to cling to their power, influence and wealth. Those benefitting from the existing economic structure will lie, obfuscate, misdirect, and use propaganda and misinformation to retain their positions.

The establishment will seek to blame others, fear monger and avoid responsibility for their actions. Ron Paul plainly explains why the US was downgraded:

"We were downgraded because of years of reckless spending, not because concerned Americans demanded we get our finances in order. The Washington establishment has spent us into near default and now a downgrade, and here they are again trying to escape responsibility for their negligence in handling the economy."

The standard talking points you have heard or will hear from the vested interests include:

- Stocks are undervalued based on forward PE ratios.

- Ignore the volatility in the market because stocks always go up in the long run.

- Buy the f$%ing dip.

- America is not going into recession.

- The market is dropping because the Tea Party held the country hostage.

- The S&P downgrade is meaningless because they rated toxic subprime mortgages AAA in 2005 - 2007.

- The market is dropping because the debt ceiling deal will crush the economy with the horrific austerity measures.

- The S&P downgrade is meaningless because Treasury rates declined after the downgrade.

- Foreigners will continue to buy our debt because they have no other options.

- Foreigners will continue to invest in the U.S. because Europe, Japan and China are in worse shape than the U.S.

- America is still the greatest economy on the planet and the safest place to invest.

Each of these storylines is being used on a daily basis by the vested interests as they try to pull the wool over the eyes of average Americans. A smattering of truth is interspersed with lies to convince the non-thinking public their existing delusional beliefs are still valid. The storylines are false.

Here are some basic truths the vested interests don't want you to understand:

- As of two weeks ago the stock market was 40% overvalued based upon normalized S&P earnings and was priced to deliver 3% annual returns over the next decade. The S&P 500 has lost 17%, meaning it is only 23% overvalued. Truthful analysts John Hussman, Jeremy Grantham and Robert Shiller were all in agreement about the market being 40% overvalued. This decline is not a buying opportunity.

- The S&P 500 was trading at 1,119 on April 2, 1998. The S&P 500 closed at 1,119 yesterday. In March 2000 the S&P 500 traded at 1,527. By my calculation, the stock market is 27% below its peak eleven years ago. As you can see, stocks always go up in the long run. It is just depends on your definition of long.

- The talking heads on CNBC told you to buy the dip from October 2007 through until March 2009. The result was a 50% loss of your wealth.

- The government will report the onset of recession six months after it has already begun. People who live in the real world (not NYC or Washington DC) know the country has been in recession for the last seven months. The CNBC pundits don't want to admit we are in a recession because they know the stock market drops 40% during recessions on average and don’t want you to sell before they do.

- The stock market held up remarkably well during the debt ceiling fight. It did not begin to plunge until Obama signed the toothless joke of a bill that doesn't "cut" one dime of spending. The markets realized the politicians in Washington DC will never cut spending. The National Debt will rise from $14.5 trillion to $20 trillion by 2015 and to $25 trillion by 2021, even with the supposed austere spending "cuts".

- The left wing media and the frothing at the mouth leaders of the Democratic Party have conducted focus groups and concluded that blaming the extreme, terrorist Tea Party for the stock market crash and the S&P downgrade plays well to their hate mongering ignorant base. They have rolled out their rabid dogs, Joe "gaffe machine" Biden, Howard “AYAHHHHHHH!!!” Dean and John “ketchup” Kerry, to eviscerate the Tea Party terrorists.

- The mainstream liberal media would like you to believe the Tea Party is an actual cohesive group that wants to throw grandmothers and the poverty stricken under the bus. The neo-cons in the Republican Party and their mouthpieces on Fox News have tried to co-opt the Tea Party movement for their purposes. There is no one Tea Party. It is a movement born of frustration with an out of control government. Ron Paul represented the Tea Party before it even existed and is the intellectual leader of the movement. His is the only honest truthful voice in this debate:

"As many frustrated Americans who have joined the Tea Party realize, we cannot stand against big government at home while supporting it abroad. We cannot talk about fiscal responsibility while spending trillions on occupying and bullying the rest of the world. We cannot talk about the budget deficit and spiraling domestic spending without looking at the costs of maintaining an American empire of more than 700 military bases in more than 120 foreign countries. We cannot pat ourselves on the back for cutting a few thousand dollars from a nature preserve or an inner-city swimming pool at home while turning a blind eye to a Pentagon budget that nearly equals those of the rest of the world combined."

- S&P's opinion about any debt should be taken with a grain of salt. They, along with Warren Buffet's friends at Moodys, were bought and sold by the Wall Street criminal element. Anyone with a smattering of math skill and an ounce of critical thinking would have concluded the U.S. was a bad credit three years ago. A Goldman Sachs trader had this opinion of the brain dead analysts at Moodys: “Guys who can’t get a job on Wall Street get a job at Moody’s.” Michael Lewis, in his book The Big Short, summarized the view of the rating agencies:

“Wall Street bond trading desks, staffed by people making seven figures a year, set out to coax from the brain-dead guys making high five figures the highest possible ratings for the worst possible loans. They performed the task with Ivy League thoroughness and efficiency.”

- The most laughable storyline spouted by the Democrats and their lapdogs on MSNBC is the extreme austerity measures forced on the country by the Tea Party has caused the stock market to collapse. The plan "cuts" $22 billion in 2012 and $42 billion in 2013. Over this time frame, the Federal government will spend $7.4 TRILLION. The horrific spending "cuts" amount to .86% of spending over the next two years. Meanwhile, we will add at least $3 trillion to the National Debt over this same time frame. Of course, we could listen to Paulie "Spend More" Krugman and add $6 trillion to the national debt with another stimulus package. When a Keynesian solution fails miserably, just declare it would have worked if it was twice the size.

- Barack Obama, the James Buchanan of our times, gave one of the worst Presidential speeches in the history of our country yesterday. In full hubristic fury he declared the United States of America would ALWAYS be a AAA country. The American Exceptionalism dogma is so very amusing. We are chosen by God to lead the world. Barack should have paid closer attention in history class. The Roman, Dutch, Spanish and British Empires all fell due to their hubris, fiscal mismanagement and overseas military exploits. The American Empire has fallen and can't get up.

And now we come to the $100 trillion question. The establishment/vested interests/status quo declares the United States as the safest place in the world for investors. They frantically point out that people are pouring money into our Treasuries and interest rates are declining. They hysterically blurt out that Europe has much bigger problems than the U.S. and China's real estate bubble will implode in the near future. These are the same people who told you the internet had created a new paradigm and NASDAQ PE ratios of 150 in 2000 were reasonable. The NASDAQ soared to 5,000 in early 2000. Today it trades at 2,358, down 53% eleven years later. These are the same people who told you they aren't making more land and home prices in 2005 were reasonable. They told you home prices had never fallen nationally in our history, so don't worry. Prices are down 35% and still falling today.

Medicare and Medicaid spending rose 10% in the second quarter of 2011 from a year earlier to a combined annual rate of almost $992 billion, according to the Bureau of Economic Analysis (BEA). The two programs are likely to crack $1 trillion before the end of the year. Medicare’s unfunded liability alone amounts to $353,350 per U.S. household. The National Debt will reach 100% of GDP in the next four months as we relentlessly add $4 billion per day to our Mount Everest of debt. Federal spending in 2007 was $2.7 trillion. Today, they are spending $3.8 trillion of your money. The country does not have a revenue problem. We have a spending addiction and the addict needs treatment. Doctor Ron Paul has our prognosis:

"When the federal government spends more each year than it collects in tax revenues, it has three choices: It can raise taxes, print money, or borrow money. While these actions may benefit politicians, all three options are bad for average Americans."

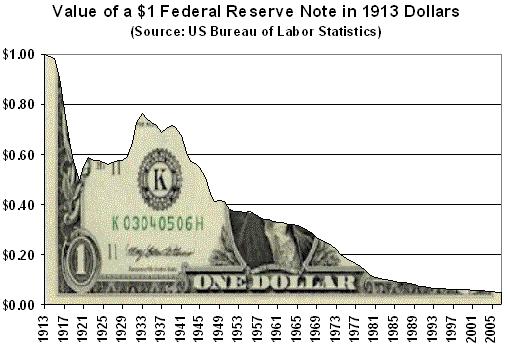

The politicians and bankers who control the developed world have made the choice to print money and create more debt as their solution to an un-payable debt problem. Europe, Japan, the U.S., and virtually every country in the world want to devalue their way out of a debt problem created over the last forty years. It has become a race to the bottom, with no winners. Every country can't devalue their currency simultaneously without blowing up the entire worldwide monetary system. But, it appears they are going to try. The United States will never actually default on its debts. Ben Bernanke will attempt to default slowly by paying back the interest and principal to foreigners in ever more worthless fiat dollars. This will work until the foreigners decide to pull the plug. For now interest rates are low and the U.S. is the best looking horse in the glue factory. But we all know what happens to all the horses in the glue factory – even Mr. Ed.

"It is true that liberty is not free, nor is it easy. But tyranny - even varying degrees of it - is much more difficult, and much more expensive. The time has come to rein in the federal government, put it on a crash diet, and let the people keep their money and their liberty." - Ron Paul

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.