Simon Ridgway on Gold Exploration and the Yukon

Commodities / Gold & Silver Stocks Aug 10, 2011 - 12:14 PM GMTBy: Submissions

Ron Hera submits: The Hera Research Newsletter (HRN) is very pleased to present a fascinating interview with Simon T. Ridgway, President and Director of Yukon gold exploration company Radius Gold, Inc. (TSX:RDU), Chairman of Fortuna Silver Mines, Inc. (TSX:FVI), Chairman and Director of Focus Ventures, Ltd. (TSX:FCV), and founder of the Gold Group of metals mining and exploration companies. Beginning as a prospector in the Yukon Territory in the late 1970s, Mr. Ridgway is today an accomplished explorationist, mine builder and mining financier. Since 2003, Gold Group companies have raised over $375 million for exploration and development projects.

Ron Hera submits: The Hera Research Newsletter (HRN) is very pleased to present a fascinating interview with Simon T. Ridgway, President and Director of Yukon gold exploration company Radius Gold, Inc. (TSX:RDU), Chairman of Fortuna Silver Mines, Inc. (TSX:FVI), Chairman and Director of Focus Ventures, Ltd. (TSX:FCV), and founder of the Gold Group of metals mining and exploration companies. Beginning as a prospector in the Yukon Territory in the late 1970s, Mr. Ridgway is today an accomplished explorationist, mine builder and mining financier. Since 2003, Gold Group companies have raised over $375 million for exploration and development projects.

During the 1990s, Mr. Ridgway served as President of Mar-West Resources, Ltd. and led the discovery and development of two gold deposits in Honduras and Guatemala, which were sold to Glamis Gold, now Goldcorp, and subsequently put into production. The properties included the historic Escobal deposit in southern Guatemala. Mr. Ridgway later served as the President of Pilagold Inc., until its merger with Radius Gold in 2007. Mr. Ridgway has served as a Consultant to Silver Quest Resources, Ltd. (formerly Southern Rio Resources, Ltd.) and currently sits on the Board of Advisors of Western Pacific Resources Corp.

During the 1990s, Mr. Ridgway served as President of Mar-West Resources, Ltd. and led the discovery and development of two gold deposits in Honduras and Guatemala, which were sold to Glamis Gold, now Goldcorp, and subsequently put into production. The properties included the historic Escobal deposit in southern Guatemala. Mr. Ridgway later served as the President of Pilagold Inc., until its merger with Radius Gold in 2007. Mr. Ridgway has served as a Consultant to Silver Quest Resources, Ltd. (formerly Southern Rio Resources, Ltd.) and currently sits on the Board of Advisors of Western Pacific Resources Corp.

Throughout his distinguished career, grass roots exploration has remained Mr. Ridgway’s passion. Exploration teams under his guidance have discovered gold and silver deposits in Honduras, Guatemala, and Nicaragua, as well as in the Yukon Territory.

Hera Research Newsletter (HRN): Thank you for joining us today. You founded the Gold Group, which now consists of seven exploration and mining companies in the Americas. You must be very busy.

Simon Ridgway: I don’t run the companies as such. The Gold Group companies have different management and investors. Fortuna Silver, for example, is run by the Ganoza family in Peru. Actually, Jorge Ganoza, the CEO, worked for me at one time as a geologist at Radius Gold. He came to me and asked me to grubstake him to find a silver mine, which he did. Since then, Jorge and his team have run the company. I chair the board and advise on acquisitions and financings. The other companies in the Gold Group, for the most part, have their own management. I just advise them on strategy and acquisitions and generally negotiate the financings. The company I run myself is Radius Gold, which is a gold exploration company focusing on the Yukon and Central America.

HRN: Would you still describe yourself as an explorationist?

Simon Ridgway: Yes, definitely. Exploration is what I’ve always loved doing. I lived in the Yukon where I prospected for many years and vended my prospects to some Vancouver companies. Most of the 1980s I spent prospecting. At some point in the early 1990s, I decided that I didn’t like the work being done on some of the properties and I thought I could do a better job myself. So I started a company and took it public.

HRN: Which company was that?

Simon Ridgway: The first company I listed, in 1991, was Tombstone Exploration, which I took to Venezuela. 1991 was a very tough year to list a company. There was an Alaskan placer miner that agreed to purchase half of the primary issue if I would go down to Venezuela and focus my efforts in that country. I went down to Venezuela with him and saw that gold was being produced everywhere, so I agreed to move down there and live there. I focused on Latin America from that time until recently.

HRN: How did you get involved in exploration originally?

Simon Ridgway: Working in the Yukon as a bush rat for exploration companies in the field. Doing that, I became more and more interested in rocks and began reading about them and prospecting.

HRN: How did you go from working in the field to staking your own claims?

Simon Ridgway: I was out on a job staking claims in the Yukon and I was weathered in with the guy I worked for and an associate. The helicopter couldn’t get in, so we were stuck in a truck for six or seven hours. We played poker and, by the time the helicopter could get to us, he owed me some money which he paid with an interest in a mining prospect. We then sold the prospect to a TSX listed company for substantially more than the debt, which got me interested in the industry. That’s when I started researching, staking claims and employing geologists to work on the ground. I would work with them and pick their brains about geology, asking them why this or that was important.

HRN: That’s amazing. You literally learned the industry from the ground up. What was your background originally?

Simon Ridgway: I left school in England early during the 1960s and traveled the world. I didn’t have any formal training or academic background.

HRN: You’re not a geologist by training but you’ve become extremely successful in mineral exploration. How do you account for that?

Simon Ridgway: Hard work, some good judgment and a sprinkling of luck. When I took Tombstone to Venezuela backed by my Alaskan investor and after I had been there a couple of years, I acquired some interesting ground and then a big gold rush began in Venezuela. I was able to sell out at quite a profit and move on. The exploration business is high risk. If I’d been an unlucky individual, it wouldn’t have been a good choice of business.

HRN: Do you have an overall mineral exploration strategy, like following well known mineralized belts?

Simon Ridgway: I chose areas like Central America where the geology was good, based on what I had learned from my years in the Yukon, and that were underexplored so the competition was low. I like to go into areas that are unexplored with prospective geology and try to be the first in there. I had some good success.

HRN: So, you had a competitive strategy, but delivering results must take more than a good idea.

Simon Ridgway: To find mines, you need to work hard. A lot of it is just getting out in the field and breaking rock and having guys with you that will do that; that will actually climb the hills and take a look as opposed to leaving it to someone else. I’ve been lucky to get some very good people around me, such as good geologists and good explorers. A lot of the people in Central America have been working for me since 1993. The same guys are doing the grassroots exploration today, which is the part I love the most.

HRN: Can you talk about some of the exploration methods you’ve used?

Simon Ridgway: Exploring for volcanic hosted gold deposits is not very complicated science. It gets more complicated after you make the initial discovery, for example, determining how to drill and where to drill. When I first left Venezuela, I took over a company called Mar-West Resources and took it to Central America, where I lived in Honduras for some years. When we went into Honduras, research I did indicated that most of the historic gold deposits were spatially related to hot springs. Using that simple approach, we visited all of the hot springs in Honduras looking for silica and we found three and a half million ounces of gold over the next few years. The San Martin mine in Honduras, for example, produced a million ounces of gold. In these tertiary volcanic belts, many of the gold deposits are related to hot spring centers spatially, or to rhyolite domes geologically. We used that as an indicator to decide where to go looking. Sometimes it can be topography. In Northern Nicaragua, for example, the ground is very flat and almost at sea level. Any topographic high in those areas is caused by silica or by intrusive bodies or volcanic rhyolite domes. So we used topography in Northern Nicaragua and it worked well for us.

HRN: You’ve mainly focused on gold exploration?

Simon Ridgway: My training from the Yukon was in gold exploration and that’s what I’ve focused on for the most part. Fortuna was a silver deposit but it was still in precious metals and it was more a situation where I backed someone I believed in. Jorge’s family has been involved in silver mining for generations. They came to me when the silver price was around $6 CAD and they explained why they thought the silver price was going to go higher and I grubstaked them based on that.

HRN: What was the case for silver at the time?

Simon Ridgway: Silver had been in the $3 to $4 dollar range for about a decade and it was starting to move based on supply and demand. Gold was already on the move so it seemed to be a good time to acquire silver mines. We spent about a year looking at various acquisition targets. Jorge spent a year looking at assets in Peru, most of which we turned down, then he came up with the Caylloma mine, which a local mining group wanted to sell. I believe we purchased it for about $7 million CAD. That was the first Fortuna mine. Then an opportunity came to me in Mexico and Jorge and I went to look at it. It was early stage but we acquired it and now the mill is turning at the San Jose silver-gold project which will go into full production within the next month.

Fortuna Silver Mines, Inc. is a growing silver and base metal producer focused on mining opportunities in Latin America. The company’s primary assets are the Caylloma silver mine in southern Peru and the San Jose silver-gold project in Mexico. The company, which is selectively pursuing accretive acquisition opportunities, has industry expertise in Latin America encompassing regional mining, business practices, exploration, geology and regulatory environments. The 100%-owned Caylloma silver mine, which contains silver, zinc, lead and copper, is located in the mineral-rich Caylloma Mining District in the southern highlands of Arequipa, Peru. It is a high grade epithermal vein system with significant untested potential within its over 10,000 hectare land package. Fortuna operates the mine at over 1,200 tpd and is working on the permitting to further increase throughput to 1,500 tpd. Exploration activities include testing of high grade silver and base metal targets within the Caylloma Mining District and evaluation of surrounding properties to identify opportunities warranting more advanced exploration and development. The 100%-owned San Jose silver-gold project is a low sulphidation epithermal system located within the Taviche Mining District located in southern Oaxaca, Mexico. A positive pre-feasibility study (PFS) published in 2010 served as the basis for construction of the company’s second mine, a 1,500 tpd underground silver-gold mine, which will be fully operational in September 2011. The PFS indicated an after-tax internal rate of return of 18% and a net present value of $36 million USD at a discount rate of 8%. Once in operation at a rate of 1,500 tpd, the San Jose Mine will deliver 5 million silver equivalent ounces annually for a cash cost of only $6.20 USD per ounce. |

HRN: With so much success in Latin America, what brought you back to the Yukon?

Simon Ridgway: The Yukon had become a difficult place to work and to explore during the nineties, but that changed a few years ago. There are higher prices for resources, a more mining friendly government in the Yukon Territory and a settlement of native land claims. The Yukon is a huge area, roughly three times the size of England, and there’s been very little exploration there for the past decade or so, and almost no investment. So, the same reasons that took me to Latin America in the early nineties have brought me back to the Yukon.

HRN: The Yukon is a hotbed of gold exploration activity this year.

Simon Ridgway: The Yukon is very active now. There hasn’t been this much investment, tens of millions, since the 1970s. With higher gold prices you can afford to explore in more remote areas. With a low gold price, you just couldn’t raise the money to explore where you need helicopters and fixed wing floatplanes to access the areas. There are few roads and it can be quite remote, as where the Rackla Belt is situated, but there are lots of lakes to take a floatplane into.

HRN: Do you think gold prices will remain high?

Simon Ridgway: Yes. When I look at the economic chaos in Europe and the debt situation in the U.S., I really have a hard time imagining that the trends in gold or silver will change in the next while. I just don’t see how you can borrow yourself out of debt. Gold and silver are becoming currencies again and I think the prices will remain high for the foreseeable future.

HRN: Radius recently announced geochemical anomalies on one of its properties. What does that mean?

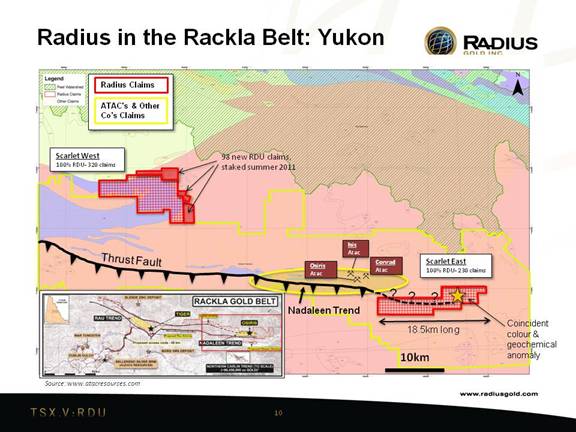

Simon Ridgway: The Scarlet East property is in what’s now called the Rackla Belt in the East-central Yukon Territory, where ATAC Resources, Ltd. discovered a cluster of Carlin-type gold deposits that could become very material. We took a look at ATAC’s ground position early last year after they released the first drill holes for their Osiris discovery. I believed this could be a major find so I made a decision to get involved in the play. A review of their ground position and the setting indicated potential along the structural trend to the east of their claims block so we went in last year and staked 25 kilometers in the structural trend that seemed to be hosting the ATAC mineralization. ATAC then followed up with several great drill holes last summer and continued to do so this spring. So it looks to be a very important belt developing there and Radius was in early enough to acquire what is proving to be an important piece of ground.

HRN: Since the Rackla Belt is remote, is supporting infrastructure going to be a problem?

Simon Ridgway: The discoveries in the Rackla Belt will need to be sizable. We went in this spring and set up a camp and started doing some regional geochem. It’s early stage but it looks to be a very significant anomaly; gold, arsenic, mercury—all the right elements that indicate Carlin style mineralization. We’re talking about soil and stream geochemistry, so it’s very early stage.

HRN: How large would a gold resource have to be to justify building a mine there?

Simon Ridgway: The Rackla Belt is going to have to be in excess of five million ounces at three grams per tonne plus. I don’t think a one gram per tonne deposit would make it in that area. It just wouldn’t be economic. At the moment, ATAC has three or four discoveries all indicating the same Carlin style sediment hosted mineralization, which, as we know from Carlin, can be quite sizable.

HRN: There have been other new discoveries in the Yukon.

Simon Ridgway: There are a couple of other good discoveries in the Yukon, for example, Kaminak Gold’s (TSX:KAM) Coffee project and Underworld’s, now Kinross Gold (TSX:K), Golden Saddle project in the White Gold District, which is in the Tintina gold belt South of Dawson City. There have been a lot of people looking for the source of the Klondike placer gold for many years. Some of the sources of the Klondike placer gold are in the Kaminak and Underworld hard rock discoveries. I believe there will be more hard rock discoveries in the Klondike region.

HRN: Doesn’t Radius also have a property in the Klondike region?

Simon Ridgway: We have the 60 Mile gold camp on the Alaska-Yukon border in the Tintina gold belt. There’s one hillside there that produced over a half million ounces of placer gold in the mid 1800’s but no one has made a hard rock discovery in there. There are three streams draining the same hillside that all produced gold. Radius went into the area about 4 years ago and acquired a very large land position covering the hills on both sides of the border and we’re drilling there now trying to find the source. We put several holes in last year with very broad, though very low grade, intercepts. I think we’re getting a good understanding.

HRN: Is Radius still active in Central America?

Simon Ridgway: We’re still very active in Central America. Some of the geos in Nicaragua and Guatemala have been with me for many years. I joint ventured all of the Nicaraguan assets to B2Gold (TSX:BTG) who are having some success at the Trebol and San Pedro properties. It’s a 60/40 joint venture where B2Gold is developing the projects. We are carried for a 40% interest up to a certain expenditure where we have to contribute to keep our percentage.

HRN: What is Radius doing in Guatemala?

Simon Ridgway: When I took Mar-West to Central America, we made a couple of gold discoveries, one of them being the San Martin mine in Honduras and the other being the Cerro Blanco project in Guatemala. I sold those two deposits to Glamis Gold, now Goldcorp (TSX:G). Part of the land package included a property called Escobal, which hosts a major silver discovery containing over 317 million ounces so far.

The Escobal property is located in southern Guatemala, approximately 120 kilometers East of Goldcorp’s Marlin mine, and approximately 70 kilometers West of its Cerro Blanco property. Escobal contains a classic hot springs gold deposit with bonanza type gold mineralization, as well as silver, lead and zinc mineralization. As of December 2010, Escobal was known to contain a 1.3 million ounce measured and indicated gold resource at an average grade of 15.64 grams per tonne and a 670,000 ounce inferred gold resource at an average grade of 15.31 grams per tonne. The Escobal property contains a major, high-grade silver deposit consisting of an indicated resource of 130.1 million ounces with an average grade of 580 grams per tonne and an inferred resource of 187.5 million ounces with an average grade of 443 grams per tonne. In 2010, Goldcorp sold the Escobal silver deposit to Tahoe Resources Inc. (TSX:THO), headed by former Goldcorp President and Chief Executive Officer Kevin McArthur, for total consideration equal to $505 million. |

HRN: So, you’re looking for more silver deposits in Guatemala?

Simon Ridgway: Yes. We have a very large land position in Guatemala just East of Tahoe Resources’ holdings. We’re doing grassroots exploration looking for deposits similar to Escobal.

HRN: How do you envision Radius’ current projects developing?

Simon Ridgway: Radius’ business model is similar to a project generator but when we find an exciting project we do all the exploration and drilling ourselves. I don’t envision Radius building any mines. We would either joint venture projects to producers that would earn an interest by developing them or sell the company. It really depends on how good the projects are that we discover. What I did with Mar-West was define the resource, leave some blue sky there and sell the company. B2Gold, for example, might become interested in acquiring Radius Nicaragua. I’m a large shareholder in the various Gold Group companies so my goals and those of other shareholders are aligned.

HRN: Thank you for your time today.

Simon Ridgway: Thank you.

After Words |

|

Using a pragmatic combination of experience, intelligence, boots-on-the-ground know how and hard work, Simon Ridgway is truly an explorationist extraordinaire. Investing in natural resource companies, such as precious metals producers, is fraught with risk and mineral exploration is the highest risk category. Where high risk junior exploration companies are concerned, the single most important mitigating factor for investors is the quality of the management team. With discoveries over his career totaling tens of millions of ounces of gold and hundreds of millions of ounces of silver, Simon Ridgway and his hand picked teams that make up the Gold Group companies are unique and highly valuable assets. In an investment category characterized by extreme risk and perhaps a 90% failure rate, the quality of the people is the single most important indicator of a company’s future prospects. |

Editor’s Note: Hera Research, LLC or its Directors are shareholders in Radius Gold, Inc. and in Fortuna Silver Mines, Inc.

###

Hera Research, LLC, provides deeply researched analysis to help investors profit from changing economic and market conditions. Hera Research focuses on relationships between macroeconomics, government, banking, and financial markets in order to identify and analyze investment opportunities with extraordinary upside potential. Hera Research is currently researching mining and metals including precious metals, oil and energy including green energy, agriculture, and other natural resources. The Hera Research Newsletter covers key economic data, trends and analysis including reviews of companies with extraordinary value and upside potential.

###

Articles by Ron Hera, the Hera Research web site and the Hera Research Newsletter ("Hera Research publications") are published by Hera Research, LLC. Information contained in Hera Research publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in Hera Research publications is not intended to constitute individual investment advice and is not designed to meet individual financial situations. The opinions expressed in Hera Research publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and Hera Research, LLC has no obligation to update any such information.

Ron Hera, Hera Research, LLC, and other entities in which Ron Hera has an interest, along with employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. The policies of Hera Research, LLC attempt to avoid potential conflicts of interest and to resolve conflicts of interest should any arise in a timely fashion.

Unless otherwise specified, Hera Research publications including the Hera Research web site and its content and images, as well as all copyright, trademark and other rights therein, are owned by Hera Research, LLC. No portion of Hera Research publications or web site may be extracted or reproduced without permission of Hera Research, LLC. Nothing contained herein shall be construed as conferring any license or right under any copyright, trademark or other right of Hera Research, LLC. Unauthorized use, reproduction or rebroadcast of any content of Hera Research publications or web site, including communicating investment recommendations in such publication or web site to non-subscribers in any manner, is prohibited and shall be considered an infringement and/or misappropriation of the proprietary rights of Hera Research, LLC.

Hera Research, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of Hera Research publications or website, any infringement or misappropriation of Hera Research, LLC's proprietary rights, or any other reason determined in the sole discretion of Hera Research, LLC. ©2009--2011 Hera Research, LLC.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.