Stock Market Collapse, Gold, Gold Stocks

Commodities / Gold & Silver Stocks Aug 11, 2011 - 06:22 AM GMTBy: Jeff_Berwick

What a few weeks it has been.

What a few weeks it has been.

Numerous times, before the end of QE2 (on June 30), we were questioned at conferences or in interviews about what would happen after QE2 ends. Here is a direct quote from the May issue of TDV when speaking about what will happen when QE2 ends:

"The only other way (other than going into QE3) that Treasury demand can be increased dramatically is through another financial crisis.

It has come to that. The only way to even come close to financing the debt of the US Government is to send world markets into freefall, prompting people to panic and, perhaps, run yet again into Treasuries as a "safe haven".

But every day that gold rises and the US dollar falls is an indication that the US dollar and US Government debt are not being seen as "safe havens" anymore. The world is slowly realizing it is quite the opposite."

We stated numerous times that it would be no more than 1-2 months after the end of QE2 that we would see QE3 launched OR a major financial crisis.

One month and a few days later and welcome to the crisis.

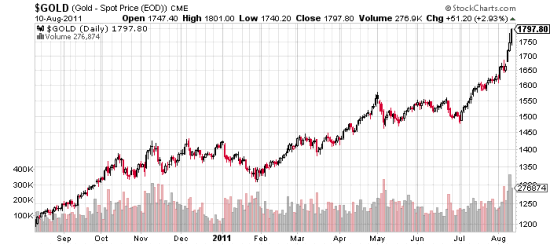

It's pretty hard not to say we told you so. We said, and continue to say, that there is no way out of this other than US Government collapse/default or hyperinflation. We've said to hide out in gold. Gold hit $1,800 today.

In the July 3rd Interim Update to subscribers, TDV Senior Analyst, Ed Bugos, called for gold to hit $2,000 by year end. At the time, gold had been doing nothing for a 3 month period and with the traditionally slow summer period for gold about to get underway, Ed heard more than a few chortles of disbelief.

Now, just a little over a month later and $2,000 is just a stone's throw away.

But, all of this is the past. I want to talk about the present and the future.

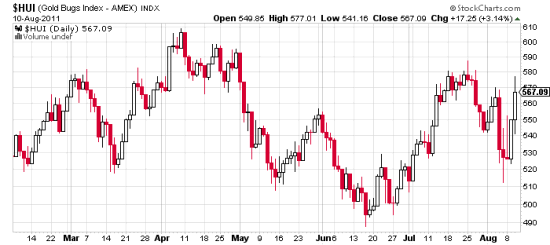

Ed stated often over the last few months to keep a generous cash position in case gold stocks get taken down by an overall market panic/crash. And, gold stocks have definitely taken a hit.

However, Wednesday's action said a lot about what might be coming for gold stocks - which have lagged behind bullion by a wide margin.

With the overall stock market in the midst of a massive plunge (Dow down 520 points), the HUI rocketed higher, up 17.25 (3.14%), for the second straight day.

Perhaps gold stocks are finally going to play catch-up with the metal.

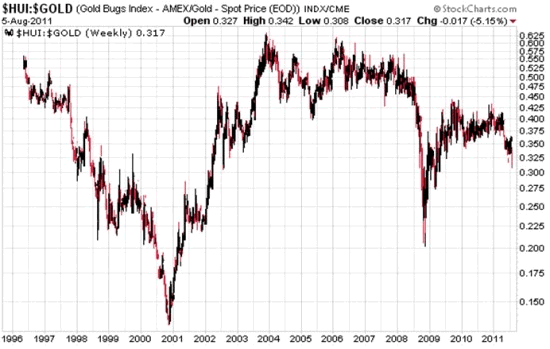

The last time gold stocks traded at this low of a valuation compared to gold was during the 2008 crisis. This time around the money supply is much more inflationary than in 2008, interest rates have been promised to be at a savings-killing 0% for another few years and gold stock valuations are much lower than in 2008.

That means that they could be nearing take-off. Even just returning to its ratio versus gold bullion from 2004-2008 would entail a 100% rise from here. And that was when gold traded for between $400-$800. Now, at $1,800, these stocks have multiple triple digit potential.

This weekend, Senior Analyst Ed Bugos will be reviewing some of our favorite gold stocks to begin getting positioned in our Interim Update.

Sign up to receive The Dollar Vigilante today to have Ed Bugos, one of the top gold stock analysts in the world, working directly for you. He updates our portfolio every weekend and features a new stock on average every month.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.