Socio-Economics Put China and India at Higher Investment Risk Than The U.S.

Stock-Markets / Financial Markets 2011 Aug 14, 2011 - 06:38 AM GMTBy: EconMatters

This week has turned out to be Wall Street's wildest week since 2008. The Dow Jones industrial average closed down 519 points on Tuesday, Aug. 10, but then went up 423.37 points. But overall, Down has now lost more than 2,000, or 16% since July 21, less than three weeks ago. The selloff intensified after the U.S. got stripped of the top notch AAA rating by S&P first time ever in history.

This week has turned out to be Wall Street's wildest week since 2008. The Dow Jones industrial average closed down 519 points on Tuesday, Aug. 10, but then went up 423.37 points. But overall, Down has now lost more than 2,000, or 16% since July 21, less than three weeks ago. The selloff intensified after the U.S. got stripped of the top notch AAA rating by S&P first time ever in history.

The double AA status has put the U.S. in the same category as China, based on S&P's rating. But one consolation for the United States is that the country's high socio-economic resilience has placed the U.S. at a more favorable investment risk position than major emerging economies like China and India. Socio-economic Resilience Index is a risk metric developed by risk analysis firm Maplecroft measuring the ability of countries to cope with the impacts of a major event.

It is interesting that although some of the developed countries and emerging economies, while all subject to economic exposure to natural disasters, it is the socio-economic resilience that sets these countries apart when it comes to the overall risk to investors.

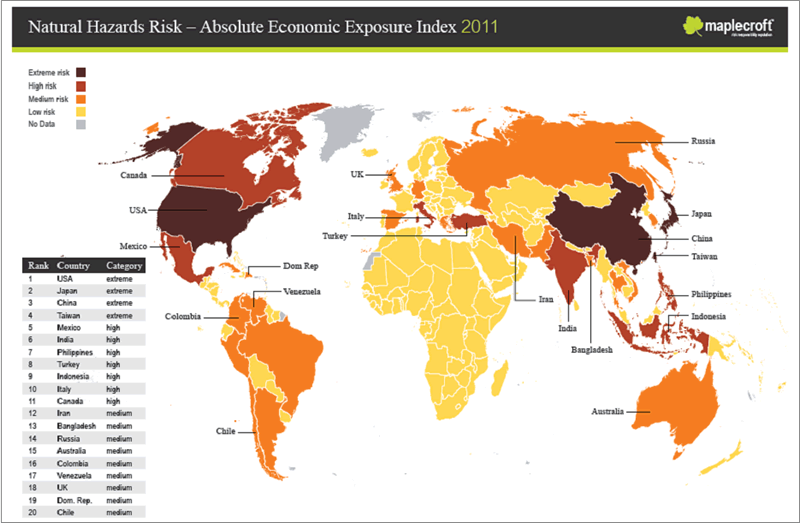

Based on another risk metric - Natural Hazards Risk Atlas 2011 (NRHA)--from Maplecroft, out of 196 countries, USA (1), followed by Japan (2), China (3) and Taiwan (4) are the only four countries rated as "extreme risk" to economic exposure to natural hazards such as floods, hurricanes, earthquakes.

The large emerging economies of Mexico (5), India (6), Philippines (7), Turkey (8) and Indonesia (9), and two developed countries--Italy (10) and Canada (11) are the remaining to be rated as ‘high risk’.(See Map)

However, in the Socio-economic Resilience category, most developed countries such as the US and Japan are rated as ‘low risk’, whereas some hot growth emerging economies like China, India, the Philippines, Indonesia, Pakistan, Bangladesh, and Iran are all rated as 'high risk’.

According to Maplecroft, while the large developed economies of the US and Japan have the greatest economic exposure to major natural hazards, they also have the capacity and readiness to weather impacts from major disasters. That includes: economic strength, infrastructures, disaster contingency plans, as well as tight building standards, etc.

Many of the emerging economies rated with high socio-economic risk have attracted high FDI (Foreign Direct Investment) inflow in recent years with their rapid growth. The rising economic power of the major emerging economies like China and India, and their lack of resources to respond to major events means the occurrence of a major disaster in these countries may also have global economic impacts and severely affect the global supply chain.

For instance, the severe drought in China earlier this year threatened global wheat crop production and prompted the U.N. food agency to issue warning due to the impact of China’s drought on global food prices and supplies.

Companies deriving a large portion of revenues from emerging Asian countries, although may have enjoyed higher growth in recent year, are at the same time subject to a greater risk of business disruptions than their more domestic-centric competitors.

Nevertheless, just as each country differentiates itself in its capability to respond and withstand major events / disasters, how each company executes its disaster response and business continuity plans may also serve as a differentiator within the pack.

For example, some companies like Apple were able to move quickly to secure their supply chain after the Japan quake, whereas others had to cut or halt production, powerless to respond to lost business and market share.

This also means investors, who are currently diversifying portfolios into Asian countries, need to also factor in natural hazards risks in to their investment strategies.

Bloomberg quoted an EPFR Global report that emerging-market equity mutual funds had more than $7 billion of withdrawals in the week ended Aug. 10, the most since the third week of 2008.

Emerging economies have been all the rage and buzz in recent years partly on stagnant growth in the OECD countries. But in times of uncertainty like we have now, investors tend to put stability above other considerations. Right now, the U.S. still offers relatively stable outlook (albeit with a gloomy near-term GDP growth projection) than most of other regions in the world.

So the risk factors discussed here probably already are playing an implicit role, particularly in the wake of Japan's mega earthquake and the resulted tsunami's, in the recent stock performance of MSCI emerging markets index vs. the S&P 500 (see chart above).

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.