What Is Stock Market SPX Fair Value

Stock-Markets / Stock Markets 2011 Aug 15, 2011 - 03:50 AM GMTBy: Tony_Pallotta

Credit and commodity markets are saying one thing while equities are saying another and only time will tell which market(s) were right. History though is clearly on the side of credit and commodities based on prior recessions including the 2008 "not so great" recession where equities peaked just two months before the NBER declared the first month of contraction.

Credit and commodity markets are saying one thing while equities are saying another and only time will tell which market(s) were right. History though is clearly on the side of credit and commodities based on prior recessions including the 2008 "not so great" recession where equities peaked just two months before the NBER declared the first month of contraction.

On Friday I asked the question what is SPX fair value based on the current and future economic realities. The answer is really one of equilibrium where free markets are given the time to find a price that balances buyers and sellers. Since historically commodities and credit markets have shown to be more forward looking and have had time to find this "equilibrium" below are four charts that show where they view current SPX fair value.

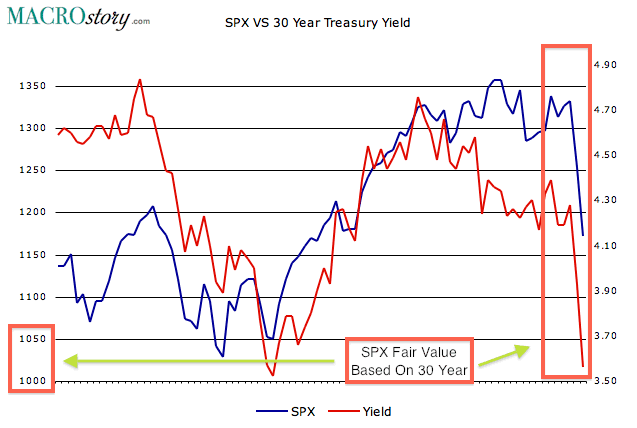

30 Year Treasury Yield

SPX fair value based on historical correlations is 1,000-1,050

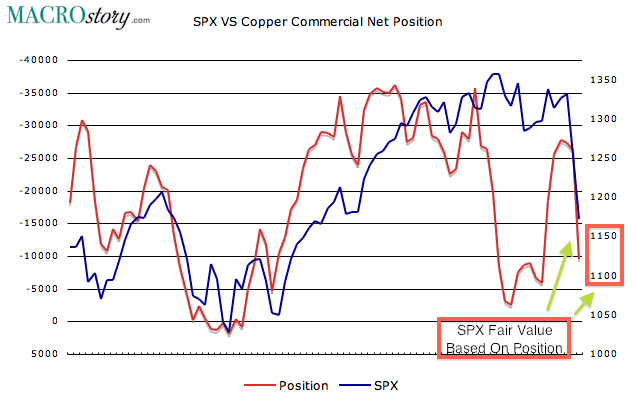

Copper Commercial Net Positions

SPX fair value based on historical correlations is 1,100-1,150.

Friday's COT report showed a massive change in commercial net positions implying copper is poised to move much lower in short order while technically copper looks very weak.

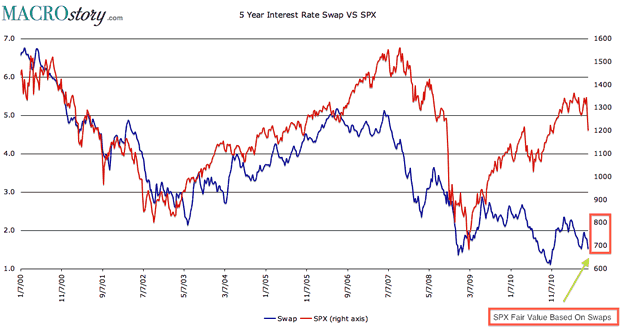

5 Year Interest Rate Swaps

SPX fair value based on historical correlations is 700-800.

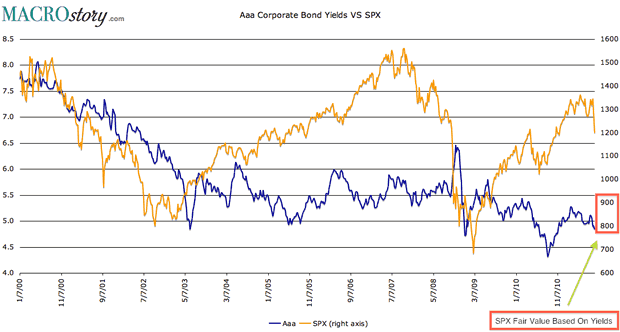

Aaa Corporate Bond Yields

SPX fair valued based on historical correlations is 800-900.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.