40th Anniversary of Nixon Ending Gold Standard and Creating Modern Fiat Monetary System

Commodities / Gold and Silver 2011 Aug 15, 2011 - 07:51 AM GMTBy: GoldCore

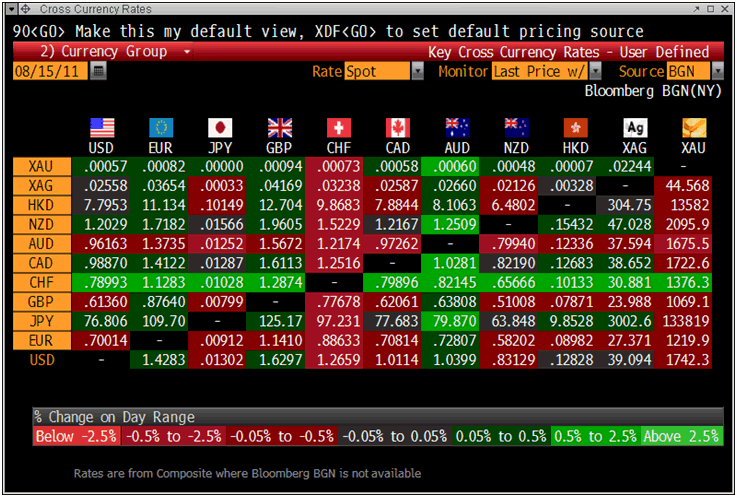

Gold has fallen today in all major currencies except the Swiss franc which has fallen sharply again on continued talk of SNB intervention. Gold is trading at USD 1,742.70, EUR 1,220.10, GBP 1,068.70, CHF 1,375.60 per ounce and 133,820 JPY/oz. Gold’s London AM fix this morning was USD 1,738.00/oz, EUR 1,214.11/oz, GBP 1,065.88/oz.

Gold has fallen today in all major currencies except the Swiss franc which has fallen sharply again on continued talk of SNB intervention. Gold is trading at USD 1,742.70, EUR 1,220.10, GBP 1,068.70, CHF 1,375.60 per ounce and 133,820 JPY/oz. Gold’s London AM fix this morning was USD 1,738.00/oz, EUR 1,214.11/oz, GBP 1,065.88/oz.

Gold in Swiss Francs reached 1,393.24 an ounce this morning – the highest price so far in 2011. Gold in Swiss francs has climbed 7.7% so far in August, 3.7% in 2011 and 8.2% in the past 12 months as gold reasserts itself as the true safe haven.

On this day, August 15th, 40 years ago, President Nixon announced the end of the Gold Standard and the end of the Bretton Woods international monetary system (see video of Nixon’s dramatic announcement here).

This was one of the most important decisions in modern financial, economic and monetary history and is a seminal moment in the creation of the global debt crisis confronting the U.S., Europe and the world today.

Cross Currency Rates

Nixon ushered in an era of floating fiat currencies not backed by gold but rather deriving value through government “fiat” or diktat.

While Nixon justified the move was that the U.S. , then as today, was living way beyond its means with the Vietnam war and growing military industrial complex leading to large budget deficits and inflation.

Governments internationally including the French and their President Charles de Gaulle were concerned about the debasement of the dollar and began to exchange their dollar reserves for gold bullion bars.

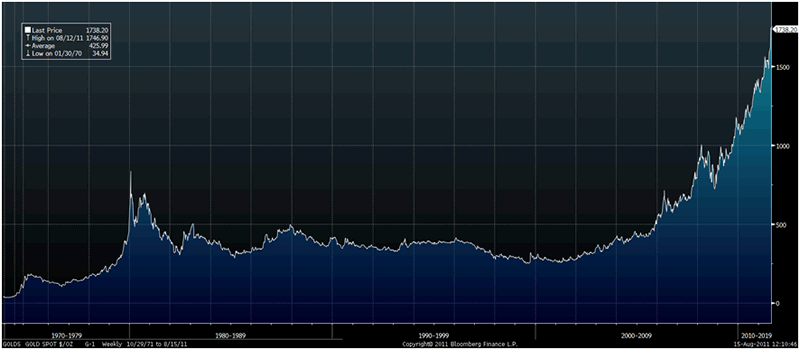

Subsequent to Nixon’s decision 40 years ago, the U.S. dollar has fallen from 1/35th of an ounce of gold to 1/1750th of an ounce of gold today.

Gold in Nominal USD – 1971 to Today (Weekly)

This is not the fault of “speculators”, rather it is the fault of profligate governments and central bankers debasing the U.S. dollar since 1971 (except for Federal Reserve Chairman Paul Volcker).

Today, U.S. dollars and all paper and digital money is declared by governments to be legal tender, despite the fact that it has no intrinsic value and is not backed by gold reserves.

Historically, currencies were based on precious metals such as gold or silver, but fiat money is based on faith and on the performance of politicians, bankers and central bankers.

Because today’s fiat money is not linked to physical reserves of gold and silver, it is becoming worth less with each passing month and risks becoming worthless should hyperinflation take hold.

If people lose faith in a nation's paper currency, the money will no longer hold value.

Throughout history most fiat currencies have not survived more than a few decades and have succumbed to hyperinflation.

The fiat currency or paper and digital based international monetary system has survived 40 years but is in terminal decline with many astute commentators now questioning whether it will survive the global debt crisis.

Gold’s role as a store of value and important monetary asset is being increasingly appreciated. Indeed, there are increasing calls for gold to again play a role in the global monetary system.

The President of the World Bank, Robert Zoellick, wrote in the Financial Times (‘The G20 must look beyond Bretton Woods II’ - November, 2010) that a new monetary system involving a basket of currencies “should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values”.

He also said that “although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today.”

This was an important statement regarding gold especially as it came from the President of the World Bank, the head of one of the most powerful financial and monetary organizations in the world.

Jack Farchy wrote in the Financial Times today, “the return of gold as a prominent financial asset is without doubt the most important development in the bullion market today.”

It is also a very important development for currency markets and for the global financial and monetary system.

Ex Economics Editor of The Telegraph, Edmund Conway wrote over the weekend how “we've had the financial crisis that usually marks the beginning of the end of established monetary systems. And now we are seeing the debasement.”

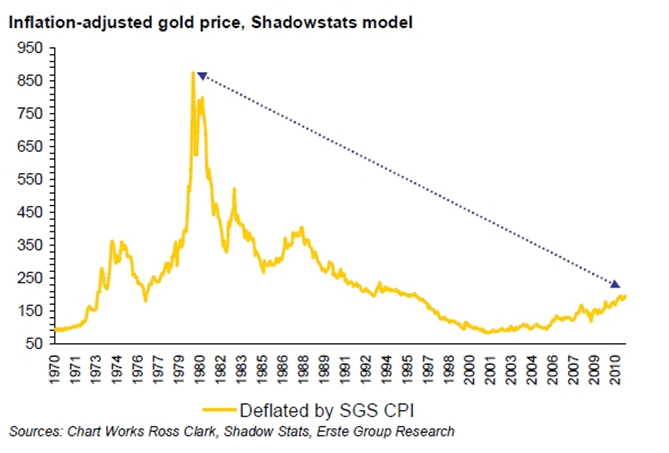

He wrote that the rising gold price “reflects many factors . . . but chief among them is a diminishing faith in the ability of fiat currencies to maintain their value.”

“These bouts of debasement typically end in disaster, as faith is lost in the currency, inflation shoots through the roof and the economy collapses, after which politicians introduce a new, more credible system.”

Conway warned that the “next stage of the crisis represents a crisis of confidence in the very system which, founded as it is on trust rather than measurable yardsticks, has no reliable, inbuilt way of righting itself.”

We have for many months now been warning of the real risk of an international monetary crisis and this risk looks more likely by the day.

While hyperinflation remains a worst case scenario, stagflation and a virulent bout of inflation looks almost certain in the coming months.

For the latest news and commentary on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $39.14/oz, €27.35/oz and £23.99/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,789.00/oz, palladium at $754/oz and rhodium at $1,775/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.