Stock Market Long Term Looks Bleak – Not The Short Term

Stock-Markets / Stock Markets 2011 Aug 22, 2011 - 02:38 AM GMTBy: Andre_Gratian

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into about 2014.

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into about 2014.

SPX: Intermediate trend - The bull market which started on March 2009 at 667 appears to have ended at 1370. The first intermediate decline of the new bear market may be close to being over.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

The stock market is going to face some powerful head winds over the next three years. One of them is the fact that the very long-term cycles which are due to make their lows in about 2014, are finally exerting visible downward pressure on equities. These consist of the 120-yr cycle and all of its components: The 40-yr, the 30-yr, 20-yr, 12-yr, 10-yr, etc... Samuel Kress deserves credit for discovering this cycle series and his friend, Cliff Droke has been its main proponent writing numerous articles on this subject for the past few years. One of his outstanding reviews of these cycles was written on January 22, 2007 and can be found in the valuable SafeHaven archives (click on "Authors' at the top of the home page) which its founder, Bruce Stratton, had the wisdom to establish for future reference. I encourage you to look up Cliff's article and read it.

It is possible to predict the general course of the stock market with some degree of accuracy by understanding how cycles affect it. But is there a way to confirm that the long-term descent is underway, and how low it might go? Yes! By analyzing the Point & Figure chart of stock indices. The value of these charts is that they create patterns of accumulation and distribution which are far more visible than they appear on bar charts and these patterns have fairly accurate predictive value.

Between 2/13/11 and 7/17/11, the SPX described a well-publicized Head & Shoulders pattern which carried a minimum downward projection of about 1165. That warned of a significant decline, but came far short of stating the full decline potential of that topping pattern. Using a standard count methodology for P&F charts, and taking it across the entire formation from right to left shoulder, we come up with a conservative projection down to about 789. A more liberal one would take the index down to 708. Whether or not these projections will be realized in full, or if the bear market concludes at some higher level, they warn us that a severe decline lies ahead and they are in full agreement with the cyclic configuration.

That's the long-term prognosis, and it should take about three years to become a reality. But what about the short to intermediate term? That looks far more rosy. Again, based on a P&F projection supplemented with structure analysis, it looks as if the SPX is about to conclude its intermediate decline somewhere between 1086 and 1096. Perhaps as early as Monday, in conjunction with a 13-wk cycle low. What happens after that is a little murky because although the structure calls for a potential retracement of 50% of the decline to 1233, there are bottoming cycles that might get in the way of an immediate recovery. These will be discussed a little later on under "CYCLES'.

Let's now turn to a graphic representation of what is likely to happen according to the scenario presented above.

Chart analysis

We'll start with an analysis of the long-term trend with the help of the Monthly SPX Chart. I have included all the pertinent information available from cycle analysis, P&F price projections, and conventional trend and parallel lines analysis. The result is a fairly clear picture of what investors may be facing for the next three years.

I'll start by discussing the cycles. You can see that in the past ten years, clusters of important cycles have created significant declines. This is what we are probably facing over the next 3+ years with a cluster of long-term cycles bottoming in 2014.

The P&F projections give us an idea of where the bear market might end. Unless some other factors mitigate those targets, the bottom should come between 708 and 789. The decline would still last into the projected time frame, but price-wise, it could end with an important phase projection somewhere between 816 and 888 (this would exclude the left shoulder of the top pattern).

The rest of the notations on the chart are derived from conventional technical analysis. When the bear market which started in 2007 finally ended, it had made a lower low than the 2002 bottom. This suggested that the bull market which started in March 2009 would top below the 2007 high. It has! And now we have started a long-term pattern of lower lows and lower highs. If the 2014 low is higher than 667 (as it promises to be), this will forecast the beginning of a new, multi-year bull market which will not only surpass the 2011 high but the 2007 top as well. And if 2014 marks the end of a 120-yr cycle, this is precisely what should happen over the next decades. Of course, this is something that we don't need to dwell on now, so let's, move on.

I have drawn several channels and trend lines. The most narrow channels obviously define the previous bear and bull markets. By connecting the 2002 and 2009 lows with a purple trend line, and then drawing a parallel from the 2000 top, we create a very wide channel. Interestingly, the 2011 high of 1370 formed precisely on that top channel line, and the level of resistance which it provided was just too much for the two+-year bull market to overcome.

Dividing a channel into thirds can be valuable because parallels drawn at those levels (dashed lines) often act like support lines from which rallies might come, as the current decline extends into 2014. The SPX has just gone slightly beyond the 1/3rd parallel, on its way to the 1096 phase projection which is just below it. Incidentally, this projection is confirmed by the re-distribution phase which took place below the 1208 level (which is very obvious on the hourly chart). The placement of this parallel adds credibility to where the current intermediate downtrend might find some support.

The 2/3rds parallel does not tell us very much, right now, but it could be of value later on, as a potential point from which the last rally takes place just prior to the final low. The dashed parallel below is more interesting. It is drawn from the top of the first up-wave of the 2002 bottom -- a technique which I have found to be valid when looking for support levels -- and it extends into the range of prices where the 2014 bear market low might settle.

Let's now talk about the red channel whose top line connects the 2007 and 2011 highs. If I draw a parallel to that line from the bottom of the July 2010 consolidation, it extends right into the range of the prices suggested for the 2014 low, where it also intersects with the purple dashed line. The intersection of these two lines are creating a potential support level in the time frame and price target area that may turn out to be very significant in determining the final bear market low.

What I have done here is not a puerile exercise in trend line drawing, but something that has worked for me time and time again in defining support levels. It gives us, in conjunction with the projections, a good idea about the extent of the bear market which lies ahead.

A couple more comments before moving on! I have suggested before that the bear market will not be confirmed technically until the SPX has broken below the 1000 level. Also, a brief look at the indicators tells us that the MACD is still positive, and that the MSO did not show any negative divergence before rolling over. That may not contradict the beginning of a bear market, but it does suggest that a good rally could develop after the index finally finds its footing.

We'll now look at the Daily Chart which may be developing some bullish features. Channels that encompass the price action have also been drawn on this chart. We need not concern ourselves with the long term channels which show up better on the monthly chart, except to note that they have been broken decisively. Those that have our attention are the red and green channels. The red channel represents the current short-term decline which will have given up 260 points if we find a low at 1096. In order to have a valid reversal, the SPX will have to break out of that channel (dotted lines) and probably continue outside of the green channel to 1233.

The indicators are showing that (if we hold at 1096) a near-tem reversal is practically assured, since all indicators (certainly the bottom two), would show strong positive divergence. If we reverse, and the 14-15-wk high to high cycle forecasts another top, the rally would last about two weeks before it ends.

Because of the cycles that are bottoming over the next two months, it is possible that by the time we get to the scheduled 3-yr cycle low, we will have made a new low. It's also possible that the near-term cycle configuration will create a sideways move which produces a base that portends a more substantial rally (beyond 1233) lasting into 2012, before we start our descent into 2014.

Let's now go to the Hourly Chart.

From a structural standpoint, we are most likely in the process of completing wave [1] of the bear market. There are always alternative counts, but for now, this is the one that stands out. As I mentioned earlier, when it reverses (assuming that it will reverse at 1096 when the 13-wk cycle bottoms on Monday), the SPX would be entitled to a price retracement of about 50%, which would take it to about 1233. We can always confirm that later when a base has been established from which a P&F projection can be made.

A 1096 low is the target of the P&F re-distribution level (marked in red on the chart) and it coincides with a 1086 projection which comes from a phase count across the H&S pattern.

There is a good chance that we will see this low on Monday because of the following reasons: the 13-wk cycle is ideally due on that day, the structure tells us that we are most likely in wave 5 of 5, and two of the three indicators show some good positive divergence (remember, the same condition exists in the daily indicators).

I am anxious to see what form the rally will take, considering the dominant cycles which lie ahead. These are marked on the daily chart, above, and will be discussed in the following section.

Cycles

The next few weeks should prove to be interesting. After the 13-wk cycle ostensibly bottoms on Monday, the index should reverse with the cycle. Besides that, the 14-15-wk high-to-high cycle (which has been very reliable for the past two years) is due to top at the end of the first week in September. That should give the SPX two weeks of rally. That cycle top is usually followed by a sharp decline and, in this case, will be assisted by the 67-wk cycle which is due for its low around 9/19. That should provide a bounce which will be cut short by the 3-yr cycle due in Oct./Nov.. Then, the 17-wk cycle will be due mid-October.

If each of these cycles has even a moderate effect on the market, we are in for a volatile period. Beyond that, I am very interested in seeing the end result of this cyclic time frame, especially how it manifests itself on the P&F chart.

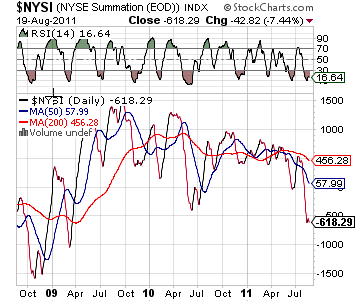

Breadth

The NYSE Summation Index (courtesy of StockCharts.com) appears to be making a bottom. It has not declined further, in spite of last week's selling. In fact, it was up slightly for the week. The RSI has also turned up from its oversold position and is making a pattern similar to the previous low which preceded the last reversal. This matches other indications that we are near a change of trend.

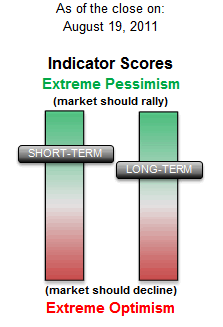

Sentiment

The readings of the long-term and short-term indices of the SentimenTrader (courtesy of same) are consistent with the general technical view that we are near a trend reversal.

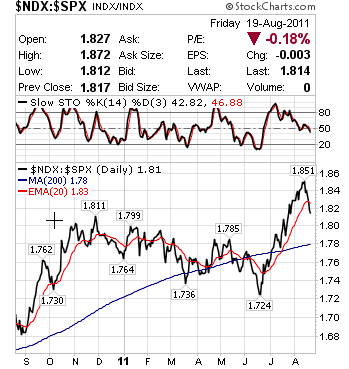

The NDX is finally beginning to show some relative weakness to the SPX (chart courtesy of StockChart.com). So far, it's only a well-deserved corrective blip on the downside after a strong uptrend. Let's see where it goes from here.

GOLD

Even though I commented on gold last week, I want to update my analysis because of the position of the index.

GLD has reached its interim projection of 180-182 and should now be ready for a consolidation before moving to its final target (for this phase) of 187-189.

Since gold now appears to be moving contra the SPX, some profit-taking at this stage would correspond to an up-move in the equity index. Let's see if this plays out.

I am, however, far more interested in seeing what the market does when GLD reaches 187-89.

Summary

One of the most distinguishable characteristics of recent market activity is volatility. Moves are quick and big. This is not likely to change if time is really speeding up, as some have claimed.

There are a number of cycles, topping or bottoming over the next couple of months that have the capability of making the market behave like a yo-yo. If so, and if it results in a sideways movement, it will create a P&F pattern that could have huge consequences on what follows, either up or down.

Near-term, there are many technical factors coalescing that suggest we are near a reversal of the downtrend from the mid-July high.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.