The Catalyst for Consolidation in the Gold Stocks Sector

Commodities / Gold & Silver Stocks Aug 22, 2011 - 05:33 AM GMTBy: Jordan_Roy_Byrne

The Gold and Silver business is one that naturally involves much consolidation. The industry product is the same and the business is such that mergers and acquisitions are commonplace. As many readers know, the secular bear market of the 1980s and 1990s had an obvious impact on the exploration side of the business. Larger mining companies cut exploration budgets because they had to. Fast forward to today and we know that has impacted supply and the ability of the large companies (who survived the bear market) to grow organically. Hence, mergers, acquisitions and takeovers will only increase. Yet we haven’t seen much of this activity despite a raging bull market in the metals.

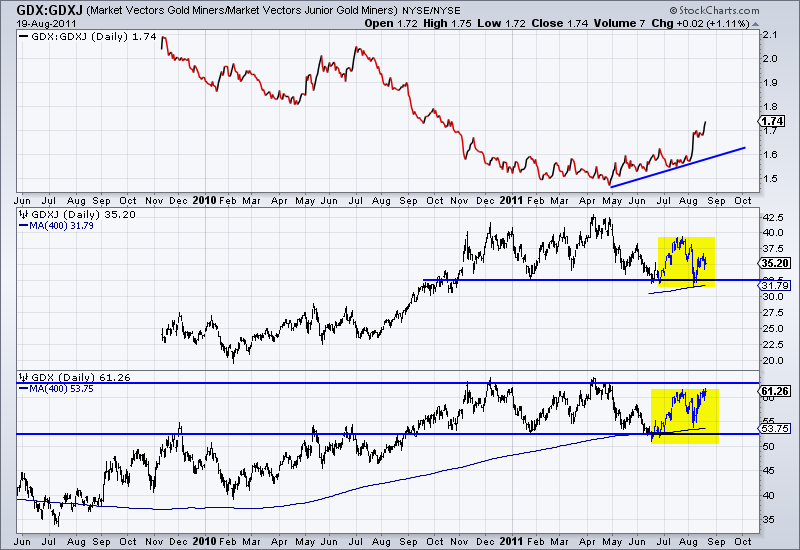

One thing to focus on is the performance of the large caps (GDX) relative the mid-caps and the larger juniors (GDXJ). The large-caps gains since 2008 occured mostly from October 2008 to May 2009. In 2009 and 2010, the mid-caps and the large juniors performed much better than the large caps. This means that the relatively speaking it was becoming more expensive for the average acquirer to make an acquisition. However, as the chart shows, the large caps (GDX) have begun to outperform the smaller companies (GDXJ). Also, the large caps are very close to a big breakout while GDXJ is lagging behind.

It appears likely that the large caps, which are poised for a major breakout, will outperform over the next few months. This means that in some cases a potential acquirer will see its currency (its stock) rise in relation to a potential acquisition. If company A wants to acquire company B and company A’s stock rises by 20% and company’s B stock rises by 5%, then the acquisition becomes cheaper and less dilutive.

The last time the larger companies outperformed was in late 2008 and early 2009. That wasn’t exactly a time you’d expect such companies to be making aggressive acquisitions. Today, Gold is raging and the market will soon demand growth from the large companies. Finally, unlike in 2009-2010 the larger stocks are performing better in nominal terms and better in real terms. The latter is crucial as it enables them to acquire assets at a better cost.

So how do investors play this development? In ourpremiumservice, we’ve focused on larger companies that have immediate growth potential are trending higher. Ultimately performance will filter down to the smaller companies and it will be time to add some risk to your portfolio. Additionally, one should focus on the smaller companies that have growth potential or are likely to be acquired.If you’d like to learn more about how to profit, manage risk and have a professional guide you, then you can learn more about our service here.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.