Gold Nears $1,900 - Venezuela Formally Requests Gold Holdings Held by BOE Ship by Sea

Commodities / Gold and Silver 2011 Aug 22, 2011 - 05:46 AM GMTBy: GoldCore

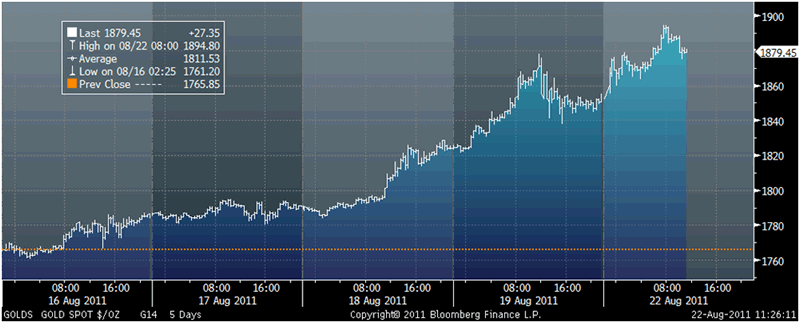

All major currencies have fallen against gold and silver again today with gold reaching new record nominal highs in most fiat currencies including U.S. dollars. Gold reached a new record of $1,894.80/oz - just shy of $1,900/oz.

All major currencies have fallen against gold and silver again today with gold reaching new record nominal highs in most fiat currencies including U.S. dollars. Gold reached a new record of $1,894.80/oz - just shy of $1,900/oz.

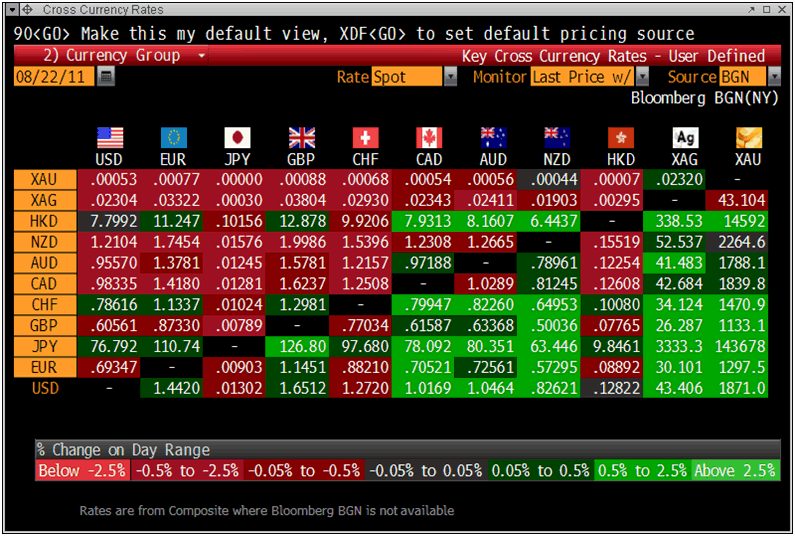

Cross Currency Table

Gold is trading at 1,870.10 USD, 1,296.40 EUR, 1,132.40 GBP, 1,470.90 CHF and 143,670 JPY per ounce and has risen some 1% in all currencies. Gold is particularly strong against the yen and Swiss franc which have fallen in international markets on concerns of debasement.

The London AM fix was a fourth consecutive record nominal high in US dollars. Gold’s London AM fix this morning was USD 1,877.75, EUR 1303.17, GBP 1139.55 per ounce (from Friday’s USD 1,862, EUR 1299.28, GBP 1126.91 per ounce).

Silver is in all major currencies and has risen another 1.4% in dollars after last week’s 8% gain.

Gold’s 6.2% rise last week and silver’s 8.2% rise was barely reported in the press and media in Europe over the weekend – with all the focus continuing to be on equities and to a lesser extent bonds. The usual suspects in stockbrokerages and banks warned about gold being a bubble again.

Silver was not reported at all and remains almost completely taboo in the non specialist financial press. Besides the very occasional article warning that it is a bubble.

According to Bloomberg, the central bank of Venezuela has sent a statement by e-mail requesting its 99 tons of gold holdings from the Bank of England, citing the institution’s president, Nelson Merentes.

GOLD SPOT $/OZ

“We’ve contacted the Bank of England and the corresponding protocols have been initiated to complete this operation as soon as possible,” Merentes said, according to the statement. “Once that’s done, the shipments will begin by sea.”

Chavez ordered the central bank on Aug. 17th to repatriate $11 billion of gold reserves held in developed nations’ institutions. Chavez fears 'hostile countries' may seize the national patrimony.

Venezuela holds 211 tons of its 365 tons of gold reserves in U.S., European, Canadian and Swiss Banks.

40 shipments will be needed to carry the 17,000 400 ounce bars by sea. Piracy must be a real concern given the value of the bullion and Venezuala should ensure that the shipment is well protected.

While physical demand remains robust, sentiment in the trading pits remains muted. An indication that speculative sentiment remains lukewarm was seen in the U.S. Commodity Futures Trading Commission data released Friday evening.

Hedge-fund managers and other large speculators decreased their net-long position in New York gold futures in the week ended Aug. 16, according to the CFTC data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 200,086 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 3,487 contracts, or 2 percent, from a week

The opposite was the case in the silver market where sentiment appears to be heating up somewhat with the risk of another short squeeze developing.

Hedge-fund managers and other large speculators increased their net-long position in New York silver futures in the week ended Aug. 16, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 21,928 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 3,540 contracts, or 19 percent, from a week earlier.

The dumb money continues to warn that gold and silver are bubbles.

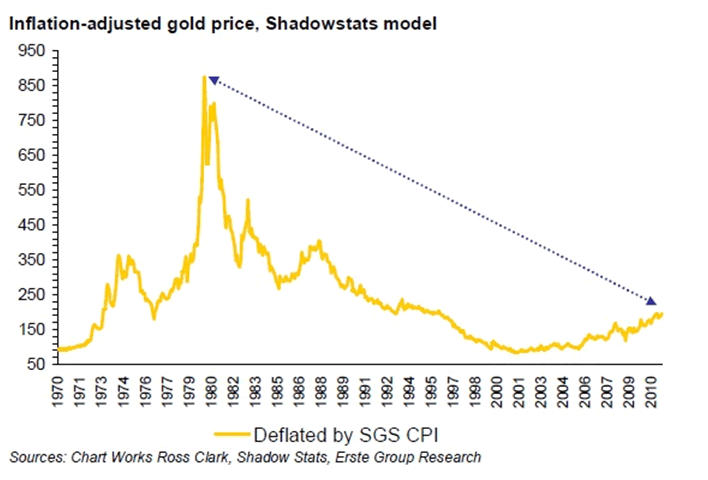

Their simplistic bubble thesis is based almost exclusively on the nominal US dollar price and recent price movements and on the assumption that (to paraphrase) ‘gold has gone up in price a lot - therefore it is a bubble’.

There is a continuing failure to look at the important supply and demand fundamentals of the gold and silver markets which leads to unsound reasoning and irrational conclusions. There is also a failure to adjust for inflation.

There is little knowledge of the very small size of the physical bullion markets vis-à-vis the stock, bond, currency and other markets.

There is also very little knowledge of financial, economic and monetary history and a continuing ignorance regarding ‘investment 101’ which is diversification.

Being prudent and having an allocation of 10% to gold will protect no matter what economic and monetary scenario develops in the coming months. If one is not leveraged and is prudently diversified and owns gold bullion (coins and bars in the safest way possible), it does not matter if gold is a bubble or not as you own a range of other quality assets.

From a purely investment point of view - an allocation of 5% to 10% makes sense.

From a financial insurance or store of wealth point of view – having a higher proportion of your overall net worth makes sense.

Especially given the risks posed to the dollar, euro, pound and fiat currencies and to deposits “guaranteed” by insolvent states.

Not putting 10% of your wealth in gold is extraordinarily imprudent today and a recipe for further financial destruction.

For the latest news and commentary on gold and financial markets please follow us on Twitter.

SILVER

Silver is trading at $43.22/oz, €29.98/oz and £26.19/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,882.50/oz, palladium at $755/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.