Gold and Interest Rates, More than Joined at the Hip

Commodities / Gold and Silver 2011 Aug 24, 2011 - 04:57 AM GMTBy: Rob_Kirby

“Interest rates to remain at zero for the next two years.” Those were the words of Fed Chair - Sir Benjamin of Bernanke last week. With inflation beginning to pick-up – the notion that rates would remain at zero for a prolonged period of time seems “paradoxical” to conventional economic thought. There have been other misunderstood ‘paradoxes’ in economics in modern times. Here’s how Wikipedia explains the relevance of this famous benchmark in economics:

“Interest rates to remain at zero for the next two years.” Those were the words of Fed Chair - Sir Benjamin of Bernanke last week. With inflation beginning to pick-up – the notion that rates would remain at zero for a prolonged period of time seems “paradoxical” to conventional economic thought. There have been other misunderstood ‘paradoxes’ in economics in modern times. Here’s how Wikipedia explains the relevance of this famous benchmark in economics:

Gibson's paradox

From Wikipedia, the free encyclopedia

Jump to: navigation, search

Gibson's Paradox is the observation that the rate of interest and the general level of prices are observed to be positively correlated. It is named for British economist Alfred Herbert Gibson who noted the correlation in a 1923 article for Banker's Magazine.

The term was first used by John Maynard Keynes, in his 1930 work, A Treatise on Money. It was believed to be a paradox because most economic theorists predicted that the correlation would be negative. Keynes commented that the observed correlation was "one of the most completely established empirical facts in the whole field of quantitative economics."

Boiled down - Gibson’s Paradox, as first described by Keynes - is the acknowledgement that movement in interest rates and the general price level [inflation] were positively correlated. This was viewed as “paradoxical” because classically – economists expected higher interest rates to ‘arrest’ demand which, it was thought, would lead to lower prices.

When speaking of Keynes comments regarding Gibson’s Paradox – what most modern day economists fail to appreciate / mention is that Keynes comments regarding Gibson’s Paradox were implicitly referencing a time period in which the Gold Standard was in force; namely, the 1821 – 1913 time period.

Folks who feel that study / attention paid to Gibson’s Paradox is superfluous, they should be reminded of the academic work / study done by Messrs Barsky and Summers at Harvard in the late 1980’s – the basis of which Lawrence Summers brought to Washington as Under Secretary of Treasury under Robert Rubin during the 1st Clinton Administration.

It was Reg Howe in a 2001 treatise, Gibson's Paradox Revisited: Professor Summers Analyzes Gold Prices, that first shed light on relevance / importance of gold prices to the determination of interest rates. First, citing Barsky / Summers work – Howe pointed out:

…[Barsky and Summers concluded] that it was "primarily a gold standard phenomenon" (at 530) that applies to real rates of return. Regression analysis of the classical gold standard period, 1821-1913, shows a close correlation between long-term interest rates and the general price level. The correlation is not as strong for the pre-Napoleonic era, 1730-1796, when Britain effectively adhered to the gold standard but many other nations did not, and "completely breaks down during the Napoleonic war period of 1797-1820, when the gold standard was abandoned" (at 534).

Howe then went on to further explain the crux of Barsky and Summers findings – citing passages from their executive summary:

With the nominal price of gold fixed, Barsky and Summers note (at 529) that "the general price level is the reciprocal of the price of gold in terms of goods. Determination of the general price level then amounts to the microeconomic problem of determining the relative price of gold." For this, they develop a simple model (at 539-543) that assumes full convertibility between gold and dollars at a fixed parity, fully flexible prices for goods and services, and fixed exchange rates.

And,

“…the bottom line of their analysis is that gold prices in a free market should move inversely to real interest rates.”

If we only read mainstream sources [like Wikipedia] we might falsely believe that Gibson’s Paradox is only about interest rates and the general price level. We can credit Howe – citing Barsky and Summers’ work - with drawing the importance and inter-relatedness of the gold standard to interest rates.

When applied to the political realities of the day [1992 – 1995 timeframe] when Clinton first came to power in Washington – it’s important and helpful to remember the following:

- from 1993 - 1995, the U.S. economy was being dogged by a stubborn recession, casting doubts on Clinton’s re-election

- Rubin [a former gold trader / overseer of gold operations at Goldman Ldn. during the 1980’s and Chairman of Goldman Sachs] came to Washington in 1993 [first as director of National Economic Council] and then [in 1995] as Treasury Secretary. He brought with him Lawrence Summers as Under Secretary. Summers’ understanding and study of gold made him a “useful idiot”.

- These qualities made Rubin such a logical successor to Lloyd Bentsen.

- Rubin needed to invigorate economy to get Clinton re-elected. Deficit spending would have typically led to a RISE in interest rates and prices.

- Summers / Barsky’s academic work theorized that deficits could be run SO LONG as the price of gold remained constant or did not power higher.

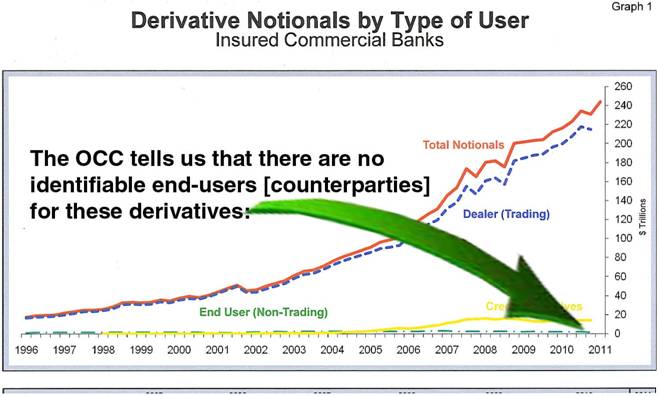

- A program of gold price manipulation was hatched simultaneously with the establishment of an interest rate control grid – essentially giving the U.S. Fed / Treasury control of not only the short end of the interest rate curve – but also the long end of the interest rate curve. Note how the geometric growth of Derivatives stems from this timeframe.

- REMEMBER: 82 % of ALL OUTSTANDING notionals are interest rate derivatives and the Office of the Comptroller of the Currency [OCC] tells us there are no [identifiable] end users for these products. Just because the OCC tells us there are no identifiable end users of endless TRILLIONS of these products – DOES NOT MEAN that the investment dealers do not have counterparties for them.

- The Reality: The undeclared counterparty for these interest rate determining trades is the EXCHANGE STABILIZATION FUND [a secretive arm of the U.S. Treasury] acting through the New York Federal Reserve. They engage in this activity to generate settlement demand for U.S. Government Securities thus creating the FALSE illusion of scarcity

- The derivatives complex acts as A PRICE CONTROL GRID of all strategic commodities from capital itself [via interest rates] to precious metals, to equities and energy.

source: Office of the Comptroller of the Currency

Morgan Stanley Lays An Egg: the Footprint of the ESF

When one considers that Morgan Stanley “strapped on” 9 Trillion [according to the OCC in Q1/2011] in notional of products that require 2-WAY–CREDIT-CHECK – we should all now be scratching your head as to “WHO” or perhaps “WHAT” would be an agreeing counterparty to such STAGGERING 9 trillion of two-way-risk trade with Stanley in 3 months????? Remember folks, a couple of years ago – no institution would consider buying / acquiring Stanley for any amount.

The ONLY answer – is that the EXCHANGE STABILIZATION FUND is acting in the int. rate swap market [through the N.Y. Fed] “RECEIVEING” 5 – 10 year swaps at “FIXED RATES” [meaning Stanley is paying the ESF fixed rate and the ESF is in turn paying them ‘floating’ 3 month libor, but does not exchange bonds with Stanley]. Morgan Stanley “IS” a spread player and the ESF is NOT. [the custom in int. rate swaps of 3 – 10 year duration is for the “receiver” of fixed to sell the “payer” of fixed a duration weighted amount of government bonds of the tenure of the swap, ie 25 million notional of 5 year swap would entail a physical bond trade of roughly 25 million 5 yr. gov’t bonds.]

This FORCES Stanley into the bond market to purchase the required amount of bonds to hedge their trades. [this has the added benefit of being quite profitable if you are the Exchange Stabilization Fund – especially when you KNOW [and no one else does] that short term rates are NEVER going to go up.

This serves to make US bonds “SCARCE” for settlement purposes [fails to deliver data available open source confirms this] over the past few years – and has served to give the U.S. Treasury / Fed control of the long end of the int. rate curve. This is why interest rates are so PERVERSELY LOW today. It really has NOTHING to do with “flight to quality” or “liquidity”.

This has all been perpetrated on humanity by a group of elite, narcissist, globalist Central Bankers to obscure the reality that “their” FIAT MONEY is FAILING – in spades.

Got physical precious metal yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.